As if we didn’t have enough troubles already, today added another nail to the coffin of the bleeding stock market. OPEC and Russia couldn’t agree to cut down on the oil production (to keep the oil price steady), and as a result of the decreased demand (hello, Corona virus), the oil price plummeted. And the stocks followed.

As a result the S&P 500 is now trading below $2800 (currently at $2750 at the time of writing – down more than 7% for the day!). This means that the massive earnings of 2019 (30%+ for the S&P 500) has now been wiped out in less than 3 weeks. Ouch…

Because I’m not massively exposed to the stock market, I can honestly say that I’m kind of excited about this development! (If I was 100% invested in stocks, I might not be that excited!). We will be talking about this event for many years to come. I’m not going to make any predictions as to whether the stocks will drop 20%, 30%, 40% or even 50%, but it will bottom out eventually, and when it does it will present an opportunity that might only happen once in a lifetime.

If you’ve just begun your journey towards FIRE (which I kinda have), this is the perfect storm. Yes, you’ve gotten off to a rocky start, but it’s much better for such an event to happen at the beginning of your journey than at the end. If you’re near the end of your journey, I hope you have limited exposure towards the stock market – if not, it kinda sucks to be you right now (sorry).

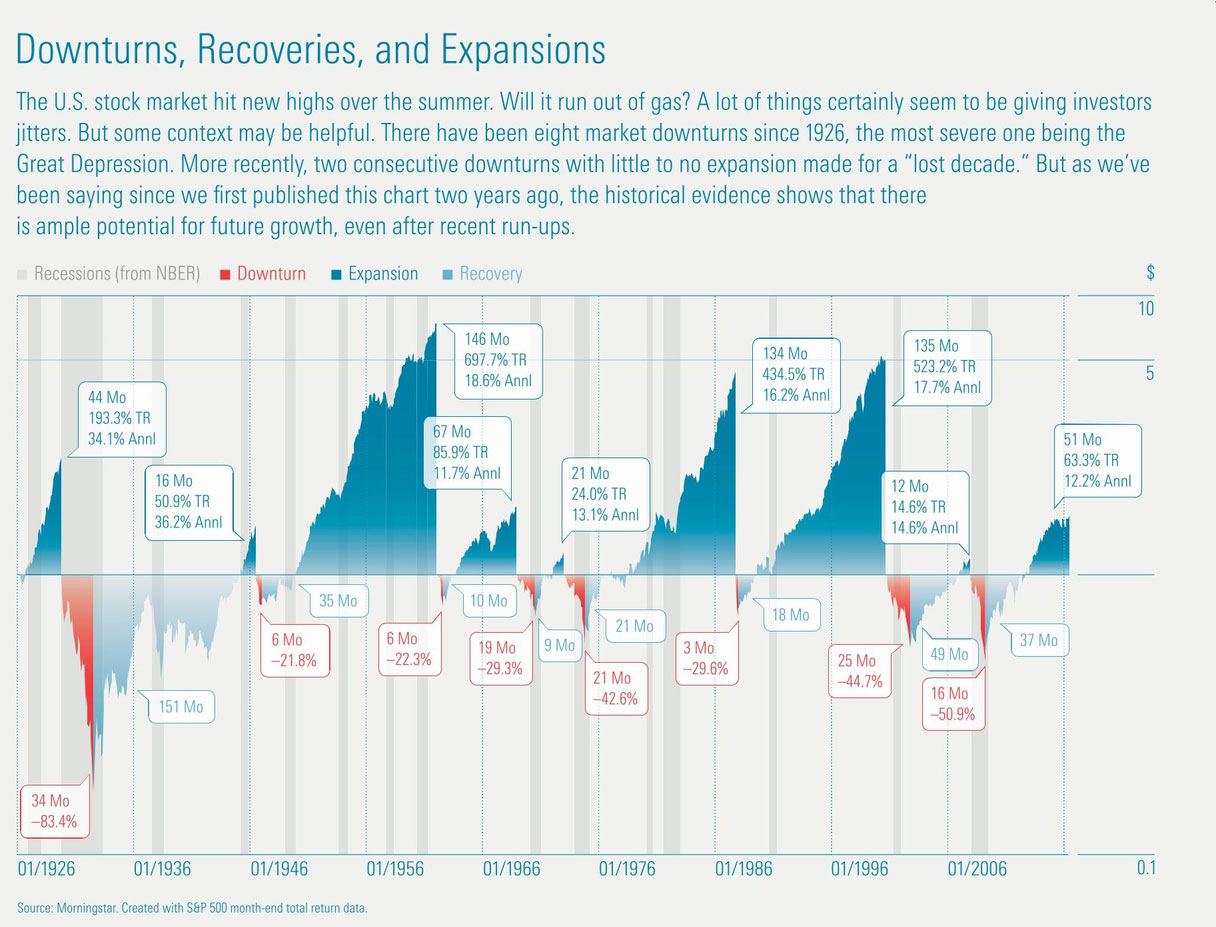

But let’s not rejoice (or regret) just yet! I thought it might be interesting to take a little look back at the last major downturns in the (U.S.) stock market, just so we can prepare a little bit for what’s to come (remember that we can’t technically use the past to predict the future…but let’s forget about that for a minute!).

The good news is; that the average recovery time for the past 7 major downturns in the U.S. stock market is about 26 months. So on average the stock market (fully) recovers from a major downturn after a little more than 2 years. The bad news is that this average does not include the Great Depression of 1929 (the worst downturn in the history of the stock market).

It took 151 months (!) for the stock market to recover from the Great Depression. Yikes! This means that the average recovery time for the past 8 major downturns in the U.S. stock market is more than 41 months! (That’s 3.5 years, for those who are counting).

So…How long will it take to recover from the great “beer”/oil crisis of 2020?…

It could be 1 year, it could be 10 years! Who knows!? Your guess is as good as mine!

But fret not! If you still have time on your side (to await the full recovery) you should simply KEEP CALM & CONTINUE TO INVEST. (Dollar-Cost-Average aka DCA)

Are you really sure about that, Nick?!

I am! But don’t take my word for it! Jeremy over at personalfinanceclub.com has created a great infographic (from June last year – but still very relevant today!) in which he depicts how 3 different investment strategies has fared during the last 40 years (fictional characters, but factual numbers). Sune over at frinans.dk reshared it last week, and I remember seeing it last year, but forgot to bookmark it! I’m happy that it has re-appeared, as I think it’s a great reminder for us all. Have a look here:

Great work Jeremy! If you doubt his math, go read the original post (he shares the numbers behind the infograph too).

Jeremy eloquently proves (yet again) that time IN the market beats timING the market.

Of course we know that we can’t use history to predict future returns, so whatever strategy you choose is entirely up to you 😉

Regardless of your investment strategy, 2020 is well on its way to become a pivotal year in the worlds financial future. It is bound to be some exciting times ahead!

Stay safe! (Wash your hands, tuck in your shirt AND KEEP CALM!!!!¤%”!!”!%%#”!#)