A while ago I wrote a post about how your personality dictates your return and since I’ve recently embraced the roller coaster (the stock market), I decided to revisit it and write down some of my thoughts, on how to pick a stock strategy that matches your personality.

Lets dig in!

The Personality Types

In case you have forgotten here are the 4 personality types:

In reality most of us are probably a mix of one or more of the personality types, but I suppose that there are “purebreds” that identify almost 100% with a single personality type. If you’re one of those, congratulations to you! 😛

In that case, picking a stock strategy should be fairly simple. – For the rest of us, it’s a little more complicated (at least for me!).

Picking a winning stock strategy

The very first things you should do before starting to invest, is write down your answers to these 3 simple questions:

- What is your goal with your investments (eg. retire early)?

- What is your risk tolerance/volatility acceptance level (high, low, medium)?

- What is your investing horizon (eg. when do you need the money)?

The next thing you should do, is think long and hard about your personal investment type profile. Are you an A, a B or C-type investor, or maybe a mix of B+C og A+C?

To determine that, you could ask yourself a simple question:

Am I cool with 100% passive investments, with subsequently very limited amount of time spent “investigating” each company to invest in?

If you can answer YES to the above question, then you’re probably a clear Type-B, and can thus start browsing for your favorite ETFs. Ideally automate your monthly additions (like on Nordnets “månedsopsparing”) to your portfolio, so you automatically invest new deposits in your selection of ETFs (or just one, if you prefer it super simple). Job done 😛

If you can answer no (or hell no) to the above question, you’re gonna wanna pick up a few books on either value investing or stock picking (or both). Either way, you need to first do some research to learn how to do some basic fundamental analysis to pick the stocks that you like (for whatever reason that may be). If this is your preferred method of investing, don’t let people deter you from pursuing it. You might end up failing miserably, but I guarantee you you’re gonna learn a thing or two by doing it 😛 Regardless, I’d urge you to start out with a small amount until you get comfortable with the process.

If you’re unsure about the answer to the above question, chances are that you (much like myself) is a bit in between. You’re not comfortable with a 100% passive or active investment strategy, so maybe you feel like dabbing in a little bit of everything. I’m not gonna lie, I like the way you think! However, chances are that the passive investment gang will be laughing at your returns at the end of the day. But don’t let that deter you from chasing your dreams! 😉

So, just what kind of return can one expect from a pure passive (broad index-based) investment strategy? That depends! What do you mean, it depends!?

The average stock market return

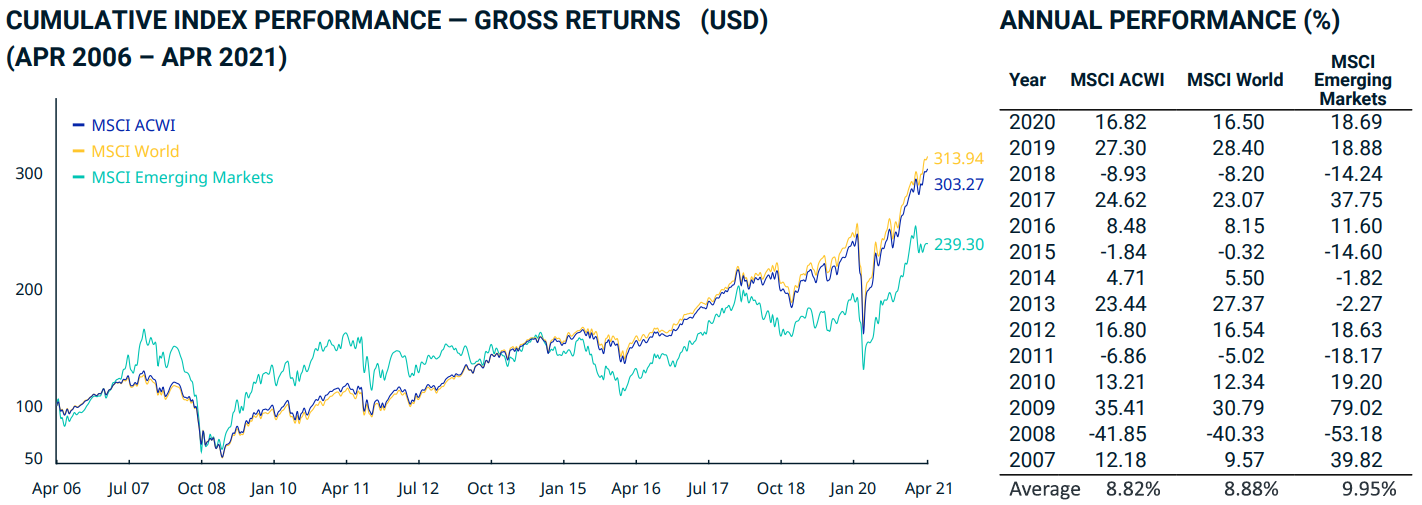

It depends on how broad an index you use. For the sake of simplicity, lets have a look at MSCI ACWI, MSCI World and MSCI Emerging Markets:

For the 3 major indices depicted above, this is the description provided:

The MSCI ACWI captures large and mid cap representation across 23 Developed Markets (DM) and 27 Emerging Markets

(EM) countries*. With 2,974 constituents, the index covers approximately 85% of the global investable equity opportunity set.

The MSCI World Index captures large and mid cap representation across 23 Developed Markets (DM) countries*. With 1,583

constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries*.

With 1,391 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

If we look at the AVG Return of the 3 major indices in the period between 2006-2021 we can see that the AVG return between ACWI and World only differs by 0,06% (8.82% vs. 8.88%). This is interesting, since the MSCI Emerging Markets alone actually have an AVG return that is more than 1% higher than both ACWI and World (9.95%). But when you combine EM with World (to form ACWI), you get a lower combined return…

So we can conclude that in the timespan between 2006-2021, your best bet would have been to allocate 100% of your portfolio towards Emerging Markets!? Yes, but you’ve had to endure a 53% loss in 2008. Ouch.

If we look further back in history, the numbers tell a similar story, albeit the general consensus among the experts seem to be that the global markets will have an average return of about 7%, within a 30-year period. In that context the previous decade (+/-) has been above average – despite both the financial crisis in 2008 and the (still ongoing) COVID-19 situation that began in early 2020.

This is all fine and dandy – but will you be getting to the point anytime soon?!

Building your personal strategy

What I’ve been trying to say is this: while the history speaks for itself, there’s absolutely no guarantee that the next 10-20 years in the stock market will look anything like the previous 10-20 years.

The last couple of decades has been driven hugely by Growth stocks (Think technology, bioscience and green energy). What if the next decade will be driven more by Value stocks (Think more classic business like Financial services, health care and consumer discretionary)?

So if you (like myself) aren’t comfortable with a 100% allocation towards <insert favorite investment object here>, maybe you should consider dabbling in a bit of everything?

It could be one of these examples:

– Or you could build your own personalized strategy…The point is to make it YOUR OWN. Whatever allocation you choose, you just have to make sure that you sleep well at night 🙂

I think we all know where I’ll be leaning towards… 😛

If you already have an allocation split between different sectors or stock types, how is it doing compared to the average market return?

Good article Nick, I see where you heading to with the Total Balance allocation.

Following your classification I would fall into conservative category.

I would have expected a small parcentage on alternative investments. I

… to account for crypto, P2P, art or “camels”?

Yes, for a diversified portfolio definitively- but this was for stocks only 😛