Hello everyone! It’s that time of the month again 😉

As you can probably read from the headline it has been an exciting month in the Total Balance household.

The excitement definitely doesn’t come from looking at our portfolio! It has yet AGAIN managed to produce a negative growth this month. – But lets not dwell too much on that part today (we’ll just get bummed out!).

What’s up with “The offers”?!

The month in review

Well, as you’ll probably know if you’re a regular follower, we’ve put our primary home up for sale.

From the December 2022 update:

Our current home is not really “FIRE-friendly” and it is a little far from our daughters school. We’d like for her to be able to walk or bike home from school by herself (she is 8). A lot of her classmates live close to the school, and most of them are able to walk home from school by themselves (or visit their classmates). When our daughter has a playdate we have to drive her, and while we knew this when we moved in (she had not started school when we moved), it has started to wear on her parents I hate “wasting time on the road”.

So those are the two primary reasons; The cost of ownership and the cost of distance from our daughters school

But Nick, are you crazy? Selling your home in the worst drawdown since 2009!?

That’s what I said! (to my wife). She remain optimistic that we’ll be able to find a buyer. I remain (very) pessimistic…

It turned out that (yet again) my wife had the upper hand here. Apparently there was no reason to be pessimistic. We’ve had showings every weekend since we started advertising the house, and 30 days after we went online we received an offer. The offer was 7% below our asking price. In the current market, I don’t think it was a bad first offer. We didn’t accept it (of course), but started negotiating a price that we could both live with. It went on for a few weeks (WAY too long if you ask me). We never agreed on a final price – before we suddenly received another offer from another buyer. This buyer had viewed the property for the first time on Sunday and the offer came in on Monday. It was 5% below our asking price. We negotiated for 1 day and ended up giving them a 3% discount on our asking price – and signed the deal on Wednesday. BOOOM!

Done deal. – It’s moving time! Up until this point I’ve had a mental block in my head about that part of the journey. I just couldn’t imagine the house selling that fast, and I did not want to worry in advance over having to move all our crap to a new location HAHA! Oh well, I guess it’s now time to open up that can of worms…

Technically the finale sale of our home happened in May, so I will keep the details for the next update! 😉 *suspenseful music*.

I’ve grown tired and a little numb frankly, reporting about our portfolios lack of performance, so I will just add that nothing noteworthy in terms of our investments happened this month!

We did however manage to break another savings record, and saved €2.666 this month. The coming months will likely see 0 savings, as we’re gonna need to pad our “new home construction fund” significantly. More on this in the next update! 😉

The Pwetty graphs

The boooring income statement

| Platform | Invested | Transactions | Last month | Current value | Monthly income |

| Commodities | |||||

| GOLD (Coins) | € 5.333 | € 0 | € 6.500 | € 6.500 | |

| € 6.500 | € 6.500 | ||||

| Stocks (Dividend portfolio) | |||||

| Bank of Nova Scotia (BNS) | € 1.000 | € 0 | € 1.144 | € 1.102 | € 13 |

| Enbrigde (ENB) | € 2.400 | € 0 | € 2.109 | € 2.142 | € 0 |

| PROREIT (PRV.UN) | € 2.018 | € 0 | € 3.647 | € 3.287 | € 17 |

| Toronto Dominion Bank | € 1.000 | € 0 | € 960 | € 932 | € 8 |

| TransAlta Renewables (RNW) | € 2.000 | € 0 | € 1.706 | € 1.705 | € 8 |

| True North Commercial REIT (TNT-UN-T) | € 3.552 | € 0 | € 1.956 | € 1.561 | € 9 |

| € 11.522 | € 10.729 | € 55 | |||

| Stocks (Indices) | |||||

| iShares Global Clean Energy (IQQH) | € 6.667 | € 6.928 | € 6.422 | € 0 | |

| Xtrackers MSCI World ESG (XZW0) | € 2.721 | € 2.449 | € 2.431 | € 0 | |

| € 9.377 | € 8.853 | € 0 | |||

| Properties | |||||

| Property #1 | € 68.667 | € 0 | € 68.667 | € 68.667 | € 0 |

| € 68.667 | € 68.667 | € 0 | |||

| Crypto | |||||

| Nexo (BTC, ETH, MATIC, EURx) | € 0 | € 756 | € 851 | € 5 | |

| € 756 | € 851 | € 5 | |||

| Cash | |||||

| Bank #1 cash (main savings) | € 0 | € 0 | € 0 | € 0 | |

| Bank #2 Opportunity money | € 2.666 | € 42.515 | € 45.181 | € 51 | |

| Broker account (CAD, EUR, DKK) | € 55 | € 406 | € 461 | € 0 | |

| € 42.921 | € 45.642 | € 51 | |||

| Total balance | € 139.743 | € 141.242 | € 111 |

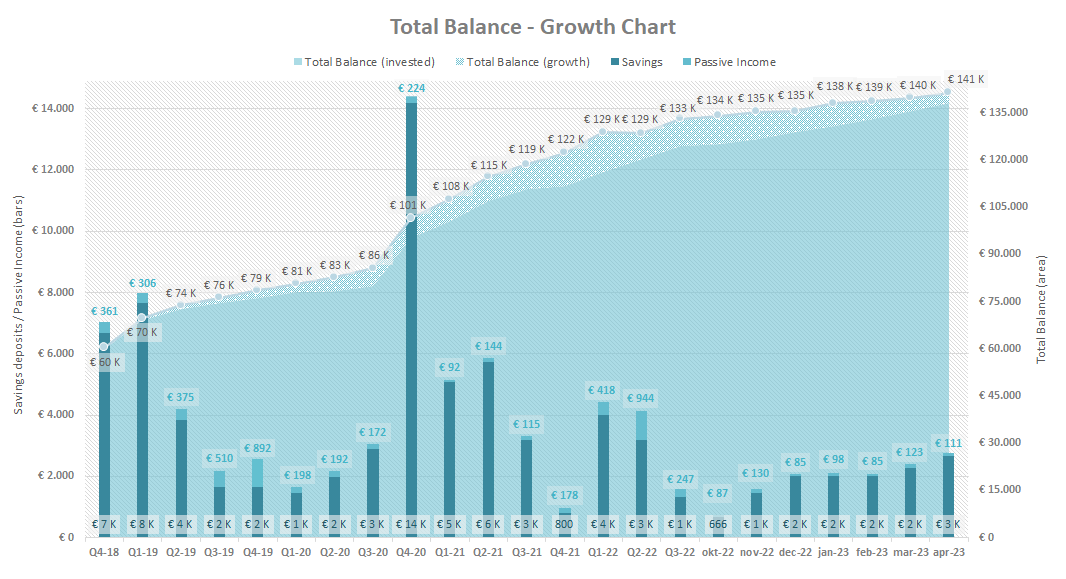

The Classic Growth Charts

As always I include the Classic Growth Charts for tracking purpose

Since we now know the sales price of our current home, we also know our exact equity. I will update the graph with the exact numbers once the move is completed (the money actually takes months to arrive – even after you’ve moved out! – Meanwhile the banks are making killer money on this delay).

The Conclusion (TL;DR)

You won’t believe it! We sold our home. Perhaps too cheaply?…We’ll know in a few years time 😉

It’s moving time! The coming months will thus see limited savings, as we’ll need the funds for various constructions in our new home. More in this in the coming updates 😉

We managed to tuck away a whopping €2.666 month, which was great since our portfolio managed to lose about €1.100! Will it ever end?!

Anyway, see you next month for the exciting reveal of our next home!

Just picked up your site from another blog. Loving the content. I’ve added you to my Feedly list.

Congrats on the home move. Would love to hear more about it and the changes in the property (size, location, cost etc).

Thank you.

Hi Ryan, thanks for the comment 🙂

I will be sure to keep you guys posted on the move. We are moving to lower our cost base and to get closer to our daughters school. Our new home is about 2/3 the size of our old home – so we will be forced to downscale a bit furniture wise. Since it’s smaller the taxes are also smaller. The mortgage will be smaller as well.

The new home is a renovation project though, so the final cost is somewhat unknown atm…Making me a bit anxious to be honest haha – but the important thing is our long term cost base will go down 🙂

Thanks for the response Nick. It looks to me that it’s a combination of lifestyle, efficiency and cost saving. The perfect storm.

Out of interest what made you choose the original house at the time? It sounds like a really good move all up 🙂

That is a really good question.

My wife wanted a romantic house in the countryside. 5 years later and my wife wants something different. Story of my life! 😛

It would have been really great if we could have skipped this step and just purchased a more “regular house” close to the school to begin with, but sometimes you have to live it to know it. This is my experience at least. It will now be the 3rd time that we move house in 15 years. I do not recommend it! Haha. We also already know that we will be moving again when my daughter is old enough to live by herself (she is 8 and already knows she wants move to an apartment in the city – if you ask her haha). So in 10-12 years we’ll most likely be moving again…

What is your living situation? 🙂

Congratulations to the Total Balance family! Exciting times are ahead.

We are moving into our new home next weekend, so yeah 0 saving for us too as we want to add some improvements here and there plus buy all the furniture and stuff.

Its so exciting that we both got the keys to our new home on the same day! Haha that is some coincidence. How are you guys progressing in settling in?

Keep us posted! 🙂