Hello people!

It’s time for another riveting update from yours truly. As is the norm these days, there has been a development that has flipped everything upside down.

The Update

On July 31st we handed over the keys to our old home to its new owners. We’re now officially living IN the new house.

We were supposed to be living IN the temporary “trailer” home in the back yard – but we’re not…

It all began on July 28. It was a Friday, and we had been looking forward to get our new temporary home installed – and to get settled in. We were handing over the keys to our old house on Monday 31st, so we only had 3 days to move everything and settle in.

The “tiny-house” arrived on time and was craned into our yard. It didn’t take them long to “install it”.

It took up quite some space in the garden – almost all of it, actually!

My wife walked inside the new living arrangement and shortly after she uttered the famous words: “Right, I’m not sleeping in this”…

*Face palm*

The room where our daughter was supposed to sleep in had clear indications of black mold! Granted, this unit was a bit older than we had hoped and since black mold is a pretty severe safety hazard there was only one thing to do; Move into the house instead!

Mind you that we had not intended to live in the house at this point, but since the actual renovations hasn’t started yet – it was/is livable. It just doesn’t have a kitchen, and there is furniture and boxes everywhere…

Anyway, a few hours later – some speed-cleaning and moving stuff around, we had a bedroom that we could sleep in. We of course called the “tiny house” company, which said they would send a “cleaning crew” first thing on Monday. The thing with black mold is, once it’s been there it’s not that easy to remove – and it cannot be done by standard cleaning products, so we demanded that they sent us a new mold-free unit. We agreed that we would let them attempt to clean it, and then we would have it tested for black mold afterwards.

Now, I should state that before all this happened, I had actually begged and pleaded with the wife to actually CANCEL the tiny-home and move into the house instead – since it was THERE. Originally we had expected to be mid-renovation at this point, and thus we would have not been able to live inside the house. But because the renovation is paused (because of the ongoing insurance case) the house was/is actually livable. BUT, at this point my wife did not want to move into the house, but would rather that we followed our original plan with the tiny home…

Alas, the universe wanted it otherwise, and I distinctly remember my wife uttering the following words on that day: “You were right all along, honey- we should have cancelled that damn thing and just moved into the house instead”. YOU READ IT HERE FIRST, FOLKS! I WAS RIGHT ALL ALONG! 😛

Anyway, we had the tiny-home tested for black mold (so now we can add this to our ever-growing resumé of shit we now know how to do!), and sure enough – it had “severe black mold growth”. Ouch. The company then decided to remove it again AND said that they could not promise us that a new one would NOT have black mold in it! OMG! So they will refund us the money and then I guess we are living in our new house for now!…

I then scoured the yellow pages for kitchen cabinets and appliances, and we have now built a pretty well-functioning kitchen for less than €500. And this is where it becomes quite interesting. We’ve now been living in a house for about 14 days that has every basic functionality that a house needs – and yet we’re planning to MOVE out of it (at some point) to tear it all apart, and install a new €10,000+ kitchen (among other things). But why? It works just fine the way it is. Granted, it’s not pretty – but it works! Unfortunately my mental state and my wife’s seem to have gone in opposite directions here. I’m now questioning this whole renovation ordeal, while she can’t wait to get it back on track. But where will we then live?! At this point, we don’t really know…But as always, I’m sure we will figure it out eventually. I put my faith in the universe once again! 😉

The situation has spurred some tension in our household… I’m trying to see things from both sides, but no matter how I look at it, it seems frivolous to spend €100,000+ renovating a home that isn’t faulty per say. – It’s just outdated and a bit obscure 😛

I’m preparing mentally to spend the winter in our temporary living situation, while my wife is on the phone with the insurance company every day, trying to get them to speed up the process. I think she’s battling a lost cause here though. There is no cure for bureaucracy and short-staffed insurance companies. You just have to be patient – and while historically patience hasn’t been my strong suit, I’m SO prepared to wait this one out! HAHA. Apparently I’m much more willing to live in “temporary accommodations” because I know that it’s temporary. Certainly there are people out there in the world, who are living in much worse PERMANENT living conditions than we are. My wife on the other hand, is NOT happy…And you know what they say; Happy wife, happy life. So as you can imagine, currently unhappy wife = unhappy life…

On the plus side of all of this, our monthly expenses have now settled somewhat (since our mortgage on the old house has now been settled) and we can now already start to see some of the savings that we will be reaping every month. Most of these savings will go towards amortization though – which means it will be transformed to equity. Just to re-cap for those of you who aren’t up to speed with what’s going on; We moved to a smaller and cheaper home for two reasons:

- To get closer to our daughters school so she could walk to/from school

- To lower our monthly expenses (to be able to save more towards FIRE)

From day 1 in the new house we’ve been reaping the benefits of #1 reason. Our daughter has been walking to and from school every day – and she loves it. The freedom that it gives not only her, but also her parents is priceless! 🙂 Because our traffic patterns have changed drastically, we believe we can live with having only 1 car (please, there are people out there living with 0 cars! 😛 ), so this will be the next step of the journey. Next month our lease is up on our little EV (Renault Zoe). I’m finding it hard to say goodbye to this little trooper. It’s not pretty or fast, but it gets the job done! It’s quiet and very economical. Unlike our soon-to-be only car, our 10-year old Skoda Rapid…It’s not quiet and it runs on gasoline…*deep breaths*. We bought it 2nd hand 6 years ago, and it has been very trustworthy. But as it ages (close to reaching 200,000km now) it’s going to need more and more repairs. It’s one thing going from having two cars to one – I think that will be doable for us. The weary feeling that I have about this, is that I don’t like the 1 car we have left. It’s my wife’s car, and I don’t like driving it. But it’s cheap (until the major repairs start to arrive!). I don’t know guys, I feel like a replacement is imminent, although given my rant above about being OK living in an old house, why wouldn’t I be OK with driving an old car?…I just hope it’ll get through the winter without any major hiccups 😛 – Because at the first sign of problems with that car, I predict it will be replaced! HAHA.

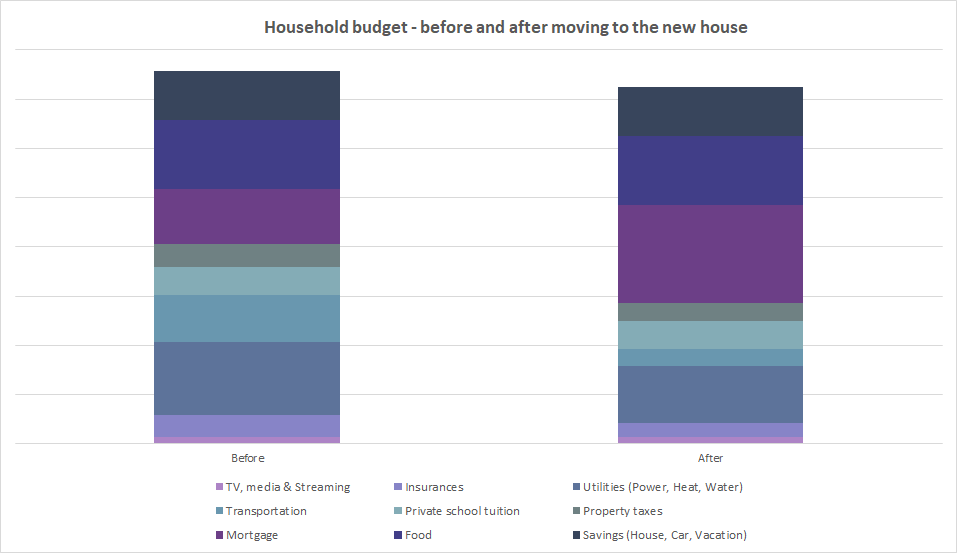

Anyway, the #2 reason for moving was lowering our monthly (living) expenses. We were on track for a 30% decrease in direct living expenses – but then this shit happened:

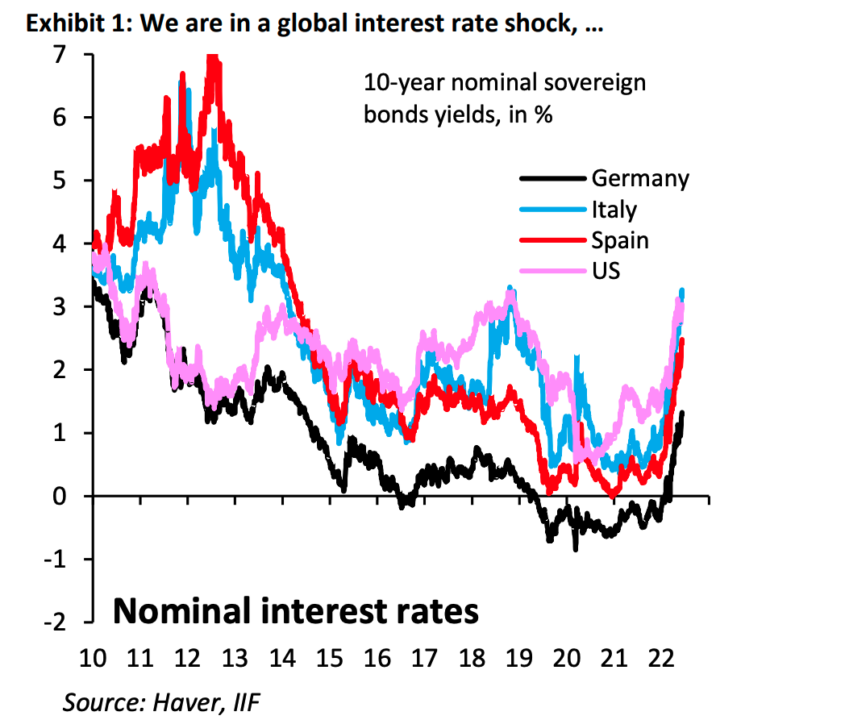

While our new mortgage is actually 40% smaller than our old one, the interest rate is 350% higher! Yikes! So we decided to go back to amortization on the new mortgage. This means that our overall budget only decreased by 4% from the old house to the new house – but, we were not amortizing in the old house with the old mortgage, so a big chunk of the new budget is obviously going to be turned into home equity. We will continue to do this as long as the interest rate remain at the current levels. Should it once again return to ~1-2%, we will probably stop amortizing and prioritize investing instead.

This is our new budget compared to the old one:

I’m clinging to the fact that it IS still (slightly) cheaper in the new house…Unfortunately, overall this is not going to get us closer to our Total Balance goal any faster…It’s back to the drawing board on that one, I guess!

But this is when it starts to get a little licorice (it’s a Danish expression. – It means: now it’s getting interesting/exciting/thrilling/nerve wrecking). Remember when I said that our new mortgage was 40% smaller than our old one? Some of the difference is currently now in our bank account. This amounts to around €100,000 actually, which happens to be our renovation budget (surprise, surprise). If you remember, I’ve been moving my cash stash around between whichever bank was paying the highest interest. Lately this has been either Norwegian Bank og Santander. They both currently pay 2.10%. But I’ve just discovered that our main broker (Saxo Bank) is currently offering 2.8% on deposits above €90,000. This means that our renovation budget is currently generating just shy of €8/day in interest at the moment. That’s €240/month. This is of course not a fortune, but it translates to almost €3,000/year. This amount of money could actually finance a small car…So this is where we’re at; Do I want a new kitchen/new bathroom/new living room/new bedroom/new driveway/you-get-the-idea or do I want a new car?!…Decisions, decisions…

The Classic Growth Chart

As long as we are not contributing to our Total Balance, I don’t think it makes sense to keep updating this chart (also, I’m very lazy). We have started dipping into the cash stash to support our crazy building project, so I will temporarily retire the Classic growth chart from the monthly update for now… (It shall return!).

In Conclusion (TL;DR)

We are now living inside of our renovation project, because the tiny home was infected by black mold. YAY!

Since the actual renovations hasn’t started yet (because we are awaiting the outcome of an ongoing insurance case) the house is livable, albeit a bit funky…

I’m strangely comfortable with the whole situation, albeit my wife is NOT. So naturally, none of us are happy right now! 😛

Well, I’m kind of happy, because our renovation budget is currently yielding a cool 2.8% interest in the bank (give me a break, I have to have something that I can be thrilled about! I know that 2.8% isn’t a lot, but mind you that 2 years ago we were actually PAYING 0.60% to have money in the bank!).

See you next month!

Good luck with the renovation and hope the work doesn’t take long. My friend unfortunately had ‘cowboys’ doing her kitchen and the whole lot (the new cupboards) had to be ripped out and started all over again due to safety reasons – she was without her main kitchen appliances for 3 months and was living on takeaways, microwaved food and BBQs, taking her laundry round to friends’ and family!

Thanks, Weenie!

Always good to hear from you. I hope you are doing well in your new(ish) house 🙂

We will be installing the kitchen ourselves, but I’ve also heard some scary tales from people who had paid good money to have their kitchen installed, just to have the top cabinets come down and crash hard and ruin the news floors!

This one had me smiling, Nick. 18 months ago, I was venturing down a similar path, and facing some of those same decisions. I wish you the very best of luck for the road ahead.

Everyone’s circumstances and preferences are different, especially true within a family as when comparing between households! But for what it is worth, here is what I learned from the experience. Your mileage may vary.

Property values are driven by size and location. Replacing an old busted kitchen with a pretty new one full of shiny appliances may make it sell faster, but adds little to nothing to the price. The same is true of just about all renovation features, if it isn’t actively creating value through adding size or subdividing for example, then we just do it because it is nice. Which makes us feel good, as owner occupied housing is primarily designed to do, but financially speaking has the same effect on our wealth as if we’d lit the money on fire.

There are a few exceptions of course. If you possess the skills/knowledge/equipment/interest to go the DIY route and achieve professional looking results then you can save some of the developer premium (while not ignoring the value of your own time of course!) Next best is knowing tame tradespeople who only charge you “mate’s rates”. That may create a little value.

Location you can’t do much about, and will determine most of the price you eventually sell for. For good or ill that aspect of the property was locked in the moment you completed the purchase. You may be fortunate and enjoy infrastructure, employment prospects, or simply changing fashions to grow at or ahead of the market. Or not, as the fates decide.

What I will say is renovations feel good once they are over. We might not have added a cent to the value, and financially are much poorer as a result, but hopefully our families are happier as a consequence of their new surroundings. Best of luck with it.

Thanks for stopping by IDAB!

Always nice to hear other people’s experiences.

I do agree with your overall assessment, but I’d add the floor plan as the 3rd major value adding potential. Some people do not have the imagination to tear down a wall, or add a door to change the layout/flow of a home.

My wife and I both have this ability, which helped us secure a nice profit on our first home (we knocked down the wall between the kitchen and the living room).

I am still not sure how everything will pan out, but my wife reminded me the other day that the best investments we’ve made has been the upgrades in our own homes (we’ve always sold our homes with decent profits). I know she is right, but the scale and magnitude of our current project has the potential to burst the reno-budget by 100%+ if we are not careful…

There is no doubt that ultimately the wife will get her way (as she always do). It’s just a matter of when and how this will play out haha.

I find myself questioning more and more the mindset of “saving as much as possible”, rather than putting the money to good use, in upgrading our surroundings.

Sometimes I wish I never discovered FIRE. People who live without the knowledge – or the interest – seem to be more at ease with spending money like there’s no tomorrow… 🙂

You’ve had a busy month!!

Here’s my unwarranted, not knowing anything, advice. Hear me out!

Why don’t you just slowly renovate the house yourself? You might get a lot of fulfillment from doing it, you’ll save a ton of money and learn new skills, and it’s scientifically proven that you love what you build yourself more 😉 I know those scandi trades-people charge sky high rates and seemingly take an age to finish projects, cut out the stress and start learning how to build – you’ve already started it with the 500 euro kitchen; bring out your inner Mr Money Mustache.

If you don’t do that, why would you have to move out to renovate the kitchen? We did ours in England and it was done in a week. You can either: eat out or plan it for when you’re going on vacation / to visit family. Or is it the lagom mentality which means the builders will need months and not a week?

Ooooo, we now have one of these wonders an “14 in 1 Ninja Foodi” – Google it – it’s actually better and more efficient than a stove/oven and we cook most of our meals in it now, all it needs is a socket. You could get by with a table, that, and a sink (or worst-case a camping dish bucket for washing up and a tap/hose pipe.) Could you not live like this inside the house, even if it takes months?

Or! You could meet half way. Do the most expensive – and most fun – bits DIY and as you go while living there, but hire a builder for the more tricky bits, e.g. for putting the kitchen counter tops on (you don’t want to fuck that up, especially if you have something expensive like quartz.) This could build a lot of equity in your home too by DIY’ing.

If you were still in your old house, would you be a lot worse off now with the interest rate hikes? It’s crazy that you don’t have fixed mortgages as much over there. In the US it’s the opposite, everyone has 15-30 year fixes, it’s due to some kind of federal law that came into place here after the 08 crisis, they forced the mortgage companies to need to fix. It means no one is moving houses / selling though.

Thanks for the idea!

It’s of course something that I/we have considered.

If I were young and didnt have a kid, the option that you describe would suit me fine. It is a possibility to do a reno room by room, but this method will void the option of adding underfloor heating. It’s certainly possible to live without this feature, but the floors today are not very well insulated – so cutting this part of the project away would make the place less desirable to live in – both for us and future owners. Also I’ve done similar but smaller projects before, and renovating a home while you live in it is tough on your relationship(s).

We have bought the place at a good price, so I am sure that any money we put into it will return again eventually the day we sell it.

It’s the uncertainty about it all that troubles me the most right now…

Actually, about 60% of the Danes are in 30y fixed-rate mortgages (we are a conservative people you know :-p ). But the fixed rate is currently 5%+ fees (which makes it around 6% total). We currently pay 3.8% total on our flex-rate. We have been in flex for more than 15 years now, and it has served us very well.

However, we had 0.5% fixed-rate mortgages in Denmark a few years ago. I’ve often hit myself over the head for not getting one of those! Haha. Anyway, I could not have brought it with me to the new house, so the option we had was 5%+ (fixed) or 3%+ (flex). Time will tell if the flex “gamble” was worth it 🙂