8 months later!

And he’s back 🙂 Still alive and kicking, folks! (In case you were wondering HAHA!)

I’ve been wanting to write this update for a while, but I just haven’t found the “right” time for it…

Well, I believe it’s now time that I TOOK my time and got back to the keyboard (I’m by the keyboard every day mind you – just doing some other shit 😛 )

SO! What has happened since my previous update? A lot it would turn out…

Status on the project

Roughly 2 years ago we began the renovations on an old house that we had purchased for the healthy sum of €440,000 (see Life Update #3 for a budget breakdown).

We’ve now put about €160,000 into the renovation (and incurred about €10,000 in “living expenses” while we lived in our own garden during the renovation). On top of this we’ve had “discretionary” spending in the excess of €10,000. This is stuff like tools, knick-knacks (decorations?) and furniture replacements that didn’t technically needed replacing, but somehow made it into our shopping basket (oops).

So all in all, we’ve sunk about $620,000 into moving to a new place…That sounds like a lot! However, during these past 2 years the house prices in the greater Copenhagen area (where we reside) has only continued to soar. This has made me confident that we’ll be able to get a good valuation on the house. Our mortgage rate is up for renewal this fall, so we’ve had our eyes fixed on the horizon for the most part of this year. We’re still missing 2 smaller (in comparison to the rest) projects; closet doors (yes, still missing those after more than 1 year! DOH!) and a hidden “bookcase” door for the boiler room.

These two “minor” projects should be doable before we invite the banks in for a valuation (in October). My expectations are currently moderate, but I’m expecting our “profit” to be somewhere between €50-100,000.

In the spring we spent some weeks clearing an old hedge and instead added a fence (easier for future maintenance). I enjoyed this project, because I got to operate a small mini excavator! That was fun 😛

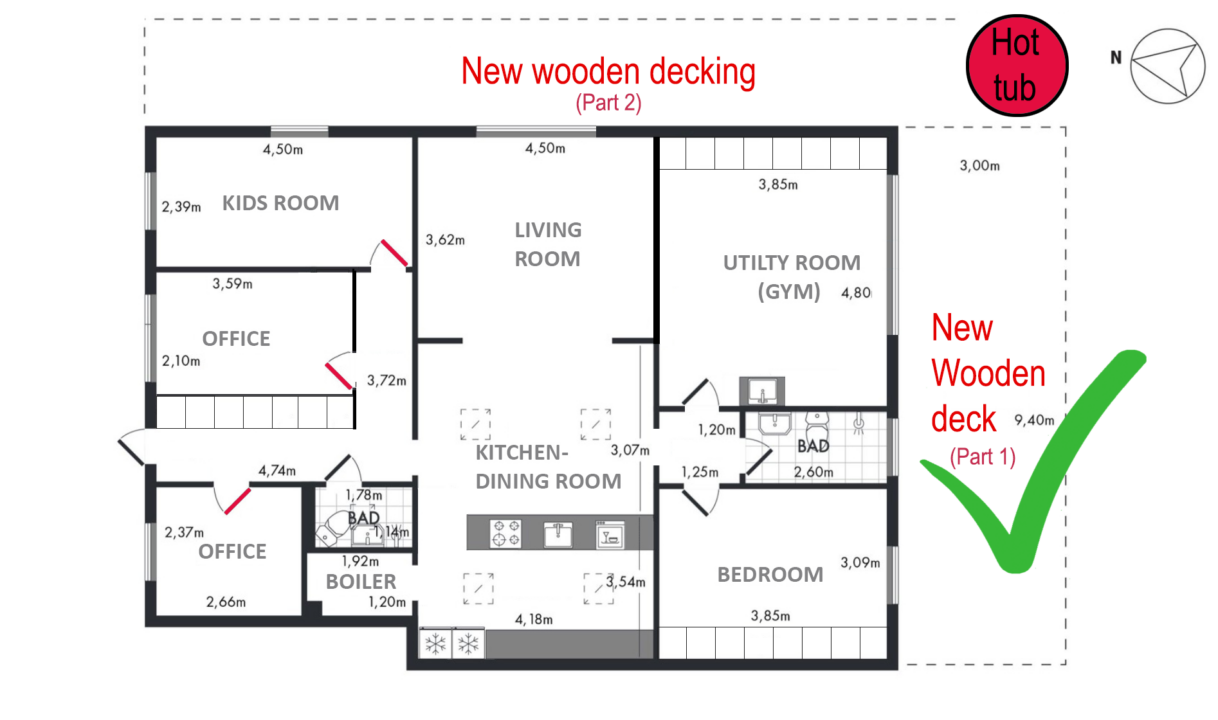

This summer we spent a couple of weeks building a wooden deck on the back side of the house. For this project we used re-used hard wood (and screws), so it was built at a fraction of the cost of a new deck. This of course speaks to my FIRE heart, but I can tell you that it was no easy feat! I built the frame under the assumption that of course the original frame had the same spacing between each joist…That turned out NOT to be the case! So it became a really, really, really big puzzle to built something on top of this frame, where we could re-use the original screw holes in the planks. We managed to reuse 70-80% of the holes, meaning we had to drill a lot of new holes. Had we worked with new wood, I would have also insisted that all the screws should line up on perfect rows. With the re-used planks, I had to abandon that ideal pretty quickly haha!

So, we turned this:

Into this:

Because we had to drill a bunch of new holes, we decided to install the planks “upside down” – meaning the back side is now facing up (the original back side is grooved, so the old holes are less visible) . This is why you can see these dark areas (this was where the joists used to be on the previous installation). I kind of like its unique rustic look, and we decided that in this case the function is more important than the form (the color differences will wash off over time).

It’s 43m² (463 sq. feet) and we feel it’s a huge value-add to the place. It almost feels like an outdoor extension of the house, as the height of the deck is the same height as the indoor floor. So you just walk directly outside (no shoes required! 😛 ) to enjoy the lounge area. The inside of the house is only 129m² (1833 sq. feet), so by adding this space we’ve basically extended the house with 33%.

We saved about €2,500 by using re-used wood, so I think this build was a big success.

Would I do it again? Absolutely NOT! HAHA! The installation took 3x as long as it would have, had we been using new wood. We had to inspect each individual board piece (and cut each end) to make it fit as best as possible (each row consists of 3-4 individually cut boards). Horrible, horrible waste of time, really. But we do feel greatly accomplished now! If we ever have to build a deck out of NEW wood, it will feel like a walk in the park compared to this project 😉

And it’s likely that we’re gonna have to, because this deck is only one half of the wife’s full vision…

NOOOOOO! No more, please!

Actually, I just noticed something on the floorplan: This is a copy of the floor plan that was presented by the realtor who sold us the house – with a few modifications added by me. The original back yard “terrace” (overgrown stone terrace) was only 3m wide. The wooden deck is actually 4,6m wide. This means that we’ve somehow managed to extend the back yard by 1,6m (5 feet). YAY!

Status on the finances

Ok Nick, so surely by now you’ve restarted the FIRE-journey, and have re-started your Total Balance savings goal(s)?..

Yeah, no.

I honestly don’t know where all our money have been going for the past year. Actually that’s not true – I have a rough idea 😛

In April we bought a new (summer) home. The kind that has wheels on it. We bought an old camper (it’s from 2013, so in camper-life that’s not that old really) which we’ve been using for our summer holiday this year. I’ll leave the details about the “camper life” for the next section 🙂

I actually also (finally) bought an electric bike. I bought it 2nd hand for 50% of the retail price – but it looks brand new and only had 400km on it. I was actually talking about this bike way back in my August update from 2 years ago 😛 That also put a little dent in my non-existing savings (it set me back about €1,100). So now I currently have 3 electric vehicles at my disposal (e-bike, e-scooter, e-car)! It’s clear that I’ll need to get rid of one of them (the biggest and most expensive one ofc) if I want to retire before I turn 70 (and I do!)…

Since we began the renovations our money has been flowing steadily in one direction; OUT!

When we finally somehow managed to built a small nest egg, we blew it all on the camper…I’m not used to living without reserves. It’s making me a little uncomfortable, and yet I’ve somehow managed to live with it for almost 2 years now. We still have a small amount invested (around €8,500) in stocks/indices, so we have a reserve, but these are a “last resort” type of reserves 😛

Anyway, we have one finale big expenditure awaiting us this year: closet doors. We have lived in the house for more than 1 year now, without having doors on our wardrobe (in the bedroom and in our gym). It’s time that we finish that project! It’ll run us around €2,500, and that’ll be the last hurrah (until the next one…). We want to finish it by the end of September, as we plan to have the house appraised in October.

Hoping for a good valuation of course. But right now our main goal with the valuation is to get one that puts our LTV at < 40%. I’m fairly confident we will be able to get that (house prices have been rising steadily for the past few years), and then we’re still debating whether to shorten the mortgage to 10 years. I like the idea of being debt free in 10 years, but of course this will come at a high opportunity cost. Our FIRE goal would essentially be moved significantly, as we’d have to channel some of the funds from the future FIRE pot towards the mortgage instead.

This is somewhat of a pivot on my part (I know!), as I previously didn’t imagine ever repaying my mortgage completely. For now I merely view my mortgage as a form of savings account that pays about 3.5% (what we currently pay in interest). This is not a lot, but it just about covers inflation. We can always choose to pivot again at a later date, should a massive investment opportunity arise. Then we can simply re-mortgage and pull out whatever money we’ve put in to bring the LTV back at 60-80%.

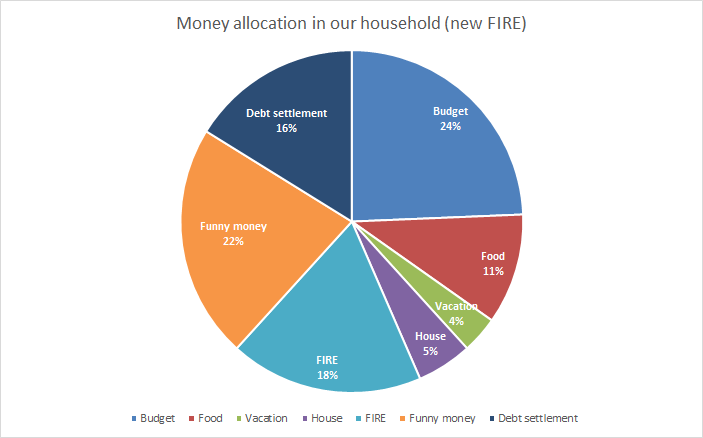

Anyway, I know you guys love looking at the graphs, so let’s do a little comparison. Here’s our budget from 2019:

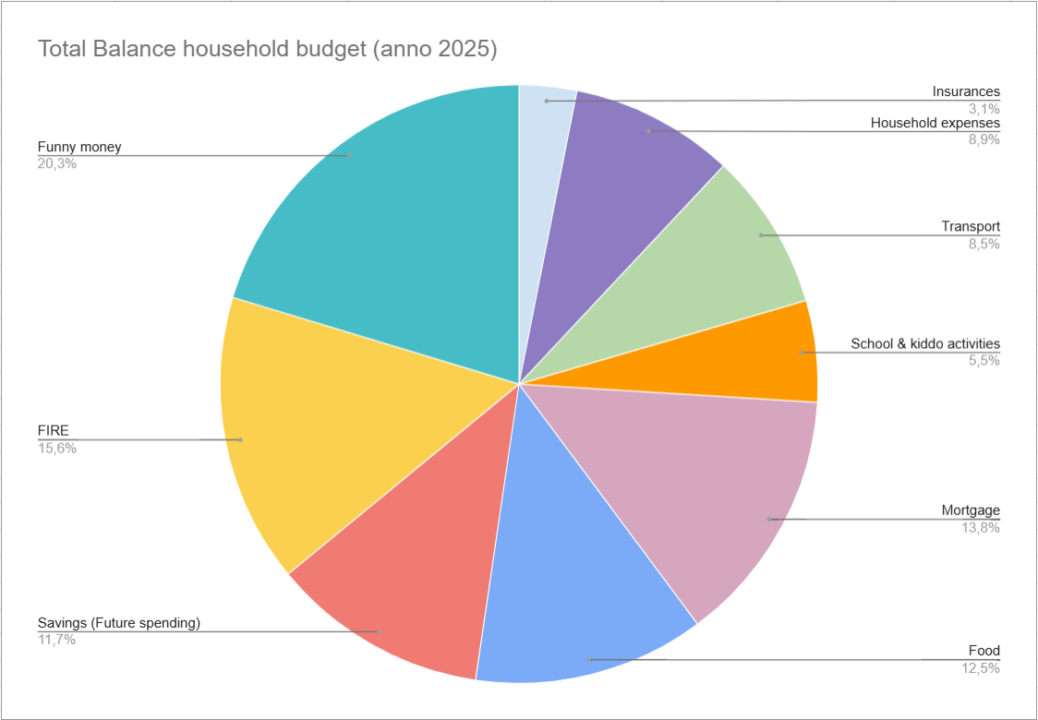

And here is our money allocation today (2025):

I apologize for the chart inconsistency – both in terms of colors, categories and “look and feel”.

I’ve switched to Google sheets (somewhat), and I don’t want to bother spending time trying to make them look similar 😛

The category called “Budget” in the chart from 2019 contains the categories called “Insurances, household expenses & transport” in the 2025 chart.

So in 2019 this category amounted to 24% of our total money allocation. In 2025 it amounts to 20.5%. This was actually news to me. I suppose this is good news?! YAY!? 🙂

However, there is a brand new category in the chart called “School & kiddo activities”. Yes, kids are expensive – and our daughter goes to private school, so that category also contains the tuition.

Then there’s the Mortgage. In 2019 we spent about 16% of our allocation on our mortgage. In todays money, we spent about 14%. So that’s also a small win here. Keep in mind though that this expense fluctuates with the interest rate. Back in 2019 the interest rate was near 0%. Today it’s 3%+. Our current mortgage is almost half of the one we had in 2019 (on the old house – which was bigger and more expensive). If the interest rate continues to decline (dare we dream?) we’ll continue to see a declining trend in this category (fingers crossed).

Then there’s the food category. This is our nemesis. Food prices have been steadily rising for the past few years, and it clearly shows in our budget. We set aside €1,066 per month for food (it was €800 in 2019). 2 adults and a pre-teen (she doesn’t eat that much – yet). And we’re struggling to keep within this allocation. So most likely we’ll have to increase this a tad going into 2026. We don’t feel like we live as kings and queens. My wife cooks for most days, and we rarely go out to eat. Every now and then we’ll get takeaway like pizza, sushi, thai etc. The wife and I had a discussion the other day, because I was under the impression that on average we had 1 take-away day per week. She believes it’s closer to every 2nd week. So maybe it’s somewhere in-between. But certainly we don’t eat take-away every other day. So living healthy (lots of fruits and veggies) in 2025 is just way more expensive than 6 years ago (but you all knew this already).

Then we have in the new chart a category called “Savings (Future spending)”. This includes the two categories in the old chart called “House & Vacation”. It’s basically our savings that we set aside for future spending for vacations, (small) house improvements, car repairs, gifts etc. In the old chart this was 9% of our allocation. In the new one it’s almost 12%. No surprise here – everything has become more expensive, but we’ve also added some extra stuff in the category (like gifts and auto repairs), so I think the small increase is acceptable here.

Then comes the last two (and most interesting) categories! The FIRE allocation and the “Funny money”. The funny money is the “pocket money” that we both get to spend on whatever we see fit. My pocket money are often spent on experiences (like if we go to the movies), take-away, clothes and tech stuff (somehow our iPhone cables and chargers seem to brake almost every month!). My wife’s money is (probably) spent on kiddo stuff, make-up, clothes and knick knacks 😛

Anyway, these two categories have not changed significantly. They’ve both gone down a tad (to support higher spend on food and kiddo activities), and currently the FIRE allotment is STILL being put towards the house. This should change from the end of 2025. By the end of 2025 the FIRE allotment will either be put towards the mortgage, or put into some form of investments (I don’t have any great ideas for investments right now, so I feel like the mortgage is the safest place to store them atm.).

Alright that was a wee bit boring, but somewhat enlightening for me – I haven’t had a chance to compare these figures until just now, so they are as new to me as they are to you 😛

In terms of absolute spending, our budget actually looks quite similar to the one in our previous house (the categories has just shifted a bit). But had we stayed in the old house, our mortgage payment would have been quite substantial (like 30% of the allocation) and of course this would have affected our funny money and the FIRE pot greatly…

Status on our life

After having experienced the “tiny living” lifestyle during the renovation, we discovered that we actually quite enjoyed it. There’s something about living small and “simple” (we had washer/dryer and dishwasher, so it wasn’t THAT simple to be fair 😛 ) that we really enjoy. So we decided to take the plunge and empty the bank account once again (we paid €6,500 for the camper) in search for a simpler life…

After having spent a total of 14 nights in the camper since we bought it, I can honestly say that we do not regret buying it! It’s small, but has a great layout that easily sleeps 2 adults and 2 kids. For now we’re planning to spend some time in good ol’ Denmark with the camper, but we’re also talking about driving it around Europe. However, I don’t want to spend too much time “on the road”, when all we really need is a nice campground with a good view and some fun activities for the kiddo. This can be found in abundance in Denmark. The problem with vacationing in Denmark, is you that you never really know about the weather. It can be sunny and warm, or it can be cold and rainy (also in the summer!). We experienced all the kinds of summer-weather that Denmark has to offer this summer (even a rain flood and a storm)!

All in all I’d say life is progressing as life should. Our day-2-day life has become easier in the new house, because our kiddo can walk to/from school by herself. She’s 11 now, and she’s just such a happy and thriving kid. We’ve been pretty lucky in that regard 🙂

My wife is back at work, and that of course challenges our 1-car household dream a little. However, since I only have 7km to work, taking the e-bike or the e-scooter to work is perfect for me (but it’s sub-optimal in heavy rain or snow!). I’m trying not to stress too much about it. For now we have 2 cars, and it might change at one point, but not right now.

Now, about the title of this post: A while back someone “outed me” at work.

Someone randomly asked me (in the elevator) if I was “that FIRE guy”. It came as a bit of surprise, so my answer was just something along the lines of “Maybe. What have you heard/read?”. I later chatted with him on Teams to get the “backstory”, and it became clear to me that I had made a mistake in sharing the same pictures on the blog and on my personal SoMe profiles. But since the cat is out of the bag, I’ve just had to accept it. It shouldn’t really change anything, but it has of course made me a bit more weary about what I share here. I can no longer share my honest opinion about my boss (she’s really great btw 😛 ) or my employer. Not that I feel like I’ve ever spoken ill about any of them, but the fact that I’m now no longer 100% anonymous does add a little more…pressure.

Anyway, I will continue to write as honest and playful as always (to the best of my ability of course)! 🙂

Until next time!

That deck is so nice!! Good job with it! I’m looking forward to more DIY projects again when we purchase a house again down the line.

Good luck with the appraisal, I hope all of your hard work is paying off and you’ll enjoy it for years to come 🙂

You have to show a picture of the camper man! Regards from “Det lille potentiale”

Haha, thanks Peter! I figured someone might ask for this 🙂

It was intentional that I did not include a picture. It’s quite distinct looking, so as to avoid any unwanted attention (it’s currently parked in our driveway), I opted to leave it out for now. – But here you can see some pics of a similar one:

https://www.caravan-center.biz/p/sterckeman-starlet-370cp-vorzelt-etagenbett-tuev-und-gas04-2023-verkauft