I know what you’re thinking: Is “Bbye” even a word?! – Well, according to the urban dictionary it is!

Bbye: A bitchy way of saying “goodbye have a nice day”, often used by “office suckers” and women with no self decency over the phone. (Sorry – but that’s what it says! You be the judge of which category I then belong to… 😛 ) – Urban Dictionary

I think that’s an appropriate salute to the year 2022.

Here we thought that this first post-pandemic year was going to be a walk in the park! Boy were we wrong, huh!?

I have lost count of the red days in 2022 by now, but I’m pretty sure it was the vast majority (unless you’re long in nothing but Guns, steel & Fossil Fuels).

Anyway, lets just get this over with, shall we?

The month in review

I suppose a “Merry Christmas” and a “Happy New year” is in order?! 🙂

December is always a little bit blurry. We had a lovely Christmas with the family. For the first time in years we were not hosting Christmas eve at our house, and I think my wife enjoyed not having to cook.

After Christmas we went on a small “camping” getaway, which was basically a waste of money, so I don’t think we’re going to repeat that mistake 😛 (We should have probably opted for a small getaway to the south instead). We already have 2 weeks holiday booked for 2023, which is very unusual for us (we’re not great at planning holidays in advance). 2023 is going to be the year of travel, I think! 🙂

I’ve been trying to find the motivation to write this update, but I haven’t really been able to get into the groove lately. On the plus side, I feel like 2023 is off to a pretty good start.

2022 ended on a similar note as it began; terribly!

On the 30th of December I logged on to my brokerage account to “check on the progress”, and to my great surprise I noticed that my broker had force-sold one of my positions (Granite REIT). I immediately opened a support ticket, and they were like “YEAH, WE WARNED YOU ABOUT THIS!”. “Erhm, No you didn’t” I replied. Silence for 3 days. “Ok, maybe we didn’t. Sorry that’s our bad!”.

It turns out this stock is a so-called PTP (Publically Traded Partnership), which is no longer supported by any decent broker in Europe that I could find (I looked, because they offered to move it to another broker – that is, if I could find one). Since I couldn’t find another broker who allow PTPs after the latest rule changes from the IRS (something about too much paperwork involved in withholding an extra 10% tax), I had to suck-up the loss. -30% realized loss. Great – GOODBYE 2022!!!

Right now I’m finding it difficult to pinpoint any great moments in 2022, but if I scroll through my camera roll I can’t deny that while 2022 was horrible in terms of the finances, it was not that bad in terms of “normal life”. We had some great experiences, and most of all we put Covid-19 behind us (hopefully for good?…).

Also, I have been debating a lot with myself whether I should share what I’m about to on the blog…I want to be as real as possible, and share life’s up’s and downs with you guys, because I feel it’s important to “know the whole story” behind my actions.

In my September update I shared details about how we had taken the first steps towards beginning a major remodel of our primary home. However, shortly after we had dropped €2,500 for the new tiles we made another decision.

We’ve decided to move instead.

Our current home is not really “FIRE-friendly” and it is a little far from our daughters school. We’d like for her to be able to walk or bike home from school by herself (she is 8). A lot of her classmates live close to the school, and most of them are able to walk home from school by themselves (or visit their classmates). When our daughter has a playdate we have to drive her, and while we knew this when we moved in (she had not started school when we moved), it has started to wear on her parents 😛 I hate “wasting time on the road”.

So those are the two primary reasons; The cost of ownership and the cost of distance from our daughters school 🙂

But Nick, are you crazy? Selling your home in the worst drawdown since 2009!?

That’s what I said! (to my wife). She remain optimistic that we’ll be able to find a buyer. I remain (very) pessimistic…

The problem is: We’ve already found our preferred new home…It’s half the price of our current home…But we can’t buy it until we sell….Needless to say, none of us are very happy about this situation! Our house has not been put on the “open market” yet, but we have hired a realtor and he’s out “scouting for buyers”. We have not heard from him since we signed the contract (HAHA). I follow the real estate market closely, and I’m fully aware that there are 0 buyers out there right now. Then my wife said: “Well, if the Universe wants it, it will happen”….I hate it when she use my own words against me! HAHA!

Obviously this decision is not going to influence our short term goals or the current strategy (hoard cash!). – But it is cause for some weariness as it’s very uncomfortable to have MADE THE DECISION, but not being able to ACT before we find a unicorn who is willing to buy our current home. Talk about bad timing, Nick! I know. I feel like it has been the story of my life for the past couple of years, so it seems only fitting that 2022 should end in yet another ill-timed decision…

The prospect of living in a cheaper home close to our daughters school means that we could (potentially) manage with having only one car, and it means that we would be able to save a lot more than we’re currently able to. If everything goes smooth (lets be real, it’s probably not going to) and we find a buyer before the end of the year, and we manage to purchase the house that we’re currently hot on, we would be able to live debt free. I know that I have previously tooted that having NO debt is silly, but that was when the interest rate was <1%. As of right now it’s 4% in Denmark. It hit 6% at one point. I believe the “healthy” interest level should be somewhere around 3-5%. At that level I wouldn’t mind having a small debt, but I’d prefer to have NONE at all…So I suppose this is the goal for 2023…

(I should mention that it’s not the debt alone that’s a problem in our current home. – It’s also the taxes and the maintenance and upkeep cost on a big house from the 1800s).

Anyway, wish us luck! 😉 (we’re definitely going to need it…)

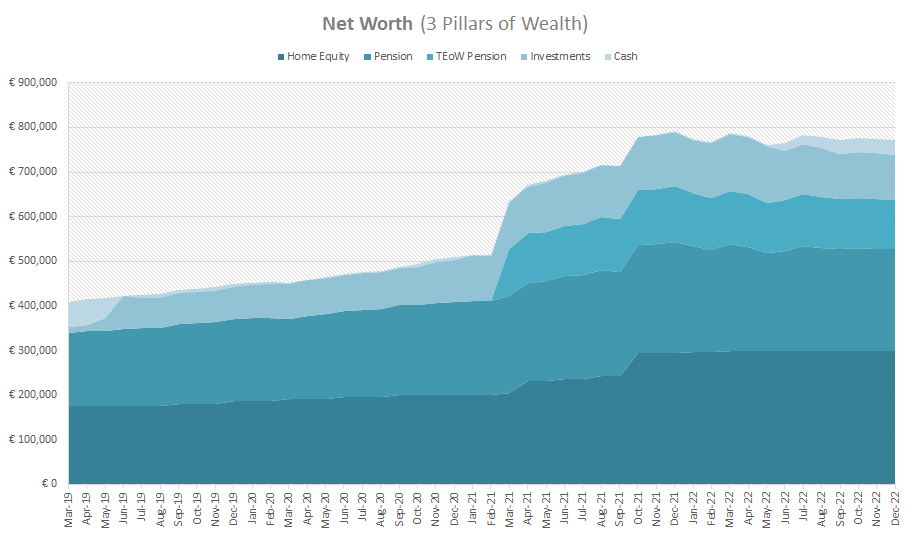

Our Total Balance for the year landed at € 135,355, which is just…terrible.

I chose to write-off the small amount I had with Celsius and Binance (maybe I will be able to recover some of the assets from Celsius, but I doubt it). My Binance holdings is so small (after the LUNA collapse) that I don’t think it makes sense to keep tracking it. It currently looks like I might as well also prepare to write-off what I have with Nexo too (judging by the latest development in January). Oh well, I guess the Universe had other plans 😛

Somehow I feel like it can only improve from here! 2023 is going to be a great year!

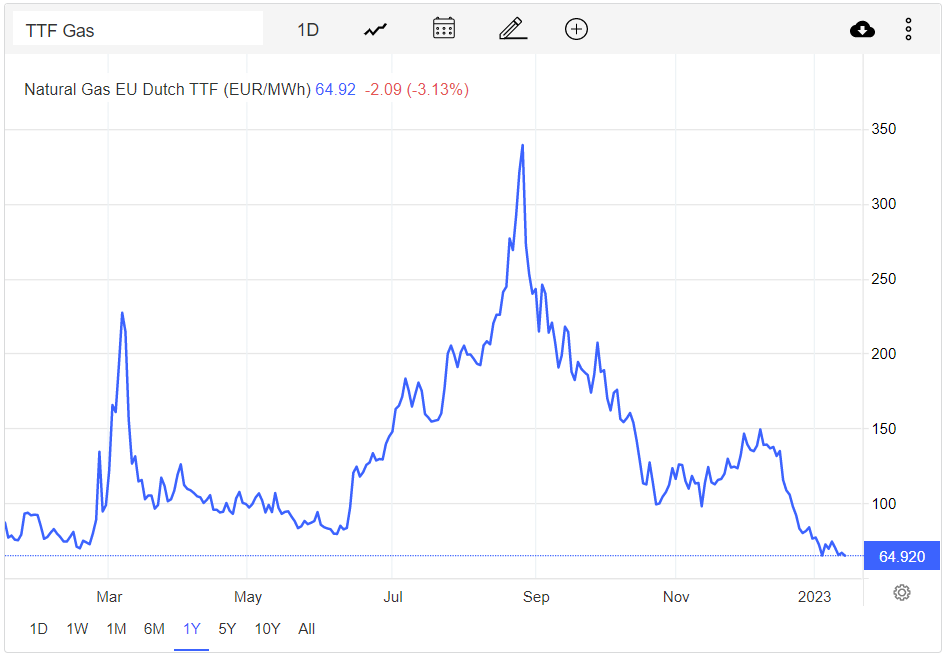

Oh, in the spirit of a great new year, here are some great news for the Europeans who are still heating their home with natural gas; prices are currently back at the same levels that we saw in the beginning of 2022:

That’s certainly some good news to end on! Take that, Putin!

(Evil tongues will say that the high prices are going to return when it’s time to re-fill the stocks in the fall…We shall see! For now, lets just enjoy this small win!)

The pwetty graphs

Well, we clearly did NOT reach our target for the year. It was a bit too optimistic, I’ll admit – but we did not get ANY help from the market this year (on the contrary!), so I will continue to set over-optimistic goals for 2023 as well 😉

The Boring Income Statement

| Platform | Invested | Transactions | Last month | Current value | Monthly income |

| Commodities | |||||

| GOLD (Coins) | € 5,333 | € 0 | € 6,000 | € 6,500 | |

| € 6,000 | € 6,500 | ||||

| Stocks (Dividend portfolio) | |||||

| Bank of Nova Scotia (BNS) | € 1,000 | € 0 | € 1,239 | € 1,131 | € 0 |

| Enbrigde (ENB) | € 2,400 | € 0 | € 2,367 | € 2,218 | € 0 |

| Granite REIT (GRT.UN) | € 3,859 | € 0 | € 2,848 | € 2,435 | € 6 |

| PROREIT (PRV.UN) | € 2,018 | € 0 | € 4,065 | € 3,693 | € 17 |

| Toronto Dominion Bank | € 1,000 | € 0 | € 1,101 | € 1,035 | € 0 |

| TransAlta Renewables (RNW) | € 2,000 | € 0 | € 2,052 | € 1,581 | € 8 |

| True North Commercial REIT (TNT-UN-T) | € 3,552 | € 0 | € 3,180 | € 3,062 | € 19 |

| € 16,852 | € 15,155 | € 50 | |||

| Stocks (Indices) | |||||

| iShares Global Clean Energy (IQQH) | € 6,667 | € 8,213 | € 7,987 | € 0 | |

| Xtrackers MSCI World ESG (XZW0) | € 2,721 | € 2,485 | € 2,331 | € 0 | |

| € 10,698 | € 10,318 | € 0 | |||

| Properties | |||||

| Property #1 | € 68,667 | € 0 | € 68,667 | € 68,667 | € 0 |

| € 68,667 | € 68,667 | € 0 | |||

| Crypto | |||||

| Celsius (ADA, BTC, DOT, ETH, MATIC)* | € 0 | € 426 | € 0 | € 0 | |

| Binance (ATOM, FTM, LUNA, ONE) | € 0 | € 55 | € 0 | € 0 | |

| Nexo (BTC, ETH, MATIC, EURx) | € 0 | € 602 | € 598 | € 3 | |

| € 1,083 | € 598 | € 3 | |||

| Cash | |||||

| Bank #1 cash (main savings) | € 0 | € 0 | € 0 | € 0 | |

| Bank #2 Opportunity money | € 2,068 | € 31,766 | € 33,834 | € 32 | |

| Broker account (CAD, EUR, DKK) | € 50 | € 233 | € 283 | € 0 | |

| € 31,999 | € 34,117 | € 32 | |||

| Total Balance | € 135,299 | € 135,355 | € 85 |

I received an interest payout of $68 from my bank. This is for little over 2 months of 2022, so this little pot should yield a decent chunk of cash by the end of 2023 (provided that I don’t spend my nest egg during 2023, which I’m currently not planning to – but you never know if something interesting pops up! 😛 ). Anyway, compared to 6 months ago where I was PAYING the bank to store my money for me, I prefer it the other way around (I’m fully aware that if you factor in the inflation I was actually better off 6 months ago! HUSH! just give me this one win will ya!?).

It is now possible to get 2% interest on a savings accounts in DK, if you lockup the money for 12-24 months. I’m not quite willing to do that right now, so I will stick with the 1.20% that I get from Norwegian Bank for now.

Anyway, it was another crappy month in my stock portfolio. There’s not much more to say about that, really…

My main goal for 2023 is to accumulate as much cash as possible! – Just because…it’s nice to have money in the bank during a recession! 😛

Oh, and remember that October 2023 is a big month for me too!…YAY!

The Classic Growth Charts

As always I include the Classic Growth Charts for tracking purpose.

In Conclusion (TL;DR)

My broker force-sold one of my Dividend stocks because they no longer support PTPs (I didn’t know what this was!). Booked a -30% loss. Somehow it seems a fitting way to end 2022! What a mess!

I wrote off my small Crypto pot with Celsius and Binance (Celsius is going through bankruptcy procedures, so I might retrieve some of the funds, but I doubt it). Binance holdings were miniscule after the LUNA collapse, so I don’t think it makes sense to keep tracking it.

We had Christmas with at my brothers house this year, and it was a nice change of scenery, which meant that my wife didn’t have to cook (she was pretty happy with that).

Our Total Balance finished the year at € 135,355, which is just HORRIBLE. – But at least we’re still in good health, right?!

Oh, and lastly we decided to move! (If you want to know more details you have to read the long version above 😛 ).

Happy new year! 🥳

I hope the real estate journey works out for you and the family. Crossing my fingers there is a buyer out there quick!

Thank you, Elisabeth! I dig your e-mail! 😛

Good luck with the house and thanks for posting.

Alright some housing adventures approaching this year for both of us, hope they will be for a better lifestyle :). Good luck with selling your home, it may not be as bad as expected (inflation) if EU manages to keep energy prices low, let’s remain optimistic! 🙂

Agreed. 2022 was not the best. Best of luck for 2023 Total Balance. Keep the updates coming.

My ‘growth’: https://www.thrivingwillow.com/the-impact-of-tiny-house-living-on-my-net-worth-growth-over-5-years/