That’s right. You heard it here first (not really), people! The main trait you really need to become a decent investor, is time and consistency.

We’ve all heard (or read) the term “Time in the market beats timing the market”. I’m not a big fan of this saying to be honest, but I understand the message that it’s supposed to convey;

If you have money that you are willing to invest, do it now rather than later.

It doesn’t matter which asset(s) you choose to invest your money in – as long as you believe it will yield a decent return (and compound on a regular basis, preferably). As long as you invest in something you’re better off than if you invest in nothing (or worse; buy new cars and expensive gadgets on a regular basis 😛 ).

Once you’ve chosen your favorite investment object(s), make sure to keep saving and investing in that/those objects consistently. It doesn’t matter if you invest monthly, quarterly, yearly or even bi-yearly. Just keep throwing those benjamins at the pole, like it had a first-class stripper twirling around it! Why? Because the only force stronger than THE FORCE (yes, that was a Star Wars reference) is The Force of the Compound.

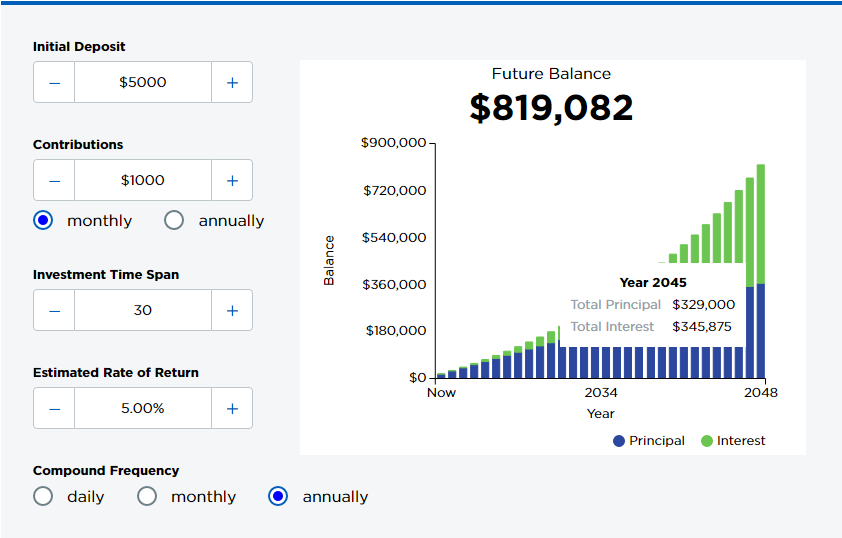

If you were to invest $1000 per month for 30 years at an average interest rate of 5%, you’d end up with more than $800.000. But here is the kicker (this never cease to amaze me!): more than HALF of those $800.000 are “earned” by interests alone. In fact, after 25 years the total interests will surpass the total principal. This means that if you were to simply place those $1000 in a bank account at 0% interest rate (instead of investing them at 5%), after 30 years you would only have $365.000 in your bank account.

So, in case you are (still) telling yourself that you can’t afford to invest anything. – The question you should really be asking yourself is: Can you really afford not to invest?

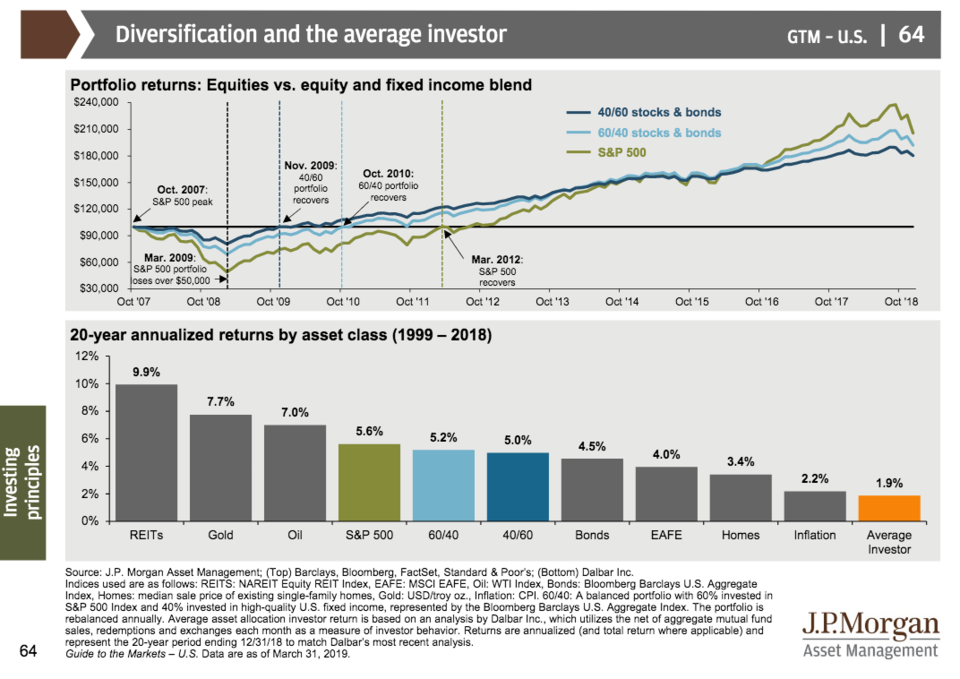

Yes, but 5% is not that easy to hit in todays market, Nick!

Really? Seems like all you really need, is time and consistency 😉

I was actually pretty surprised to see these graphs myself. Look at those REITs, huh!? Note that the period is 1999-2018. Remember the .com crash and the “little” financial crisis in 2008-2009? (of course, history does not provide any guarantees for future returns). I’d probably shy away from Oil though…Perhaps the 2018-2038 graph will have Renewables in there instead? Who knows 🙂

Regardless, historically it seems you have a fairly big selection of assets, which will provide you with an annual return of 5% (or above). So how come the average investor only manage a measly 1.9% you ask?

Because the average investor lack the most important trait to become more than average: Consistency!

Avoid acting on your impulses and emotions, and keep consistently investing in <insert your favorite asset class here>. Oh, and one last thing: If you fail at consistently being consistent, at least diversify for Christ sake! 😛

So, what did we learn today, kids?!

Invest today, not tomorrow. Pick your asset(s) and continue investing in them on a regular basis. Let time (and compounding) do its magic!

Congratulations! You’re now on the path to becoming a decent investor 😉

Geek out on some (alot) more graphs from JP Morgan here:

Geek out on your own compound interest calculations here:

https://www.nerdwallet.com/banking/calculator/compound-interest-calculator

Great thing to remember. I really got the idea after reading Rich Dad, Poor Dad that the important thing is to have money working for you.

To bad that I am 35 years old -should have known this when I was 20 🙂

You and me both, brother! But you know what they say: Better late than never 😉

Story of my life. Started investing 6 months ago at the age of 36

And ended up reading Rich Dad, Poor Dad as well.

Thanks you for the uplifting article Nick, it soothes my soul a bit 🙂

Inspiring read Nick, thanks!

Can you do a post about REITs? 😀

Hehe, I could – but the truth is, REITs are just as volatile as stocks, and the reason for them moving in one way or the other has proven (at least to me) even more difficult to explain, than regular stocks :S

They are an easy and simple way to get Real Estate into your portfolio (and they can be a good source of dividends), but I don’t think I will expand my REIT portfolio anytime soon (in fact, I just sold one this month). I prefer the more local Real Estate projects, where you have much more control over, how you choose to use/distribute the profits 😉

You’re doing pretty well with your current portfolio though! 😛

The best time to start is now!

It amazes me how much investing generates capital gains in the long run. Yet, so many people don’t do it..

Looking at the graph, it’s very clear that you don’t have to be an investing guru and know every little detail if you want to make gains. There are many ways to glory 🙂

– FN

Yeah, we definitely need to make Investing SEXY somehow! 😛