It’s Easter already!

Once again I’m a little late with my monthly update, but better late than never, right?! I feel like that’s my life’s story lately; I’m always a little late to the party 😛

My stocks & ETFs portfolio currently constitute about 15% of our Total Balance, and yet this 15% is what’s currently giving me the most grief! For a while I’ve been questioning my own choices (if I’m being honest), and this month we took another big hit…

The month in review

– But first to some good news!

I managed to tuck away a cool €2,266 this month. It has been a while since I managed to save this much in a single month, and the best part is that there’s no extraordinary reason behind this amount. It’s simply due to us living a little extra “frugal” lately (and the fact that the energy prices have somewhat returned to previous levels). This gives me hope that the coming months will look equally good in terms of savings. On top of this I also learned that I would be getting a decent tax return this year. This will unfortunately not result in any extraordinary savings, as this amount has already been earmarked to pay for the mandatory “home inspection” report that you have to get, when you’re selling your home. It’s always a bit of a roulette when you’re getting home inspections – you never know if the inspector is having a good or a bad day 😛

Our report turned out pretty good I’d say (considering the house is almost 200 years old). There was nothing alarming in this report that would scare away potential buyers, so we were quite pleased with that.

Anyway, I know some of you guys are a little obsessed with tracking your Savings Rate, so in order to maintain full transparency, I thought I would share how our budget looks these days (I will also be updating the Budget-page soon, and maybe do a separate post about it too). So without further ado, I give you the Total Balance household budget for 2023:

I’ve been staring at this chart for hours, trying to find ways to expand that FIRE pot. The obvious choice would be to lower our “funny money” budget (this is ad-hoc spending like restaurants, clothes, personal hygiene, make-up and the occasional weekend trips etc.), but mainly my eyes tend to wander towards the Mortgage & property taxes…if one could somehow get rid of those?… 😛

Anyway, I think this chart warrants it’s own separate post, so I will keep you guys posted! (pun intended)

One thing worth noting here though, is that we do not count passive income towards our Savings Rate (nor is it included in our Total Balance). Maybe we should? Property #1 is actually generating around $6,500/year in passive income (this is after tax). But, this “income” is stored as equity within the project. If you’ve been following my ramblings for a while, you know that 2023 is THE YEAR, where we’re going to attempt to release some of this equity (October 2023).

Update on Property #1

We had the yearly general assembly in the investor group behind Property #1, and on this meeting it was decided to approach the bank to ask for a complete re-mortgage of the Property. Originally the plan was to remortgage at 70% of the original book-value of the property (it was valued at about €2,466,000 when we bought it ). Because we’ve been able to increase the rent along with the inflation the book-value of the property has increased along with the inflation. It’s now valued at €2,866,000, but there’s no guarantee that the bank will agree on this valuation. Actually, I’d really prefer it if we just stuck to the original valuation, as this would lower the risk of over-mortgaging the property. Anyway, as we only own 10% of the property, we can’t decide what to do – we have to follow the majority vote. We knew this when we entered this project, and for now we’re ok with it, but it has made me question whether Property #2 should be a similar project. I’d prefer a project with a majority share (of course this is a lot more expensive – and it also carries significantly more risk). Anyway, we are currently in the mercy of the bank, and I’m not sure what to expect from them to be honest (given the current situation in the financial sector – credit crisis and all). They might allow re-mortgaging at the original book-value, which I think would be great. If they don’t allow a re-mortgage at all that would also be ok for me, but the majority of the investors prefer “cash in hand”, rather than “cash in bricks” 😛 We’re good either way. Cash-in-hand would certainly speed up the process to acquire Property #2 of course…

Anyway, the “bank-heist” is set for May, so we will not hear anything until June probably. I will be sure to keep you posted 😉

So, we’ve covered the majority of the exciting events of March 2023 – except for one little thing; The meltdown.

True North Commercial Real Estate Investment Trust’s shares plummeted Wednesday after the company said it will slash its distribution to unitholders by 50% due to higher inflation and rising interest rates.

Shares declined 39% to 3.55 Canadian dollars ($2.59) at 1:39 p.m. ET. – Marketwatch

Ouch. This REIT was already down about 15% – but now it stands at -54%. Yikes! So now I feel like I’ve got two options:

- Do nothing and hope that it will recover eventually

- Double-down and buy more! (I currently hold 740 shares)

Given the current market situation, I’m leaning towards doing nothing at the moment. I might buy more at one point, but right now I feel like I need to focus on hoarding as much cash as possible. I do however have a couple of hundred CAD in my broker account, and eventually I might use the dividends from this portfolio to buy more shares of this REIT.

I bought this REIT in January 2022, after having made 50% on Shaw Communications. This is what I wrote back then:

Anyway, I bought True North Commercial REIT (TNT.UN). An OFFICE REIT, Nick?! Really?! ARE YOU CRAZY?! Haven’t you heard that REMOTE WORK is the new black (since you-know-what)!?

Yes, I have – But 8% dividend yield!? Sometimes you just have to take a chance! And I’ll admit, this is a bit of a gamble! It will be interesting to see how they develop their portfolio in the coming years, and whether they can continue to deliver such a high pay-out ratio. Personally I wouldn’t mind if it was slightly lower, but they didn’t even lower their dividend payout during the you-know-what dip (unlike my other Canadian REIT, which immediately took the opportunity to slash the payout by 25%! – Still waiting for them to raise it again!). So – hoping and expecting TNT.UN to provide a decent steady dividend for the next decade. Clearly I can’t expect much in terms of capital appreciation here, but they have high quality tenants (mainly government) in most of their properties, and I was in a gambling mood – so yeah, there you have it HAHA!

Bwahaha! I guess this is what one can expect when you gamble… 🙂

The proceeds from the sale of Shaw Communcations have now been (completely!) wiped out. Better luck next time, Nick!

In regards to our ongoing house-selling project, we’ve had decent activity in March and remain hopetimistic (that’s a word!) that a buyer will eventually present itself.

The Pwetty graphs

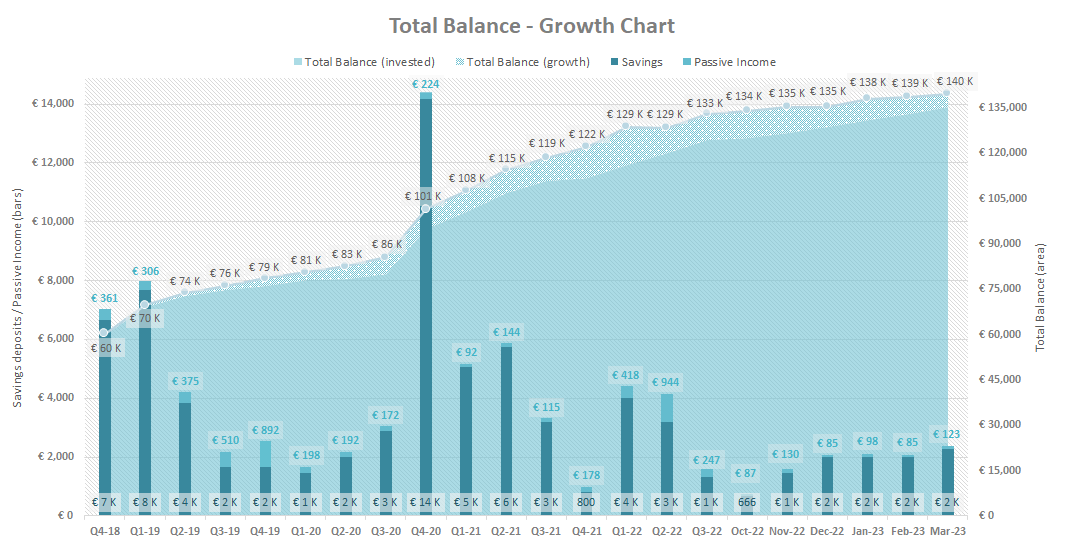

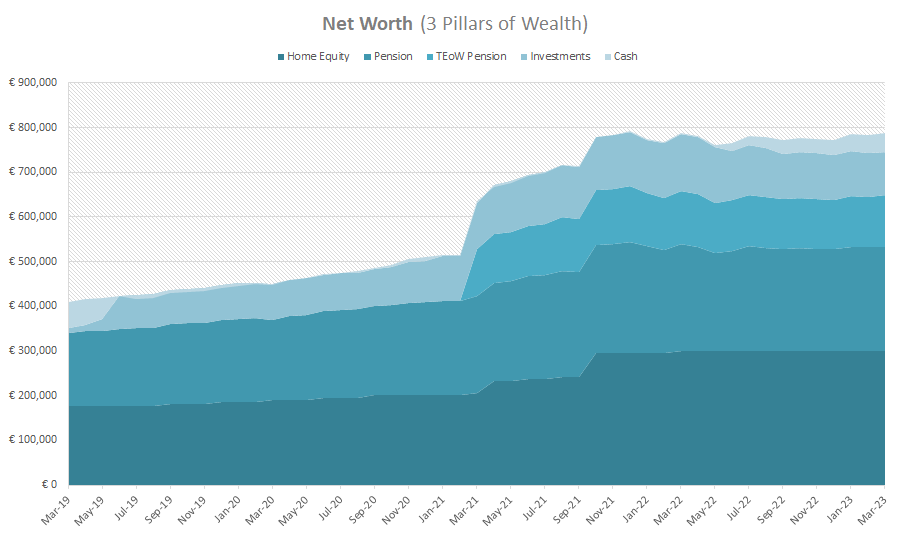

It’s difficult seeing the upside here, but at least (I’ve just noticed this) we’re still on target for reaching our yearly goal – provided that we don’t see anymore meltdowns that is!…

The boring income statement

| Platform | Invested | Transactions | Last month | Current value | Monthly income |

| Commodities | |||||

| GOLD (Coins) | € 5,333 | € 0 | € 6,500 | € 6,500 | |

| € 6,500 | € 6,500 | ||||

| Stocks (Dividend portfolio) | |||||

| Bank of Nova Scotia (BNS) | € 1,000 | € 0 | € 1,250 | € 1,144 | € 0 |

| Enbrigde (ENB) | € 2,400 | € 0 | € 2,102 | € 2,109 | € 27 |

| PROREIT (PRV.UN) | € 2,018 | € 0 | € 3,826 | € 3,647 | € 17 |

| Toronto Dominion Bank | € 1,000 | € 0 | € 1,049 | € 960 | € 0 |

| TransAlta Renewables (RNW) | € 2,000 | € 0 | € 1,557 | € 1,706 | € 8 |

| True North Commercial REIT (TNT-UN-T) | € 3,552 | € 0 | € 3,044 | € 1,956 | € 19 |

| € 12,828 | € 11,522 | € 71 | |||

| Stocks (Indices) | |||||

| iShares Global Clean Energy (IQQH) | € 6,667 | € 7,345 | € 6,928 | € 0 | |

| Xtrackers MSCI World ESG (XZW0) | € 2,721 | € 2,349 | € 2,449 | € 0 | |

| € 9,694 | € 9,377 | € 0 | |||

| Properties | |||||

| Property #1 | € 68,667 | € 0 | € 68,667 | € 68,667 | € 0 |

| € 68,667 | € 68,667 | € 0 | |||

| Crypto | |||||

| Nexo (BTC, ETH, MATIC, EURx) | € 0 | € 756 | € 756 | € 4 | |

| € 756 | € 756 | € 4 | |||

| Cash | |||||

| Bank #1 cash (main savings) | € 0 | € 0 | € 0 | € 0 | |

| Bank #2 Opportunity money | € 2,266 | € 40,249 | € 42,515 | € 48 | |

| Broker account (CAD, EUR, DKK) | € 71 | € 335 | € 406 | € 0 | |

| € 40,584 | € 42,921 | € 48 | |||

| Total balance | € 139,029 | € 139,743 | € 123 |

I kind of feel like I’m piling money into a black hole at the moment. I’ve been eye-balling a 6% Danish (realkredit) bond for the past couple of weeks, and it’s certainly looking mighty interesting, compared to the dogshit returns my portfolio has been seeing lately! Anyway, I’ve made my bed! I guess I must lie in it 😉

What do you guys think? Does it make sense to move some of that cash into a 6% bond at this point? 🙂

The Classic Growth Charts

As always, I include the Classic Growth Charts for tracking purpose:

Our Total Balance growth value has not been lower since Q2-2020! Quite the setback. I have faith that it will recover again eventually though. I think my portfolio pretty much mirrors what’s been going on in the world for the past 3 years. It has not been great! Our return currently stand at 3% without dividends (passive income). If we count the dividends our return is actually a more respectable 7.4%. I suppose that’s not that bad, all things considered (this is not counting the appreciation/added equity in Property #1, which we’ll hopefully see some of in the fall).

In Conclusion (TL;DR)

I managed to tuck away a cool €2,266 this month.

Our savings rate is currently hovering around the 25% mark, which is ok – but not great! Ideally I’d like to see it go above 30%, but this will not be possible before we move to a (hopefully) cheaper house.

One of my dividends stocks (True North Commercial REIT) had a meltdown because they cut the dividend by 50% (and because of the credit crisis) – it’s down -54% since I bought it This obviously leaves a bit of a dent in our portfolio! No biggie – we’ll keep going!

We had the annual general assembly in the investor group of Property #1 and it was decided to push that leverage lever all the way UP. This will have to be approved by the bank though, so we won’t know what’ll actually happen until June/July.

Lastly, I’m considering dumping a big part of my cash stash into a 6% bond and would love to hear your thoughts on this (good/bad?). HIT ME UP in the comment section below, guys! 😉

Cheers!

Congrats on a nice saving month, Nick.

6% sounds tempting, theoretically bond prices should increase as interest rates start to fall soon, but if I’d plan on using cash stash for property 2 shortly then I am not sure if I would risk it. Let’s say, I wouldn’t probably do it if I knew I would need the cash in less than 2 years.

Yeah I know…it’s just that securing a 6% for the next 30 years straight is awfully tempting! 😛

I just figured its fairly low risk, even if the horizon is only 1-2 years. I bought a 5% Bond for my daughter in her special childrens savings account (tax free) and she now gets paid a small sum every quarter for the next 30 years. That is mind blowing to me!

How are things over there in the UK?

Yeah it may be save but you’re losing some potential long term growth there. Use a dividend growth calculator, you’re better off on a moderate 5% annual portfolio growth and 5% dividend growth over 30 years period.

Things over look messi, it was to be expected but need to be patient and hopefully things will start looking better in a few years