I recently read Rich Dad, Poor Dad by the famed author, Robert Kiyosaki.

The book is one of the best selling personal finance books of all time, and Robert Kiyosaki has built an empire out of his Rich Dad, Poor Dad concept. If you haven’t read it, I suggest you go pick up a copy at your favorite literacy pusher today!

One of the main lessons of the book, is that you should know the difference between a liability and an asset. Robert suggests that people falsely believe that their home is an asset.

Rich Dads definition of an asset, is something that puts money IN your pocket. A liability is then the opposite – something that takes money OUT of your pocket.

To Rich Dad, your mortgage is thus per default a liability.

Rich Dad, Poor Dad was written in 1997, but didn’t become a bestseller until the early 2000s. Like so many other aspects of life, timing is everything and in the case of Rich Dad, Poor Dad, the .com crash in 2001 was the perfect storm for his “teachings” to become household knowledge across the globe.

But is your home (mortgage) really a liability?

Join me, in a quest to discover whether this is truly the case!

Rich Dad also stipulate that you should only have debt, if somebody else is paying for it (which of course is the case for rental properties). That statement really resonated with me. I see what he means, and I agree with him – to some extent. The idea that your house is an asset, is something that we’ve been taught growing up. By our educational system, by our parents and by our peers. This is something that we teach each other, basically.

“Owning” property will never be a bad investment, my granddad always used to tell me. He just forgot to factor in the maintenance costs of owning (and the property taxes) a property (in this case, his own house), and these costs only rise with time.

I bought my first house in 2009, when the prices were down, but the interest rate was more than double of what it is today. The last couple of years we’ve experienced an interesting development in the interest rate and the inflation (CPI) in Denmark. The average inflation rate in Denmark for the past 5 years was only 0.66%. This is unusually low (in a historical perspective), and coupled with a historically low interest rate, you get an interesting outcome, if you do the math. Since I only pay 0.5% interest on my mortgage (flex-fixed, 3 years) my debt depreciates by 0.16% per year. This is in itself not very impressive – lets get some more inflation, please!

Hold your horses there, buddy! We also need to factor in my purchase power.

Since I’m (still) fairly young, and I’ve been active in advancing my career, I’ve managed to double my salary in 10 years. I’ve worked for 5 different companies in 10 years (this is not necessarily something that I’m proud of – but I would have never managed to double my salary, had I stayed with the same company for 10 years). I believe I’ve reached a (salary) plateau now though, so I don’t expect to double my salary again within the next 10 years 😉

However, since I’m now (back) working in the financial sector (which is highly unionized in Denmark) I’m secured a yearly salary increase of currently 1.95%. This is typically negotiated by the unions for a 3-year period, and prior to the crash of 2008 we had salary increases of around 4%/year in the financial sector. The times have changed for everyone though, so I don’t expect to hit 4% again anytime soon. Anyway, the relationship between the interest rate, the inflation levels and your salary (increase) is the key to understand, whether your mortgage is a liability or not.

So let’s calculate my “real salary” and my “real interest”:

real salary = Salary increase – inflation

real interest = Interest rate – inflation

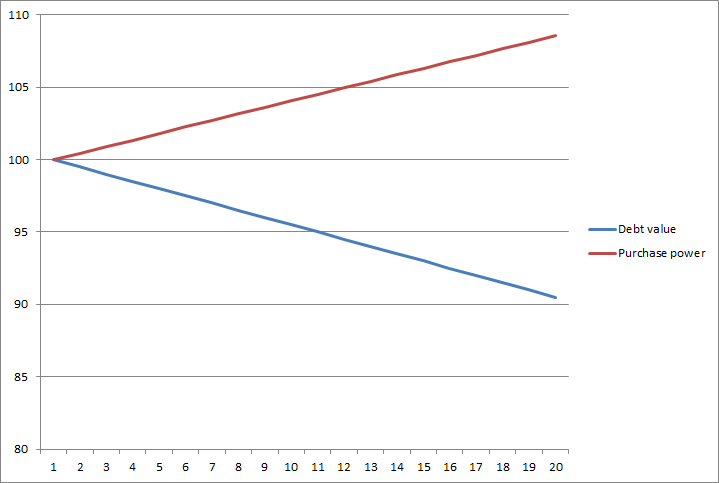

Let’s just for the sake of the skeptics out there round up the numbers a bit: Let’s assume that the average inflation level in the coming years will be 1.5% (which is the 10-year average currently) and my interest rate will be 1% (double of what it is today). Then my real interest will be -0.50%. As long as the inflation is greater than my interest rate, my debt will technically depreciate every year. However, if my salary doesn’t increase more than the inflation, my salary will depreciate as well. In this case, I know that my salary is going to increase by 1.95% in the coming years. So my real salary increase will be 0.45%. If we plot my real income and my real interest in a line-chart over 20 years, we clearly see how time (in this example) works for me:

Due to the favorable relationship between my interest rate, the inflation and my real income, I will be able to “buy back” my mortgage in 20 years, with an 18% discount! Of course, this is all theory, since its highly unlikely that this favorable scenario is going to continue for the next 20 years…

But, what if it did!?…We won’t know until 20 years from now, whether this scenario is going to become real (or not) 😛

If you remember, Rich Dad didn’t in fact say that my mortgage was a liability – he said that my HOUSE was a liability. There’s a difference. With the above graph, I’ve proven (in theory) that my mortgage can pay for itself (if given enough time – like 100 years or so! 😛 ). But your mortgage is only a part of the expenses that you incur, when owning your own house. There’s also the property taxes and the maintenance costs. Those will vary, based on the age and the location of your house.

If you instead rent your home (instead of owning it), someone else have to pay the mortgage, the taxes and the maintenance cost. Since I’m into real estate investments I know (I suspect you also know this) that that someone is in fact (also) you – the guy who rents the place (surprise)!. When you rent, YOU pay all those costs, and the guy who sublets the place then reaps the benefits, of having other people pay his bills. So, what does Rich Dad actually mean, when he say that your house is a liability!?

Most people start out their adulthood by renting a small condo. Then you finish school and get a good job. You then meet a girlfriend, and you decide to have kids. The condo thus become way too small (maybe it already became too small, when the girlfriend moved in). And then!

Hello, lifestyle inflation!

When we move from the (cheap) rented bachelor pad, into a big house that we can hardly afford (but it’s ok, because we expect to get promoted soon) that is when WE become the liability. You then spend the next 30 years, paying government taxes, maintenance costs and your mortgage – while what you should have been doing, was to stay in that condo and save and invest like a mad man!

Your house is a liability, because YOU choose to inflate your lifestyle, in order to keep up with the joneses. Welcome to the rat race! 😛

So, is YOUR house a liability?

I will let you be the judge of that 😉

Nick,

I think you’ve got some good points here! Primarily that we envision a mortgage to have an end date (15 year, 30 year mortgage–whatever the case). In reality, most people will move from one place to another, and probably more frequently than the term length of their mortgage. That means they’ll always be making those debt and interest payments.

Ultimately, I’d have to agree that in a vacuum a home is a liability (and certainly a mortgage is). But the reality is that you have to compare it the alternative, which is renting. Both of those options are a liability in the sense of an investment — you’ll be paying more than you earn from your primary residence assuming you aren’t renting out some portion of it. But, that doesn’t mean that buying won’t be an “investment” in the sense that at the end of your homeownership lifecycle–10, 20 years later–your net worth might be higher than if you’d rented for the same period. There’s a whole bunch of variables though that could send that outcome either direction.

That’s very different from owning rental real estate and if you have the third option to live somewhere for free, well, then, I suppose buying or renting is entirely a liability.

Thanks for writing this!