Hello dear readers, goodfolk, friends and future self!

September 2021 is now a thing of the past, and thank God for that! What a terrible month it has been!

Red numbers across the board. Luckily October is already proving to be a bit more merciful.

I have been busy at work, at home (and other places) in September so I haven’t had much time to follow Mr. Market or be active in the community.

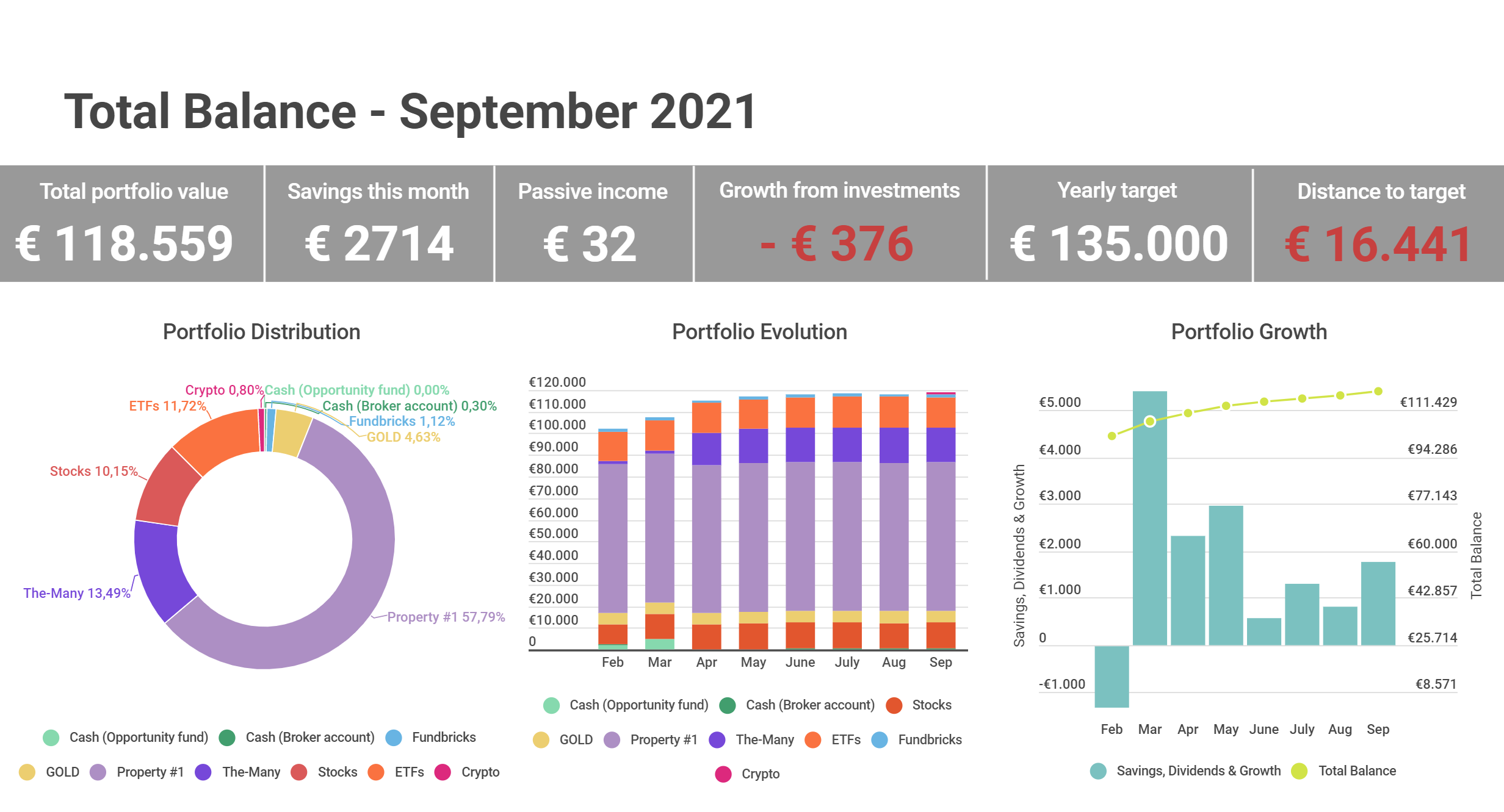

I have however taken some time to add a new asset class to my Total Balance!

The month in review

YES, you guessed it – I’ve added a little Crypto to the portfolio, to be that fun quirky ADHD-like little brother (it certainly is volatile) to my “boring” older brother (the Gold position). Nothing much is happening here, and since crowdlending didn’t really pan out for me, I figured “why not”. Just for the fun of it…We’ll see how fun it really becomes, as I’m not really a fan of the volatility (hence why 80%+ of my portfolio is in real estate). BUT, one of the reasons why I decided to add it to the portfolio is there are ways of getting a good INTEREST rate on your crypto. And I do love me some passive income!

But first, I’d like to take you back! Back to before this blog even started.

In December 2017 I bought 0.04245725 BTC. BTC was around $17,000 and had been on a crazy rally since the beginning of 2017 (it was $800 at the beginning of 2017). At the beginning of 2018 it then crashed completely, and didn’t pass $17,000 again until late 2020.

So since I bought them back in 2017 they’ve dropped more than 80% in value, and then since surged back up more than 300%. I had kind of forgotten about them, until I saw that they had surpassed $50,000 in early 2021. I thus kinda re-discovered them and realized that I had tripled my initial “investment”. Unfortunately it wasn’t big money (it never is, right?!) so they’ve remained “in the shadows”.

A while ago I decided to exchange about half of my BTC to ETH (as I disprove of the current power consumption of the BTC network) and transferred them to celsius.network because they offer interests on the crypto you store in your wallet. It varies from coin to coin. BTC is currently 6.20%, ETH is 5.35% and DOT is 8.86%! I also received a bonus in the form of $40 worth of BTC, which has now more than doubled since. I gotta say, free money is great 😀 – But is celsius.network safe?…

Every Monday an email ticks in with your “rewards” from the celsius.network. And I’ll be completely honest with you guys; it smells a little bit like a ponzi scheme, since you also get “rewards” for signing up and transferring xx amount of crypto (if you sign up using an affiliate link). I thus do not recommend putting all your crypto with celsius, simply because I don’t trust that you will be able to get it OUT again (I have made transfers out though – just to test it) in case you want to withdraw your “rewards” at one point. The rewards are added in the crypto currency you are holding though, so over time your crypto portfolio is slowly growing. I really like that! But again, if it’s too good to be true? It probably is, right? :S

Since my last “high stake” adventure didn’t pan out quite so well (goodbye, Crowdlending!), I figured it was time to start a new adventure(?) – apparently…HAHA! No risk, no reward! (pun intended!)

The idea behind celsius.network is basically a “bank” where you can borrow money (fiat) and use crypto as collateral. How they are able to offer such a high spread (eg. 8% on DOT) I don’t really understand, as I’d expect someone to then be paying like 10% on a USD loan (with DOT as collateral I guess?) in order for these “rewards” to be sustainable. The fact that they call them “rewards” and not “interest” should also tell us something. Who would pay 10% to borrow USD in todays market? Yeah that’s right – people who has no business taking out loans in the first place!…So essentially, this is peer-to-peer (high risk) lending wrapped up in crypto.

So anyway, I now have about half of my crypto holdings with celsius.network. The other half is tucked away somewhere (a lot more) safe 😉

As I proclaimed in a previous update, I decided to put whatever money I could recover from my failed crowdlending adventures into crypto, and it has amounted to about €250 at this point (from crowdestor and Mintos), of which most of them has been put into Cardano (ADA) and DOT. I initially bought 20 ADA in my Revolut App, but it bothers me that you don’t have an actual wallet where you can transfer crypto from- and to in Revolut. Revolut is its owned closed eco system, so you can exchange fiat to crypto to stocks to commodities (and back) – of course with a pretty fat spread to Revolut (nothing is free here). So it works great if you just want to feel like you’re “in the game”, and it has the obvious advantage that exchanging crypto back to fiat is super fast, easy and secure with Revolut. But I don’t really plan to exchange my crypto back to fiat (until the zombie apocalypse!), so I prefer to hold my crypto in an actual crypto wallet.

The pwetty graphs

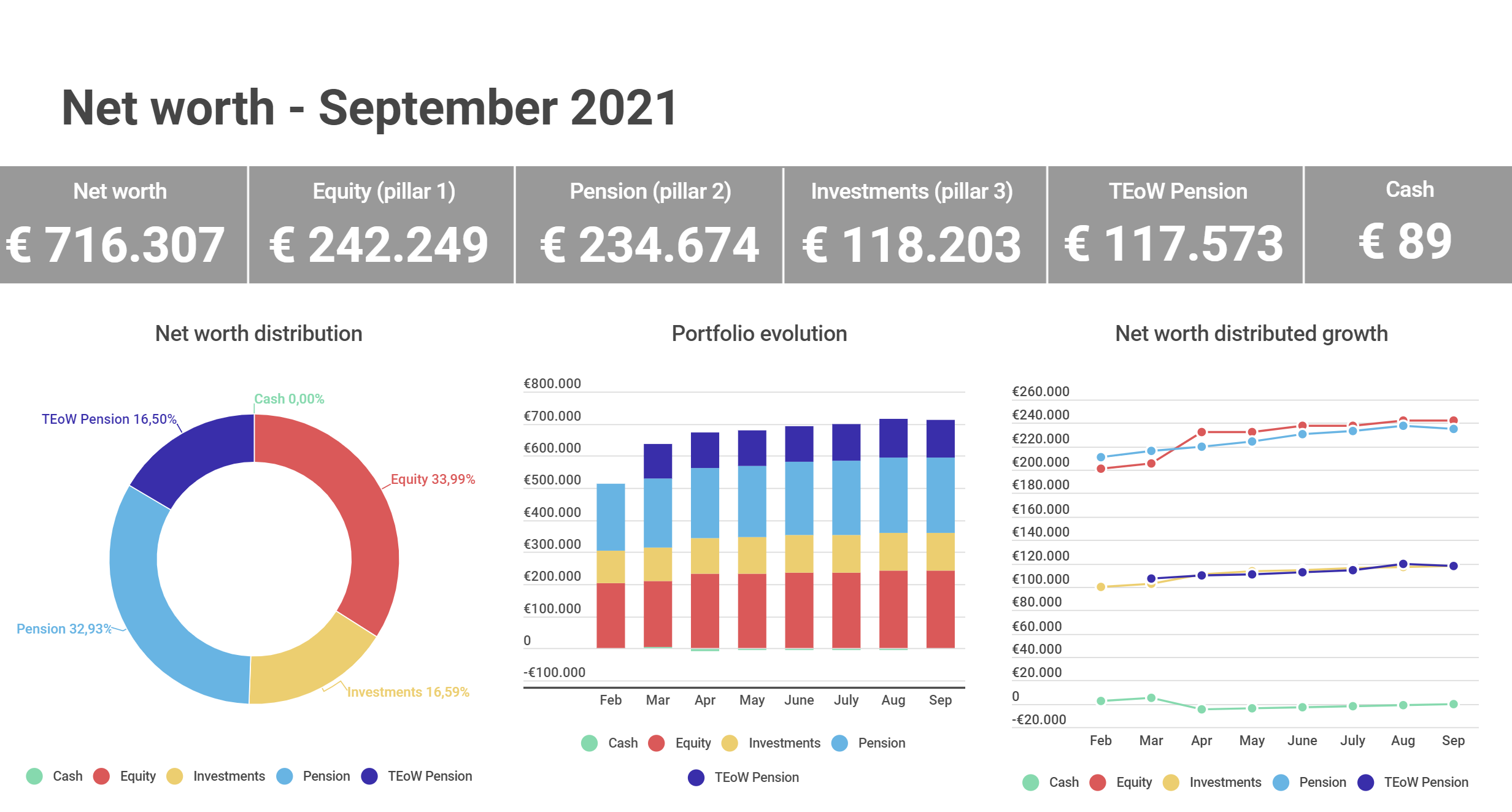

The infograms most interesting page (if you ask me) is Page-3 (Net Worth). We’re slowly moving towards that €1 million mark! 😀

Unfortunately our Net Worth also took a slight dip this month, due to the bloody Mr. Market. Oh well, I’m sure it’ll look a little brighter again next month.

We’re getting our house appraised in October (preparing for a re-mortgage) and I’m hoping/expecting that this will add a significant amount to our equity, as the house prices in our area has run amok since the Corona arrived. We’ll see what the bank(s) have to say 😉

The Booooring income statement

| Platform | Invested | Transactions | Last month | Current value | Monthly income |

| Commodities | |||||

| GOLD (Coins) | € 5,333 | € 0 | € 5,500 | € 5,500 | |

| € 5,500 | € 5,500 | ||||

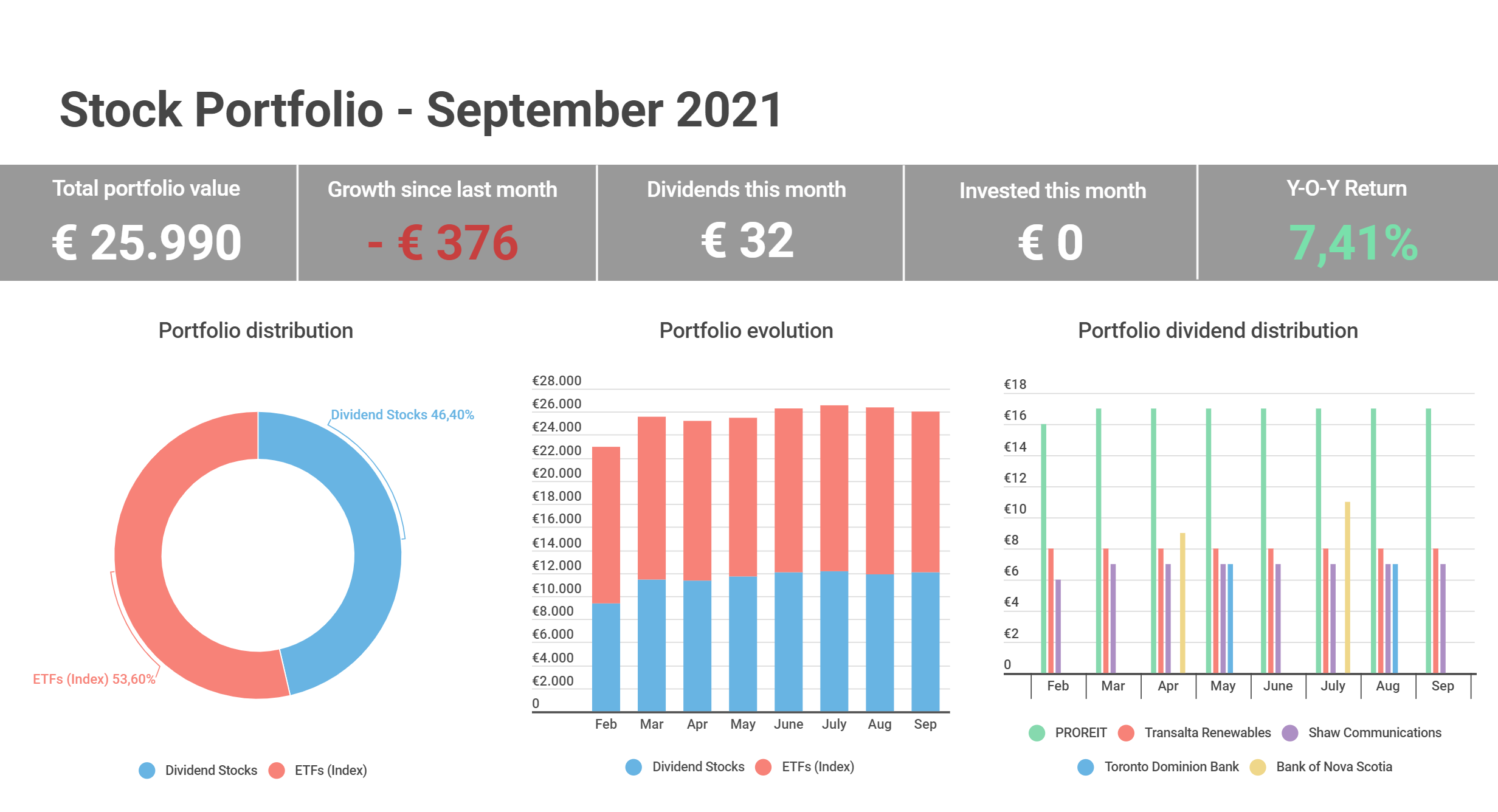

| Stocks (Dividend portfolio) | |||||

| Bank of Nova Scotia (BNS) | € 1,000 | € 0 | € 1,245 | € 1,293 | € 0 |

| PROREIT (PRV.UN) | € 2,018 | € 0 | € 4,042 | € 4,045 | € 17 |

| Shaw Communications (SJR) | € 2,000 | € 0 | € 3,150 | € 3,252 | € 7 |

| Toronto Dominion Bank | € 1,000 | € 0 | € 888 | € 968 | € 0 |

| TransAlta Renewables (RNW) | € 2,000 | € 0 | € 2,517 | € 2,503 | € 8 |

| € 11,842 | € 12,061 | € 32 | |||

| Stocks (Indices) | |||||

| iShares Global Clean Energy (IQQH) | € 6,667 | € 7,168 | € 6,768 | € 0 | |

| iShares MSCI World Min Volatility (IQQ0) | € 6,667 | € 7,357 | € 7,162 | € 0 | |

| € 14,525 | € 13,930 | € 0 | |||

| Properties | |||||

| The-Many (Brickshare) | € 15,999 | € 0 | € 16,034 | € 16,034 | € 0 |

| Property #1 | € 68,667 | € 0 | € 68,667 | € 68,667 | € 0 |

| Fundbricks | € 1,333 | € 0 | € 1,333 | € 1,333 | € 0 |

| € 86,034 | € 86,034 | € 0 | |||

| Crypto currencies | |||||

| ADA | € 0 | € 40 | |||

| BTC | € 0 | € 78 | |||

| DOT | € 0 | € 50 | |||

| ETH | € 0 | € 777 | |||

| € 945 | |||||

| Cash | |||||

| Bank #1 cash (main savings) | € 1,200 | -€ 1,467 | -€ 267 | ||

| Bank #2 Opportunity money | € 0 | € 43 | € 0 | ||

| Broker account (CAD, EUR, DKK) | € 32 | € 324 | € 356 | ||

| -€ 1,100 | € 89 | ||||

| Total balance | € 116,801 | € 118,559 |

My cash stack is now FINALLY back in green, after having spend the better part of the year paying down a credit that I used to purchase more real estate (with The-Many) at the beginning of the year. The plan to use the credit was to animate me to save more to get rid of the red numbers. Looking at my savings numbers for the past 5-6 months it didn’t appear to have helped much…Better luck next time, Nick!

Unfortunately the coming months will (also) see lower than usual savings… (more on that in the next update).

The markets were bleeding red in September, so my growth this month was slightly negative (again!). October is luckily looking good so far, so hopefully the next month will be a green month! 🙂

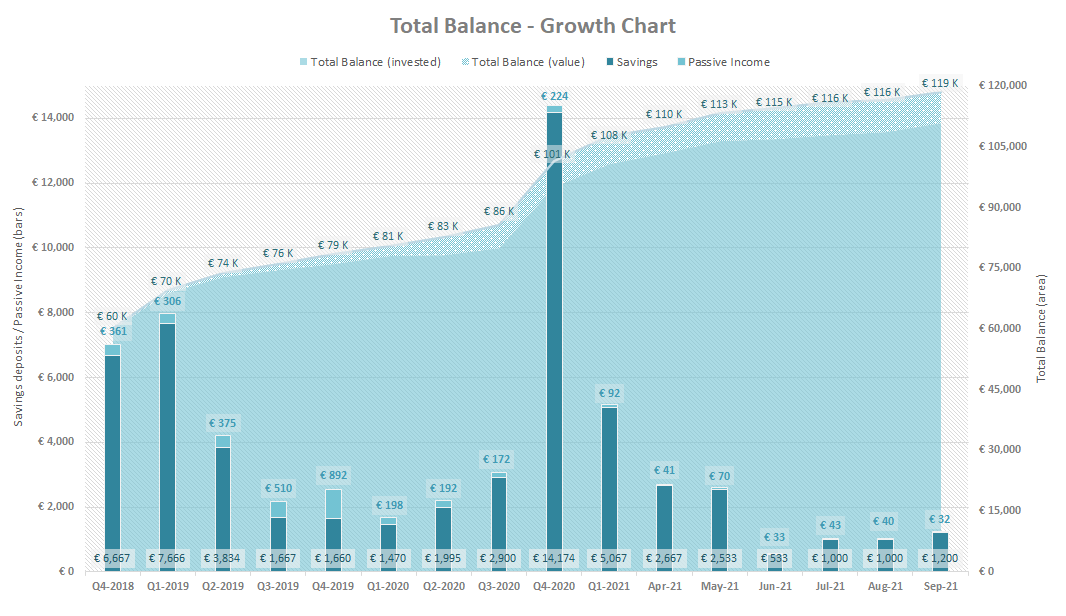

The Classic Growth chart

As always, I include the Classic growth chart for tracking purpose.

Should I one day decide to stop blogging (I’m not saying that I will!) this one chart is something that I will continue to update. It’s nice to see the progress slow and steady moving towards the sky! 🙂

It’s becoming a little busy and the low monthly passive income is really annoying me. I will spend next year trying to add some (more) dividend-paying assets I think 😉

In conclusion (TL;DR)

I managed to add €1200 to my savings, which is a slight improvement compared to the past 3 months. Unfortunately the coming months will see lower savings for reasons that I will share in the next monthly update 😉

I added a small crypto stake to my portfolio this month (been holding them for a while though), and while it’s not a lot it will hopefully help drive up my monthly passive income a bit going forward. I will continue to funnel whatever cash I recover from my failed crowdlending adventures into crypto (not much left to be recovered, but will maybe get €100-200 back).

I also finally managed to become CASH positive again, and that’s a nice feeling. I plan to build up a small cash stash again, while looking for opportunities to add more assets to the portfolio as we go along 🙂

That’s it for this months update, folks!

See you next month!

We’ve almost made the move to crypto at the same time, although in my case I’ve fallen in love with the DeFi side of crypto. No referral programs, no misleading advertising, no direct manipulation, it’s just you in the middle of a jungle hoping a bug won’t blow up your money haha

Is the celsius network similar to the Nexo platform? Is it built in the Etherum blockchain?