Here we go again! Another month blew by, and it’s thus time for another riveting financial update from yours truly!

It has been quite an eventful month!

I sold some stuff, bought some new shiny “stuff”, entered 3 new crowdlending platforms and exited 1 (actually planning to exit a few more). I also received my biggest payout to date, which I had been waiting for for an entire year! It feels good to harvest the first fruit from a seed that was planted more than 1 year ago!

I also teed up for another Brickshare investment, which I promised in last months update (see the project here). It didn’t quite make it onto the books this month though, as the payment hasn’t been processed yet (not sure what we are waiting for, but I will let you know, once I know more!).

Anyway, enough jibber-jabber – let’s get to it!

The month in review

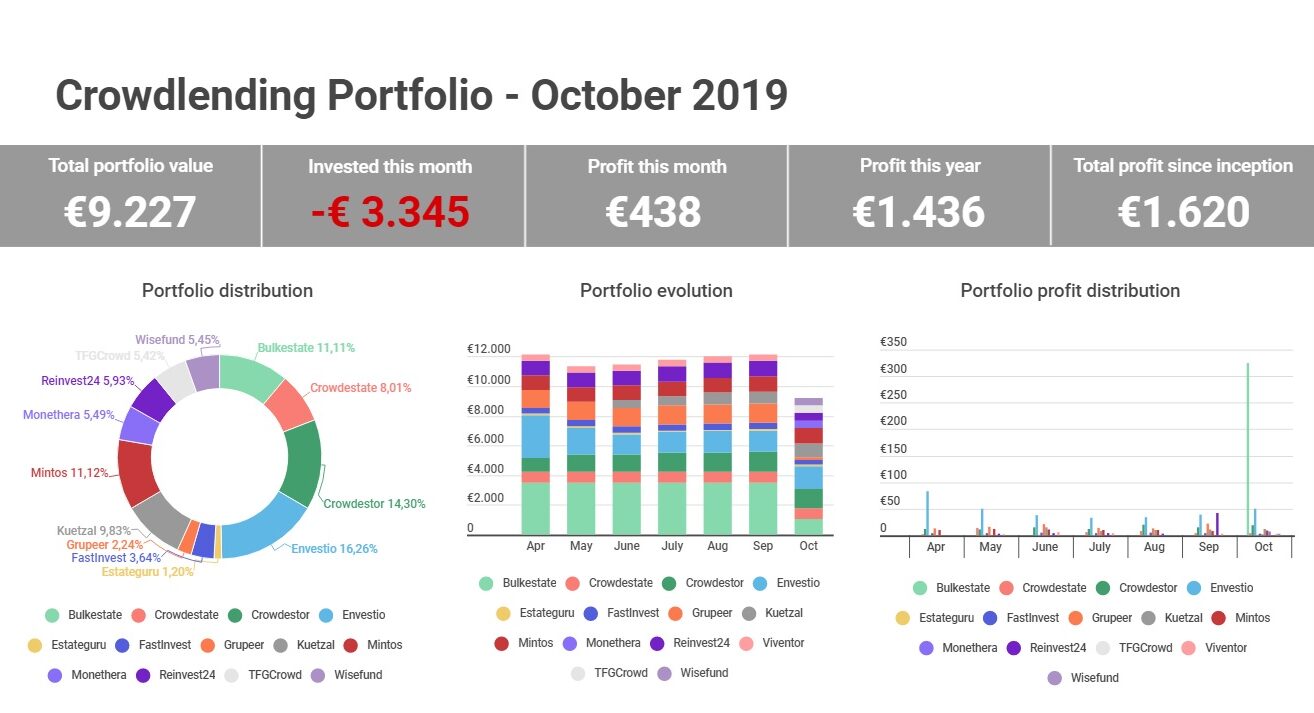

Crowdlending income this month soared through the roof, thanks to a long awaited first payout from one of my very first crowdlending investments with Bulkestate. I invested (way too much) €2.500 in a single project (see it here) and I’ve been worried ever since – but for no apparent reason, as I received my principal AND my accrued €325 in interest on the day that was promised (it arrived very late in the day though, so I was really anxious the entire day!). It arrived on Oct 15, as promised. Bulkestate has not announced the exit of the property yet though, which is a bit puzzling to me…I wonder whether they’ve settled this property out of their own pockets, to satisfy their investors, while awaiting on the sale of the property to go through. This is merely speculation though. Either way, it’s something that ReInvest24 could really learn from! As they have STILL to repay their investors on a project that was promised to exit on Sep 30. Selling properties is not an exact science, so I understand that deals can drag out – but clearly Bulkestate has found a way to take on that risk alone, and hold their investors unaccountable – so kudos to them 😉

Anyway, this experience has made it clear to me that I should try to limit myself to this kind of exposure in the future. I don’t think I will be investing again with Bulkestate OR ReInvest24, once I receive my principal (and hopefully some interest too). I currently have about €1.500 combined invested in those two platforms. I have another project with Bulkestate, which is scheduled to exit on Nov 12. However, I’ve noticed something interesting with that project. It’s this one. Apartment in “Sun Terraces” in Jurmala, a €270.000 loan at 16% interest. Now look at this one, which was announced last week (Apartment in “Sun Terraces” II). It’s basically an extension of the original loan, but at a lower interest rate (14%). So, new investors gets to take over from the previous ones, but at a lower interest rate, which is interesting. It might be business as usual, as I’ve seen these kind of extensions before, but I’m not touching that thing with a fire poker – call me a prude, I don’t care 😛

As I outlined in my biggest crowdlending mistakes post a while back, one of the things that I learned since I first invested (with Bulkestate) was to only put a small amount of money in a lot of projects, instead of a big amount of money in a small amount of projects 😉 I’ve since turned that approach into a strategy, which I try to follow. This approach has led me to open up accounts with 3 new platforms this month! – So, welcome Monethera, TFGCrowd and Wisefund to the roster!

At the same time, I have decided to “follow my gut”, and to start withdrawing my funds from platforms that primarily offer P2P loans. This means (an eventual) goodbye to FastInvest, Grupeer and Viventor. I have decided to keep Mintos in the roster, simply because it is one (if not THE one) of the most established players in the P2P sphere. The interest levels on Mintos have however been approaching 10% for a while now, and most people are reporting that 12% is a rarity these days. I consider this quite normal, and it would surprise me if the interest wouldn’t continue to plummet. If it reaches 8% I will consider withdrawing from the platform, as I can get more than double that elsewhere.

My crowdlending strategy going forward will thus continue to be: Follow high-interest opportunities in the “pick-and-choose” platforms which pays monthly interests, like Crowdestor, Envestio, Kuetzal, Monethera, TFGCrowd and Wisefund. I didn’t mention Crowdestate here, as I’m currently undecided whether I’m going to continue to invest on this platform. I currently have two outstanding loans, and the interest rate of new projects is in a continuing decline, like Mintos. I honestly see this trend as healthy, as the platforms become more established, it’s only natural that the interests find a more “reasonable” level. But for now it doesn’t seem like the risks follow the downward trend, so a 12% loan on Crowdestate seems just as “risky” as a 19% loan on Kuetzal (this is just an example). Thus I see no reason to stick with the 12% loans…

The Gold Standard

I’ve been debating heavily with myself, how to reveal my latest “impulse purchase” to my readers, but if anything, you know me as a guy who doesn’t sugar coat things, so here goes: I bought 4 gold coins (4x 1oz) in October…

I’ve since regretted it a bit (ooops – I got Gold fever there!). Not the fact that I bought them, but the timing of the purchase was less than perfect, if I’m honest. I’ve been looking at gold coins for years, and I’ve always imagined owning a few (I used to collect coins when I was young – so I have a soft spot for coins), but I never got a around to make an actual purchase. I attended a webinar on gold in the beginning of October and decided in the spur of the moment (while still in the webinar) that there was no time like RIGHT now to act…

Gold and the dollar was both kind of expensive in October…Not the best timing! – BUT, now I have them, and since I don’t intend to ever sell them, the timing of the purchase is sort of irrelevant. How will you make any money off of them, if you don’t plan to sell them, Nick?!

Well, I consider gold in my portfolio as a form of insurance policy. Against what?

For when the zombies come, of course! 😛 A small part of me does not believe that our current monetary system is sustainable. The fact that the banks are actually PAYING people to take out loans (negative interests) kind of says it all. Something is terribly wrong, and even Mr. Twitter President himself believes that our only viable option to restore faith in our monetary system, is to return to the gold standard. Gold is a finite resource – €, $ and £ aren’t. It’s highly unlikely that it will happen – but now I have a small insurance against such an event (the zombies) 😉

Anyway, the Bulkestate payout opened up a “diversification opportunity” for me, so I decided to also part with my single REIT and move into some gold instead. There’s an old saying:

You don’t invest in Gold to become rich – you invest in Gold so as to not become poor…

I don’t know who said it, but i like it! 😛 I don’t recommend you go out an buy gold, honestly. If you want to buy gold, there are plenty of ways to do so, without buying it physically (ETFs & goldmine stocks etc.). I’ve always been a bit of an oddball, going against the stream, so it’s no surprise really that I would suddenly go and buy some gold coins! (at least not to me…). Anyway, my Total Balance portfolio now consist of approximately 7% gold! YAY!

(Spoiler: I’d like to eventually add a 5th coin to the collection, as I think that would make it “complete” – but the American Eagle coin is a collectable in itself, so it trades a bit higher than it’s actual value in gold – so I will wait for a golden opportunity to add that to the collection – get it?!).

The most notable change this month is obviously the decline in invested crowdlending funds, due to the addition of Gold to the portfolio. And the big spike in the income from Bulkestate also distorts the picture a bit (not that I’m complaining). My pension also continue to rise slowly but steady. It will be interesting to see, if our equity can continue to keep up with my pension (I hope my pension funds eventually leaves our equity in the dust! – At least this is where the magic of the compound should come into play!).

The boring income statement

| Platform | Invested | Deposits / Withdrawals | Value last month | Current value | Bonus / Fees | Return | Expected return |

| Crowdlending | |||||||

| Bulkestate | € 1.025 | -€ 2.825 | € 3.525 | € 1.025 | € 0 | € 325 | 14% |

| Crowdestate | € 700 | € 0 | € 735 | € 739 | € 0 | € 4 | 13% |

| Crowdestor | € 1.300 | € 0 | € 1.300 | € 1.319 | € 0 | € 19 | 16% |

| Envestio | € 850 | € 0 | € 1.450 | € 1.500 | € 27 | € 23 | 16% |

| Estateguru | € 100 | € 0 | € 110 | € 111 | € 0 | € 1 | 11% |

| FastInvest | € 300 | -€ 100 | € 433 | € 336 | € 0 | € 3 | 14% |

| Grupeer | € 40 | -€ 1.100 | € 1.283 | € 207 | € 0 | € 2 | 14% |

| Kuetzal * | € 850 | € 100 | € 795 | € 907 | € 0 | € 12 | 19% |

| Mintos | € 900 | € 0 | € 1.017 | € 1.026 | € 0 | € 9 | 11% |

| Monethera *NEW | € 500 | € 500 | € 0 | € 507 | € 7 | € 0 | 16% |

| ReInvest24 | € 400 | -€ 500 | € 1.047 | € 547 | € 0 | € 0 | 13% |

| TFGCrowd *NEW | € 500 | € 500 | € 0 | € 500 | € 0 | € 0 | 17% |

| Viventor | € 0 | -€ 420 | € 417 | € 0 | € 0 | € 3 | 13% |

| Wisefund *NEW | € 500 | € 500 | € 0 | € 503 | € 1 | € 2 | 18% |

| € 7.965 | -€ 3.345 | € 12.112 | € 9.227 | € 35 | € 403 | 15% | |

| Commodities | |||||||

| GOLD (Coins) | € 5.333 | € 5.333 | € 0 | € 5.333 | € 0 | € 0 | |

| Properties | |||||||

| Brickshare | € 1.333 | € 0 | € 1.333 | € 1.333 | € 0 | ||

| Property #1 | € 68.667 | € 0 | € 68.667 | € 68.667 | € 0 | ||

| € 70.000 | |||||||

| Cash | |||||||

| Bank #1 cash (main savings) | € 0 | € 0 | € 0 | 0,70% | |||

| Bank #2 cash (emergency fund) | € 0 | € 0 | € 0 | 0,5% | |||

| Portfolio Leverage | -€ 7.000 | € 0 | -€ 7.000 | -€ 7.000 | |||

| Total balance | € 76.140 | € 77.560 |

I managed to grow my Total Balance by €1.438 this month, of which €438 was a record-breaking crowdlending income!

Next month also boasts a Bulkestate payout (albeit not quite as big), so next month should be a decent (income) month too.

I’m currently in a bit of a platform shuffle, so the crowdlending is a bit of a mess. Hopefully I will get back in “business as usual” during the next couple of months (I’d like to have a minimum of 10 platforms with at least €1.000 invested on each platform).

The Classic Growth Chart

For tracking purposes, here’s the classic growth chart (I like to look at this):

Still ahead of target for the year. I’m hoping to breach €80.000 by the end of the year, but it will be very close (December is typically VERY expensive!).

The Conclusion

This concludes this months record-breaking update. I remain at 19% of the way towards my first FIRE-goal of €400.000.

Next month should be a little less eventful than this one, as we’re going on a weeks holiday to the sunny south, to replenish our vitamin-D deposits 😉

See you next month!

I hope you have a good holiday!

Am I right in thinking that you have nothing invested in the stock market? Is that because of Danish taxes or just a personal choice?

Personally, you should might want to consider just stopping the old P2P investing – if you are comfortable with the leverage of property investing, your money will be able to work a lot harder than keeping an eye on 10+ platforms.

Feel free to disagree.

Hey GFF, thanks for the comment.

You are absolutely correct – sort of 😉

If you look at page-3 of the infogram, you’ll notice that quite a bit of my net worth is tied up in my pension. About 45% of these funds are currently invested in the stock market.

I once invested in stocks, but came to realize that the roller coaster rides greatly affected my mood. I know that the stock market will go up over the long run, but I simply prefer a more stable flow, which is why I for now have decided to purely focus on properties – and then the crowdlending is mainly because it’s a fun, new and high risk/high reward kind of asset, which also coincides well with my interest for fintech in general 🙂 As you might have noticed, Crowdlending currently constitutes about 15% of my Total Balance, and I’m comfortable with that for now. It has developed into quite the hobby, so I don’t mind the 10+ platforms, but if I were to grow tired of it, I would probably move those funds into more (local) real estate projects.

From a FIRE perspective, (non dividend) stocks are the preferred method of investing in Denmark, because you get to defer your tax payments til the day you start withdrawing the money – but at that point you will get slapped fairly hard (if you withdraw more than €14.500 from capital gains per year, they are taxed with 42% – below that is taxed at 27%). My property #1 income is currently tax free, but I will get taxed when I start pulling money out of the company shell structure that currently holds my Property #1 (and any future properties). So yes, it’s a mix of reasons really, but my main reason for disliking stocks is the volatility. From a logical perspective, I know that it’s stupid – but from an emotional perspective, this is what works the best for me. I also like the illiquid investment vehicles, because it forces me to stick with a long term strategy…

So, while I would not recommend anybody to base an investment strategy off of minimizing your mood swings, I seem to have done just that myself haha.

funny – I’ve thought of moving to Scandinavia but I’ve not spent the time to really look into the tax situation – income tax / social security is one thing but investment income/tax/dividends and all that are another matter altogether.

Added into the mix would be that the family money is in the UK now – would it be taxed by the UK or non-UK?

The answer to that is pretty complicated. Your ISA is something we Danes could only dream about, but you only eligible to deposit to your ISA when you actually live in the UK (I have UK friends who lives in DK who hates this fact 😛 ). For the rest of your investments I couldn’t say for sure – but expect it to be complicated and I’d think it would not be favorable – tax wise – to move from the UK to DK/NO/SE 😉

I’m thinking that we could keep our money in the UK – need to put more into ISAs – and work it like that.

the UK is favourable for tax but I do love Scandinavia!

Personally if I were to move, I’d move further south! Portugal for example 😉 have you seen their NHR deal!? I’m tempted!

I’ve thought about it – it’s a big decision if you have kids and the tax situation in the UK means that it might be worth keeping a toe in both countries – plus what you might like and where to live can change as you swap being a tourist for being a resident

Great month, Nick! I’m not surprised to see you buying gold coins 😉 You definitely keep your investments (or was it more of an insurance?) more interesting than the traditional passive index fund investor.

Have a great vacation!

Woohoo congrats on your passive income for October Nick, doesn’t it motivate you to allocate more money in crowdlending?

I’ve been debating with myself in regard of buying gold too. In fact I did buy some last year through an ETF as a sort of experiment. Ray Dalio, one of the most intelligent hedge fund managers holds gold in his portfolio, the so called ”all weather portfolio type. But then on the other side Warren Buffett goes against it, arguing that gold doesn’t produce anything and as such it isn’t an investment.

I sold my ETF as the fees are expensive to cover rental or maintenance costs from where the gold is kept. Then I came up with the conclusion that buying coins or bullions was the way to go. Never bought any as we keep constantly moving out and still renting I worry I would lose any.

Aren’t you happy with the negative interest rates in Denmark? I’d be thrilled! 🙂

Good luck with your coins, they look beautiful.

Have a nice Vitamin D month ;p

Thanks! No I’m actually not tempted to add more € in crowdlending, as I know it is high risk. And I’m approaching the point of interest neutrality (u know where paying and receiving interest evens out to 0), which is the most lucrative spot to be in, in terms of tax optimization 😉

Gold is kinda fun – but you shouldn’t consider it an investment (like WB says). It’s pure insurance/security/hedging against the zombie apocalypse 😛

Yes short term I am very happy with our current interest rates, but long term I fear the consequences 😉 I’d rather be paying 2-3% and then trust that it was sustainable. (Also that would give me more incentive to invest more in Crowdlending 😛 )

If the interest remain at this level, I see no reason to be paying off my debt at all – the inflation basically eats it away by itself! 😀