Hello, new pension provider!

After waiting for about 3 months, my pension funds have now been moved to a new provider (chosen by the company that I work for).

I have been anxiously awaiting this move, as the new provider allow me to create my own custom investment strategy, in that they have a number of different funds, where you can choose to place your money (rather than just place them in an index or an actively managed fund with a certain stock/bond split, which is typically what most providers offer).

Since I started tracking my Net worth (which my pension currently constitute 40% of), I figured it could be interesting to write a post about the pension part of it, and get everybody to chime in, how they invest their pension funds. The general consent among “the mortals”, is that pension is an extremely boring subject – but not here! Not in the FIRE community! Here Pension is hot stuff! And so it should be!

So let’s get to it, people!

When I first learned about the new provider, I immediately started to investigate what kind of investment options they offered. I was hoping that this particular provider would grant me access to invest my pension in a vast selection of asset classes. Unfortunately, while the options are far better than my previous provider, they are still kind of limited! I can’t pick individual stocks (or REITs for that matter), nor do I have the option to buy commodities (such as Gold or Silver). But there’s a fair amount of alternative investment funds, such as forest, properties and Forex (not my cup of tea though). You can see the list of funds here, if you’re curious (sorry, it’s in danish!)

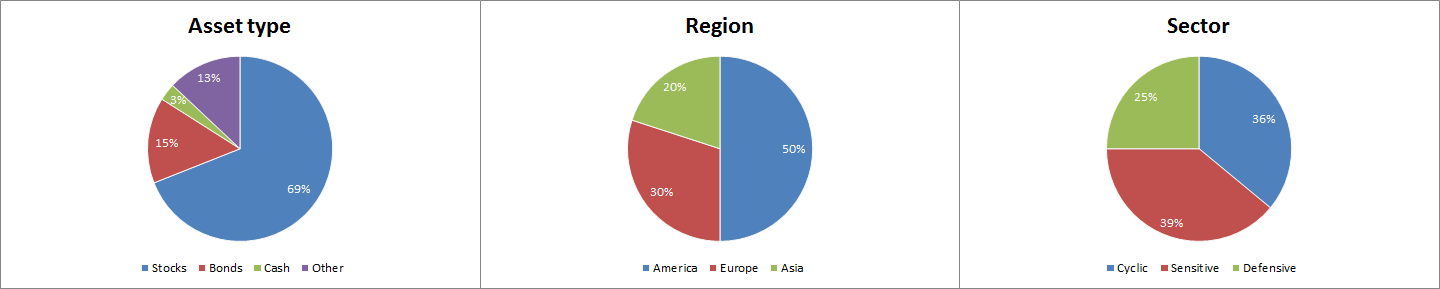

Per default (because of my age), my pension funds are invested in a single (actively managed) fund, which has a mix of 4 different asset types. The fund contain investments spread out across the globe and across several different sectors. Here’s a couple of pies that roughly describe the Active fund:

I apologize for the crudeness of these diagrams, but you get the idea! (I couldn’t be bothered to create an infogram – sorry 😛 ).

Historically, this fund has provided an average yield of 6,73% over the past 5 years. In 2018, like most other heavy stock funds, this particular fund had a negative yield of -6,28%. In comparison, my previous provider managed to create a negative yield of -9.80% in 2018, but this was a passively managed fund. Luckily, the losses of 2018 was quickly regained during the first 3 months of 2019, so at least we had that going for us! 😉

Anyway, the downturn of Q4-2018 taught me that in times of great turmoil, the actively managed funds actually tend to beat the passively managed funds (index), and since I expect hurricanes and twisters ahead (metaphorically speaking!), I’ve decided to switch away from the passive strategy for a while (maybe it’s smart – maybe it’s stupid – time will tell! 😉 ). On top of that, I also believe that the stock market is currently overvalued (It’s not a hunch – it’s a fact. – Just look at the Shiller P/E index), so I don’t believe that right now is the time to be ~70% in stocks (neither does Jacob Lund Fisker by the way. He shared his current portfolio allocation with us at a FIRE meetup last month, and I made a mental note that he said he was currently 50% in bonds, and that he was planning to decrease his stock allocation to <40%. I believe him to be a smart man, so I decided to follow suit! – Not just because of what he said, I already had those thoughts, but sometimes it’s nice to get a little extra nudge).

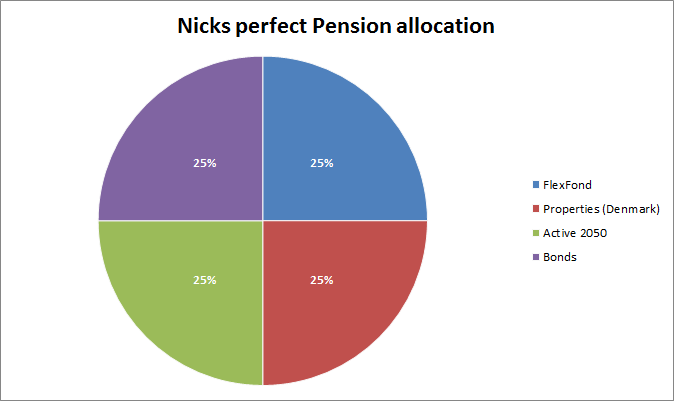

I therefore devised a lovely symmetrical investment allocation that looks like this:

Symmetry! YAY!

Wait, what is a FlexFond? That is an excellent question! The FlexFond is a fund that provides a fixed (yearly) interest rate. It’s currently 3.11%! So for the rest of 2019, this fund guarantee a yield of 3.11% (it’s been 3%+ for the past 5 years). That’s not half bad, if you ask me! What’s the catch!?

There’s no catch. This fund is a so-called averaged interest fund (gennemsnitsrente), and basically this interest rate is secured by a huge money-reserve (a buffer) that they accumulate during the good years on the markets. Since it’s kind of been “the good years” for 10 years straight now, I guess 3% isn’t that impressive. I’d like to see how much they can average, once the markets start to tumble (because we all know that this is going to happen – eventually). Anyway, for now I’ll take what I can get 😉

The Danish Property fund has averaged a yield of 7.90% for the past 5 years. Not bad, if you ask me! You can’t really fault me for wanting a piece of that, can you?

The bonds are truly the boring one though, only yielding an average of 2,45% for the past 5 years.

All in all, I’ll be satisfied if this 25%/25%/25%/25% allocation can net me somewhere between 4-6% during the coming years. I don’t need to be greedy at this point 😉 I’ve got time on my side!

So, I logged on to the online dashboard and changed my investment profile to match the above pie chart (you assign percentages to the funds you want in your profile – so it’s pretty straight forward).

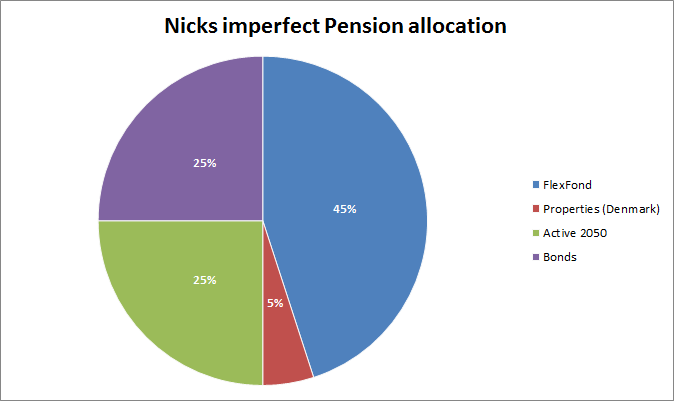

Then something really, really annoying happened. I was only allowed to allocate 5% of my total portfolio towards the Property fund…WHAT!? I immediately wrote to my adviser from the pension company, and he was surprised to learn that there was a limit (great adviser, huh?!), but he unfortunately confirmed that due to the popularity of this fund, they’d found it necessary to limit the allocation to 5%/customer…GREAT!(“/#&”!/( Just another confirmation that property really is “da shit” 😉

Goodbye, symmetry! 🙁 My allocation thus ended up looking like this:

I considered my “perfect allocation” to be defensive, so obviously the “imperfect allocation” is EXTRA defensive…

Oh well, at least 3-4% should be attainable I guess…I could have chosen to spread out those extra 20% on all the other 3 funds, but I really didn’t feel like having more than 25% allocation in either Bonds or the Active fund…So, now we wait – for the hurricanes! 😛

How is your pension invested? Any thoughts on my choices? Share them below!

Interesting thing, the FlexFond. I’m curious to learn the mechanics behind that. Maybe an idea for a new article?

My pension fund is invested 100% in the MSCI world index through a passive and super cheap index fund. It will be at least 45 years before I can withdraw that, so I like to make it 100% stocks and as passive as can be.

My after-tax investment portfolio currently is 50% stocks (of which 90% large and mid cap via VWRL and 10% small cap via IUSN) and the other 50% I hold in cash. This allocation is in anticipation/preparation of purchasing rental real estate. Otherwise I would probably be somewhat like 85/15 in stocks/bonds.

I’ve yet to completely understand how the FlexFond to be honest 😛 but I will try learn more about it for sure 😉

Nice that you have at least a bit of control over your pension investments. In my case, I have none. Would you consider p2p investments if it would be allowed (as in uk) for a part of your pension funds or would you strictly separate?

Hi p2phero! Thanks for stopping by!

That’s a good question.

To answer it shortly – No, I dont Think I would invest in p2p using my pensions funds. At least not until the major platforms have proven seaworthy during a long recession etc…I Think It’s one of those things that are fun to play with right now, but I wouldn’t bet more than 15-20% of my total portfolio in p2p. I’m sure you’re of another opinion? 😉

I agree with the 15 to 20% for p2p of the total wealth. But if I could use pension funds, I would definitely invest about 10% of it into p2p. This would put my total exposure north of 20%, but I’d do it 😉 And maybe gradually increase, when the platforms prove themselves. But it is only hypothetical, as the rules in my country are strict….

I’ll check back from time to time. I like your approach and style of writing.

Thanks! I’d really love to buy some more Real estate with my pension money – I would be able to, if it was privately managed, but because It’s a corporate agreement, I cant. In Private pensions you can almost buy anything you can Imagine, so Hopefully once I reach FIRE I can convert it to a private scheme, and start investing properly 😛

Oh wow, this flexibility is great, at least compared to my available solutions. We have not much to choose even if the pension is privately managed. Maybe this changes, but I guess I will have reached retirement age by then lol.

Nice weekend to everyone.

Currently, my pension fund is nearly 100% in stocks but I have about 30 years before I will be able to draw money from it.

March inflation rate was 3%, so any other strategy now loses money, but our pension system offers only very limited options (conservative vs growth fund).

It will be quite interesting to see how Europe manages the situation with an aging population. I’m quite scared.

Hey Druss, I get why you are concerned, but I think we will manage OK in the future, as we see a tendency here that multiple generations start moving back in together, to take Care of each other (Which was the norm 100 years ago too).

Inflation in Denmark has been very low for the past 5 years, actually averaging below 0.8% – but you are right that inflation is obviously a factor that we shouldnt neglect in our pension considerations.

My pension provider has also changed very recently. The default fund is only 40% equities which isn’t enough for me in a fund I can’t access for at least 25 years. We haven’t been sent the details for selecting our own funds yet, but just looking at the provider’s website I think the fees become quite a bit more expensive if you’re not in the default. Seem like they make sure their default is catering for the most nervous investors.

Hi FF!

This is an excellent point – one that I actually forgot to mention in my ramblings above.

The actively managed funds with the Danish providers has historically been rather expensive, but in recent years the APR has gone below 1% for those funds. The one that my funds was 100% invested in before I changed it (the Active 2050) has an APR of 0,87%. The APR for my current allocation is only 0,56% 😎

So that is definitely something that you need to keep an eye on as well – good point!

Interesting post Nick!

My pension is currently actively managed. Low-risk ‘investeringsprofil’ (without any clue about the details, investment-wise). No involvement from my side. Average return for last 5 years close to 5%. -2.8% in 2018.

While I do consider moving the ‘investeringsprofil’ up a notch (but only after I have figured out what it means for the allocations), I am not planning to pick my own funds just yet (which my pension provider does allow). While it would be good of course to take more ownership of my own pension by doing my own (symmetric or non-symmetric) allocations, I prefer to be in the passenger seat for now. Unless I conclude that none of the ‘investeringsprofiler’ fit me. In that case I’ll kick out the driver and take over the steering wheel.

Interesting! 5% is not half bad I guess, and -2.8% for 2018 is pretty decent too, when you look at the avg of the big providers! 😉

I think the important thing here is simply that we look at it every now and then, and change the investment-profile according to our risk-profile. We’re encouraged to take more risks when we’re young, but I’d be happy with 5% on my pension any day 😉

The projected payouts from the big danish pension providers are all based on a conservative yield of <3% (if I remember correctly). So technically, anything above that can be considered a bonus :D

Interesting thoughts! When it comes to pension that I won’t see until +40 years from now, I am 100% stocks always! If I needed the money to withdraw in the next couple of years, I would follow Fisker’s advice more 🙂

My pension provider also allow for individual index fund selection. I’m 80% global stocks and 20% biotech stocks. I’m taking very high risk with my pension as there are so many years until it can be withdrawn.

I know 😛 And that might very well turn out to be the best strategy – we won’t know until 40 years from now. However, I’ve never been shy to move against the stream, and it’s done me well so far (I pulled my pension from the stock market in early 2008 – not because I thought a recession was coming, but because I didn’t know what was coming, and because I was happy with the 2-3% that the “gennemsnitsrente” was giving at the time).

You were there at that FIRE meetup 😉 So you might remember another thing that JLF said; He said that he believe the next 30 years (in the stock market) will be nothing like the previous 30 years.

I do believe he’s right on the money, in that prediction 😉

My main concern (about the economy as a whole) is that last time we had a recession, we could “boost” ourselves out of it, by lowering the interests rate. In 2008, the interest rate was 7%. It’s now <2%.

So obviously, this tool will not be available in our toolbox again, should we run into a new recession. The next recession can thus end up being significantly longer (and deeper), compared to the last ones (which basically only took 5 years to recover from).

The future is certainly unpredictable, but people none the less always try to predict it, using the past as a reference - which has proven to be somewhat reliable. I simply no longer believe that we can continue to predict the future, based on the past 😉

I guess it’s all a matter of what your position is towards the financial markets in the next 40 years, which is, as you say, impossible to predict 🙂

I heard JFL, but I don’t necessarily agree with him (he knows as well as we do – OK, maybe a bit more, but he’s not a magician ;)). And more importantly, he comes from a position with a large net worth that he has to protect. I would also be a lot more cautious if I already had a large net worth that I was relying on to pay my bills.

It would be interesting to compare returns every year in the coming decades to see whether my volatile and high risk portfolio performs better or worse than yours. My pension returns are up +17% return this year to date, but I don’t expect that to last 🙂

I was up 10% for the year before I made the change – but 17% is pretty good too! 😛

I think you probably will win in the long run – I just really dislike those massive roller coaster rides that such an agressive investment strategy is bound to produce – so I’ll do anything to try to avoid those 😛 it might not be the best approach in the long run though! We shall see!