It’s JULY already!

In the words of my 8-yo daugther: OMG!

Time is flying by and I really try to not let it get to me, but summer is rapidly coming to an end before it even really began!

We are busy in the new house, and haven’t even started packing down our old house yet! My wife JUST started packing a few boxes last night, and we have begun selling some of our furniture that we will not bring to the new home (simply because it’s a lot smaller than our current one).

The update

During this manic two-household phase I’ve had to slim down the update format so as to not spend too much time on it. We have two mortgages right now, and our finances is a big mess to be honest! SO much paper money gets burned when you buy/sell a home…If you can somehow manage to move only once in your life, I highly recommend that! 😛

Anyway, it should all normalize in a year or so…hopefully!

We’ve been working tirelessly on building a new garden shed for the new house. We need a place to store tools and shit 😛

There was an old shed that we tore down, and we purchased a new (almost IKEA-like) that was supposed to take 2 days to assemble (according to the manufacturer) – well, 7 days later and we’re still not finished! HAHA

People have been asking us why we are not working INSIDE of the house. Unfortunately, we’ve had to halt most of the work inside of the house, because we have discovered that that kitchen and the main bathroom has been connected to the wrong sewer line (rain water instead of waste water). This is now illegal, and thus it’s become an insurance case. They have 5 weeks lead time on consultants, and they’ve told us to halt all work in the house (if we want them to pay for anything)… *deep breaths* We knew it would be a challenge, but now the deadline has been pushed back to an unknown point in time, because of the ongoing insurance case. We have decided to give them 2 months. If they do not come up with something by then, we’re going to continue the work regardless (I will take those fu**ers to court if I have to!). We don’t want to be living in the garden when winter comes, but it’s starting to look more and more likely. *deep breaths* It’s all good!…

Meanwhile, my employer has decided to switch pension provider. I could have opted to keep my pension with the previous provider, but those b**tards has hefty fees for “inactive policies” (if you don’t continue to contribute to your portfolio, they slap you with a fee – and they all have this). So I decided to move it…*deep breaths* This new pension provider is the 6th biggest provider in the country. They have taken more than 2 months to transfer the funds and allow me to access them (in order to put them back to work in the market). 2 months!?! June and July has so far been some of the best yielding months for years! And my single biggest pile of cash has been stuck on the sideline. DON’T worry though (they say) – you get an interest on your cash while you wait!…OH, great – how much though?….1 % *face-palm*

*deep breaths*

So, in conclusion; don’t move house and don’t move your pension…That’s the best life/finance advice I can give you guys right now! HAHA

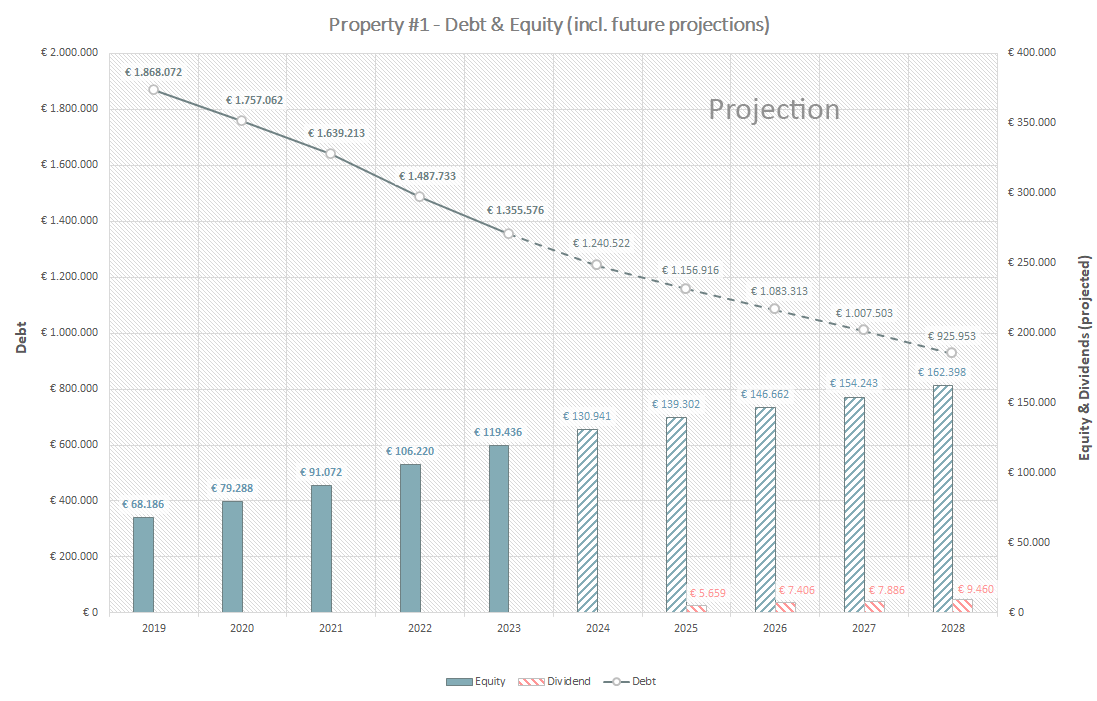

In other news! October 2023 is fast approaching, and those of you who have been following my journey for a while knows that this is a big milestone for our Property #1 investment. The 5-year mortgage is up for re-financing. The reason why I bring it up now is that you have to decide 3 months in advance, if you want to make changes to the mortgage. If you don’t do anything, the mortgage will automatically get a new interest rate, which will then be locked in for the next 5 years. Given that the interest rate is record high at the moment it would be foolish to lock the interest rate for the next 5 years (or would it?!). Originally the plan at this point was to re-mortgage into a new 20-year (5-year flexrate) mortgage and borrow up to the original principal, in order to release some equity from the project. They call this “The active debt management strategy”. Well, to none of our surprise the bank wasn’t too fond of this idea… The credit market has tightened significantly in the past couple of years, and as a result the banks are taking on way less risk on their books, compared to just 2-3 years ago.

The leases (two tenants) on the property are up for renewal in less than 5 years. What I gather from the banks new guidelines, is that they want to make 100% sure that they will be able to get their money back, so they will allow you to mortgage the property at 60% LTV (realkredit) as long as the remaining years on the lease(s) will cover the repayment of the mortgage in full. This is a significant change, compared to 5 years ago when we purchased the property. Anyway, I was kind of prepared for this, so it didn’t come as a big surprise to me.

This means that we will not be able to see any payouts from Property #1 until earliest year 2025. In 2025 we will have paid off the 2nd mortgage (bank loan), and we can thus opt to use the free cashflow to payout a dividend to the investors, or pay extra on the primary mortgage. Luckily, I know the group of investors quite well by now – they will be hungry for cash at this point, and the mortgage company will not be able to force us to change the payment scheme for the primary mortgage.

I’m not at all sad or bummed out about this development actually, as I currently do not trust myself with money HAHA. Better that we keep the equity in the property instead of having it in my account (I would most likely use it on silly stuff like a new driveway, a bathroom or even a new car?!). This will of course benefit our solvency in the project in the long run. The lower the debt the lower the interest payments 🙂

Our current mortgage allow us to change the flex-time though, so we have chosen to change profile from F5 (5-year fixed) to F1 (1-year fixed). This is done in the expectation that the interest rate will be lower next year (who knows though?). This means that we will evaluate the flex-time every year from now on (compared to every 5 years previously). This is a significant change in the risk profile of this project, and it also makes it a lot harder to predict the properties’ budget for the coming years, because the interest rate can move in both directions…

Anyway, I’ve done a little doodling in order to visualize the possible outcome. If we project the current interest rate out into the next 5 years – while maintaining a very conservative estimated property value – then this is what the Property #1 investment will look like:

In 2027-2028 we will have to re-negotiate the leases. At this point I’m unsure what to expect. Originally I had imagined that the tenants would want to continue for another 10-years, on similar terms as the first 10…However, given the current development I’m no longer sure that they would want to extend their lease, unless they get a discount on the rent. – But this is pure speculation on my part. I don’t have any indications that this will be the case, but I’m preparing myself for such a scenario at this point…This of course means that there’s no way to know for sure what the property will be worth in year 2029, because it will depend on the leases. Will they be willing to sign another 10-year lease? If so, what will be the terms of the new leases? Will they be similar to the previous 10 years? Worse? Better?…We don’t know until we get there…

This is also one of the reasons why I have chosen not to write up the value of my 10% stake in Property #1 since we bought it. However, on paper my 10% share is now worth almost twice as much as we paid for it. This feels good to know, and I’m slightly inclined to start adding this equity to the Total Balance chart (I had this a while back too, but it looked a bit foolish so I removed it again).

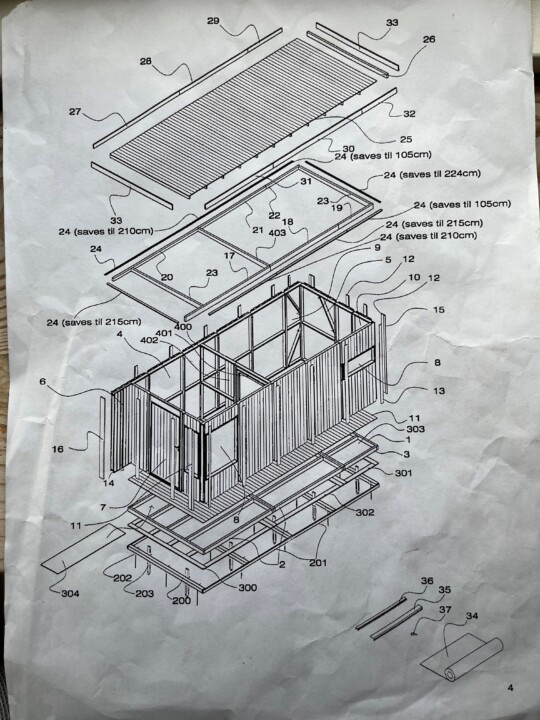

Now to something a little more interesting! – The shed! As you can see from the first page of the assembly manual – it’s been well-read! HAHA

It’s 12.1m2 (130sqft). The bottom frame was not included in the kit. It’s build onto of a screw foundation, which means that the entire thing is supported by the bottom frame and 15 so-called groundplugs. They are 75cm long (29.5in) and you screw them into the ground using an impact wrench. This too took a little while longer than expected. 8 out of 15 went into the ground without a hitch – the rest took a little extra work. Time will tell whether 15 plugs is enough HAHA (it should be…).

It will be insulated (insulation not included!) so we can store tools and furniture and stuff in there all year around. Looking through my camera roll I’m proud of the result so far! Still missing internal insulation, cladding, electrics and linoleum flooring (none of which is included in the price…). It will be painted black (paint not included!…). Soon this project will be finished, and then it’s onwards to the next! 🙂

The Classic Growth Chart

As long as we are not contributing to our Total Balance, I don’t think it makes sense to keep updating this chart (also, I’m very lazy). We have started dipping into the cash stash to support our crazy building project, so I will temporarily retire the Classic growth chart from the monthly update for now… (It shall return!).

In Conclusion (TL;DR)

Moving is very expensive…

Be careful who you allow to take care of your pension funds (this is true for any of your funds, really).

We are busy building a garden shed, and have hardly even had any time to worry about the actual move (which will happen by the end of this month).

Property #1 re-finance has been postponed, and thus there will be no payout this fall after all. I was prepared for this, so I’m not at all bummed out about it – the future is still very bright for this investment 🙂

See you next month!

Brilliant update as usual and the shed is looking superb!

Thank you, Ryan! 🙂

Bit of a bumpy ride, but I’m sure you will land on your feet on the other side. Thanks for taking the time to keep us posted and the shed looks great. Do you still have the Zoe? My lease was extended so I can keep it for another 2 years if I want to. I know it would be (a little) cheaper in the long run to buy something, but I just can’t bring myself to do it.

Thank you for following my bumpey journey 🙂

You are probably my most faithful follower – so thank you for still being with me 🙂

We still have the Zoe, but the lease is up by the end of September. We are currently not planning to extend it, as we are going to try and see if we can get by with 1 car. Our traffic patterns will change a lot after we move. The kid can walk to and from school, and I can bike to work. I want to give it a try, but having had access to a car since I was 18 I’m sure it’s not going to be easy haha. We will definitely miss that little car. The next problem is then our old car. It has been very faithful, but it’s nearing 200.000km and it is going to need more repairs as it ages. I’d like to replace it, but on the other hand, as long as it runs it doesn’t get any cheaper than that…This also means that we will be EV-less for a while…I have been looking at the e-C4 as a Zoe replacement. They are nearing 200.000kr, and if I can get one for like 180k, I think I would jump on it. They don’t have a tow hook option though 🙁

I’m also looking at the e-c4. Maybe I’ll see a review here one day 🙂