The titles just keep getting better and better, don’t they?…

Here’s a small update, on my first month on FIRE:

If you’ve read The Plan, you know that I plan to turn my original nest egg of 400.000 DKK (approx. $62.000/€53.000) in to 3.000.000 DKK (approx. $470.000/€400.000). If you’ve also read The Dough, you know a little bit about, how that is even going to be possible!

However, I’ve yet to disclose how I plan to diversify my portfolio (currently I’m still in all cash), in order to secure an interest rate of more than 8% on my hard earned cash.

I will be very clear about this: There’s no way to be sure that I will actually be able to attain such interest rate, and I’m not a financial expert, so if you choose to follow ANY of my ideas on this blog – whatever happens is on you 😉

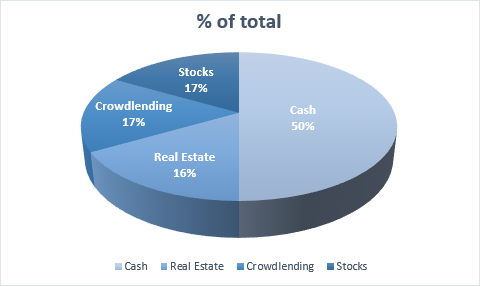

Now that we’ve gotten that out of the way (shit got a little dark there for a moment, huh?) here’s how I plan to diversify my portfolio, over the coming months:

My entire nest egg is currently safely tucked away on a bank account, which yield 0.70% in interest rate. THAT is obviously not going to help me reach my goal, so I’ve got to get some of that cash out there working for me.

Originally, I considered throwing all of my money into 1 big real estate project (I still consider that, every now and then). The problem with those type of projects is that your money is tied down for 5-10 years. So the “magic compound” is not going to be working a whole lot for you, during those years. Also, it would be kind of boring to make monthly updates, based on 1 single real estate investment… 😉

So for now, my goal is to spread 16,67% (give or take) on 3 different asset classes – namely:

1. Real estate (via brickshare.dk, estateguru.co, bulkestate.com, crowdestate.eu or similar sites)

2. Crowdlending (Mintos, Grupeer, Viventor, Envestio etc.).

3. Stocks/bonds/index (I’m currently eye-balling some of the indexes from the danish provider SparInvest, SparIndex)

I’m reluctant to throw a lot of money into the stock market at the moment, as my spider-senses tells me that the bear market is imminent (shit is about to hit the fan, red.). It’s therefore likely that I will be going to put a larger part of my cash, into real estate (and maybe crowdlending as well) during the coming years.

As of right now though, the 400.000 DKK have become 405.000 DKK, as my monthly savings goal (5.000 DKK) has been added to the top of the pile.

So, what’s with the shattered dreams – and the broken glasses?

Well, had it not been for my extreme nearsightedness (thanks mom? dad? granddad?), I would have added another 5.000 DKK to the savings pile this month.

Last month, my 7 year old pair of glasses decided that they had done their job (granted, they had served me well). The frame snapped while I was polishing them one day. Since I’m blind as a bat, a new pair set me back 6.000 DKK (yikes! I got the frame for cheap, of course – but the lenses are fu***** expensive). This is a FIRE starters worst nightmare. I’m off to a rocky start! 😉

OK…What about the shattered dreams?

Oh that. I added that for the dramatic effect. Sorry.

See you next month! 😉

In that case it seems very reasonable! 🙂

Each to his own. Would love follow stories about the proces of real estate investing.

/Sune – frinans.dk

I will make sure to keep you posted 😉

Ultimately, my goal is to be able to afford having multiple apartment buildings in my portfolio, but the buy-in for such projects is DKK 1 mio+. Since I don’t have that (yet), I figure I have to start in the smaller scale. I’m currently in dialog with a couple of real estate development project companies, such as Koncenton, GefionGroup and my current favorite – Imbro.dk. They have buy-ins for 10% of a real estate project all the way down to DKK 300.000, with a double-digit yield and even a nice dividend on some projects too. I’m prepared to put DKK 4-500.000 in the right project. I realize that this is a very passive real estate investment, but it is fairly low risk, and I plan to re-invest the dividend in more high risk projects from envestio.com, bulkestate.com and grupeer.com (so far, those are my top-3 crowd real estate sites).

If you’re in to those sort of investments, but don’t have DKK 300.000, you can always start out with smaller shares from brickshare.dk (which I also plan to put a little money into).

Hi that guy 🙂

Why so much in cash still?

Sune – frinans.dk

Hi Sune,

I must say that it has been quite the eye-opener for me, to have embarked on this journey. It’s been a huge step for me, to withdraw 100.000 DKK from my account, and start investing in various “unknown/unsafe” platforms…

I’ve come to realize that my heart lies with real estate, when it comes to investments.

Therefore, my short-term goal is high in cash, because I’m planning a big real estate investment in the near future. My long-term goal is 5-10% in cash 🙂

I realize that for a lot of people real estate is too “heavy” and illiquid, but my stomach just tells me that I primarily need to have (a lot of) real estate in my portfolio – so my next post will contain a little bit more about my thoughts on real estate investing 🙂

/Nick

What a shame with your broken glasses, but we all get nice surprises like that on the way to FI 🙂

Your 50% allocation to cash is very high in my opinion. If you need the money in the short term, it might be a good idea, but if you are in it for the long FI run, then you should get those 50% working for you instead. I always tell myself it is not about timing the market, it is about time in the market – and people have been saying a crisis is imminent for the past two years (although I also sense a correction is coming soon!). A way to mitigate it would be to slowly increase your stock share to average out the risk of volatility in the stock market.

Hi Carl,

Thanks for reading – and commenting – on my ramblings 😀

The above pie-chart depicts my short-term goal for diversifying my portfolio. The reason I plan to stay high in cash, is because I’m planning a big investment in real estate. Long term, I plan to keep cash at about 5-10% of my portfolio. I’ve also considered gold, just because I think it would be kind of cool 😛 However, “investing” in gold is inherently also an investment in the dollar, which in my opinion is currently overrated. Ideally, I would like to see the dollar below 6 dkk, and the gold below or around $1000 if I was to convert some of my cash into gold.

I don’t want to give away too much of my next post, but so far what I’ve learned from this (still fairly new) journey, is that my heart lies with real estate – not in stocks or crowdlending…More to come on that topic! 😉