January is my least favorite month of the year (it’s long, cold, dark and it seems like the Summer is never going to come back).

– But this part right here is something I look forward to every year!

I get to look back at the previous year, and zoom in on one of the pillars of my future retirement; My pension portfolio.

This is especially interesting, because it’s my longest running portfolio (going on year 15 now).

As the years goes by, it becomes more and more obvious that the “set it and forget it” strategy really does have its merits. I have not been great at doing that though, and as a result my pension portfolio has performed way below the market average for years. Luckily, my portfolio still has plenty of time to try to catch up, so I’m comforted by the fact that the returns matters less in the beginning of the accumulation phase. In the “early days” (I think we’re kind of passed that at this point 😛 ), the most important thing is to keep contributing to the portfolio. And I’ve managed that quite well, if I have to say so myself.

This year however (2021) has been the best year yet for my pension returns! Well that’s exciting! Did you finally manage to match the market average then?!

…No. I didn’t even come close! 😆

Looking back

Lets not get too caught up in the details here! The point is: I did pretty good (I think…). I did better than ever before (well that’s something at least).

But yet again, I fell short of the market average. My pension portfolio returned 13.9% in 2021.

Market average: 19% (MSCI ACWI).

OK, still not quite there, but at least I’m getting a lot closer, right!? 😛

So what happened this time?!

Well, for some reason I refuse to acknowledge the obvious fact that a guy my age (38), should simply just stick to a broad global index, and nothing else. But I’m a risk adverse kind of guy – there’s no denying it! 😆

So I’ve simply not been able to persuade myself to pursue this route of simplicity for my pension portfolio (I’m slowly getting there though!). I’m especially fond of properties and alternative investments, so part of my portfolio has been allocated towards these asset classes – which also did very well in 2021 – just not quite as well as the global stock index 😛

Meanwhile, I also have a large(ish) cash reserve that is parked in a “high-interest”-like product, which my provider call the “FlexFund”. The yield is guaranteed at 2% (nothing more – nothing less). I figured it wouldn’t be bad to have some cash reserves, given the current all-time high situation in the market. The problem with this approach though, is that we KNOW that one should not attempt to time the market, right? 😉

2% guaranteed interest in todays market isn’t bad though – it’s just very far from the market average (or so it turned out at least 🙂 ).

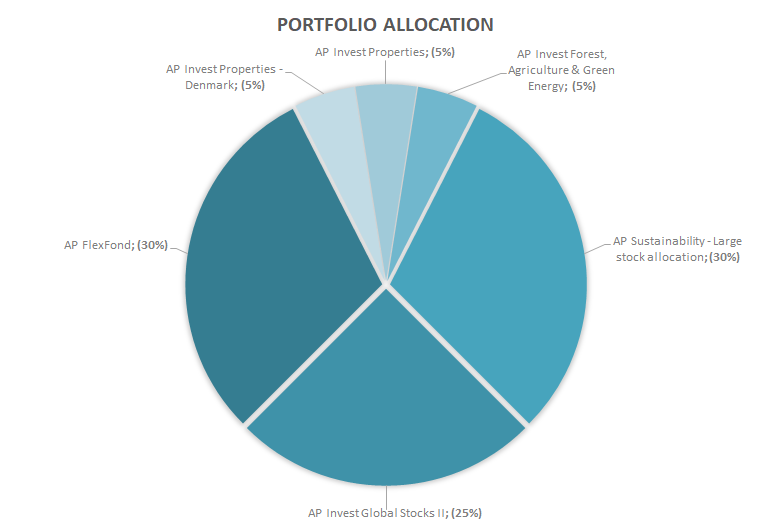

This was my “Pension portfolio – Asset Allocation Distribution”, going into 2021 (Provider: AP Pension):

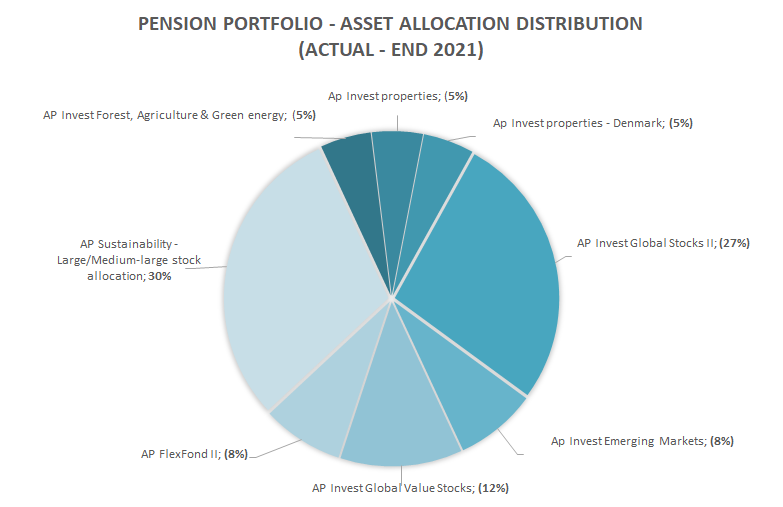

However, as the year progressed I realized that it was simply too conservative to leave 30% of my portfolio “stuck” at a 2% return (yay to me for realizing this!).

So I decided to put more of that cash to work, and selected two new funds (yea I know, still and idiot 😛 ) to replace the majority of the FlexFund allocation (left 10% allocation at that time). I added “Emerging Markets” and “Global Value” to the portfolio.

When 2021 was over, the allocation looked like this:

Going in- and out of a fund has a cost, so in retrospect it was not a great idea to be spreading my portfolio across that many funds – however, all funds but 1 returned a positive yield (Emerging markets). In retrospect, I should have probably just dumped everything into “AP Invest Global Stocks (II)”. This fund returned a staggering 27.49% in 2021.

Better luck next year, right?! 😛

Well, as the avid reader would know I have once again switched jobs, and this also means that I will be switching pension provider (again). (Un)fortunately, my new provider does not provide quite the same amount of options as my current one, so my AA for 2022 will look a lot more simple than that of 2021! (More on this subject later though 😉 ).

All in all, I’m quite satisfied with this years result (albeit, it can always be better, right?).

This is how my pension portfolio has developed over the years:

I gotta say, I absolutely love staring at these charts. 33% of the total portfolio value is now made out of pure returns. I can’t wait to see those next 10+ years added to the graphs 🙂

It’s clearly the magic of compound interest here, just doing its business 😎

Note that these charts are displayed AFTER tax, which in Denmark is 15.3% (only on our pensions though). So my returns was actually more than 2x my deposits. I would very much like to see more years like the one we’ve just had 🙂

Fingers crossed that the coming years will be just as fruitful!

Looking ahead

That being said, since my job situation has changed, my pension contributions are also going to drop dramatically in 2022.

My new job doesn’t come with a generous pension scheme (like my previous one), so I will only be adding 8% of my salary to my pension in 2022. I’m ok with that for now though. I can always choose to add more than the mandatory 8%, should I feel like it (it makes sense from a tax perspective, but for now I prefer to get a higher portion of my monthly salary paid out directly to my account – even though it’s currently very tax-inefficient).

My new pension scheme does not begin until March, and they have less funds to choose from than my previous provider. This most likely means that I will (have to) allocate the majority of my portfolio towards a broad world index. Finally, he came to his senses!

If one didn’t know better, one could get the idea that “The universe” is trying to tell me something 🙂

So, after almost 15 years, I guess it’s time to accept that the best I can do for my pension portfolio, is to keep contributing and look away 😀

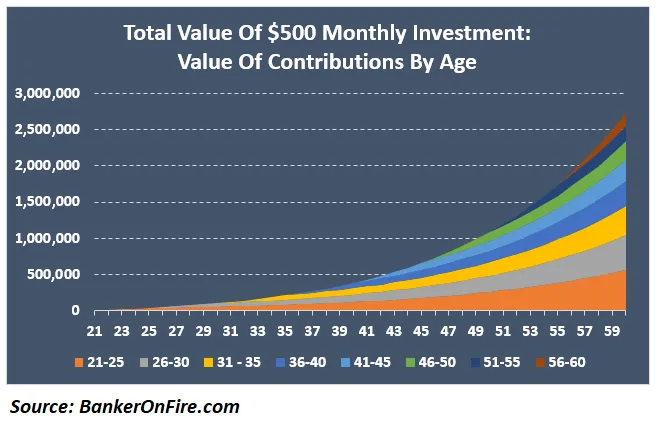

Which leads me to one of my favorite posts from 2021 by Mr. BoF! It reminded me that my snowball is already substantial in size, and that the most important contributions has already happened. This is one of the reasons why I’m perfectly comfortable, only adding 8% of my salary to my pension portfolio.

Mr. BoF poses this example:

From the age of 21 you add $500 to your pot every month, and invest it in a low-cost, diversified index tracker. Every 5 years, you increase your contributions by 25%. You continue this approach for 40 years.

After 40 years, this is how your portfolio will look:

Notice how the contributions matters less and less for the overall portfolio value, as time goes by. I’ve been contributing to my portfolio for almost 15 years, and I don’t plan on stopping, but I’m ok with having lower contributions for a while, because those first 15 years of deposits are already doing their work.

The main lesson here is thus to start early, and to put in as much as you possible can in the beginning. Your contributions will matter less as time passes and the magic of compounding does its – well, magic 😉

In conclusion

Once again, I did not manage to match the average market return. It was however the best year yet for my pensions portfolio, so I’m still pretty satisfied 🙂

To no-ones surprise, the wife beat me by a margin – again. She actually managed a return that matched the market average. When I say “she”, I mean her provider. She doesn’t spend 5 minutes worrying about her pension. She just lets them handle it…

So what can you learn from that, Nick?! 😛

I guess it’s time for me to get out of the way, and stop worrying about it. Just dump everything into a low-cost, diversified index tracker, right?

Be sure to check back in another year. – We will get to see how it all played out! 😎 haha

How did you do in 2021?