I often see people asking whether XX or YY is a good investment, and when talking to people about the general topic of investing, they often ask one of these two questions (or both):

How much money have you made (by) investing?

or

What have you invested in – is it XYZ?!

I’ve never been asked the question:

What is your strategy?

I understand that to most people “the strategy” is of little interest, as a strategy typically implies a set goal. Without a goal, then how would you build an appropriate strategy to reach that specific goal?

Few people have a goal with their investments – that is, if they are even investing at all. Most (ordinary) people invest to make their money grow, obviously, but they have the idea that this ONE (big or small) investment in XYZ is going to make them RICH! (Spoiler alert: this is rarely how you get rich…).

Of course “our kind of people” (the FIRE people) all have a very specific end goal with our investments; Financial independence – and for some of us, also Early retirement.

The goal & the strategy

So, in order to discuss strategy (any kind, really) one must first define the goal.

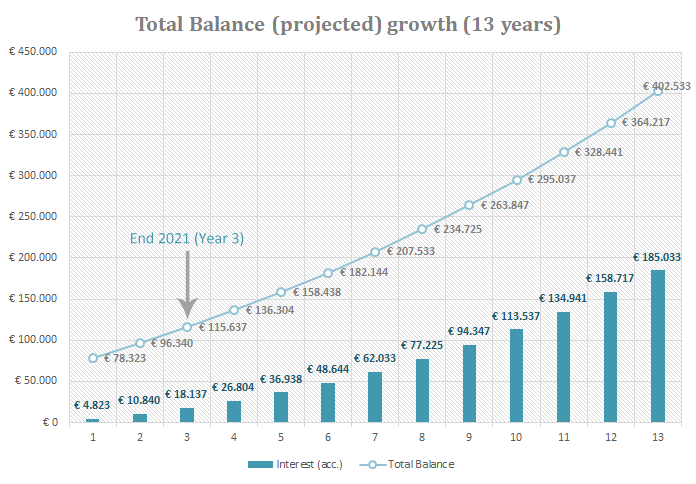

In my case, I have a goal of reaching a portfolio of €400.000 invested in various assets. This is the target, because that would give me 10 years worth of spending (in 2018 numbers) without having to earn another $, € or DKK. After those 10 years I would be required to dip into my pension fund (which is attainable when I turn 60). I’ve outlined all this already in last years “goal post”.

I also outlined my original strategy about 2 years ago. I’m happy to report that so far the original strategy seems to be doing OK, with one major exception of course…

This was my original investment strategy:

- Accumulate a shit ton of money (“a shit ton” is relative of course – I think I’m getting there!)

- Allocate 10-15% of that money towards a high yield, high risk asset class

- Allocate another 10-15% towards the stock market, via a few select indexes/ETFs

- Use the rest to buy real estate!

So how is it currently looking in terms of asset allocation?

Well, at least the real estate category is fairly on par with the strategy. The rest, not so much!

So what happened?

Well as you might remember that “high risk, high yield” asset class that I initially fell in love with was Crowdlending. – And that adventure turned out to be mainly high risk, and no reward. So I’ve iced Crowdlending completely (except for 1 Danish platform called Fundbricks that I plan to exit at the end of the year), and have been looking for a new “fun asset” to allocate those 10-15% towards instead. And I believe that I’ve found it in Crypto. I currently have very limited exposure in Crypto, but I plan on spending most of 2022 “easing” more into this new(ish) asset class.

In this context that 5% Gold allocation wasn’t really part of the original plan, and I’ll admit that buying physical Gold happened a little bit on a whim (oops! 😛 ). I have 4 physical 1oz Coins, and I feel like I need 5 to make my collection complete (I’m missing the American Eagle). However Gold was never part of the original strategy, but it has performed extremely well since I bought it, so I think it’s warranted, still. I don’t know when I will add the 5th coin, but knowing myself it will probably happen out of nowhere at one point. It will require the Dollar to weaken significantly towards the Euro though, which I believe will happen during the next couple of years (but you never know!). Maybe the window has closed, but at the current price point it definitely doesn’t make sense for me to buy more Gold – but I so want that 5th coin! (I’m a collector, I can’t help it…).

Anyway, it currently appear as though I’m overly exposed towards stocks (remember that I also have stocks in my pension portfolio, which is why I don’t want high stock exposure in my Total Balance too). This is because I divested away from Crowdlending into dividend stocks to see some steady passive income. I’m fairly comfortable with the current stock exposure though, so I’m in no rush to change it over night – it will happen gradually as Crypto is phased in slowly.

So why Crypto?

Well, it just seems like the opportunity of the century, really. I’ve recently opened accounts with so called “Crypto Banks”, whose business model looks an awful lot like the regular banks (used to).

You can deposit your crypto in “the crypto bank” and earn interest (some call them “rewards”, which should warrant an eye-brow lift). The “bank” then earn money off the spread between the lending rate and the deposit rate. You can earn more than 10% interest by depositing stable coins in these banks. Seems like a decent rate for a limited risk (albeit the risk is there!). I know that the young kids are all into DeFi, and technically this is just CeFi and since you don’t hold the private key to your wallet, the crypto in it technically does not belong to you – so HIGH RISK, HIGH(ish) reward! Just what I’m looking for 😛

Why anybody would want to borrow crypto at 15-16% is beyond me though, but who am I to judge?

Anyway, back to the strategy!

This was maybe a lot of words to describe an overall unchanged strategy (besides the 5% Gold allocation…) 😛

But how has the strategy then fared so far, you ask?!

It has actually delivered a yield just shy of 7% (not counting the added equity in Property #1 from the mortgage payments), and this just so happens to be on par with the original plan (see below):

We’re currently in Year-3 of the original 13-year plan, and the Year-3 end goal has already been reached. – But it will be hard to keep up in the coming years, until the first dividend payout from Property #1 arrive in late 2023.

Originally (way back) I was actually planning to go with 100% real estate, but as I quickly learned that PASSIVE real estate is just that (very boring and passive), I need something to keep me busy while I wait for the dividends from my real estate investments (hAhA) 😛

Slow and steady wins the race!

How are you progressing with your (investment) strategy?

Thanks for the post, our strategy is simply stocks, at least until we hit the high taxation bracket which should be around 300k eur invested so there’s unfortunately lots of time to figure out what comes after 🙂

The whole 15% return on cryptolending thing sounds extremely fishy to me, almost reminds of something I remember from a few years back, was is crown-lending, proud-lending, ah who can remember.

You’re braver than me. As crypto climbs higher and higher I’m always thinking I’ll shove 1% into Bitcoin, but then I get scared off by the thought of storing it. Most crypto-hipsters will say that you MUST hold the coins yourself in a wallet “Not in your wallet, not your coins”, but I don’t trust myself to keep a physical wallet safe from either being lost, being broken, or being stolen over the course of 20+ years… It just seems like a burden and provider of a lot of anxiety.

The exchanges have a history of being hacked and declaring bankruptcy, which is a worry if you don’t go with holding the coins yourself. And lastly, the index funds that I’ve found have ludicrous fees or skim the true value of the coins by a lot!

Due to these concerns I’ve stayed out of it for a big portion… I did try buying 1k dollars of ETH which I still hold in liquidity pools but the 25% cost of buying that has put me off in a big way! When I sell them again I’ll probably have to pay another 25% in gas fees….

Anyway, hats off to you! Make sure you let us know how you plan to hold these coins and mitigate the risks!

I fully understand!

I don’t really trust these crypto banks to keep the keys safe anyway, which is why I’m taking the same approach as I did the crowdlending; Spread the risk (multiple platforms).

There’s a lot of FOMO in this space for sure, and no doubt the safest thing to do would be to store your crypto in a hardware wallet. But much like yourself, I just can’t be bothered *haha*. Also the interest rate in a hardware wallet is 0% 😉

I will be sure to keep you all posted on the progress! 😛 Oh, and congrats on (almost) reaching your first major FIRE target! Can’t wait to see what’s next for you guys 🙂