I made my first (ever I think?) international money transfer via my bank in October 2018. I had selected a few crowlending platforms that I wanted to take for a spin.

It was scary as hell!

I transferred €1.000 to Bulkestate, Grupeer and Viventor via a SEPA transfer in my bank. The fee to do so was DKK 20 (€2.6/$3) per transfer. I thought that seemed reasonable.

To my big surprise, the money appeared in my Bulkestate account the SAME day! In the case of Grupeer and Viventor, they didn’t appear until two days later. I expected the transfers to take between 2-3 days, so it seemed that Bulkestate was just extremely fast at handling deposits (compared to the norm).

I continued to use bank SEPA transfers to transfer funds to a couple of other platforms, which meant that my transfer fee bill was racking up to more than DKK 100 (€13.3/$15.3). It felt OK to begin with, but spending double-digits just transferring funds didn’t seem viable in the long run. When I decided to test out a few other platforms, and only transfer €100 to each, I concluded that I had to find a different method of transferring money. Enter: Revolut

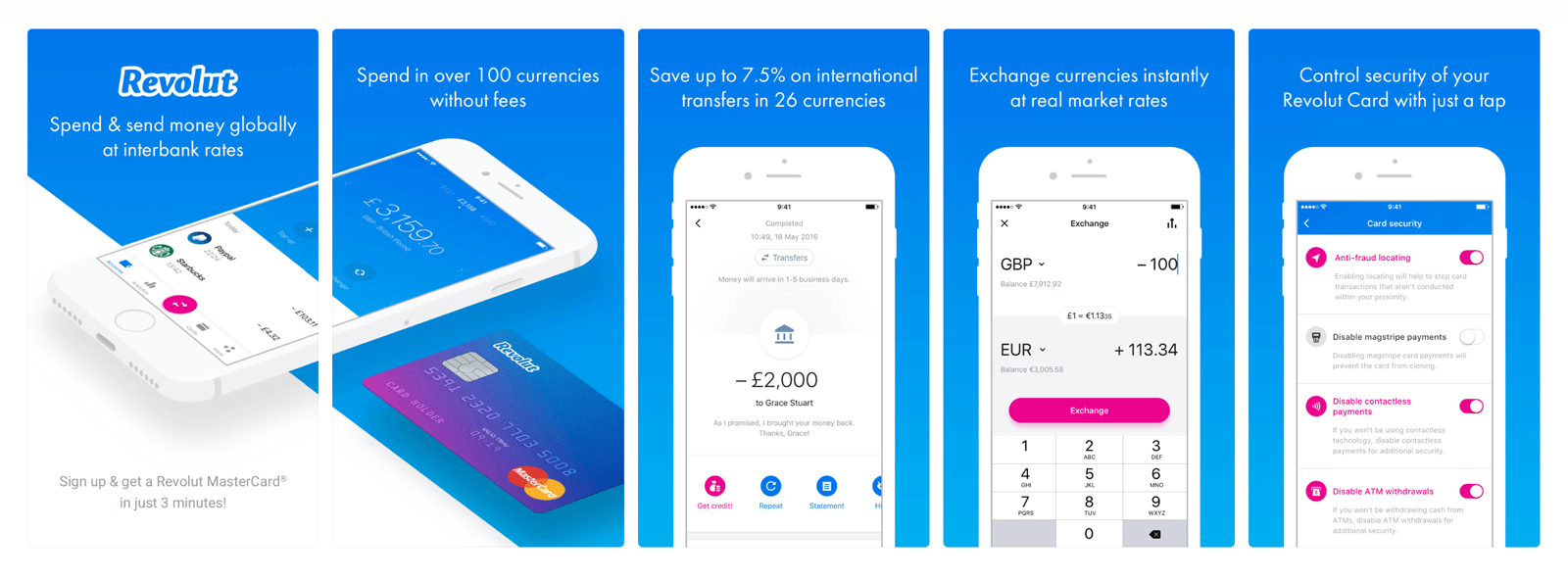

I’ve now been using Revolut to transfer money to 5 different platforms (SPOILER ALERT: I’ve entered new platforms in December!), and the transfers are fee-less and the funds arrived on ALL platforms the same day I made the transfer (on different days).

The way it works is, I “top-up” my Revolut account in my own currency (via my bank issued VISA card, stored in the Revolut app). I then make a currency conversion when transferring funds to a platform (typically in euro – but as you can see from the propaganda poster above, they support 26 different currencies). Note: You should make sure to do currency conversions and transfers during normal bank opening hours (9-5ish). This way you get the best exchange rate, and if you execute the transfer in the morning, you can expect the funds to arrive on the platform later in the day (typically late in the afternoon). Note that your account has a default currency (mine is DKK), but you can have money in multiple currencies in the app at the same time.

I assume that there is a form of SEPA settling account, where the platforms have access to look into “incoming funds” and then credit your account before the funds are ACTUALLY transferred to their bank account. This is just an assumption – I have no proof of this. I honesty don’t really have to care how “the magic” happens, I’ve just experienced this consistently, since I started using Revolut. As this same-day transfer also happened when I used a classic bank transfer (to Bulkestate), I assume this is not a “feature” which is unique to Revolut.

I’m currently only using Revolut as an intermediate between my bank and the platforms, but I believe Revolut has been working on obtaining a European banking license. It’s been a while since they announced this plan, so whether they are close I don’t know. – But should they eventually obtain a banking license, you could safely deposit money on your Revolut account, and have them protected by the same regulations, as your normal (european) bank account (DGS especially – Deposit Guarantee Scheme, which secure deposits up to €100.000, should the bank go under).

You can even get a payment card for your Revolut account (Mastercard/VISA). This will come in handy when (if) I travel, because it will allow me to avoid the payment fee from the bank that they call “foreign currency payment”. If I pay with my Danish issued VISA-card in another country – it’s per default a “foreign currency payment” and a fee is thus slapped upon it! I believe Revolut has the potential to revolutionize (hence, the name – clever, huh?!) the way we do cross-border payments in the future. I sure am hooked, so I thought I would share this experience with my readers (please note: I get no bonus or kickback from Revolut by writing this! – It’s just a service that I like to use! – Use it at your own discretion!).

Payments via your Revolut credit card will be withdrawn from your “default currency account” per default – but if you travel to a country with a different currency, you can “disable” your default/home currency (or convert it to the local currency on-the-fly or before you leave) and withdrawals will then be made in the local currency instead (hence avoiding day-to-day exchange rate fluctuations and foreign payment fees). It does require you to keep a close eye on your spending – but I assume you’re already doing that, of course! 😉

You can save your preferred “beneficiaries” (platforms/banks/mother/sister) in your Revolut account, so you can quickly transfer funds to a platform, should an interesting investment opportunity suddenly arise 😉

Protip: Make sure to always add your personal reference/client ID when you transfer funds to a platform (you have to do this for each transfer – unfortunately you can’t save your personal reference number/account ID for each beneficiary. It would be really cool, if you could!) Are you taking notes, Revolut?

What is your preferred money transferring service?

Share your thoughts/experiences in the comments below! (Good/bad/etc.)

Hi – you should be able to convert currency Mon-Fri (UTC) with no markup

https://www.revolut.com/help/getting-started/exchanging-currencies/what-foreign-exchange-rate-will-i-get

Yes that’s true – however, this has recently been clarified (apparently). I saw some forum discussion regarding this a while back, and people was recommending as a thumb rule that if you local bank was open for business, then you could expect a fee-less exchange on Revolut as well. I think that’s a good rule of thumb, so I will leave my advice standing for now 😉

Thanks a lot for reading (and your eagle-eye comments 😉 ). It’s much appreciated! I hope you’ll keep reading 😉

Hi

Iam in for paypal and something else.. but i forgot didint use if for long time. Used it when i used to play roulette 🙂

Greetings Swedendivin

Nice! I didn’t even know Revolut existed looks like a far better way to make transfers.

Hi Victoria, thanks for stopping by!

I think Revolut is in an explosive growth curve at the moment, so I’m sure the news would have reached you eventually – but I’m glad that you red it here first! 😛

– And thanks for introducing me to instocknews.com 😉 There’s some really awesome reading material for newbies like myself. I’m particularly interested in REIT investing at the moment. I’ll be sure to follow your writings 😉

I’m hesitant to make any new investments at the moment, given the current market situation. I’m considering going into gold, actually! Just because I think it would be kind of cool to be in a defensive position – awaiting the “big bust”, should such one ever occur (again)… 😛