When I started this blog back in September 2018, and wrote my first post I really didn’t have a clue what I was doing or where I was going (this is the honest truth!). I had read a lot of other FIRE blogs, and thought it would be a good idea, to create my own blog, so I could follow (and allow others to follow) my progress towards FI.

A little over 3 months later, here we are! I wrote 16 blog posts since, and I grew my Total Balance by more than 15%! Granted, the main reason for the nice growth, was due to a double-salary payment back in November. None the less, keeping my eye on the ball, and writing the monthly updates really helps me kind of “keep myself in check”.

Historically, I’ve not been a huge fan of New Years resolutions, and I’m thus not going to set any major new goals for myself, for 2019. I see a lot of FIRE bloggers set a whole list of goals for themselves, which they then often fail miserably at achieving. Since this is a FIRE blog, I will focus on my FIRE goal alone 😉

I know that the “thumb rule” of FIRE is: Accumulate 25x your yearly expenses, and with a 4% SWR (Safe Withdrawel Rate) – you’re home free!

I follow bloggers who manage to save upwards of 60-70% of their net income (savings rate). I’m currently at just around 15% (25% if you count my mortgage payments)…Not very impressive. However, my goal of having a Total Balance of €400.000 was never a goal that would make me FI for life. It was a goal I set, based on the assumption that I would “bridge finance” my early retirement from my 50’s into my 60’s. When I’m 60, my pension will kick in. Obviously, it would be nice if a Total Balance of €400.000 would make me FI for life, but given inflation and all (and our exorbitant spending habits), that is not likely to be the case. I would most likely have to double it (to €800.000) at least, to be FI for life…

Well that’s kind of upsetting! No, not really. I still think my goal of €400.000 is a nice target (for now), and it would certainly give me options (to work part-time for example), if I had that much cash in my stash. I don’t include my house equity in my Total Balance (which at the time of writing is more than €150.000), which is obviously also only going to increase over time (provided that I keep paying off my mortgage – which I might not continue to do). It might come in play later, but for now I will leave it out of the picture…

So, I’m not going to change my ultimate target just yet (although I probably should – maybe next year? 😛 ). I am however going to up the ante a little!

I have been playing with the idea of changing my savings goal from DKK 5.000/month to DKK 7.500/month (€1.000 / $1154). Given that my starting point is now 15% higher than when I first began calculating my “FI numbers”, the stakes have already changed. So much in fact that if I manage to add €12.000 (€1.000/month) to my savings in 2019, and somehow manage to invest the majority of my nest egg (I still believe it will happen…eventually 😛 ), I would reach my Total Balance goal 2 years prior to my initial calculations (15 years was the original number). At the same time, I can lower my target interest rate from 8.33% to 7.1%. This is really a huge deal!

So, not only do I get to “retire” 2 years prior to my original calculations, now I can also cut 1.23% off of my avg interest rate goal. Given the taxes on dividends/interests, this actually means that an average of 12% interest rate on my investments is enough (it was 14% before). If you’ve noticed, I currently average 13% on my crowdlending investments. Of course, reaching pre-FI 2 years earlier than anticipated now means that I need 12 years worth of expenses in my stash, instead of only 10 (to bridge my expenses from my 50’s to my 60’s)! Let’s not dwell too much on that fact for now 😛 (It kind of ruins the mood!). That’s going to be a problem for future me to deal with (future me says: damn you, past me!).

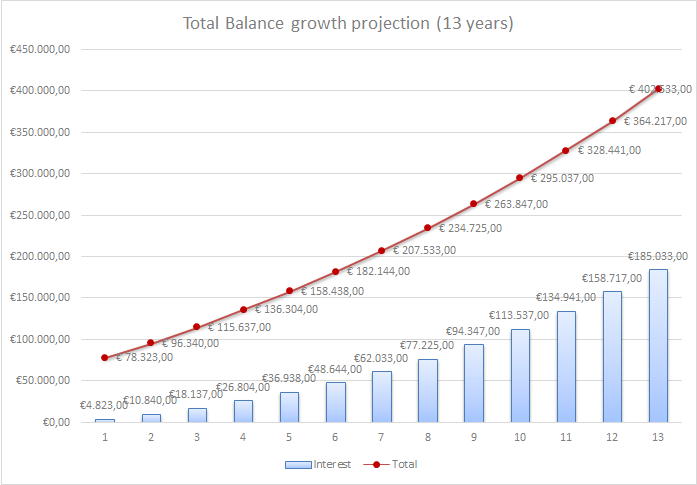

Here is thus my new 13-year plan to my ultimate Total Balance goal (Interest Rate: 7.1%):

| Year | Year Deposits | Year Interest | Total Deposits | Total Interest | Balance |

| 0 (2018) | €61,500.00 | €61,500.00 | |||

| 1 (2019) | €12,000.00 | €4,823.16 | €73,500.00 | €4,823.16 | €78,323.16 |

| 2 (2020) | €12,000.00 | €6,017.61 | €85,500.00 | €10,840.77 | €96,340.77 |

| 3 (2021) | €12,000.00 | €7,296.86 | €97,500.00 | €18,137.63 | €115,637.63 |

| 4 (2022) | €12,000.00 | €8,666.94 | €109,500.00 | €26,804.57 | €136,304.57 |

| 5 (2023) | €12,000.00 | €10,134.29 | €121,500.00 | €36,938.86 | €158,438.86 |

| 6 (2024) | €12,000.00 | €11,705.82 | €133,500.00 | €48,644.68 | €182,144.68 |

| 7 (2025) | €12,000.00 | €13,388.94 | €145,500.00 | €62,033.62 | €207,533.62 |

| 8 (2026) | €12,000.00 | €15,191.55 | €157,500.00 | €77,225.17 | €234,725.17 |

| 9 (2027) | €12,000.00 | €17,122.15 | €169,500.00 | €94,347.32 | €263,847.32 |

| 10 (2028) | €12,000.00 | €19,189.82 | €181,500.00 | €113,537.14 | €295,037.14 |

| 11 (2029) | €12,000.00 | €21,404.30 | €193,500.00 | €134,941.44 | €328,441.44 |

| 12 (2030) | €12,000.00 | €23,776.01 | €205,500.00 | €158,717.45 | €364,217.45 |

| 13 (2031) | €12,000.00 | €26,316.10 | €217,500.00 | €185,033.55 | €402,533.55 |

Or for the more visually inclined (I do love me some graphs!):

Isn’t it awesome!? A picture says more than a thousand words (from a bloggers perspective, this is interesting – I’m closing in on 1000 words in this post already. Should I just stop typing now?… 😛 ).

13 years to reach my Total Balance goal! Away we go! Onward and upwards!

Anyway, to sum it up: In 2019 I will need to add €12.000 to my savings, AND get an average monthly yield on my investments of more than €400 (this is post-tax even!) to stay on target.

Oh boy. €400 (after tax!?) is far from my average of €80 (pre-tax) in 2018…How will I ever achieve this?! Let’s be honest, it’s highly unlikely that I am going to achieve this – especially given the nature of a lot of my investments (which only pay dividends once per year), and the fact that I have yet to invest in that real estate project that I’ve been japping about for the last couple of months. Let’s imagine that I finally find a project worthy of my money in March 2019 (this is just an example). This means that the dividends from this project wouldn’t arrive until March/April 2020! And in the meantime, I wouldn’t get any interest at all, on my invested money (at least not interests that will actually hit my bank account – and remember, I only count realized earnings!).

What then?!

Well, aggressive goals require aggressive measures/actions to be met! I could set my goal to €200/month, which I believe is within reach/reason for me. – But what’s the fun in that!? 😉

What are your goals for 2019?

*The calculations above are provided courtesy of TheCalculatorSite

It’s always good to set lower, achievable goals so that you feel motivated to carry on. My first goal is for covering £12,000 per year with a stash of £300k. But I won’t actually quit when I achieve this. For starters, this would only make me FI and not my partner. Also, I may want to move to a bigger house or need more income if I have kids or whatever.

There’s no point in having your first goal be a FatFI number, LeanFI is more achievable 😛

Have you thought about reducing your exposure to real estate and re-mortgaging so your portfolio is a little more balanced?

Oh I’m definitely going for LeanFI here 😛 Unlike yourself, I still lead a somewhat lavish lifestyle – we still eat sushi on a regular basis, albeit not quite as much as we used to 😛

Unfortunately, my before mentioned lifestyle has also brought me into a pretty expensive house. Since we have a flex-rate mortage up for renewal next year – and considering the expected clime of the interest rate is imminent – I unfortunately do not feel that now is the time to reduce my exposure towards rising interest rates. Thus I’m scrambling to pay off my mortgage as fast as I can. I am however regularly considering just to fuck-it-all, and stop paying off the morgage (go interest-only for a while) and then channel all those saved payments into something entirely different – like boring dividend stocks for example 😉

But actually, I’m currently contemplating exposing myself even more to real estate. I’m considering buying a small condiminium, but unfortantely I don’t have quite enough for the down-payment yet..

Good luck with your goals. I don’t think there’s anything wrong with being quite ambitious/aggressive with them so long as you don’t beat yourself up about it if you don’t meet them through no fault of your own. You’d probably still end up saving more than if you set yourself an easy target.

Thanks, FF! That’s what I figured too! I can probably save myself to my 2019 target, but it’s going to be very difficult to do the same for 2020, so eventually I’m going to have to find me some assets with a decent yield 😉

Hi there. Just found your blog and read a bit here and there. 400k€ is ok but have you looked at dividend growth investing? with thouse 400k€ you could get 15k€/year or something of growing dividens income which eliminate inflation threat or even surpass it. I think it is better then 4% withdrawal as that way you may endup broke in 20y or so if for some reason you will reach +80y or so 😉 Hence I picked dividend growth investing path. Also I see your invrsted in p2p lending platform. Personaly im not into these type of investments as they are too risky. Yes you get 15% or so return, but understand that these are the people your lending that could not get a bank loan and in general should not get a loan at all. For now when economy is booming they are ok repaying some way. maybe just borrowing from another p2p to refinance. But if shit hits the fan like in 2008 your p2p most likely end up crashing down. So I would recomend you to diversify your investmenta. Invest in RE, borring dividend stocks, bonds even. I think p2p alone is just too risky investment.

Either way good luck on your y2019 goals. Looks like we are in a similar saving rate of ~15%. Ive put 20% goal for 2019%. BTW I have a daughter too 😉

Hi p2035!

Thanks for stopping by – and I like the new look on your blog. I was just recently looking at the same theme for myself 😉 Decided to stick with this one for a while still 😛

My current crowdlending portfolio is a mix between the classic p2p (“micro” short-term loans, typically car- or personal loan) and the larger crowd “real estate” bridge financing loans. Bridge loans are pretty standard in the real estate development industry, and most of them is secured by a 1st grade mortgage. I understand your skepticism, and I do share it – to some extend, which is why I’ve only invested about 15% of my current Total Balance in crowdlending.

The rest I hold in cash, because I’m waiting to invest in a real estate project (the classic kind) or buy a small rental apartment bulding (or just a single rental apartment). I was actually just browsing apartments when your comment ticked in. – Funny story: I just found out that an apartment I lived in, in Copenhagen 10 years ago is for sale! It’s appreciated by 30% since we sold it. Probably should have held on to it 😛 Anyway, I might start dabbling in some dividend stocks, once I get my real estate project in my portfolio. I agree that you should diversify your portfolio in at least 3 different asset types, so I will probably get there eventually. For now, I’m not really interested in the stock market to be honest. It’s simply too volatile, and my mood tend to swing violently along with the market (I have owned stocks before).

I currently have a nice pension (provided by my employer), which kicks in when I’m 60. It is life-lasting, so I don’t really worry a whole lot about my life from my 60s+. It’s taken care of 😉 – It’s my life NOW that I worry about 😛

I have been thinking about including my mortgage payments (not the interest part) in my savings rate 😛 That would bring it up by quite a bit. But I guess it’s kind of cheating 😛

Good luck to you as well! 🙂

Weeeeel I wouldnt say that RE croud fundings are less risky then p2p lending. I was at bank enforcement unit after the crisis for few years and shitty projects bring lots of loss. Again like in p2p RE croud funding absorbes all the leftovers that are not financed by the banks. Yes maybe in some cases some projects are just to small for the banks. Avoid land plot developments, especialy speculation kind – change or land plot purpose and selling it. These are the most risky RE projecys 😉 I think REITs would be a better pick as they aim for RE projects with cash flow (rental properties) In some cases you might sqeeze 10% return as well.

Either way 15% or portfolio ir more or less reasonable. I didnt noticed the big cash stack you have and tought you are invested 100% in croudfunding 🙂 Good luck on finding rental property. Small apartments 1-2 room in good locations in a city are the best and easyiest to find tenant. But understand that Rental bussines is not a passive income. Its a halftime work 😉 this is why im not into that myself. For now at least 🙂

I’m currently looking at local non-publically traded REIT-like assets 😉

I agree, owning rentals is not technically “passive” income, but then again that has never really been my goal. If I retire before I’m 50, I’m going to need something to keep me busy 😛 My dream is to own multiple apartment buildings. I guess I will have to start somewhere, if I want to realize that dream. I don’t mind doing things a little differently than everybody else. Should I loose ALL of my invested money, I’ll still be able to put food on the table, and pay off my mortgage – I just won’t be able to retire until I’m 60 😛

Love the growth projection and I keep my fingers crossed that you can keep up with it.

Thanks, Druss! I think I’m going to need all the finger-crossing I can get, to stay on target this year 😉

Great to see you plan to step up your savings rate Nick! It’s good to be ambitious and know where you’re heading – whether it is realistic or only semi-realistic. I have multiple scenario’s, some more realistic than others. Models that differ in terms of when I’d retire (early), whether or not I’d do part-time/freelance work, where I will live, how I will live, etc.

There is one constraint: I WILL RETIRE BEFORE I HIT 60. This can not be negotiated.

As far as my plans for 2019 are concerned, it’s kinda boring. Continue to invest in ESPP company stocks and (try to) diversify/expand my crowdlending/funding asset class.

What’s the plan with your real-estate project? Do you want to buy property? Or would this be a brickshare (or similar) thing?

Thanks, Marc! Setting myself unrealistic goals is apparently my new thing. I somehow got pursuaded into participating in a friends new year resolution “russian roulette”-project, where he conjures up a new challenge for himself each month of the year. First challenge: NO CAKE JANUARY! I somehow agreed to participate in that! I don’t know what got into me 😛

I WILL retire before I hit 50! That’s definitely my goal, but I know you’re a bit older than me 😉

In this old blogpost https://totalbalance.blog/no-guts-no-glory/ I outline my plan to invest with a real estate developer in Denmark. However, since I heard the latest podcast from Christian over at https://mininvestering.dk/podcast-ep-17-interview-med-junaid-ahmad-fra-brickshare/ about brickshare and their future plans, I’m starting to have doubts about my plan. One of the major news that they revealed, was that they are working on adding monthly interest payments to the projects. Then it suddenly becomes a little more interesting (I think). I’ve become quite fond of following my monthly cashflows from crowdlending, so I’d love to invest in more assets that provides a form of monthly dividend/interest. I still consider investing DKK 3-400.000 in one project with Imbro, if they come up with just the right project for me. I’ve also been considering buying a small rental property with 2-3 condos, but I think that would simply result in too much work on my part (I have my own house and a family to look after).

Anyway, I’m keeping my options open for 2019 basically – but I’m sure my next (big) investment will involve some kind of real estate for sure 😉

I remain reluctant to invest in stocks. Like you so vividly painted that lovely “drunken” picture – we tend to go into a mild state of depression, whenever stocks take a dive. However, this is the nature of stocks, so we should not be surpised that it happens. – But we do. I think that’s just the nature of the human brain. We fail to see the 8 (almost) consequtive years of constant growth, once the stocks suddenly take a dive. Everything just becomes so god darn depressing when it happens! 😛

I’ve come to terms with that fact, which is why I’m reluctant to join that shit-show (sorry) 😛 For some reason, we have convinced ourselves that even though stocks go up and down, if you look over a large enough period, they will go up. Depending on who you ask, the average yearly growth of the stock market varies anywhere between 8-12% (as far as I remember). So one year it’s down by 10% (like this year!), and the next it’s up by 20%. I aim to have assets with a lot less volatility. I’d rather see a steady continous 2-3% growth per year, than be in that stock market rollercoaster to be honest (because I KNOW I will get depressed and start drinking – like you did 😛 – once the markets hit a rough patch).

So this is what I’m aiming for. I know it might be a bit out there, but I really don’t want to see a single year of negative growth in my portfolio…

Is that even going to be possible? We shall see! 😛

No cake for a whole month?! That’s insane! 😉

Yeah I wish I could say that I retire before 50. But it would require a SavingNinja thought experiment to come true 😉 Instead I focus on 60 or rather 59. Any year I can retire before will be a huge bonus! I just started the whole FIRE thing too late. Well, that’s not entirely true actually, but I’ve always looked at it through entrepreneur glasses: Turn a great idea into something tangible, earn a lot of money and retire. I’ve had a few ideas. I made a bit of money as well. But far from enough. It’s only in the last 4-5 years or so that I started to shift my attention to saving/investing. Well consciously that is as I have invested quite a bit by paying off the mortgage on my home.

I absolutely understand where you are coming from and that you rather go for a steady 2-3% growth than subjecting yourself to the volatility of stocks. As for me, I can live with having a ‘high risk, aggressive expansion’ corner in my portfolio (even though I do not consider my ESPP shares as high risk). For a few more years at least. But I will definitely consider moving more and more funds to safer assets as my risk tolerance drops (= as I get closer and closer to FIRE).

Your considerations/plans regarding real estate investments are interesting and I will follow you closely 😉 I had’t heard of imbro, but brickshare is definitely on my list.