If you’re new to this whole idea of early retirement and are eager to learn “how it works”, I’d urge you to take a gander at the great article from the one and only Mr. Money Mustache entitled “The Shockingly Simple Math Behind Early Retirement”.

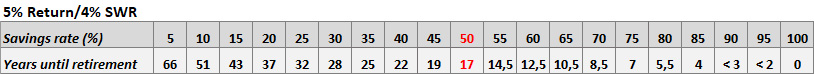

His calculations are based on an average return (after tax and inflation) of 5% and a Safe Withdrawal Rate (SWR) of 4%. The last variable you need in order to calculate how many years it would take you to reach FI is then your savings rate. Needless to say, the higher the savings rate the shorter the journey.

But as the saying goes: There are many ways to skin a cat (it’s a metaphor, grow up!).

Let’s have a look at the math, shall we?

The Simple Math

Mr. Money Mustache presents this table (I’ve altered it to be horizontal for aesthetic reasons – bear with me) to visualize at what point you can expect to retire, when you start with a cash stash of zero:

Assumptions:

- You can earn 5% investment returns after inflation during your saving years

- You’ll live off of the “4% safe withdrawal rate” after retirement, with some flexibility in your spending during recessions.

- You want your ‘Stash to last forever, you’ll only be touching the gains, since this income may be sustaining you for seventy years or so. Just think of this assumption as a nice generous Safety Margin.

So from the table above, we can see that IF we somehow manage to live our lives for 17 years with a 50% savings rate netting 5% interest on our investments, then we’re home free! Shocking indeed, no?! 😛

When i first realized this fact it absolutely blew my mind! 17 years?!

But the question is:

How realistic is it, for a regular person to live a normal/half decent life with a 50% savings rate?

You tell me?…

I have an above average paycheck, so for me it would certainly be realistic (my current savings rate is somewhere in the 15-25% range though. – Remember I live in an expensive area in an expensive house with an expensive wife, a kid, two kats, two cars and 6 chickens…). Had I known about “The shockingly simple math behind early retirement” 5 years ago, I’m fairly sure I would have made a different choice in housing (among other things). Which is why I’m now sharing this with you TODAY, so that you can (hopefully) avoid making the same mistakes as I did! 😛

But what about the average person with an average salary? Is a 50% savings rate for the average Joe at all possible?

I’m not going to be the judge of that, as it’s been a while since my salary was average. Judging from the FIRE community though, it seems like anything is possible if you set your mind to it, and are willing to live less extravagant than the average person 😉

For some 50% will be achievable, and for others it wont.

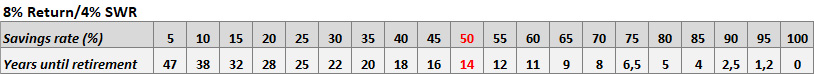

But what if we played with (just for fun?!) the idea of an above-average ROI? Let’s just say, 8%? How would the table then look?

Obviously the higher the return the shorter the journey…40% savings rate with an 8% return will make you FI in 18 years.

But is an 8% return on investment realistic (long term)?

You tell me!?…

I don’t know. It will certainly depend on your ability to pick above-average investment vehicles. For the average Joe, using a net return of 5% as a base might be more realistic than 8%, but sometimes being average is just really…boring! 😛 So whatever you do, I’d encourage you to aim as high as your risk profile will possibly allow you! Why settle for 5% if you can hit 7%?

Spending less (or earning more) should be your go-to action, when wanting to up your savings percentage, no doubt! But don’t be shy to also consider aiming for above-average investment returns! 😉

Changing (some of) the parameters

We could also question the motive of “assumption #3”: You want your ‘Stash to last forever

Do I? Do I care if I have money in the bank if I’m dead?! I’m sure my daughter wouldn’t mind, but in my case I don’t plan on living solely off of my Total Balance investments. I also have a private and a public pension (government). My private pension is accessible when I turn 60 (yes, I’m one of the lucky ones!).

So what if we played with that Idea? – Allowing our FIRE pot to be drained over time, to eventually reach 0.

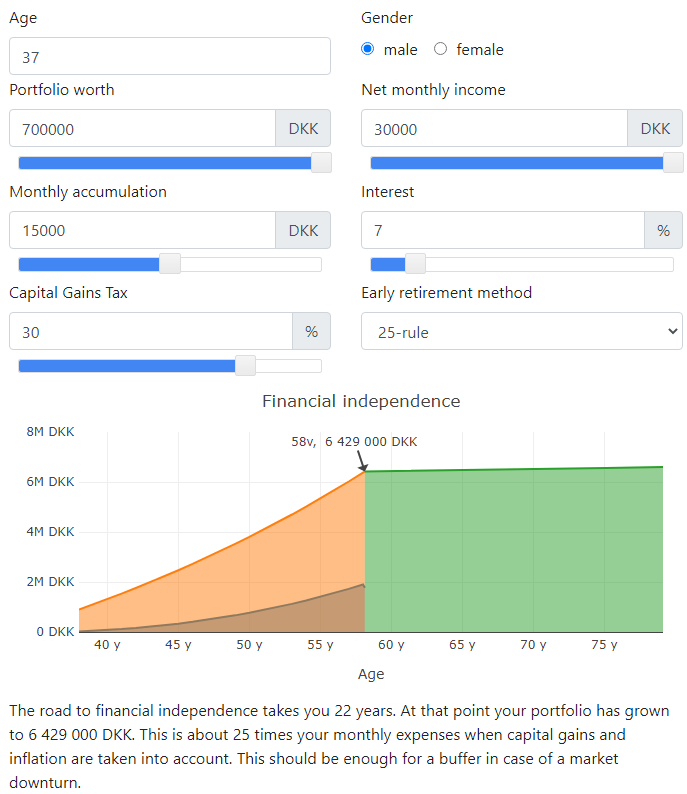

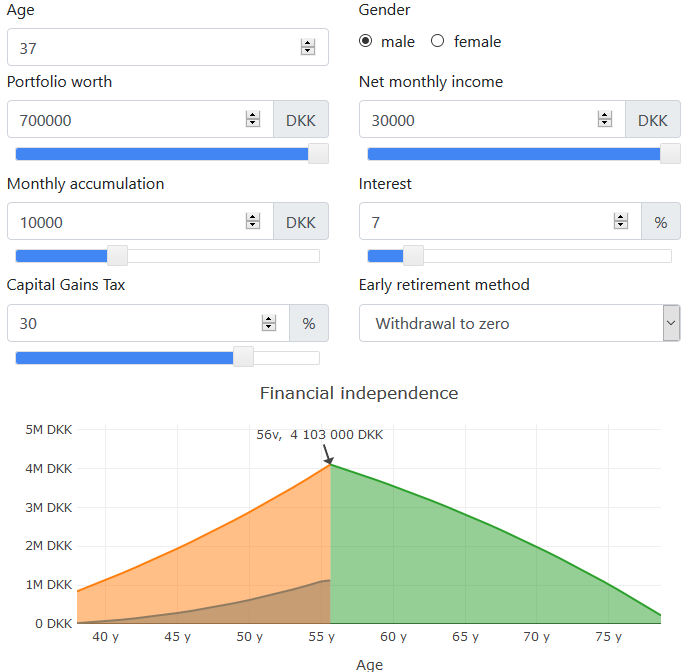

Using the FIRE Calculator over at thewealthyfinn.com I can play with a couple of different scenarios for myself. Here’s an example of 7% ROI and a 50% savings rate:

Using the 25x Rule (Net worth = 25x your yearly expenses) it would take me 22 years from now with an ROI of 7% and a savings rate of 50% to become FI. I would thus reach FI by the age of 58 years. Still not bad, all things considered. The only problem is, my current savings rate is nowhere near 50%, and as I mentioned before: having a shit ton of money in my bank account by the time I die seems a bit pointless.

So let’s change the calculation method from 25-rule to “Withdrawal to zero”, using a 33% savings rate instead (same ROI and capital gains tax as before):

This time it only takes me 19 years to reach FI (even using a lower savings rate than before), but I’d run out of money by the time I’m 80.

But obviously this calculation doesn’t factor in my Pension, which would kick-in at the very latest in my mid 60’s, and at that point I expect my pension to be worth a substantial amount (similar to that of my FIRE pot at that point in time).

There are thus many levers to choose from, when trying to find your own personal FIRE number.

Start early. Start saving today. Start investing tomorrow. Compound interest will take care of the rest 😉

What’s your FIRE number, and how do you calculate it? (hit me up in the comment section below!)

One thought on “The (Shockingly) Simple Math Behind Early Retirement”