2023 is off to a flying start!

By the end of 2022 everyone was screaming about a looming recession (even myself). So far it’s no-where to be seen, and the “experts” have now pushed it to arrive in the 2nd half of 2023 (instead of the 1st half).

Nobody knows what’s going to happen, so all we can do is smile and keep going, right? 🙂

January 2023 in the Total Balance household was filled with both smiles and laughter, but also tears and sadness, as we attended a(nother) funeral…

The month in review

When you live long enough, funerals are inevitably part of life. I’ve said goodbye to 3 grandparents within a handful of years, and it’s a reminder every time that life is short and that you should enjoy it while you have it.

Dying of old age is a normal consequence of living. One that we all have to prepare for eventually. However, no-one can – or should – prepare for saying goodbye to their child. This was unfortunately the reality for a family whom we’ve been close to for the past couple of years, via my daughters school. After 4 years of battling with cancer, they had to say goodbye to their daughter, who almost made it to her 9th birthday. That was tough, and still is heavy to write about. I can only imagine how hard it must be for her family. It was however the most beautiful funeral in her spirit, and they have planted a tree in front of the school in her honor. Every morning when I drop my daughter off at school, we say good morning to the tree. She does not get to grow up with her friends at school, but the tree will grow as a symbol of her ever lasting optimism, refusing to give up or succumb to self-pity or negativity. Dying was never an option to her – she insisted on living every day to the fullest. R.I.P sweet J.

We got word in December that it was time to prepare ourselves to say goodbye. We hoped she would make it past Christmas, because it was her favorite holiday. She made it past New Year, and in mid January we got the call. A week after it was time for the finale goodbye. It’s honestly a bit hazy at this point, but I remember – as if in a movie – at one point during the ceremony the sun bursting through the skies, shining through the windows (the ceremony was not held in a church, as the family isn’t religious) illuminating the entire gathering, as if “someone upstairs” was letting us know she was in good hands. This is not something I’m making up! This actually happened! And I’m (still) not religious, but that was a pretty crazy experience.

This next part I also remember very vividly. As it was time to carry the casket outside, I heard a familiar sound. I could not help but burst out a laugh in the midst of all the tears and sorrow. It was the familiar sound of the ice cream truck, speeding up and down the street ringing its bell (every kid knows this sound). It was so in-appropriate at that exact moment, and yet so perfect. Somehow it seemed like a fitting backdrop for the finale goodbye. I’m pretty sure she would have approved of that send off 🙂

January was a tough month in that regard. However, we also had some fun times; one of them being that we celebrated my fathers 60th birthday. I might even have gotten a little tipsy! (Those of you who know me knows that I very seldom drink alcohol). I suppose there was a little extra incentive to “loosen up” after the “week of sorrow” that we had endured up to this celebration…

January was also the month where we re-opened our travel-account – as I alluded to in my yearly goals-post – we’ve booked a(nother) winter-retreat to sunny Egypt. This is my daughter’s favorite holiday destination, as she loves to swim in the ocean and just “hang out” on the beach. Luckily that fits perfectly with my wife’s appetite for sun and mine for “hanging out in the shade with a good book” 😛 (some would say that this makes me a “shady person”. Bwaha). Anyway, this little trip was actually inspired by the first piece of good news that I received in 2023; we got a big refund from our energy company. Because of our energy saving abilities, we got more than €1,100 back from our energy company. And WHAT does a true frugalist do with that sort of “wind fall” money? SPEND it on a vacation, of course! 😛 (no?…I guess we’re not true frugalists then…). Just for the record: the trip is more than €1,100…but it does cover about 1/3 of the cost, so yeah…

Anyway, in money-land January 2023 was not a bad month – in fact, it was a pretty good one 🙂 I’ve been especially impressed with the performance of Gold lately. This is a bit of a niche investment for me, but as time goes by I regret more and more not buying that 5th Gold coin (I’m missing the American Eagle in my collection). On the other hand, it’s a pretty “boring” investment, in that I’ve been told that one should not buy Gold to become rich. – One should by Gold so as to not become poor…Excuse me, but isn’t that the same thing, Nick!? Well, the theory goes that “when the shit hits the fan”, Gold will always hold some value. Yeah, I don’t recommend Gold as an investment to be honest – it’s more of a “collectable” to me, similarly to an expensive watch (which I’ve also considered buying…). I suppose the best collectable would be a Gold watch, then?! 😛

Anyway, Crypto had a small resurge, and stocks also had a small rebound as well. Whether this is sustainable is tough to say, but it’s fairly clear by now that the market is a bit skew at the moment, where Europe and Asia in general is in “fair value” territory, while the US is (still) in “over valued” territory. I think we will see further weakening of the USD vs. EUR during the coming years, and I’m starting to also smell the end of this QT season as well. All in all there are good reasons to be optimistic about the future (if you’re in Europe at least), and this gives me a little hope that we will be able to sell our primary home at a decent price this year (fingers crossed). We’ve had 3 showings without advertising online, so I think that’s a sign that at the right price there are buyers out there – even at the current interest levels (4-5%).

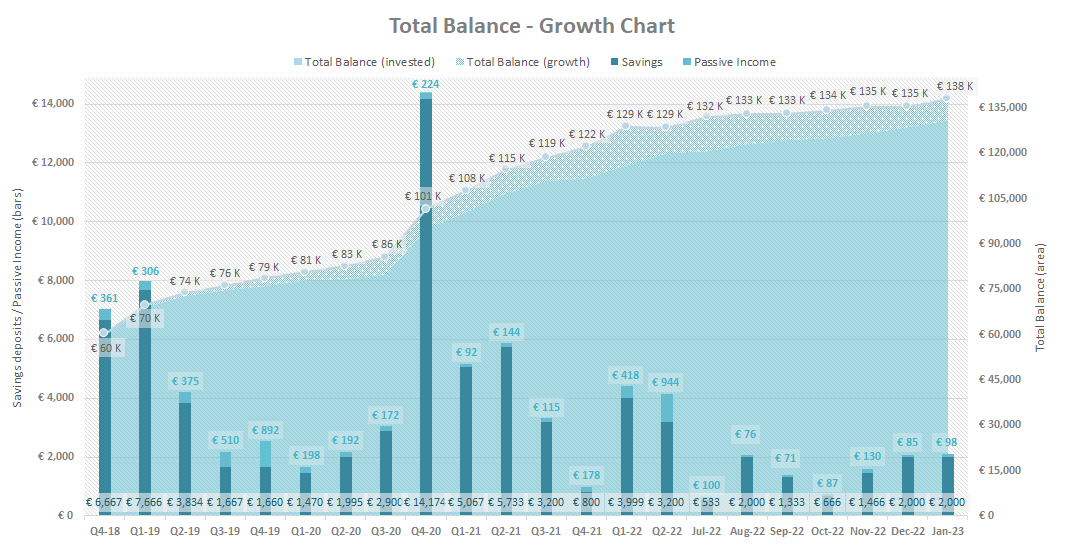

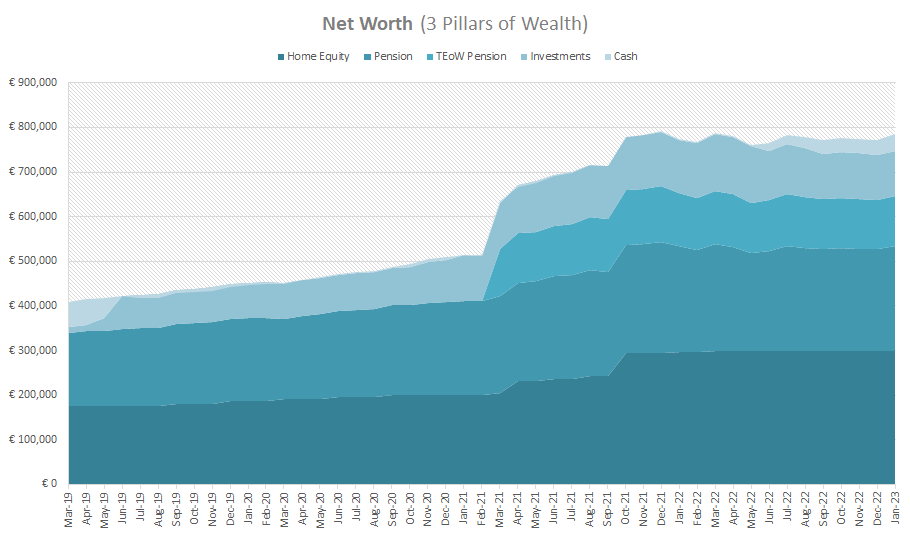

The pwetty graphs

Finally a green month! 2023 is off to a decent start 🙂

The boring income statement

| Platform | Invested | Transactions | Last month | Current value | Monthly income |

| Commodities | |||||

| GOLD (Coins) | € 5,333 | € 0 | € 6,500 | € 6,500 | |

| € 6,500 | € 6,500 | ||||

| Stocks (Dividend portfolio) | |||||

| Bank of Nova Scotia (BNS) | € 1,000 | € 0 | € 1,131 | € 1,243 | € 0 |

| Enbrigde (ENB) | € 2,400 | € 0 | € 2,218 | € 2,243 | € 0 |

| Granite REIT (GRT.UN) | € 1,859 | € 0 | € 2,435 | € 0 | € 6 |

| PROREIT (PRV.UN) | € 2,018 | € 0 | € 3,693 | € 4,028 | € 17 |

| Toronto Dominion Bank | € 1,000 | € 0 | € 1,035 | € 1,076 | € 8 |

| TransAlta Renewables (RNW) | € 2,000 | € 0 | € 1,581 | € 1,643 | € 8 |

| True North Commercial REIT (TNT-UN-T) | € 3,552 | € 0 | € 3,062 | € 3,144 | € 19 |

| € 15,155 | € 13,377 | € 58 | |||

| Stocks (Indices) | |||||

| iShares Global Clean Energy (IQQH) | € 6,667 | € 7,987 | € 7,803 | € 0 | |

| Xtrackers MSCI World ESG (XZW0) | € 2,721 | € 2,331 | € 2,426 | € 0 | |

| € 10,318 | € 10,229 | € 0 | |||

| Properties | |||||

| Property #1 | € 68,667 | € 0 | € 68,667 | € 68,667 | € 0 |

| € 68,667 | € 68,667 | € 0 | |||

| Crypto | |||||

| Celsius (ADA, BTC, DOT, ETH, MATIC)* | € 0 | € 0 | € 0 | € 0 | |

| Binance (ATOM, FTM, LUNA, ONE) | € 0 | € 0 | € 0 | € 0 | |

| Nexo (BTC, ETH, MATIC, EURx) | € 0 | € 598 | € 724 | € 4 | |

| € 598 | € 724 | € 4 | |||

| Cash | |||||

| Bank #1 cash (main savings) | € 2,415 | € 0 | € 2,415 | € 0 | |

| Bank #2 Opportunity money | € 2,000 | € 33,834 | € 35,834 | € 36 | |

| Broker account (CAD, EUR, DKK) | € 58 | € 283 | € 291 | € 0 | |

| € 34,117 | € 38,540 | € 36 | |||

| Total balance | € 135,355 | € 138,037 | € 98 |

Since my broker force-sold my holdings in Granite REIT, I’ve got some extra cash laying around, which is now resulting in a pretty decent interest income from my cash stash. My bank has even raised the interest rate from 1.20% to 1.45% now! Soon this passive income stream will be rivaling my dividend income in size. All in all a good month in terms of the financials!

The Classic Growth Charts

As always I include the Classic Growth Charts for tracking purpose.

We’ve not been this cash-heavy since February 2021. Ahoy! Dry gunpowder aplenty, matey! 😉

In Conclusion (TL;DR)

January was a huge mix of emotions. We had the first showings of our house, we attended the funeral of a small wonderful soul, and we celebrated my dads 60th birthday.

Meanwhile the world seem to have gone a little less to shits (not counting the ongoing war) than usual, and our financials have somewhat recovered (not completely though).

Looking at the macroeconomics and the geopolitical landscape (which I enjoy to do, for some obscure reason), I remain positive for the coming months/years. We’re definitely not “out of the woods” yet, and there will be (more) bumps on the road, but I’m finding myself in a state of optimism, rather than pessimism (which I kind of felt like 2022 had a lot of!).

We will be going on a winter-getaway in the beginning of March (back to Egypt!), and we’re very excited for another family trip out into the world. The pandemic almost seem like a faint memory at this point (almost…).

That’s it for this months update! See you next month!

How was your month?!