We all know the famous quote from Warren Buffet: Diversification is protection against ignorance.

Well, admitting ignorance can also be a strength…So there! – I admit it: I’ve invested in 10 different crowdlending platforms, in hundreds of different loans to hundreds of different people/businesses of whom/which I know very little about. All I know is what the platforms (and the community) tell me. How much of this information can truly be trusted? I’m hoping the majority, but I’d be a fool to blindly trust “strangers on the Internet” 😉 – And so would you!

So don’t take my word for it! When investing in crowdlending, you need to protect yourself against (your own) ignorance. How can we best go about that, then? Well, I’ve got a few ideas that I will share with you today, dear readers 😉

I have an inherent need to put things into systems and/or boxes. So first off, lets start by breaking down the term “crowdlending”, and put some categories on some of the platforms that I use. The table below contains a classification of the 10 platforms that I’m currently invested in:

| Platform | Category | BBG | Secondary Market | Risk classification |

| Bulkestate | Real Estate (Development) | No | No | High |

| Crowdestate | Real Estate/P2B | No | Yes | Medium |

| Crowdestor | P2B | Yes* | No | High |

| Envestio | P2B | Yes* | Yes* | Low |

| EstateGuru | Real Estate (Development) | No | No | High |

| FastInvest | P2P | Yes* | No | Medium |

| Grupeer | Real Estate/P2B | Yes* | No | Medium |

| Mintos | P2P/P2B | Yes* | Yes | Low |

| Reinvest24 | Real Estate (BTL) | No | Yes* | Medium |

| Viventor | P2P/P2B | Yes* | Yes | Low |

I have chosen to assign a risk classification to each platform (High, Medium or Low), based on whether they offer Buy Back Guarantee on their loans (means the platform will buy them back, if the borrower default on the payments) and whether they have a secondary market. This might be a bit crude (I know), but you can (should) also factor in the proven track record of the platform (this is why I’ve chosen to put Crowdestor in the HIGH category, even though they do offer a form of buy-back, via their buyback fund – but it’s currently a very limited BBG, so I think it’s unfair to the other platforms to actually compare them).

You could also choose to classify them, based on their category (Real Estate Development is generally considered high risk, compared to Real Estate BTL and/or P2B). That’s up to you. For this example, I’ve chosen to do it solely based on the “features” offered by the platform (and their respective track record).

So, based on the Risk Classification of the platform, we can now assign a bracket of how much to invest in each platform. How you go about this is entirely up to you. – I would do it like this (this is an example):

| Risk classification | Weight | Platform Allocation |

| Low | 3/3 | € 3.000 |

| Medium | 2/3 | € 2.000 |

| High | 1/3 | € 1.000 |

So that was the easy part. Now you need to figure out, how much to invest in each individual loan/project. For the sake of simplicity, I’d choose a percentage of the Platform Allocation – let’s say 10% (for P2P I’d make it 1%…). So in this case it would look something like this:

| Risk classification | Weight | Platform Allocation | Single Loan allocation (P2P) | Single Loan allocation (other) |

| Low | 3/3 | € 3.000 | 1% of platform allocation | 10% of platform allocation |

| Medium | 2/3 | € 2.000 | 1% of platform allocation | 10% of platform allocation |

| High | 1/3 | € 1.000 | 1% of platform allocation | 10% of platform allocation |

When you create a system (and stick to it!) you avoid acting on your emotions, which we all know can often lead to irrational decisions 😉 – So we want to try and avoid that, right?

While the above outlined strategy seems simple enough, re-balancing, re-categorizing and re-classifying (whenever someone begin to offer BBG or get a secondary market) can become kind of a nightmare. Also, I would question any platforms ability to actually honor the BBG – especially platforms like Envestio (BBG is offered by the platform itself – not the originators, which is the case with platforms like Grupeer and Mintos, although I would question the originators ability to honor the BBG, even more than I would the platform itself…). So basically, BBG seems to me like a false sense of security. If push came to shove, BBG is pretty worthless (in my humble opinion). I still value loans with BBG as slightly more “secure” than the ones without – but only slightly 😉

This is why I’ve chosen NOT to implement this strategy (that doesn’t mean you shouldn’t, though. If it speaks to you – go for it!).

You see, I’m not only a systems-guy, I’m also a symmetry-guy (you all know this already! – I’m a sucker for even slices!). I’ve already outlined a bit of my thoughts on this topic in a previous post, but I think I’ve now decided on the strategy that I’m going to pursue (within crowdlending) for the next couple of years (maybe more, maybe less – you never know!).

The first question you should ask yourself, when going into crowdlending, is this:

How much money am I willing to lose on a single platform?

The answer to this question is obviously going to be very subjective. And the answer will most likely also be fluent, depending on the amount of experience (and the depth of your pockets) with the platforms/concepts.

For the purpose of this “demonstration”, let’s imagine that I’m willing to lose €1.000 on a single platform (in the event that the platforms goes bust, or someone steals all your money in your account etc.). So I deposit €1.000 to each of my chosen platforms. This means that the before-mentioned risk categories no longer apply. You could argue that the risk of you loosing your entire deposit on Mintos is a lot lower than, let’s say Crowdestor. You would assume this, based on the track record of the two platforms (one is “old” and proven, the other is young and unproven). It would be an assumption though – one that is fair to make – but an assumption none the less. – And having seen the movie Under Siege II back in the ’90s (multiple times), we know that: “Assumption is the mother of all fuckups!”. Therefore: Don’t assume, kids! 😉

So the second question one should then ask, is:

How much money am I willing to lose, if a loan defaults (and BBG is “broken” or non-existing)?

Let’s just say €100 (I’m comfortable with that. It would annoy me to lose €100, but I wouldn’t lose any sleep over it). Again, for the P2P loans I’d say €10, because they are a dime a dozen, and people default on those all the time (this is where you need the BBG – which actually works on Mintos atm. – but once the default rates start to rise rapidly, originators will default too eventually…).

Now, this approach obviously doesn’t scale very well, because once you’ve deposited €1.000 on a number of different platforms and invested all the money in xx amount of loans, it will take some time before interests starts accumulating, and it will take 8-12 months (depending on the interest rate of the loans you invest in) before you get that next €100 that you can then re-invest. If you have 10 different platforms (like me), and you deposited €1.000 to each of them, you should be getting €100 (give or take) in total interests each month. The problem is, they are scattered across 10 different platforms, and some platforms charge you to withdraw small amounts.

Now, imagine that you ran a set-and-forget approach, and left the platforms alone to run for 1 year (using auto invest where it’s available). After 1 year of run-time, you should have around €1.100 on each platform (maybe a little more on some, and a little less on others).

Now, losing a platform would now mean a loss of €1.100 (+/-) instead of the €1.000 that you were willing to lose to begin with. Obviously, you technically only lose your original deposit (€1.000) – the interests are just a bonus (money you didn’t have to begin with). You now have two options:

- You can accept the new “loss-limit” of your original deposit+accumulated interest OR

- You can withdraw the earned interests from each platform, and invest them in a new platform (~€1.000)

Choosing Option #2 is obviously also going to have its pitfalls, as this will require you to add at least 1 new platform to your roster, every year. I know other bloggers with 20+ (even 30+) platforms in their portfolio, so this approach is not impossible – it just seems a bit cumbersome. I would go for Option #1 in this case.

Taking Option #1, the question you should now ask yourself, is this:

How high am I willing to raise my loss-limit?

If I may make a suggestion! 😛 Let’s start by looking at the compound over time:

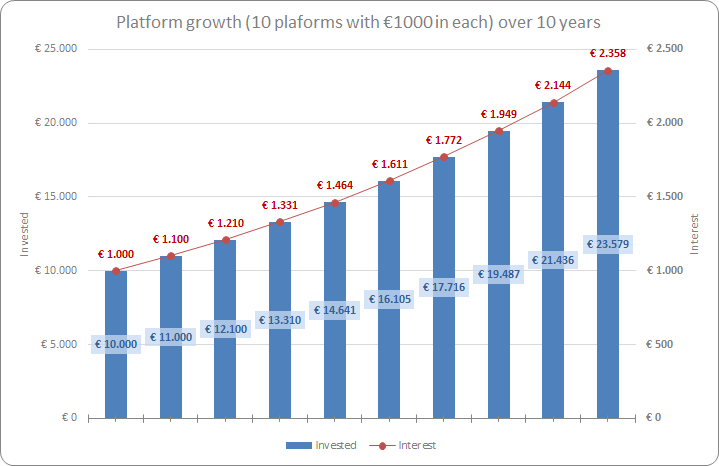

Assuming (oops) a 10% flat interest on each platform (and re-investing the interests), after 10 years your initial deposit of €10.000 (€1.000 x 10) will be turned into €23.579 (€2.358 x 10). Don’t you just love compound interest? 😛

Anyway, back to my point (you sense I’m starting to ramble a bit now too, huh?).

How high am I willing to raise my loss-limit (for a single platform)?

Well, I’ve decided to tie my “loss-willingness” to my savings rate. It can be expressed by this “formula”:

Loss-limit = 6 months rolling savings avg. + last months crowdlending interest

For my current portfolio (and savings rate), this would mean: Loss-limit = €1.266 + €113 = €1.379

This limit would take me into year 4, before I would have to open up a new platform, and re-balance my investments.

This makes absolutely no sense, Nick. Why would you do this?

Because: first and foremost I (currently. – The following statements is of course subject to change! 😛 ) don’t want my crowdlending portfolio to become larger than (somewhere between) 10-20% of my Total Balance (ref. my first monthly update). It is a risky asset class, and due to the nature of hedonic adaptation (the willingness to adapt to the new norm), I already sense that I will need to put “mechanisms” in place, to put my crowdlending asset allocation in check 😉 (I constantly feel the urge to put in more money, as it delivers so steadily every month – but it would be unwise, giving the risky nature of crowdlending).

Secondly, I’ve set myself a goal to never have to report a monthly loss (negative growth) of my Total Balance. Ever. You’re insane, Nick. Thanks! – I know! 😛 To avoid such a thing from happening, enduring the (eventual?) loss of a platform, would mean that I would have to use my monthly savings to “fill the void” from the loss of said platform (including the interests, of course).

Having said this, then there’s of course also the matter of the individual loans. I’ve currently set a limit of €100 in individual loans (€10 on P2P platforms), because this would mean that if a loan were to default (it WILL happen eventually), my monthly (crowdlending) interests alone would account for the loss. CLEVER, huh?! 😛 (No?…OK…)

As my monthly interests grow (as seen in the graph above), I can gradually raise my single-loan limit as well.

That’s it, folks! What do you guys think? Brilliant or crazy? (That’s me – you never quite know which category to put me in! HAHA).

Let me know in the comments below ↓

Hi Nick,

Definitely an interesting read and the post highlights a couple of strategies I had not considered.

I recognize the need for categorization to some extent but also feel there needs to be room for personal judgement when it comes to risk. This judgement doesn´t have to be based on emotion, sometimes factors such as size, track record and financial statements help you make decisions as well.

Having said that, it´s extremely helpful having a rough strategy to follow and not let emotion dictate your investments. I definitely have room to improve in this area as well.

Best regards

Hey Nick,

Well done on setting a crowdlending strategy that works out for you.

Why do you reckon that development loans are riskier than businesses loans?

Have you considered adding the investment location in your self risk assessment? Most of your platforms invest in the Eastern European market, and I am guessing that it’s primarily in Latvia, Estonia and Lithuania?

I personally prefer to diversify my lending investments across different economic areas or countries.

As your lending portfolio is focused on an specific area, are you aware that several platforms or loan originators of your portfolio may fall at a similar time?

That may affect your new goal of never having to report a monthly loss?

Btw, great post it contributes to a continuous learning approach

Brilliant minds do crazy things 😉

Hey Tony, thanks for the comment.

Real estate development loans is (this is my take on it anyway) isn’t really investing in the Classic sense – It’s speculation. Real estate BTL (Equity investing) is based on a budget of similar projects in the area (typically). Development loans is based on a valuation of what someone Think the property might be worth after a renovation/new build, and they are typically very short term. A sudden turn in the market situation/demand/delay in the process might render the “investment” poor. Typically the risk/reward ratio tips you off on which kind of projects should be avoided. The more speculative it becomes, the higher the risk (and the reward).

I did consider that my portfolio atm. is very Baltic-centric, Yes – and once the UK gets that whole Brexit deal sorted out, I will be open to diversifying into the UK (£) as well 😉