Well, we made it this far.

I remember looking so much forward to writing these “yearly goal posts” in my first couple of years of writing on this blog.

I’ll admit, I can’t seem to muster the same kind of excitement for this particular one. Perhaps it’s because it was a huge loss-year where I didn’t finish anywhere near my goal, or perhaps it’s simply because there is less and less “interesting news” to report as time goes by.

I deposited a shitload of cash into my accounts, my investments yielded a negative result in 2022, and yet I plan to do exactly the same in 2023 as I did in 2022 (hoping for a better result, of course! 😛 ).

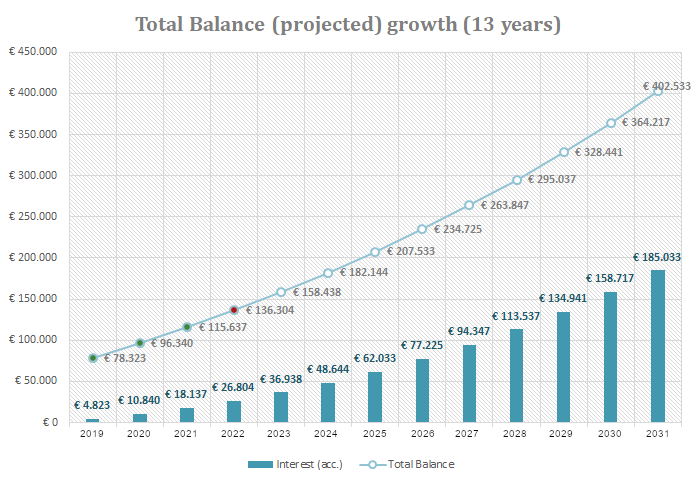

So, this marks the 2nd year in a row where I didn’t manage to reach my Total Balance target. The target for 2022 was € 158.438. We ended the year at € 135.355. Bwahaha, how pathetic! (You have to laugh it off!).

BUT! Something exciting is happening in 2023!

Loyal followers will know that we bought Property #1 in 2019. The project is funded by a 2-part loan. The first part is the “bottom” part of 70%, and then there is a bank loan on top of this of approximately 10%. This means we took over the property with an LTV of around 80%. Since we bought it we’ve been paying down on both loans, which means that our current LTV now stand at around 60%.

The original plan for Property #1 was (still is) to re-mortgage after our first 4 years of ownership. This will bring the LTV up to 70% (of the original evaluation) and the proceeds would be used to pay off the last part of the bank loan and the rest would be paid out to the owners (us) as a dividend. However, this was when the interest rate was close to 1%. It’s now 4% and valuations are in a downward trend. So basically, there is no certainty that the group of investors will be able (or allowed) to follow this original plan. We will have to wait and see what will happen here.

If everything goes according to plan, we should be in a very good position to add Property #2 by the end of the year.

At this point in time, I’m actually not sure if I prefer to follow this original re-mortgage plan, or whether I would prefer to just keep the equity in the building, and just keep lowering the LTV. The next natural re-mortgage point is not until the year 2028 where the leases are also up for renewal (in reality you would probably renew them a year or two prior to the expiration date). However, we have options for several different routes, so it will all depend on the general mood of the investor group, and then of course of the valuation from the mortgage provider, and where the interest rate is at in autumn (renewal is October 2023).

Anyway, the reason why I’m japping so much about this, is because the financial goal for 2023 is going to be greatly influenced by the Property #1 re-mortgage situation. Therefore I will define two different Total Balance goals:

- Property #1 is re-mortgaged according to the original plan.

- Property #1 is only partially re-mortgaged or not re-mortgaged at all.

If Property #1 is re-mortgaged according to the original plan, this should yield me a dividend payout in the excess of €25,000. Mind you that this is merely accumulated equity from the past years, which is then “released” by converting it (back) to debt. If we do not re-mortgage, then nothing will happen. Then we will simply continue to accumulate equity and lowering our LTV. (In 2025 we will thus have paid off the bank loan, and from here on out a small dividend of about €6,000/year will then be paid out to the investors, while still paying down the big loan.)

Looking back

Before we can set the goals for the new year though, I normally take a look back at the previous year to try and learn if something could be changed to optimize the outcome for a better performance.

We already know that 2022 didn’t live up to our original expectations – far from it, actually. The markets had a rough year, and on top of that we battled double-digit inflation and the fastest interest rate hikes in modern history. Because of this trifecta, all of our 3 Pillars of Wealth saw negative growth (The 3 Pillars are: Home Equity, Pension and our Total Balance).

We began 2022 with a Total Balance of €122,189 and ended the year with €135,355. This constitutes a monthly growth of €1,097, but we actually averaged a monthly contribution of €1,266. This means that the growth was -13% for 2022.

We’ve seen similar negative growth in both of our Pension portfolios, and Home equity is down by about 10%. I suppose it could have been worse, but it’s definitely not been fun. However, unfortunately the ups- and downs are part of the game. I don’t think I will ever be able to “not care at all”, but the more you experience it the “easier” it becomes I suppose.

None the less, we’re actually still pretty on-par with the original 13-year plan to FIRE:

So year-4 of the 13-year FIRE plan became the first year where we missed our target. We came up short by €949. All in all, I don’t think I can complain much about that to be honest. It’s important to note that we have a great deal of equity in Property #1, which is currently not included in our Total Balance. If we were to include this, we’re actually above the target for 2023, so I don’t see any reason to panic (just yet) 😛

We re-mortgaged our primary home in 2022 and converted to an interest-only loan. The plan was to divert our mortgage payments towards our Total Balance instead. Unfortunately, because of the energy prices and the rising interest rate, the savings only amounted to about €400/month, as we had to revise our budget dramatically to accommodate for the higher interest rates and the increased energy (and food) prices.

Looking ahead

Luckily, when we look ahead into 2023 the energy crises seem to be “resolved” (for now), so we will be able to divert a bit more funds towards our Total Balance than we first anticipated.

I also received a nice pay raise in 2022, so I’m fairly confident that reaching the target for end 2023 should be very possible. I’m hoping to be able to add an average of €2,000/month to our Total Balance in 2023.

If everything goes according to the original plan with Property #1, then I’m fairly confident that we can even (maybe) reach the target for end 2024! ($182,144). But if we just reach the 13-year target for 2023 (€158,438), then I will be quite satisfied – so lets go get it!

I do feel the need however to add a small disclaimer to these targets…

As I alluded to in the monthly update for December 2022, we’re planning to sell our primary home in 2023 and move to a cheaper place, in order to lower our cost-base and get closer to our daughters school. Depending on whether this move will materialize or not, there will undoubtedly be some changes to the Total Balance distributions. It might be that we opt to convert some of our Total Balance into equity in our new home, if we want to live debt free. It will however all depend on the finale sales-price of our current home, and the purchase (and remodel?) price of our new home…

Now, one could also argue that since we set our Total Balance to €400,000 the world has changed…So maybe it’s time to raise the target?

For now, I have chosen not to change the target, as it already seems way too far away! So we will keep the €400,000 target for now, knowing very well that this probably won’t be enough.

But then, how much is going to be enough?…If the previous couple of years has taught me anything, it’s that you never know what the future is going to bring.

Plan for the best, but prepare for the worst! I’d REALLY like to see us hit that 13-year target, before we start moving the goal-post…

I think it would probably be clever to add at least 2-3%/year to account for inflation…This means that we should shoot for (at least) €500,000…Yikes. Well, we have to pass €400,000 first anyway then 😉

Personal goals

As per usual, I like to “repeat” my goals from the previous years, but this year I feel like adding a little something. These are my “regular” goals:

- Move more

- Get outside more

- Play more

- Laugh more

- Be more present

- Eat more greens and less meat (anti-inflammatory diet)

- Eat less sugar (anti-inflammatory diet)

- Exercise more

- Worry less about stuff that doesn’t worry about you

I feel like I’ve been somewhat successful in improving in most of these areas. They’re really not “goals” per say, as a real goal is finite and you should be able to say whether you reached it or not. These are more like “guiding principles”…I still eat way too much sugar, and I certainly still worry way too much about stuff that doesn’t worry about me.

“I am an old man and have known a great many troubles, most of which never happened” – Mark Twain

I try to remind myself that worrying is pointless, but it seems to be embedded in my personality that I spend a great deal of brain power trying to anticipate “the universe’s next move” 😛

Anyway, I try to improve but I’m probably never gonna be able to kick that habit entirely…

This year I would like to add a new goal though.

I’m finding it harder and harder to “connect” and “relate” to “regular” people. I miss having deep meaningful conversations with people whom I can relate to, and who share my (our) values and life goals. So my new personal goals for 2023 looks like this:

- Do more (take action)

- Get outside more

- Play and laugh more

- Be more present

- Eat more greens and less meat (anti-inflammatory diet)

- Eat less sugar (anti-inflammatory diet)

- Move and exercise more

- Worry less about stuff that doesn’t worry about you

- Seek to connect more with like-minded people

I have one last thing that I’d like to add, which is not really a goal per say, but more of another “guiding principle”;

I’d like to travel more – and actually for the first time in many years we’ve already planned 3 different trips for 2023 (3x 1 week), which is extremely unusual for us. After the pandemic I’ve not had the desire to travel outside of Denmark much, but I’m already very excited to get BACK out there. FUCK COVID!

Sorry. I think that was it for this one 😉

What are your goals for the year?!

What a shitty year for the markets ey?

Don’t worry though, what is it those smart investor people say? “The real money is made in the bear markets,” or something like that That extra you invested while it dropped like a stone in 2022 will hopefully be worth more when it recovers, you’re already sitting on your fortune! Something something about buying hamburgers?

How do you plan to eat less meat and sugar, do you guys plan your meals/weekly shops? I recommend reading the book Atomic Habits if you haven’t already (let me know if you want the ebook.) Same with worrying less, have you tried meditation? I know I’m the type of person that worries a lot and should probably get into meditating, but that habit never did stick for me.

I request a Total Balance post about each of your goals!!!

Here’s to a fortuitous 2023

I actually already have Atomic Habits loaded on my kindle, but I’m currently finding myself more in the mood for reading fiction. It takes a clear mind to read “self development” subjects I think…Right now I don’t feel like I have that much room for those topics tbh.

Anyway, the not eating meat part is going very well. I’ve just gradually transitioned into a flexitarian, and do my best to avoid meat daily. Chicken is ok for me though, so we still eat a lot of that.

Sugar has always been my vice! I also still eat a tiny bit of cereal (mixed with other stuff) for breakfast. I’d like to remove that from my diet though! Haha

Best of luck to us all!

Hi Nick.

Thank you for a nice in-depth post! I have followed you all the way, and is almost equally excited about property 1, as I where considering investing in a similar case back then (we didnt btw).

Your realization about connecting and relate really hit me hard – I am starting to have a small feeling of the same. I really donøt like to talk to anyone unless it is about something deep or meaningful. I can’t relate to commercials from tv, but love to reflect on the current situation in the world. This seems to be the opposite, when I am in a social context for the most part.

Anyway – all the best in your effort to sell you home. I hope the best for you and your family. You have worries but you also reflect on these and know, that they are of no benefit at all. Enjoy the journey – with kids this is hard to do 24/7, but in the big picture your everyday life sholud be enjoyable.

/Mikael

Thank you for your continuing support of my ramblings! 🙂

I agree that life with kids is never smooth sailing. And it is as they say: small kids, small problems. Big kids, big problems

I suppose it’s then up to us to set the tone of the conversations we engage in. I think it also has to do with everyone being afraid to talk about the important stuff. People don’t like to be reminded about their own fears. So it’s easier to keep them bottled up inside.

I have a few people in my social circle with whom the subjects always flow naturally into more meaningful and deep conversations. But it’s rare to have those kind of conversations..

Good luck with your own endeavor! I hope you’ve enjoyed finding back to your roots 🙂