Another month, another update! 🙂

I’ve been pushing this update in front of me in hopes that there would eventually be some good news to share!

Alas, there is not.

Here we go…

The month in review

On September 25th I’ve been writing on this blog for 4 years. In preparing for my “4th birthday” post I’ve been reading through some of my older posts. Like many of my peers have experienced, there comes a time where you start to contemplate whether it makes sense to continue. At this point in my journey I’m kind of running on auto-pilot and it’s seldom that there’s “big news” to share on a monthly basis. This month is no different; No major events/new investments and I’m here to report ANOTHER red month (which makes it #5 / 8 months this year). What a crappy year we’ve had so far!

Well, it’s part of the game, people! It doesn’t help much on the “loss aversion”, but I find that it helps a little to remind myself that the market always run in cycles, and I’m sorry to remind you of this (damnit), but it’s not looking very bright at the moment. I found this chart from Lance Roberts and I think it frames the current situation pretty spot-on (note that this chart is about 2 years old):

He re-iterated this 2-year old prediction in an article this week titled “Recession Signals Abound as Fed Hikes Rates”.

I try not to listen/read too much from the Mainstream Media, as it kind of puts you in a state of “constant alert”, as the news are always “doom and gloom”-style journalism. So it occurred to me that I don’t actually know what angle the media is currently spinning (except that they talk a lot about the energy crisis and we’re approaching an election in Denmark too, so there’s a lot of political sales-speeches going on at the moment). Anyway, I predict that the word “recession” is going to start trending in the MSM pretty soon. Which is why I’ve started to hoard cash. Just in case 😉

Just in case what, Nick?!

Well, just in case there’s a fire-sale in the not too distant future 🙂

There’s another graph that I like to study from time to time, as it gives you a good indication of “where the markets are heading” (remember: Nobody can predict the future – especially not by looking at the past):

31% higher than the long-term trend line. Ouch. I’m trying to mentally prepare for another handful of RED months in the near future :-S

Anyway, enough of this future-guessing bullsh**. If you believe in your investment strategy, you stick to it and ride out the storms, right!? 😉

Right…

Aaanyway, I managed to tuck away a decent chunk of cash this month, and the passive income was pretty standard too (main passive income currently generated from a handful of Canadian dividend stocks). I’ve been wanting to add another dividend stock for a while, but I’m hesitant to put my cash on that roulette right now, having just concluded that we’re most likely staring at a looming recession (maybe? What do you think?! Hit me up in the comments below!).

Just reminding everybody (and myself!) that I’m awaiting the first major dividend-payout from Property #1 in October 2023. I’ve been waiting on that payout for 3 years now, so I’m determined to keep this blog alive to at least share the day that this (hopefully!) happens. Currently equity is building up each month in the property, as the mortgage is paid down by the cashflow. It currently yields a return of around €7,000/year, which I could/should technically add to the value of Property #1 on my balance sheet, but I prefer to not write up the value of the property until I actually see the money in MY bank account…

No update from Celsius this month, so we still don’t know what’s going to happen to our coins there (but I’m not counting on being able to retrieve them anytime soon).

The pwetty graphs

The boooring income statement

| Platform | Invested | Transactions | Last month | Current value | Monthly income |

| Commodities | |||||

| GOLD (Coins) | € 5,333 | € 0 | € 6,000 | € 6,000 | |

| € 6,000 | € 6,000 | ||||

| Stocks (Dividend portfolio) | |||||

| Bank of Nova Scotia (BNS) | € 1,000 | € 0 | € 1,490 | € 1,346 | € 0 |

| Granite REIT (GRT.UN) | € 3,859 | € 0 | € 3,087 | € 2,767 | € 4 |

| PROREIT (PRV.UN) | € 2,018 | € 0 | € 4,422 | € 4,332 | € 19 |

| Toronto Dominion Bank | € 1,000 | € 0 | € 1,081 | € 1,129 | € 0 |

| TransAlta Renewables (RNW) | € 2,000 | € 0 | € 2,746 | € 2,532 | € 8 |

| True North Commercial REIT (TNT-UN-T)* | € 3,552 | € 0 | € 3,828 | € 3,383 | € 20 |

| € 16,654 | € 15,489 | € 51 | |||

| Stocks (Indices) | |||||

| iShares Global Clean Energy (IQQH) | € 6,667 | € 8,221 | € 8,368 | € 0 | |

| iShares MSCI World Min Volatility (IQQ0) | € 4,417 | € 5,432 | € 5,309 | € 0 | |

| Xtrackers MSCI World ESG (XZW0) | € 2,721 | € 2,549 | € 2,421 | € 0 | |

| € 16,202 | € 16,098 | € 0 | |||

| Properties | |||||

| Property #1 | € 68,667 | € 0 | € 68,667 | € 68,667 | € 0 |

| € 68,667 | € 68,667 | € 0 | |||

| Crypto | |||||

| Celsius (ADA, BTC, DOT, ETH, MATIC) | € 0 | € 426 | € 426 | € 0 | |

| Binance (ATOM, FTM, LUNA, ONE) | € 0 | € 50 | € 70 | € 0 | |

| Nexo (BTC, ETH, MATIC, EURx) | -€ 2,040 | € 3,810 | € 1,770 | € 25 | |

| € 4,286 | € 2,266 | € 25 | |||

| Cash | |||||

| Bank #1 cash (main savings) | € 2,000 | € 3,733 | € 2,000 | ||

| Bank #2 Opportunity money | € 2,040 | € 16,358 | € 2,040 | ||

| Broker account (CAD, EUR, DKK) | € 51 | € 150 | € 20,292 | ||

| € 20,241 | € 24,332 | ||||

| Total balance | € 132,050 | € 132,852 |

I’ve pulled some € from Nexo this month and moved to my “cash stash”, which is reaching record highs (almost) every month. While it’s obviously not a good idea to pile cash in the long run, it feels good to have some “dry gunpowder” in case some nice buying opportunities should arise in the wake of the current…situation 🙂

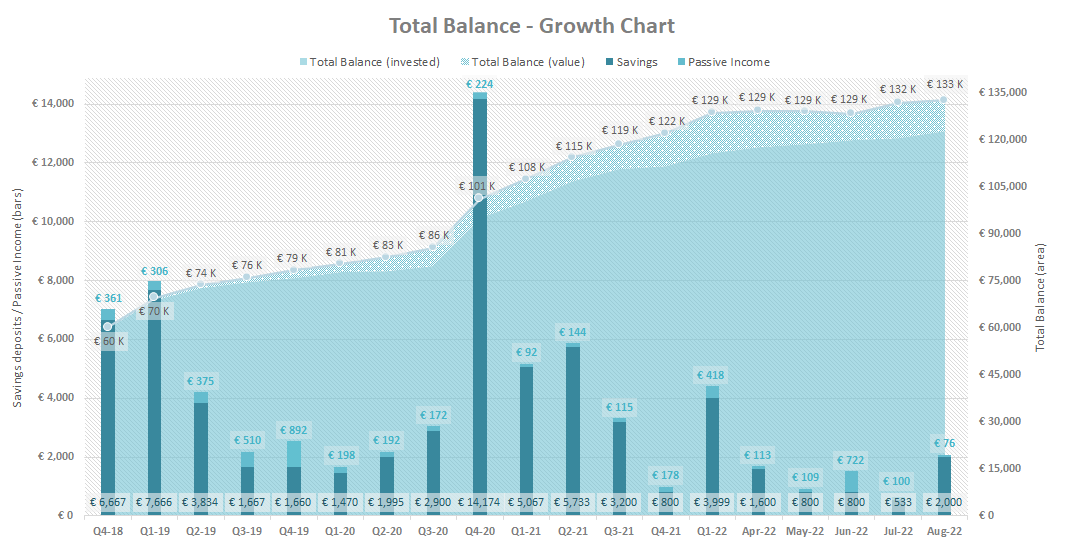

The Classic Growth Charts

As always, I include the Classic Growth Charts for tracking purpose.

It’s a little depressing to look at the Total Balance progress since Q1-2022…

In Conclusion (TL;DR)

Yawn. OMG. What a bore. Another red month. Blah.

I’ve concluded that at this point a recessions is inevitable (do you agree? Yes/no – hit me up in the comments below!), so I continue to hoard and stash cash (they are good for a rainy day you know 😛 ).

See you next month!

If you stop posting, you’ll have to continue to send me a monthly update via email anyway, so you may as well do it on your blog!!

Before quitting, try cutting out everything that doesn’t add value to you. Slim down your posts and treat it like a journal entry, it’s OK to have months where you just post a paragraph or two – some months you might want to write/rant more 🙂

You must be excited to see the first dividend of your property investment, so long in the waiting! I remember when you posted about it. How’s the search for Property #2?

I really haven’t watched any news, but it felt like the dip was starting to be over. I do think you Europeans are fairing worse than the US however, and my portfolio may be skewed in dollars as GBP declines. I just hope my company stock stays this low until next year as I should have a stock grant refresh in December! (My first stock grant is worthless now :D)

Ha! I will be sure to keep you posted

I think part of it is because of the horrible market direction this year. It’s just really no fun to keep reporting one red month after another! But it is part of the game, and I think I would be a really bad example for the community if I gave up because I couldn’t handle the roller coaster

So thanks! I will try to cut down on the fluff.

Property #2 is out there for sure! I just have to find it. Interest have skyrocketed here (from 0.5% to 5%). I’m expecting the prices to begin declining in the coming months/years – so will be sure to keep my eyes open for great deals!

How can your first stock grants be worthless? I’m sure it can’t be that bad