I know.

It was bound to happen eventually, right? – “How to do x-y-z” is the most boring blog posts of them all. I do believe we even refer to them as “filler posts”. Something we use to fill the void between the good stuff, right? – But not this guy! I’m here to tell you that this IS the good stuff! Why? Because, it involves the use of technology to help me (and you) to facilitate my favorite activity: being lazy.

Thanks to the somewhat monopolized payment industry, I no longer have to lift a finger to control my spending. How is that, Nick? You might ask. Well, to be fair, the monopoly doesn’t exactly help me control my spending – but it helps me categorize my spending, which is pretty much the most important part, of budgeting…

We can start by categorizing our expenditures in two categories: The variable and the fixed.

The fixed expenses

The fixed expenses are typically your mortgage payments, insurance, property tax, (leased) car payments and these days typically also your phone/internet and your Netflix subscription. And in our case also daycare. All of these expenses are fairly fixed (they can all change, but typically only once per year, which is why you do your budget once per year!…).

The variable expenses

The worst/biggest one of your variable expenses will typically be your utility bill (water, electricity, heating), followed by transportation (gas) and then food. My wife stipulates that our food expenses are fairly fixed (because we have a fixed budget for food) – but that’s only because she doesn’t see the full picture. When we go out to eat (it happens occasionally), I typically pay (with my so called “funny money” – you know, my “free to spend as I please” money).

Our utility bill can vary quite a bit from year to year, depending on how rough the winter is, and how warm/long/wet the summer is. So that one is always difficult to calculate, which is the essence of the variable expenses. Our transportation expense is however pretty steady, as we have two cars (one leased, one owned outright) and we tend to drive about the same amount in them each month. The gas prices vary a little, but not by a lot. So this expense is somewhat fixed, but can still vary depending on the mileage and the gas prices.

Hey Mr. Blabber-mouth, can we get back to the lazy part now, please?!

The budget

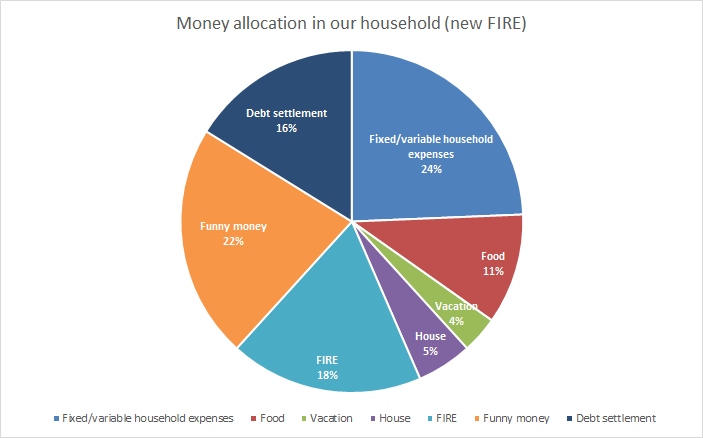

OK, lets have a look at my (our) current household budget:

So, 24% of our net income is currently sunk into housing, property tax, insurance, transportation and media (phone, Internet, Netflix etc.). As stated earlier, the transportation and the utility bill can vary a little, but not by a great margin. I can impact it positively by taking short showers, biking to work and reading in the dark – none of which I really fancy 😛

We’re not willing to cut back on our vacation spending (it’s already been cut back a lot), and the “House” category is money that we spend renovating/decorating our old house. The older the house, the more upkeep it requires. The only way we can change that, is to move (which is currently not an option – although we are considering moving to a cheaper/simpler house in the future).

So, I figure if I want to allocate more money towards the FIRE project, there are two main categories, where I could go look for savings: The funny money, and the food budget. We spend more than DKK 6.000 (€800) per month on food (this counts the occasional take-away meals, but rarely the restaurant visits too as that is paid from the funny money budget). To be fair, the “food budget” also include utensils like toilet paper, tooth paste and shampoo. But how much can one spend on toilet paper, really? (Well, as it turns out: not an insignificant amount, actually – but we’ll get back to that later!).

The technology, Nick?! C’mon!

Right!

The wonders of monopoly

I’d like to apologize in advance: The following is mostly relevant for danes, but if you’re a budget-buff, I encourage you to read on anyway! 😉

The Danish payment provider NETS (according to them selves) handle 98% of all payments in danish retail stores*.

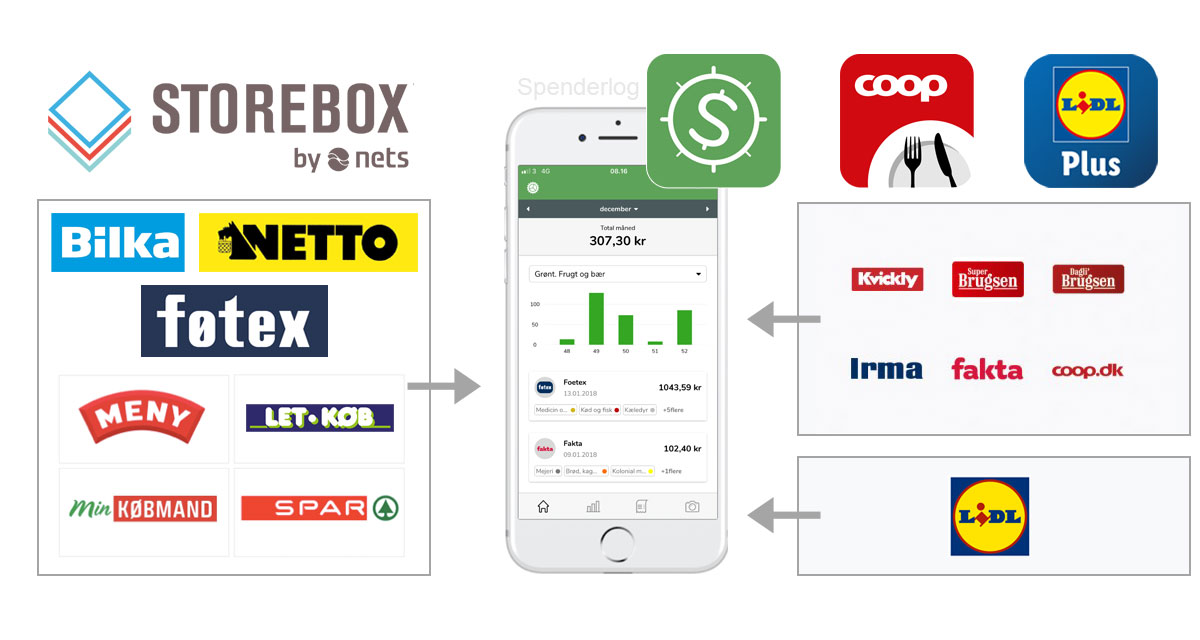

At the same time, our supermarkets (grocery stores) are dominated by 4-5 players. – So, when the biggest retail company in the country (Salling Group) and the biggest payment service provider in the country (NETS) decided to shake hands, it paved the way for a digital receipt concept, now known as Storebox (it started as an independent company, but NETS is now the primary shareholder).

This means that you can now opt-in to get your receipt from any of the Salling Group stores (Bilka, Føtex & Netto – and now also the toy-stores, BR of course) in a digital format in Storebox (an App on your phone). All you need to do, is download the App and register your credit cards in the App, and whenever you swipe your card in one of the partner stores, your receipt automatically pops into Storebox (you can still opt to get them on paper also – if that floats your boat).

Storebox actually offer digital receipts from a lot more stores than just the Salling Group stores, so about 75% of our grocery shopping is now covered by Storebox (Rema1000 and all Dagrofa stores like Meny, Spar, Min Købmand and Let-Køb are also available in Storebox). Even DIY-stores like Harald Nyborg and Bauhaus also offer digital receipts in Storebox now. For someone who loves anything digital, this is like heaven to me!

But why is this so cool, you ask? – Because not only does it save a shit ton of paper, it also gives you a central SEARCHABLE location for all of your purchases. Never lose a receipt again! 😉

– But wait, I’m not done yet! I promised you a tool for lazy budgeters (budgeteers?), and before we get to that part, we need to download a couple more Apps, before we can get to the good part.

As I mentioned before, the Storebox solution only covers 75% of our grocery shopping. Danish shoppers will know that the 2nd largest retailer in Denmark, is Coop (Brugsen, Fakta, Kvickly & Irma). Now, they don’t like Storebox (or Storebox/Salling Group doesn’t like them?), so they have their own App, where you can get your receipts. This is pretty annoying, but it’s something we can live with. The Coop App requires you to become a member of Coop, which I hope you are anyway, if you ever shop in their stores (it’s free), as it saves you money when you shop with them (the App also gives you access to special offers).

That then covers 95% of our grocery shopping. The last 5% (give or take) of our shopping is done in Lidl. SURPRISE, SURPRISE, they ALSO have their own App, like Coop (it has similar functionality – if you don’t already have it, and shop regularly in Lidl, I would give it a spin).

SO, we now have 3 Apps on our phone: Storebox, Coop, Lidl+. We now get digital receipts from 100% of our grocery shopping. (We never shop in Aldi, but this is the only major store that I can imagine, which is missing from my round-up?).

NOW comes the fun part; the 4th and final App! Spenderlog! (May the 4th be with you!…)

Spenderlog is an App, which can pull your receipts from the other 3 apps, and categorize your purchases for you! YOU’RE WELCOME! 😛

Spenderlog actually also has a scanner function, where you can take a photo of your paper receipt (the one from Aldi, maybe?!), and it will then digitize it for you. I’ve never actually used this myself, as this is simply too cumbersome for me to want to bother with it! (LAZY, remember?!). I have read mixed reviews about it though, so I wouldn’t expect it to be 100% perfect – but give it a spin, if you often shop in Aldi (or other non-digitized shops), and let me know how it goes! 🙂

Before we start looking at Spenderlog, I did a little graphical mock-up, of how it works (for those of you who are more visually inclined, like myself):

OK, smart-ass. So now I have 4 different (new) Apps on my phone, and the CIA, NSA and CTU now knows exactly how much money I spend on cheese, wine and condoms? (Like they didn’t already know this before…)

Pretty much! How great is that!? (F.U. Jack Bauer!) – Now let’s get back to the toilet paper!

How much money do you think, we spend on toilet paper per month?

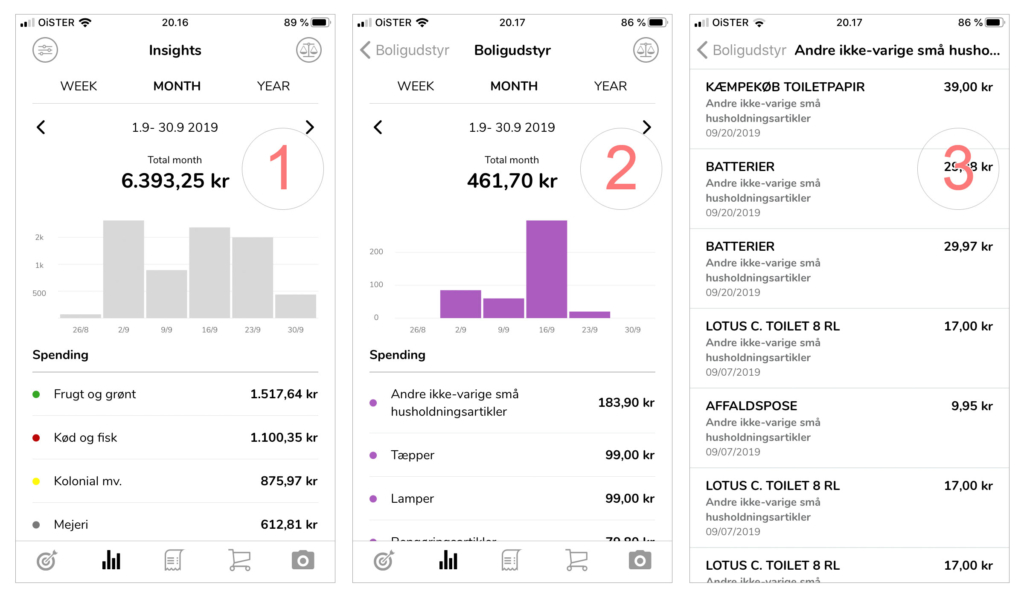

You don’t know?! – Well, let’s ask Spenderlog then!

Unfortunately, Spenderlog does not have a “toilet paper” category (and you can’t make your own categories – yet), so it falls under the category called “other non-lasting small household items”, which also includes batteries and paper towels (and probably a few more items). Subtracting those items are pretty straight forward though, and the grand toilet paper spend for the month of September then comes to: 106,90kr!

That’s more than DKK 1200 (€600 / $185) down the drain – every year. You’re welcome!…

As you can tell from the screenshot above, we spend about DKK 6000/month (€800 / $920 ) on food (and toilet paper). I was happy to learn that the biggest category was Fruit and Vegetables after all. It’s followed by Fish & meat, which is no surprise. We’re also pretty crazy about almond milk & cheese (the 4th highest category). What you can’t see in the screenshot above, is the 5th highest category; ALCOHOL!

Now I know what you’re thinking; He’s a dane, they all drink like crazy. – But those of you who know me, knows that I don’t drink! (I will drink the occasional alco-pop on festive occasions, but not the “just-for-enjoyment” beer or wine on a regular basis). My daughter is 5 – she doesn’t drink either…

“!#P§”!(*/#][(“**!#”++!N#”! *E§J(“!#§§”!#&!”#”!§\\</=?”§?

…My wife says I have to end this post now. B-bye now! 😛

* Please note that I am not affiliated with any of the above mentioned companies. All Apps are free to use, and I have not been paid to endorse them. I endorse them because I like to use them – especially since they are free of charge!

source: https://www.nets.eu/dk-da/SiteCollectionDocuments/Nets-i-tal-dk.pdf

not a total fan of having hundreds of apps for everything or even just a few apps for 98% but it’s a step in the right direction.

Part of the power of reviewing receipts is that you can go “what I spent, 500DKK in IKEA?? oh yeah, that was stupid”.

Also it might help you to return things that you bought but don’t need – bonus!

IKEA also support Storebox, so that is a great example 😉

and we’ve all spent money in IKEA that we shouldn’t have!

Great post Nick.

I should start tracking my expenses down too. I’ve generally been good at savings and found it too time consuming in the past. I also became a bit obsessed with it and thought it wasn’t mentally worth it.

That was years ago though and a lot has happened since then.

So, I need to work on finding a way that’s easy to do and works out for me, as I could potentially improve my savings further.

Technology may be the key. Perhaps I’ll start using Revolut for paying groceries and see how it goes.

Always interesting to see how things work in other countries ;p

Thanks.