Since I’ve now been on the path to FI for more than a year (and recently wrote a somewhat philosophical rant about my first year on FIRE) I thought I’d spend some more words, looking into how the numbers have progressed during that first year. I (somehow) managed to grow my Total Balance by more than 40%! However, only 2.5% of that came from my investments (primarily crowdlending). That’s a little weak, Nick! You can do better than that!

Well, as always those numbers don’t tell the whole truth, in that I’ve made a big investment, which doesn’t pay out until the year 2023. I also have a substantial investment with Bulkestate, which doesn’t pay monthly interests, so there’s a bit of a “backlog” here, waiting to be paid out in Q4-2019. I also made a small investment with Brickshare, which is not scheduled to pay dividends until Q1-2020.

BUT, if we look at my property #1 investment and imagine that instead of a big payout in 2023 (which is currently the schedule) I’d get smaller installment payments from year 2020, the numbers certainly paint a different picture!

I don’t like to count unrealized earnings, so this is merely a thought experiment for me to figure out, whether I’m on the right track. But first, let’s take a little trip down memory lane!

In the past

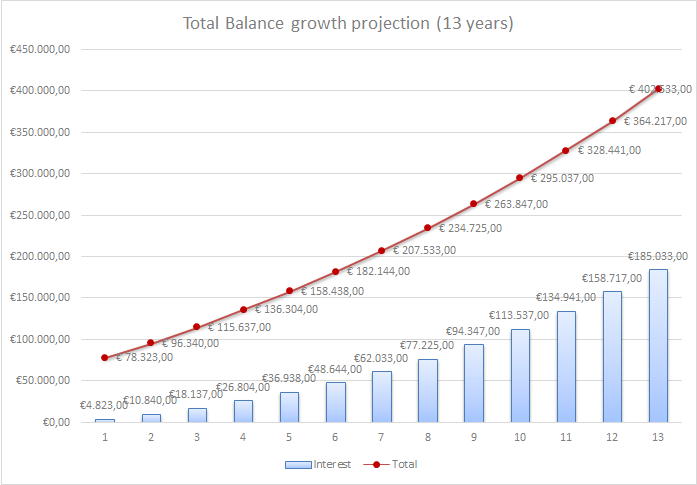

In my goals for 2019 I outlined how a post-tax interest rate of 7.1% on my portfolio would have me reach my target (€400.000) in less than 13 years (originally, it was 15 years, but I upped my savings rate a bit in 2019. – Spoiler alert: I might up it again in 2020!). Here is how my (modeled) projected growth looks:

So far, I’m on track in year 1, but this is mainly due to the fact that I have been keeping a savings rate way above my projected 13%. I do intend to keep my savings rate as high as possible, but due to a recent development in my wife’s employment, our cash flow has been challenged lately, and will remain so going into 2020 (most likely). Therefore I’ve had to divert some of my allotted “FIRE money” into other accounts, and for that reason I’m unsure whether I’ll be able to keep my savings rate up. Hopefully the cash flow situation will resolve itself eventually 😉

Ideally, I would really like to achieve a long term sustainable savings rate of 20%+ (which would cut off 3 years of my projection), but that might be a bit of a pipe dream. We shall see! I will remain positive, and aim high 😉

Aaaanyway, back to the future!

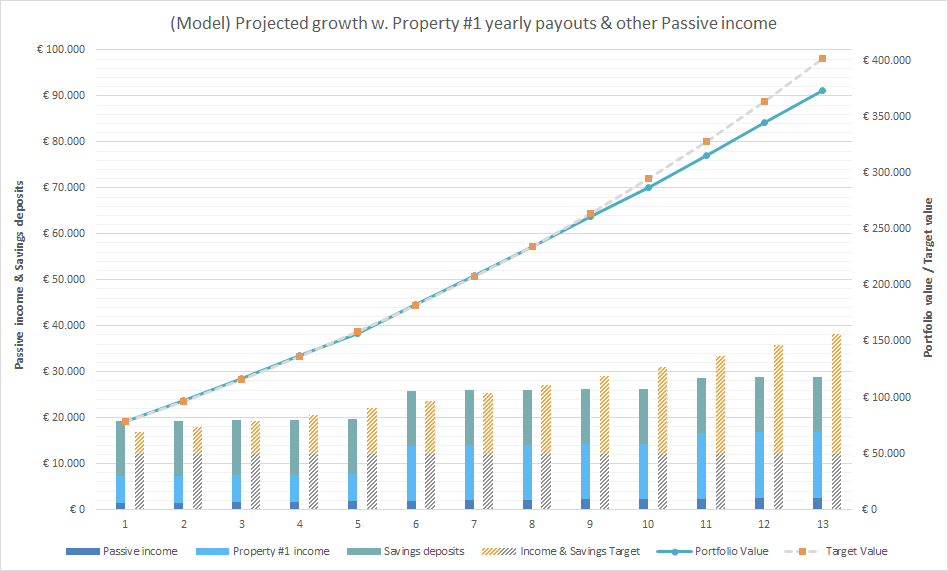

Looking ahead, imagining that Property #1 paid monthly dividends, it would add a projected cash flow of €500/month in the first 4 years. Now, in the next 4 years (2023-2028) it would look even better (because at this point we are clear of the bank debt in the property, which is the most expensive loan part). According to the projections, the monthly dividends from year 2023-2028 will be €1000/month!

Because of the special company structure in which I’ve invested in Property #1, these dividends are tax free! HOWEVER, while the first 4 years are pretty much secure (because the interest rate is fixed for 5 years), the next 5 (2023-2028) will depend on how the interest rate looks at that point (2023 is when the mortgage is up for refinancing, fixing the rate for the next 5 years), so these figures are merely projections. Obviously the income will also require the 2 tenants of the property to remain solvent and paying their rent on time. Because it’s a retail property with a 10-year interminable contract, I’m not too worried about that. The only way the tenants can stop paying rent, is if they go bankrupt. Which of course is a risk, but I consider it unlikely to happen (they are strong chain store tenants).

Enough with the jibber-jabber, Nick – show us them pretty pictures!

OK, here you go:

Looking at the graph above, with my current savings rate and a small amount of passive income (from crowdlending etc.) and imagined yearly payouts from Property #1, it’s actually not until year 9 that I would really begin to fall behind my target. This model use a fairly conservative passive income, and a flat savings rate (€12.000/year). So, I basically have 3 “levers” that I can pull to reach my target in time (or even faster). – The third one being: Adding Property #2, which is definitely the plan! (And Property #3 and #4…). I expect to add Property #2 to the roster in 3-4 years (I need at least €60.000+).

Once Property #2 is in my portfolio, I can update the model, and hopefully be able to chop a couple of years off of the time to FI 😉 Keep in mind that this model does not factor in compound interest at all (since I’m not actually getting yearly payouts from Property #1 until year 2023). I am not planning to re-invest the dividends from Property #1, until I have enough cash to buy Property #2. So I do expect to get a little help from the magic of compound eventually, but not until I’m around halfway there or so. My crowdlending income should benefit from compounding, though – but as the graph clearly depicts, this pot constitute a fairly small amount, compared to my savings and the (expected) income from Property #1.

In the real world, the payouts from Property #1 are scheduled in chunks (the first big one being in 2023), and then smaller yearly installments until another big chunk again in year 2028 and then again in 2033 (they come in chunks because the mortgage is a 5-year flex mortgage). If I were to model the actual payouts, the graph would look a lot more “choppy”. The end result however, should be about the same (since I don’t rely on the compound during the initial years).

In conclusion

I started the year with a huge cash stash, waiting for the right opportunity to arrive. The right opportunity finally arrived in April, and I’m still quite psyched about the Property #1 investment. I believe it will provide a solid base for my passive income for the next 10-20 years 😉

On the crowdlending side, things have progressed slow and steady, and I believe I’ve found a good approach to balancing the risk and the reward. If I were a bit less conservative, I would undoubtedly put more money in crowdlending. This asset class has delivered steadily the entire year, and there is a clear connection between how much you put in, and how much you get out. The greater the risk, the greater the reward! I think a crowdlending allotment between 15-25% of my Total Balance would be acceptable for my risk tolerance. Right now, I’m at 15%. Short term, I don’t plan to change this, but long term I might add some more platforms (Spoiler alert: I entered new platforms this month!…) to reap some of the rewards that crowdlending has to offer 😎

Anyway, I managed to get 19% towards my Total Balance goal so far, which I’m quite thrilled about! Not bad, Nick. Not bad!

is this a Danish property?

I suppose that the rules are different but I would have thought that other markets would be a better place to invest – maybe you know something different.

Yes, it’s a danish property. Personally I prefer to invest in my home market – simply because I know a lot more about the demographics here. Perhaps I will eventually branch out to other areas of Europe, but the current low interest rates in DK also help out on turning a decent profit in the property market 😉

Keep up the good work Nick!

I’m quite envious of your property investment. I’d love to do something similar with one of my chunks, but I feel it would take too long to build up enough savings which are outside tax-sheltered accounts.

Maybe down the line when I have to stop paying into my pension due to the LTA I’ll have some more liquid to play with that isn’t sheltered! Then I’ll be coming to you for advice 🙂