Hello dear readers and good folk.

Here we are – yet again – as it’s time for another riveting update from yours truly.

As is the norm these days, this one is a bit delayed, as we’ve been on a getaway to “the promised land”. We didn’t quite get what we were promised though – but we did get some sun and some nice needed rest AND a break from the Danish winter-weather. I also managed to read 3 books in 1 week. I love reading, but for some reason I can only really “concentrate” on doing it when I’m on vacation…

The month in review

Since we left Denmark at the end of February, I did not get the chance to check up on my portfolios around the 28th, and unfortunately the beginning of March has not been kind to our portfolios.

We’ve been busy with preparing our home to get listed, and we’re now almost ready to go online. I’m still quite weary about the whole situation (always the pessimist) and don’t really know what to expect. Anyway, I try to remain hopeful that there’s going to be a buyer out there – at the right price.

Meanwhile, we hired a building inspector to go through the house that we were planning to buy (instead of our current home). He found major issues, so now “the dream home” has turned into a bit of a dud. This has kind of put a bit of a stick in the wheel, in terms of our future plans. The “cheap home” that we were planning to move to, which was close to our daughters school, now no longer exists…This house was the whole basis for our moving plans. So now…everything is kind of up in the air again. Anyway, the first step to moving anywhere is to sell our current home, so that will be our focus for the coming months 🙂

Another shite-month in the markets. I don’t have a lot to add, other than I’m starting to get really sick and tired of it! 😛

Also, the CAD->EUR exchange rate has dropped 5% in 1 year, so my CAD dividend portfolio is bleeding money at the moment. I’m starting to think that I should quit the currency race, and just sell everything and put it into my bank account. At least here I get 1.5% 😛 But who am I to run away when the going gets tough? 😉 I think I will have to stick to it for a little while longer (at least until Property #2 presents itself, and I might need the money here instead?…).

Anyway, I feel like I just need to get this one off the ramp, and once again point out that after all the majority of our investments are safely placed in a property, which is currently spitting out cash faster than the markets can drop! (HA!). I got word from the board (of the company that I own 10% of – which then owns Property #1) that we are going to attempt a remortgage and a full re-leverage (meaning we will re-mortgage back to the original 70% of the property value). This is not until October though, but the decision will be made during summer. Currently we’re looking at an interest increase from 1.38% to 4.10%. Ouch. Luckily the company will still be (very) profitable, even at this interest rate, because we’ve also raised the rent by 4.5% because of inflation. Hooray for CPI-adjusted leases! 🙂

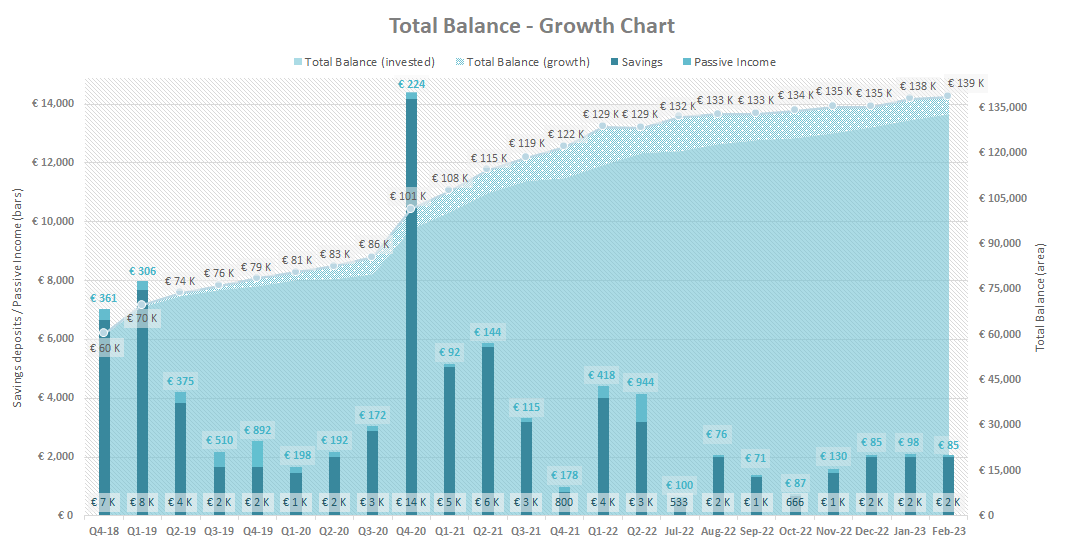

The pwetty graphs

I’l be completely frank (in New York I’m Frank, in Chicago I’m Earnest – get it? 😛 ) here: it’s kind of frustrating to be putting €2,000 into your savings and only see the Total Balance grow by €573! Oh well, better luck next time, right!? 😛

The boring income statement

| Platform | Invested | Transactions | Last month | Current value | Monthly income |

| Commodities | |||||

| GOLD (Coins) | € 5,333 | € 0 | € 6,500 | € 6,500 | |

| € 6,500 | € 6,500 | ||||

| Stocks (Dividend portfolio) | |||||

| Bank of Nova Scotia (BNS) | € 1,000 | € 0 | € 1,243 | € 1,250 | € 0 |

| Enbrigde (ENB) | € 2,400 | € 0 | € 2,243 | € 2,102 | € 0 |

| PROREIT (PRV.UN) | € 2,018 | € 0 | € 4,028 | € 3,826 | € 17 |

| Toronto Dominion Bank | € 1,000 | € 0 | € 1,076 | € 1,049 | € 0 |

| TransAlta Renewables (RNW) | € 2,000 | € 0 | € 1,643 | € 1,557 | € 8 |

| True North Commercial REIT (TNT-UN-T) | € 3,552 | € 0 | € 3,144 | € 3,044 | € 19 |

| € 13,377 | € 12,828 | € 44 | |||

| Stocks (Indices) | |||||

| iShares Global Clean Energy (IQQH) | € 6,667 | € 7,803 | € 6,926 | € 0 | |

| Xtrackers MSCI World ESG (XZW0) | € 2,721 | € 2,426 | € 2,349 | € 0 | |

| € 10,229 | € 9,275 | € 0 | |||

| Properties | |||||

| Property #1 | € 68,667 | € 0 | € 68,667 | € 68,667 | € 0 |

| € 68,667 | € 68,667 | € 0 | |||

| Crypto | |||||

| Nexo (BTC, ETH, MATIC, EURx) | € 0 | € 724 | € 756 | € 4 | |

| € 724 | € 756 | € 4 | |||

| Cash | |||||

| Bank #1 cash (main savings) | € 0 | € 2,415 | € 0 | € 0 | |

| Bank #2 Opportunity money | € 2,000 | € 35,834 | € 40,249 | € 37 | |

| Broker account (CAD, EUR, DKK) | € 44 | € 291 | € 335 | € 0 | |

| € 38,540 | € 40,584 | € 37 | |||

| Total balance | € 138,037 | € 138,610 | € 85 |

A little below-average passive income month this month, but the bank interest is slowly beginning to become a significant part of my passive income. I know that 1.5% is silly little, but it feels a lot better than loosing 1.5% (or more) to the stock market 😛 I’m quite happy with not being fully invested during these volatile days/months. 2023 is impossible to read at this point, so I prefer to keep accumulating cash over anything else. I remain on target for an average of €2,000 in monthly savings deposits. I hope to keep it up, but whether it will be possible will all depend on WHEN/IF the house move is currently to materialize this year or not…

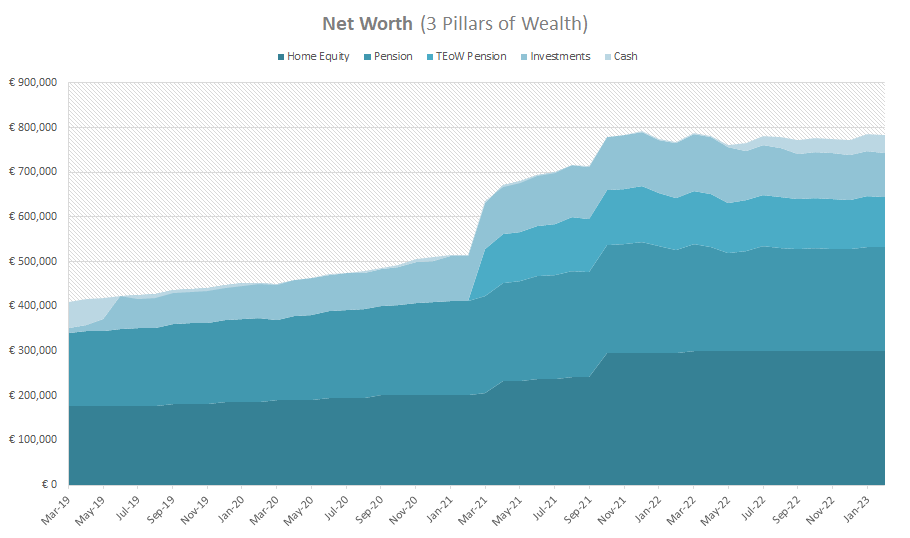

The classic growth charts

As always, I include the Classic Growth Charts for tracking purpose:

The conclusion (TL;DR)

I’m tired of watching my portfolio decline month after month! But such is the game – it’s long and hard 😉

Nothing exciting or out of the ordinary happened in February – except that our “next home hope” died with an inspection that pinpointed severe damages below the surface of the house (literally). So now we don’t really know what to do IF we manage to sell our own house. There is currently no other house in the area where we want to live that’s in our price range (mind you that we want to buy a CHEAPER place than the one we have now). I will put my trust and faith in The Universe that it’s all going to work out in the end 😉

See you next month for another riveting update from yours truly!

How was your month?