I often see people asking whether XX or YY is a good investment, and when talking to people about the general topic of investing, they often ask one of these two questions (or both): How much money have you made (by) investing? or What have you invested in – is it XYZ?! I’ve never been…

My investment strategy (2.0)

How to build a winning stock strategy(?)

A while ago I wrote a post about how your personality dictates your return and since I’ve recently embraced the roller coaster (the stock market), I decided to revisit it and write down some of my thoughts, on how to pick a stock strategy that matches your personality. Lets dig in!

New lessons learned (analyzing my returns from 2007-2020)

Early last year I wrote my “Lessons from the past“-post, in which I analyze my returns on my Pension from its infancy (2007) until the end of 2019. This post became the most read post of the year. So as promised, I will do a follow-up each year to analyze how my Pension portfolio have…

The goals for 2021

Another year, another milestone! We managed to hit last years target of €100.000, crossing into 2021 – with a little help from the Mrs. 😉 (Some call it “cheating” – I call it team work! 😛 ) Some of you might now be sitting with this question (or something similar) on your mind: Well, how…

Debt vs. leverage – what’s the difference?

If you spend some time in the various personal finance spaces around the great Internet, you’ll eventually stumble upon statements like this: Debt is bad! You should avoid debt by any means necessary! While I don’t dispute the fact that living debt free might “feel good”, in terms of economical advantages, living without leverage is…

What makes a good (retail) property investment?

Mr. MoneyMow recently reached out to me, and several other FIRE bloggers, to get our take on how the pandemic has affected our investment strategy (if at all). In short; my strategy hasn’t been affected by the arrival of a pandemic. Looking back though, I originally outlined my plan in one of my first posts…

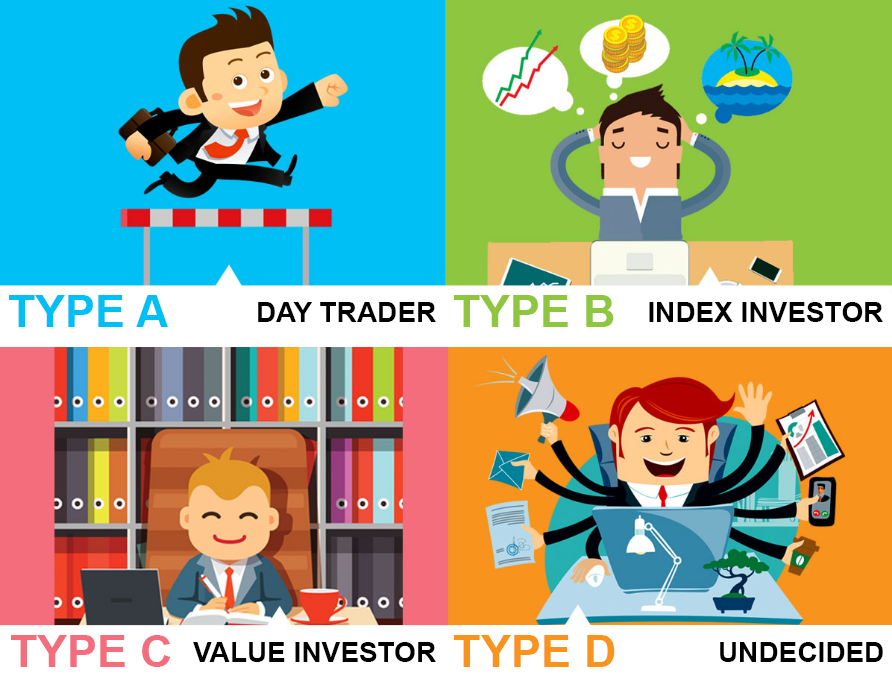

How your personality dictates your return

Being that I’m a person who is very interested in the “personal finance sphere”, I often find myself in discussions with people about just that; personal finances. It occurred to me the other day that there always seem to be a pattern, in how people approach this; Some refuse to discuss it at all, as…

History in the making

As if we didn’t have enough troubles already, today added another nail to the coffin of the bleeding stock market. OPEC and Russia couldn’t agree to cut down on the oil production (to keep the oil price steady), and as a result of the decreased demand (hello, Corona virus), the oil price plummeted. And the…

Make a plan and stick to it! (Or change it?!)

In my Goals for 2020 I outlined my plan to boost my Total Balance in 2020, by diverting funds from my mortgage payments towards my Total Balance (investment account) instead. Unfortunately, “The Universe” had another plan. Sometimes it’s simply easier to “take the path of least resistance” (go with the flow?), than to “fight the…

If it sounds too good to be true

It probably is (too good to be true)… In case you missed the latest development in the Baltic crowdlending industry, let me give you a quick recap; Two of my (previously) best performing platforms have turned out to be fraudulent (nothing is proven yet, but I think the writing on the wall is pretty clear)….