June has flown by, and it’s thus time to look back at another record-breaking month. – Not in terms of my finances though, but the heat is breaking all sorts of records, frying the Europeans to a crisp these days!

It’s been so hot (even in Denmark) that my faithful buddy, Russel the LEGO mascot, has moved out of his green garden, and into the Frozen castle! (I cannot take credit for this – it was my daughters idea…).

Something pretty significant did actually happen in the Total Balance household this month (besides the scorching heat), as I had to “rob” the bank to pay for the final part of the Property #1 deal…

I didn’t actually expect for the developer to ask for the rest of the money for Property #1 until the end of July (we take over the property on the 1st of August), but they decided to finalize the deal early (I guess), so I had to fork up €53.333! Since my bank account only held about €45.000 in total, I was more than €8.000 short to complete the deal…

Hence: I had to rob the bank 😛 Not literally of course – I asked them politely whether they would lend me the money. Luckily, my current occupation comes with certain perks (I work in the financial sector), so I got a line of credit, on which I can draw a maximum of €13.333. The credit was free to establish, and I can raise the maximum limit, if required. They charge an annual interest rate of 3.5% though (nothing is free in the bank) 😉 Remember that this is a credit without any form of collateral, so I think 3.5% is fairly OK. I expect to pay off the “loan” within the next 6-8 months, so the interest is not going to ruin me.

I did consider cashing out on a few of my P2P crowdlending platforms, in order to minimize the draw on the credit, but €1000-€2000 more or less is not going to make a huge difference, when the term is so short. So I decided just to leave it as is (the wife made a good argument too: 13% – 3.5% is still a 9.5% profit 😉 ).

Anyway, we spent the first week of June on vacation in Malta, enjoying the sun and the beach (I enjoyed it in the shade, as always 😛 ), and I’ve been busy at work for the rest of June, so I haven’t had a whole lot of time to play with my investments. However, I did manage to enter a new platform this month! (oops, I did it again…).

I welcome Kuetzal to the roster, which is a platform similar to Crowdestor and Envestio. I must say that these type of platforms simply speak to me a lot more, than the P2P-type of platforms (Mintos, Viventor, Robocash, FastInvest etc.). I simply like to hand pick the (larger) projects that I find interesting to invest in (loan money to), rather than letting an auto-invest invest in 100’s of small loans, of which I know very little about…

For the purpose of diversification, I will keep the P2P in my portfolio for now though.

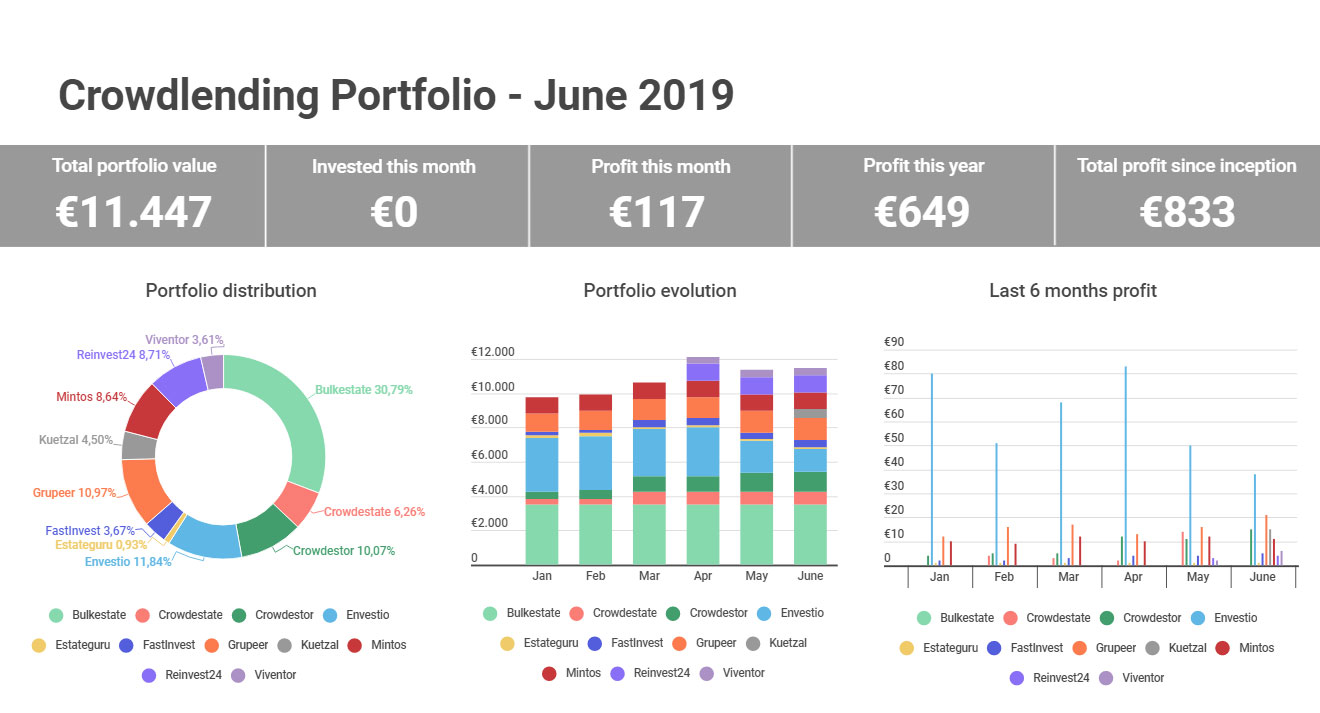

Enough jibber-jabber! Let’s look at some pretty colors, Nick!

85% of my Total Balance is now invested in properties! I have to say, looking at that pie chart – it seems kind of crazy! What was I thinking? Well kids, there’s a meaning to the madness 😉 Eventually, something else besides properties is going to be creeping into the portfolio (I hope!)…

I have €0 left in cash reserves for the first time in a very long time. Luckily, I’ve had quite a few months to prepare myself for this situation, so I’m not stressed out about it. This simply encourage me to replenish that cash pile faster than I’ve ever done before! Wish me luck! 😛

Income statement (June 2019)

| Platform | Invested | Deposits / Withdrawals | Value last month | Current value | Bonus / Fees | Return | Change (%) | Expected return |

| Crowdlending | ||||||||

| Bulkestate | € 3.525 | € 0 | € 3.525 | € 3.525 | € 0 | € 0 | 0,00% | 14% |

| Crowdestate | € 700 | € 0 | € 717 | € 717 | € 0 | € 0 | 0,00% | 13% |

| Crowdestor | € 1.100 | € 0 | € 1.138 | € 1.153 | € 0 | € 15 | 1,30% | 16% |

| Envestio * | € 850 | -€ 500 | € 1.817 | € 1.355 | € 7 | € 31 | 2,29% | 16% |

| Estateguru | € 100 | € 0 | € 106 | € 107 | € 0 | € 1 | 0,93% | 11% |

| FastInvest | € 400 | € 0 | € 415 | € 420 | € 0 | € 5 | 1,19% | 14% |

| Grupeer | € 1.140 | € 0 | € 1.234 | € 1.256 | € 9 | € 13 | 1,04% | 14% |

| Kuetzal * | € 500 | € 500 | € 0 | € 515 | € 15 | € 0 | 0,00% | 19% |

| Mintos | € 900 | € 0 | € 978 | € 989 | € 0 | € 11 | 1,11% | 11% |

| ReInvest24 | € 1.000 | € 0 | € 993 | € 997 | € 0 | € 4 | 0,40% | 13% |

| Viventor | € 400 | € 0 | € 407 | € 413 | € 0 | € 6 | 1,45% | 13% |

| € 10.615 | € 0 | € 11.330 | € 11.447 | € 31 | € 86 | 0,76% | 15% | |

| Stocks | ||||||||

| Pro Real Estate Trust (REIT #1) | € 910 | € 0 | € 955 | € 961 | € 0 | € 5 | 9% | |

| Realty Income Corp (REIT #2) | € 60 | € 0 | € 63 | € 61 | € 0 | € 0 | 4% | |

| € 988 | ||||||||

| Properties | ||||||||

| Brickshare | € 1.333 | € 0 | € 1.333 | € 1.333 | 3% | |||

| Property #1 | € 68.667 | € 53.333 | € 13.333 | € 68.667 | 10% | |||

| Property #1 Leverage | -€ 8.667 | -€ 8.667 | € 0 | -€ 8.667 | -3,5% | |||

| € 61.333 | ||||||||

| Cash | ||||||||

| Bank #1 cash (main savings) | € 0 | € 1.167 | € 32.234 | € 0 | 0,70% | |||

| Bank #2 cash (emergency fund) | € 0 | € 13.333 | € 0 | 0,50% | ||||

| € 45.567 | € 0 | |||||||

| Total balance | € 72.546 | € 73.768 |

A pretty standard income month, with a combined interest of €122 across crowdlending and REITs.

Not much to complain about there (or so I thought). The wife is beginning to become a little impatient, with the income from crowdlending. She believe that I’m being too “conservative”, and would like to see the income grow significantly from month to month. I’ve tried to explain my “strategy” to her, but she is not impressed (her words!).

So, we might just have to hand HER a chunk of money to invest for herself at one point 😉 – But as long as I have a leverage loan on Property #1, there is no free cash to invest. So until then, we’re following the plan of Mr. Conservative, Missy!

The classic growth chart

The classic grow chart is my favorite graph of them all. It clearly shows my progress, and I’m now up more than €20.000 since my journey began!

Staying on target for the year! I’m hoping to kiss €80.000 by the end of 2019! Fingers crossed, guys!

What else happened this month?

I had a post featured on firehub.eu this month (the one where I talk about diversifying your crowdlending portfolio), which I was pretty stoked about, so thank you for that (Sonia) 🙂 This resulted in a little extra traffic, albeit it didn’t quite match the record visitors of last month. July is off to a rocket start though (thanks to ANOTHER feature on firehub.eu 😉 ).

I’ve been busy at work, so I’ve been very inactive in the community, which means that I haven’t really had time to create a shout-out list this month 🙁 (sorry guys – keep up the good work!)

Anyway, enough about me! How was your month?!

See you next month!

Woah! No cash left – there goes your FU money 😉 I know this is well thought through though. Good decision to keep your P2P investments and borrow a bit in the bank at relatively low interest rates. Looking forward to following that real estate investment.

Yeah, letting go of that FU money was definitely the hardest part. Also, I know from experience that having a little bit of debt in the bank is a great motivator for me, to save a little extra 😛 gotta get rid of those red numbers there!

I’m really looking forward to the year 2023 now though! Haha. The project is already DKK 70.000 ahead of budget though, so we’re off to a good start 😉

Great month! It sounds a little bit scary to me the developer came asking for money early. I mean, what if you didn’t have a loan secured? You would have had to sell assets. Now that’s fine, but what if those assets tanked 30% yesterday and then you had to sell? These are the things scaring me about real estate, and making me “over save” so I’m sure I have the money up-front.

The lesson here I guess, is that you shouldn’t spend money you don’t have 😉 Technically I already spent the money back in May. I was considering cashing out on some of my crowd investments back then already, but decided just to deploy a little bit of leverage. I’m usually well-prepared when it comes to money, so I had my line of credit secured way before the money was due. Originally they had told me that they would need the money in mid-July, but because of the summer holidays, they wanted to finish up the paperwork a little earlier, which makes sense. A property deal has lawyers, banks and sometime even the city involved, so I take it as a good sign that they were prepared in time 😉

It must feel odd (emptiness feeling?) every time you check your bank account out and see that there’s actually nothing in it, the psychological impact must be strong, at least during the beginning? Good that you prepared yourself mentally for it.

I like the way you split your investments into different asset classes. Was just wondering, isn’t Reivest24 an equity property investment, same as Brick share, or is it just lending platform?

Congrats on the featured post on firehub.eu! 🙂

You’d think that, Yeah! But actually, before I started this whole journey, I was pretty used to not having a whole lot of cash in my bank account, because it was always tied up in some form of Real estate. So I guess this is just “business as usual” for me. Actually now when I look at my bank account, there’s a huge minus (because of the leverage loan), and this is really motivating me to spend less and save even more. With a little luck, I’ll have wiped out that leverage loan before Christmas 😉

You are in fact absolutely right about ReInvest24 and Brickshare – however, reinvest24 also offer development loans, so It’s not only equity investing, unlike Brickshare who only offer pure Equity investments.

I have 1 loan at ReInvest24 which is a “Classic” crowdlending loan. When that matures (in September), I’m planning to move ReInvest24 out of the crowdlending category and into the “crowd properties Equity investment” category 😉