Here we go again.

Another monthly update (have you grown tired of them yet?) from yours truly.

The month of April has been pretty eventful. Denmark is slowly beginning to open up from the winter lockdowns (please don’t let this become a returning thing!), and we’ve spent some time in our garden planting trees and crops.

The Danish movie “Another Round” (see what I did there? 😛 ) won an Oscar for best international motion picture, and it was well deserved if you ask me! Great movie – especially for someone who doesn’t drink and as a result (apparently) has a tendency to become a wee bit depressed.

According to the thesis in the movie (based on a real study from a Norwegian psychiatrist) humans actually live with a deficient blood alcohol content and all of our problems would go away (well, most anyway), if we simply attempted to maintain a blood alcohol level around 0.5%. I kid you not, this is based on a REAL study! 😛

And somehow it made perfect sense to me – maybe Finn Skårderud (the psychiatrist) is right!? I would lie if I said I hadn’t thought about trying it – but alas, I do not drink… 😉

The month in review

Drinking aside, I decided to begin another leveraged adventure (albeit smaller than my previous one). I got tempted by another Brickshare (now The-Many) project and decided to break the bank (again) and deploy a bit of leverage. (For the International audience: The-Many is a platform similar to ReInvest24. However they only deal in the buy-to-let type of deals, so all their projects are equity based and have a 5-10 year horizon).

There’s a couple of reasons why I chose to do this:

- I was a little bored

- Leverage incentivize me to SAVE MORE (to get rid of the debt fast)

- The project somehow spoke to me (I know the area very well, and I liked the tenant mix and the appearance of the building)

- I now know exactly what to focus on for the next 4-5 months; SAVE as much as possible!

After the “expensive” re-model of our “workshop/storage” room in March, I decided to attempt to have a no-spend April, and I somewhat succeeded (not counting investments and leverage ofc 😛 ). From previous experience I know that red numbers in my account (I have a line of credit at 3.5% interest) works as a great motivator for me to be extra frugal, and let’s face it: If I’m to reach my goal of €135.000 by the end of the year, something pretty extraordinary has to happen! 🙂 So I will attempt to continue my healthy no-spend habits into May. We shall see how that goes (HAHA)…

Also; the stock market has been bringing me down lately, and I felt inclined to add some more “stability” to the portfolio. This particular property that I suppose we can now dub Property #1.5 has a big potential – but much like Property #1, it’s not scheduled to actually payout anything before year 2023. WHAT is it with that year?! If everything goes according to plan (which let’s face it, it probably wont) 2023 is going to be an EPIC year, passive income wise…

I put €1333 in my first property on the Brickshare/The-Many platform to have some skin in the game, and to follow their development up close. They’ve had a few projects since that I did not participate in, but they’ve now introduced a secondary market where you can buy shares in already finished/running projects.

You can also sell your shares (at a 1% fee) and you have your money back (guaranteed) within a month (This would obviously be a problem to honor in case of a “bank run”). Their most popular project (Frederiksberg) is up 25% since they purchased the property, and shares sell QUICKLY on the secondary market in this property. Some of the other projects has had a rough start – but my first project is doing pretty well, and my investment in this project is up about 10%.

So, I decided to put €13333 in this new project. 10x that of the original. Why? It seemed like a good idea at the time HAHA. We shall see how this one pans out. At this point I feel it can go both ways. The project has both residential and retail (an ALDI) and it also includes the neighboring plot, where they plan to build a new building with 19 small studio apartments (for students), which is the 2nd phase of the project. It’s this part of the project that is a bit of a gamble if you ask me…They are still funding the project, and it doesn’t seem to be going that well at this point. I think it’s likely that we will see this new development project be “split out” from the building that’s already in operation (and generating a decent profit I might add). I think I would actually prefer that, as rumor has it that building supplies and materials has absolutely soared in price during the last 6-12 months. The budget for the development project is more than 1 year old. It’s HIGHLY unlikely that they will be able to complete the development of the new apartment building within that original budget – especially since they are still trying to fund this part of the project.

Anyway, it will be interesting to see how they handle this situation. Needless to say, I’ll be monitoring them closely for the next couple of months 😉 I like that they have started to think BIG though. Their first project was just a single unit in a big building. Now they are buying up entire buildings AND land plots. I like it 😛 I now own 0.1% of this big building! (yay…).

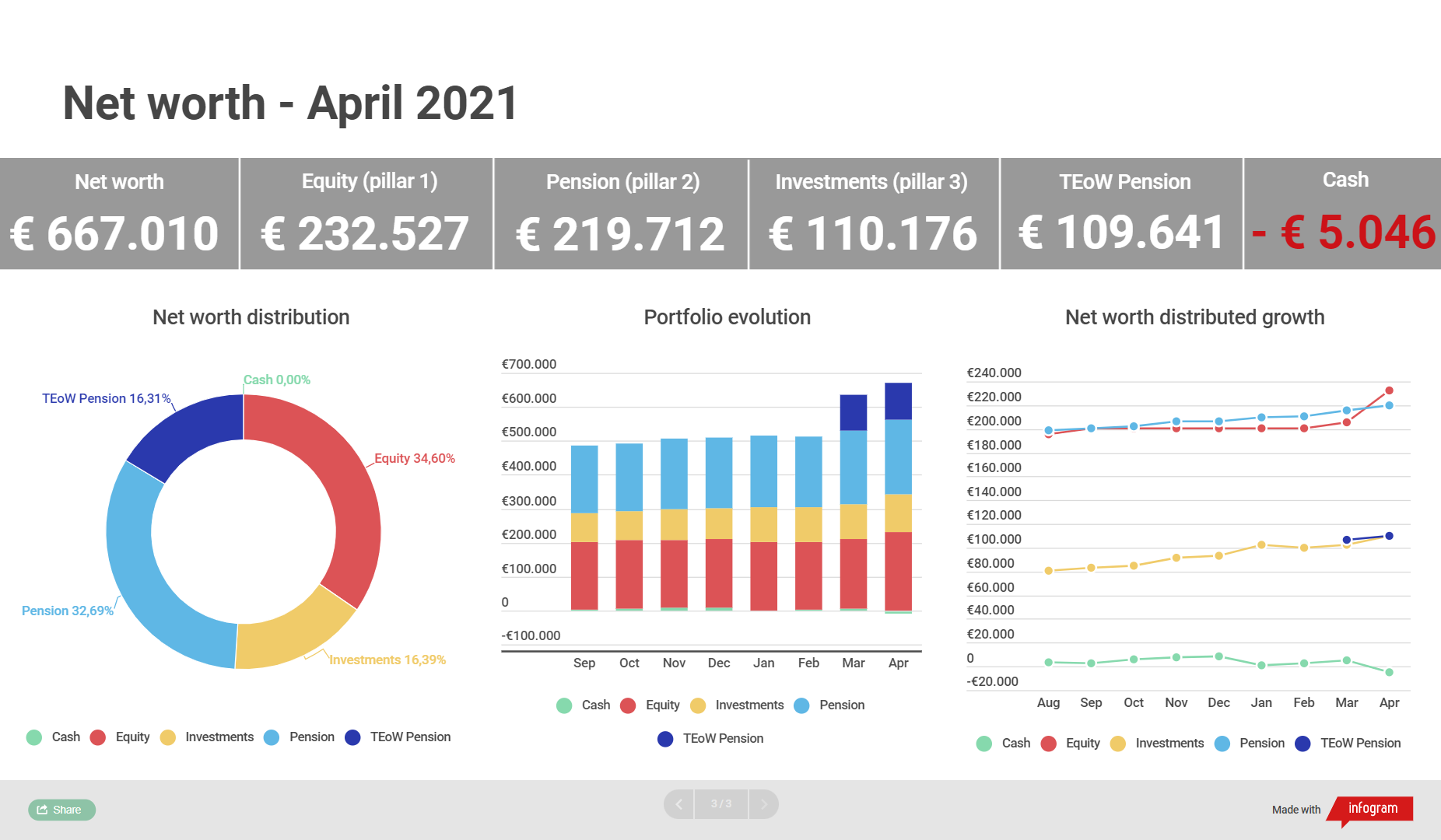

In other news we got our home appraised because our local realtor offered a free gift card of €67/$80 which can be used in various local shops and webshops – and because I was curious of course. And who am I to say no to free money?! 😛 He even brought cake with him too! (Romkugler). I knew that prices had gone up in our area, but we got an appraisal that was 20% higher than what we paid in 2018. We’re aiming to get below 60% LTV, which will enable us to get a 30-year interest-only loan (next year when our current loan is up for re-financing). With this new appraisal I’m hoping that the bank will recognize the higher value (maybe not 20%, because they have to be a lot more conservative, but 10% higher would be nice!). The bank will be appraising our house in Q4-2021, and we will aim for a new loan in Q1-2022. Going interest-only on our mortgage will free up cash flow that we can use to invest in other assets (more REAL ESTATE?! 😛 ). We shall see how that all plays out – this is the current plan anyway…

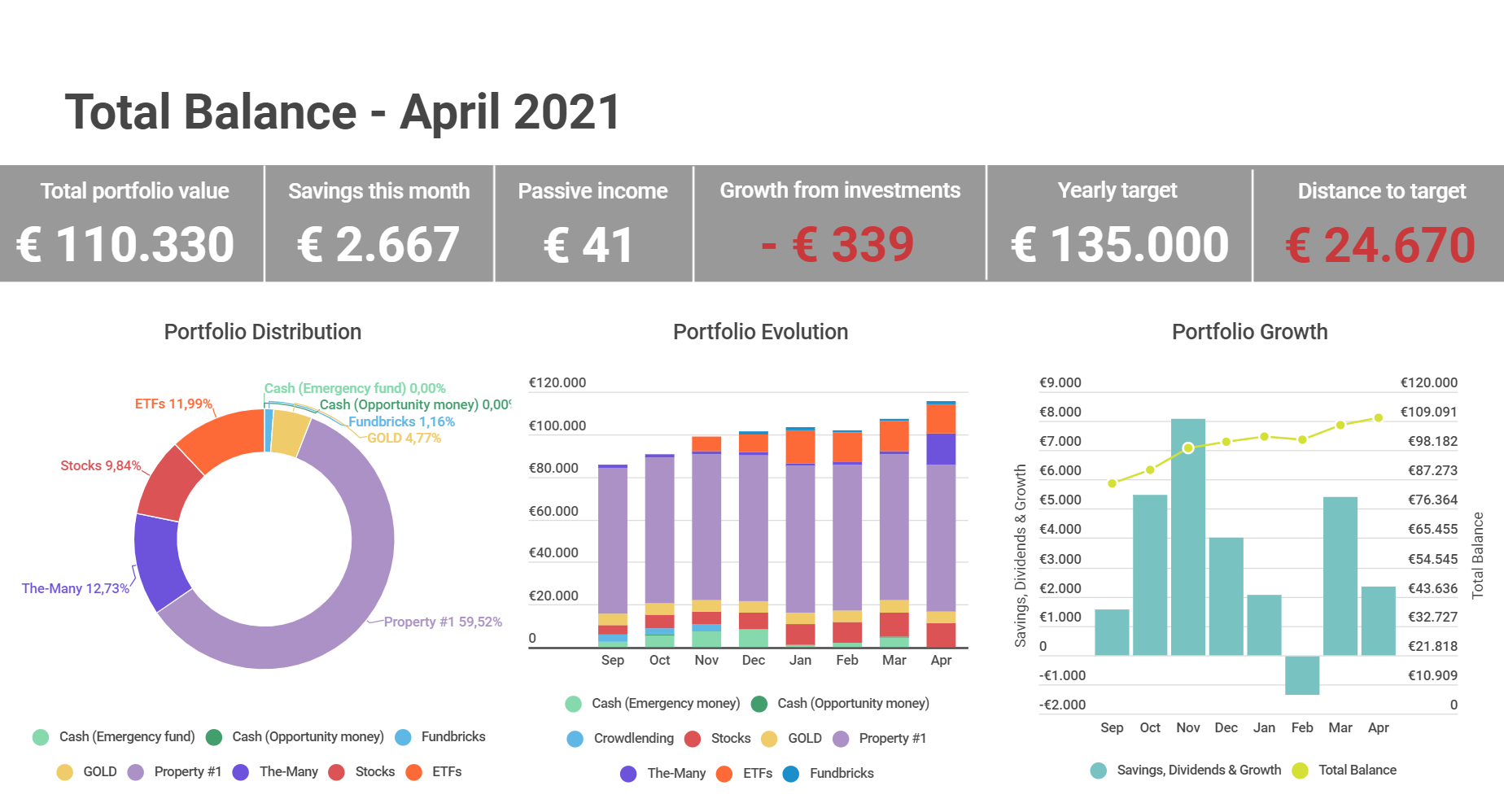

The pretty graphs

Based on a new appraisal of our primary home I’ve chosen to raise our equity slightly (reflected on the Net Worth page). I prefer to be conservative with this, but it means that (yet again) my pension has to play catchup with our equity…We shall see how that goes! 😛

I realize that by doing so, at SOME point I will also have to adjust the value of my Property #1, because my equity in this property is rising each month (as the tenants pay their rent), but I’m reluctant to do so for now. Eventually I will have to though, as the current book value doesn’t reflect the actual share value. But I suppose this will be a pleasant surprise at one point, so having this “reserve” in my back pocket feels pretty good… 😛

The boring income statement

| Platform | Invested | Transactions | Last month | Current value | Monthly income |

| Commodities | |||||

| GOLD (Coins) | € 5.333 | € 0 | € 5.500 | € 5.500 | |

| € 5.500 | € 5.500 | ||||

| Stocks (Dividend portfolio) | |||||

| Bank of Nova Scotia (BNS) | € 1.000 | € 0 | € 1.254 | € 1.254 | € 9 |

| PROREIT (PRV.UN) | € 2.018 | € 0 | € 3.745 | € 3.695 | € 17 |

| Shaw Communications (SJR) | € 2.000 | € 0 | € 2.835 | € 3.049 | € 7 |

| Toronto Dominion Bank | € 1.000 | € 0 | € 900 | € 912 | € 0 |

| TransAlta Renewables (RNW) | € 2.000 | € 0 | € 2.664 | € 2.438 | € 8 |

| € 11.398 | € 11.348 | € 41 | |||

| Stocks (Indices) | |||||

| iShares Global Clean Energy (IQQH) | € 6.667 | € 7.472 | € 7.098 | ||

| iShares MSCI World Min Volatility (IQQ0) | € 6.667 | € 6.693 | € 6.737 | ||

| € 14.165 | € 13.835 | ||||

| Properties | |||||

| The-Many (Brickshare) | € 14.666 | € 13.333 | € 1.360 | € 14.693 | |

| Property #1 | € 68.667 | € 0 | € 68.667 | € 68.667 | |

| Fundbricks | € 1.333 | € 0 | € 1.333 | € 1.333 | |

| € 71.360 | € 84.693 | ||||

| Cash | |||||

| Bank #1 cash (main savings) | -€ 12.982 | € 2.667 | € 4.650 | -€ 5.200 | |

| Bank #2 Opportunity money | -€ 351 | € 351 | € 0 | ||

| Broker account (CAD, EUR, DKK) | € 41 | € 113 | € 154 | ||

| € 5.114 | -€ 5.046 | ||||

| Total balance | € 107.537 | € 110.330 |

Another above average savings month brought our Total Balance to new heights yet again. The stocks have been moving a bit south lately, and it has (yet again) confirmed my aversion towards this asset class. I find it difficult to look away and not care about it, but I know that I have to just let it be and find some better use of my time. – But it’s just so damn hard!… 😛

My account is now (yet again) in the red with a deficit of €5200 and it will take me 4-5 months to get it back down to 0. This I know I’m good at, so I’m quite comfortable in this “territory”. It will prevent me from spending unnecessary time looking for “opportunities” in the meantime. I just have to spend as little as possible and save as much as possible in the coming months. Away we go!

I finally received some extra dividend from one of my recent additions to my CAD dividend portfolio, so the passive income landed a tad higher than normal.

€41 in passive dividend income this month. Not bad, but of course it’s not something that’s going to drastically change my trajectory…I’m currently in a little bit of limbo as to whether I should keep chasing dividends, but for now I’ll keep what I have and probably not add any new dividend stocks in the foreseeable future (also because of the leverage loan of course 😛 ).

My dividend portfolio is currently up more than 35% (not counting the dividends), so I’m not complaining 🙂

It’s a different story with the ETFs…When I bought iShares Global Clean Energy (IQQH) last year it only contained 13 different companies. It has now been expanded to contain 80 different companies, which I think is very nice, but “unfortunately” it’s probably also going to “stabilize” the future growth, so I don’t expect it to continue the growth spurt that we saw last year (which has unfortunately ended drastically this year!). I believe in the sector long term though, so I don’t plan to make any changes to the allotment in this ETF.

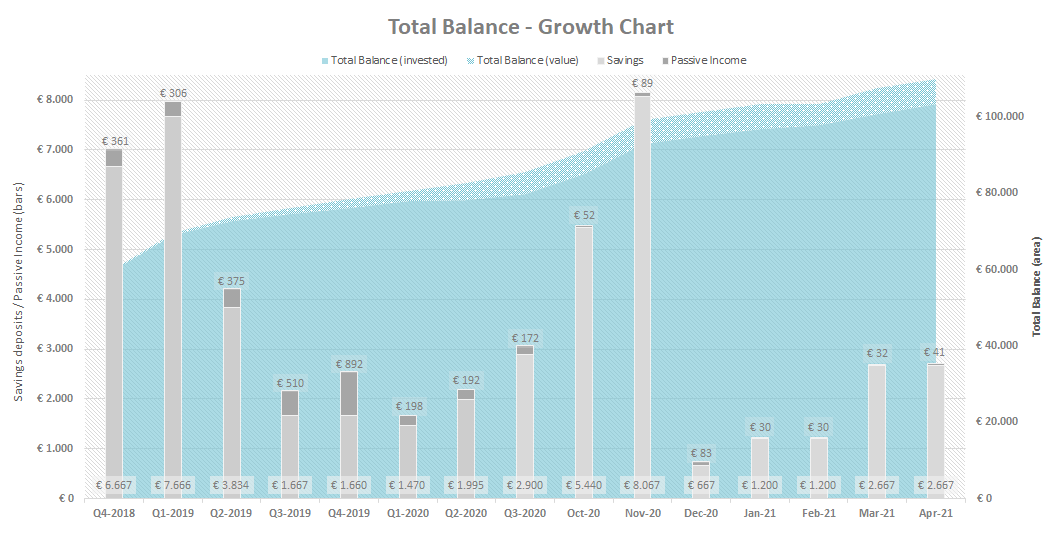

The (not so) Classic Growth Chart

As always, I include the Classic growth chart for tracking purposes:

We’ve kept a fairly high savings rate during the first 4 months of 2021, but it’s mainly due to some extraordinary payouts (vacation allowance and vacation “bonus”). In the coming months we will most likely see average levels of savings once again (unfortunately 😛 ). As long as the trend is going upwards, I don’t stress too much about whether I can save €1000 or €1500, as long as I save as much as the monthly budget will allow me 🙂

In conclusion (TL;DR)

I decided to deploy a bit of leverage to acquire a stake in a new Brickshare/The-Many project. The property is a mixed-use property (Residential and Retail) and it includes a future development project on the neighboring plot.

I managed to save above average (again) due to a yearly vacation bonus payout (part of the union agreement in the financial sector). Our savings rate should go back to normal in the coming months, where I will be spending most of my energy on bringing down my leverage loan (a credit line in my bank).

We also had our house appraised this month (we’re not planning on selling) because we want to remortgage (at one point) once our LTV drops below 60%. We got a nice appraisal, which should hopefully enable us to get a 30-year interest-only loan next year when our current loan is up for refinancing. I’m keeping my eyes peeled at the long interest rate these days, as they have been climbing steadily since February, and I’m a little “worried” about where it’s going to end… Time will tell 😉 I was hoping to land a 0.5% loan, but now it’s looking more like 1.5%. Could be worse, but perhaps we will get lucky and land on 1% (fingers crossed) if the market stabilize a bit.

Stocks declined a bit in April, so it was a pretty awful month, growth wise – but the dividend income was a tad above average, so at least there’s that to celebrate 😛 Let’s hope May will be a tad better overall though 🙂

That’s it for this months update! Hope to see you again next month!

How was your month?

Interesting move. How did you manage to borrow money to invest in an online crowdfunded project? What did you use as collateral?

No collateral, I have a line of credit in my bank on which I pay 3.5% interest. Its one of the benefits of working in the industry 😛