Welcome to my Monthly update #12. The 1-year anniversary month of the Total Balance blog has arrived!

I wrote my first post on totalbalance.blog on the 25th of September 2018! So, I will save the birthday celebrations for another 25 days (give or take). This is a monthly update, so let’s focus on the month of August, for now? 😉

Astute followers will probably have noticed that it’s been a while since my monthly update has included an updated LEGO-model of my Total Balance progress (which I started a while back). The reason for this is quite simple: I ran out of bricks…In the search for 2nd hand bricks I realized that LEGO’s aren’t cheap! Spending €20-€30/month on bricks, JUST to model my progress, would kind of undermine my current measly crowdlending income, of around €100/month. And since my (not so) trustworthy mascot, Russel the LEGO guy has gone AWOL anyway (my daughter magically made him disappear), I figured it might be time to lay off the LEGO’s for a while.

And thus, a new era of the Monthly updates can commence! 😀

The month in review

The first month back at work after the summer holidays is always a bit blurry! What did actually happen in August?

There was a little trouble, with one of the originators at Mintos (and Viventor), called Aforti. The problem appears to have solved itself though. Anyway, this experience has taught me another lesson about the importance of diversification. It turned out that 30% of my loans at Viventor was with the same originator (the auto doesn’t have an option to ensure equal diversification among loan providers). I thus decided to sell a handful of loans (from Aforti) at Viventor, and this has brought the income at Viventor down to €0 for this month (because I had to sell them at a small discount). Not a major issue, but enough for me to reconsider my exposure towards these kind of risks in the future (what happens to your portfolio, if an originator goes bankrupt?).

If you remember, I’ve never really been a huge fan of the classic P2P market to begin with, and I’ve been considering a complete re-balance of my portfolio for a while (a little platform-shuffle perhaps?!). Anyway, since nothing has changed yet, I will elaborate on those plans at a later date 😉

I sold REIT #2 (I just had 1 share) as I had mainly bought it to follow the movement of this particular REIT – and when I bought it, I setup an automatic limit order that would sell it again, if it hit a certain target, as I wanted to test the functionality of the SaxoTrader. Well – it worked 😀 So now, I’m back to owning only 1 REIT. The value of REIT #1 fluctuates a bit, but the book-value in the income statement is purchase price+accrued dividends (this is obviously not the correct way to do it, but for now it will do. The value has yet to fall below my purchase price, so I’m good with this approach for now).

I unfortunately had a savings rate of 0% this month, due to the fact that I had two weeks of vacation (from June) deducted from my salary (remember the Vacation Money that I got in march?), which obviously had a pretty adverse effect on my savings capacity. This was all expected though, so I’m still on track to hit my yearly target (next month should be back to normal again). I actually had to sell a few (unused) items, just to cover my basic budget. This is however a perfect example, of how “using” (they are part of my Total Balance now) the vacation money beforehand can force you to find alternative “income” streams. This is exactly why I choose to do it this way, as it simply forces me to find the extra money that I need. We have quite a few unused kiddie-items in the pipeline now, ready for sale, which should chip in quite a few € to the balance next month. It feels good to turn those items (back) into cash! We actually managed to sell a crib (that we had bought 2nd hand about 4 years ago) at a higher price than we originally paid for it! Quality furniture is in high demand on the 2nd hand market it seems 😉

It’s really interesting to see, how my Pension and my Equity are now almost the same! At the end of this month is the quarterly mortgage payment though, so unless some serious growth happens in my Pension funds in September, the Equity should once again take a small leap ahead next month 😉

The boring income statement

| Platform | Invested | Deposits / Withdrawals | Value last month | Current value | Bonus / Fees | Return | Change (%) | Expected return |

| Crowdlending | ||||||||

| Bulkestate | € 3.525 | € 0 | € 3.525 | € 3.525 | € 0 | € 0 | 0,00% | 14% |

| Crowdestate | € 700 | € 0 | € 723 | € 731 | € 0 | € 8 | 1,09% | 13% |

| Crowdestor | € 1.300 | € 0 | € 1.265 | € 1.285 | € 0 | € 20 | 1,56% | 16% |

| Envestio | € 850 | € 0 | € 1.388 | € 1.422 | € 12 | € 22 | 1,55% | 16% |

| Estateguru | € 100 | € 0 | € 108 | € 109 | € 0 | € 1 | 0,92% | 11% |

| FastInvest | € 400 | € 0 | € 424 | € 429 | € 0 | € 5 | 1,17% | 14% |

| Grupeer | € 1.140 | € 0 | € 1.270 | € 1.283 | € 0 | € 13 | 1,01% | 14% |

| Kuetzal * | € 750 | € 150 | € 623 | € 784 | € 0 | € 10 | 1,28% | 19% |

| Mintos | € 900 | € 0 | € 999 | € 1.009 | € 0 | € 10 | 0,99% | 11% |

| ReInvest24 | € 1.000 | € 0 | € 1.002 | € 1.005 | € 0 | € 3 | 0,30% | 13% |

| Viventor | € 400 | € 0 | € 417 | € 417 | € 0 | € 0 | 0,00% | 13% |

| € 11.065 | € 150 | € 11.744 | € 11.999 | € 12 | € 92 | 0,78% | 15% | |

| Stocks | ||||||||

| Pro Real Estate Trust (REIT #1) | € 910 | € 0 | € 961 | € 962 | € 0 | € 5 | 9% | |

| € 998 | ||||||||

| Properties | ||||||||

| Brickshare | € 1.333 | € 0 | € 1.333 | € 1.333 | € 0 | |||

| Property #1 | € 68.667 | € 0 | € 68.667 | € 68.667 | € 0 | |||

| Property #1 Leverage | -€ 8.000 | € 0 | -€ 8.000 | -€ 8.000 | -3,5% | |||

| € 62.000 | ||||||||

| Cash | ||||||||

| Bank #1 cash (main savings) | € 0 | € 0 | € 0 | 0,70% | ||||

| Bank #2 cash (emergency fund) | € 0 | € 147 | € 0 | 0,5% | ||||

| € 0 | ||||||||

| Total balance | € 74.731 | € 74.997 |

All in all a combined passive income of €109 for the month of August.

Pretty standard month, really! Eventually I’d like to see every platform chip in with at least €10/month. This would obviously require me to up my deposits on the smaller platforms (like Viventor and FastInvest), but as I mentioned earlier, I’m not too keen on adding more funds to my current P2P platforms.

The extra money I got from my bank interests last month, I added to Kuetzal.

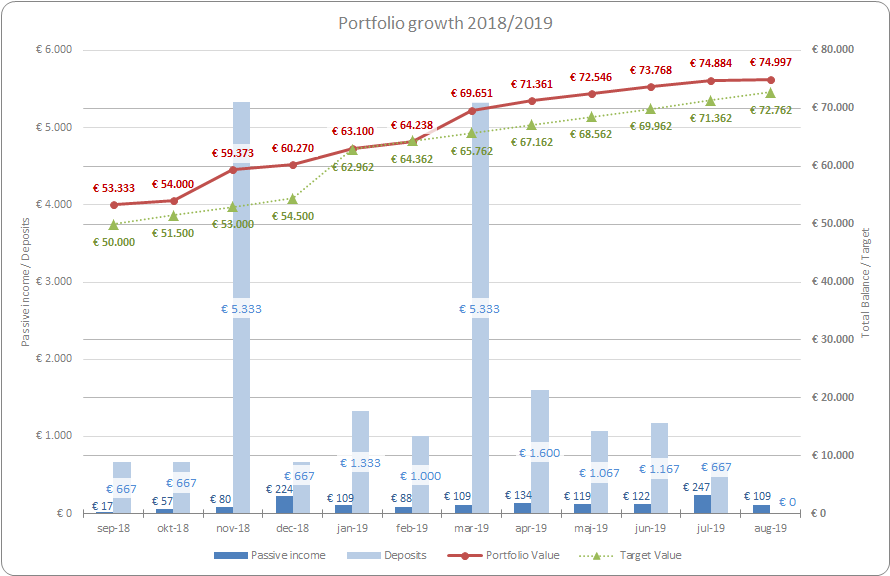

The Classic Growth Chart

Not much to say to my classic growth chart this month – those (normal) savings are really missed this month, and it’s clear that I will not remain way ahead of my target for the remainder of the year (like I have been, since “receiving” my vacation money in march).

The conclusion

In conclusion I ALMOST breached €75.000 this month, which would have been a really nice number to surpass! I will save that joy for next month. My Total Balance progress thus remain at 18% (18,75%). I hope to blow by 19% next month 😉

That’s it for this months update, kids! Remember to stay in school! See you next month! 😀

Like your update post, they are very inspiring!

Thank you. I aim to inspire 😉

Congratulations on your progress. Even if you have a slightly different approach and attitude, the size of the pension and investment fund shows that you will eventually achieve your goal.

Whaaat, I was hoping to see some comparisons of your first year of blogging. Will this come in another post? 😀

Whaaat comparisons?…But yes, I will do a birthday celebration post later this month! 😛

Sad to see the demise of the Lego bricks, but glad to see that you’re continuing on with the (extremely) pretty graphs!

My savings rate was also much lower than usual this month, so I feel your pain. Regardless, looks like you’re making steady progress to that first 100K!

Slowly but steadily you’ll get to 100k 😉

-FN

Yea, when you don’t have those stocks to suddenly spike your gains, it seems it’s gonna take forever to get to those €100K. But I will get there, no doubt 😉

Dont’ worry, some of us has only just started and are currently on €1500 invested so far! – but i will of course also get there eventually 😉