Since I started this blog back in September, the monthly updates has been my absolute favorite posts to write. They basically write themselves, right? So, what happened in January 2019?

I have to be honest with you: I hate January. January is my least favorite month of the year. It’s cold, dark and summer and daylight in general seem like so far away, that even dreaming about it makes me uncomfortable. It’s the longest month of the year! (or so it feels, anyway…).

This particular January should turn out to be one of my least favorite of all times (now that I think about it, all the bad shit that ever happened to me, always happened in January – or so I remember it anyway…). Luckily I now have two different perspectives to view my life – a financial and a personal – and much to my surprise, January turned out to be a record-breaking month in terms of passive income (thanks to a little help from my friends! 😉 ).

Enough jibber-jabber – let’s get to the good stuff!

Not so fast! I wasn’t done wallowing in self-pity…

The reason why this January was awful (on a personal level) was due to the fact that I had to empty the wife-credit bank, in order to survive a devastating round of the man-flu. It was no ordinary man-flu, no sir. – It was the worst kind. Brought home from a foreign country, after a 3-day business trip to the middle-east.

I don’t really like travelling that much (especially not for business), but i tried looking at it with a positive mindset. 3 days with the possibility of getting some sun and maybe even a swim in January – that doesn’t sound half bad, does it?! It was OK, the problem was I had been pushing a case of the sniffles at an arms length ahead of me, and once I got back from my trip and started decompressing from all the “stress/pressure” of travelling, my body just decided it was time for some illness! Yay! First my stomach just called it quits (thanks to the middle-eastern cuisine, no doubt) . I didn’t eat (or poo) for 3 days. But that was just the beginning. Oh man, I’m still not completely recovered after more than 1 week on the self-pity train, binging “Comedians in Cars – getting coffee” on Netflix and coughing my lungs out every 2 minutes.

Anyway, It’s time to get off the pity-train! It’s a numbers game now, and while the better part of January seem a bit hazy to me, it’s now behind us! Thank God for that. It turns out I have made some new friends too! Two people signed up to invest with Envestio via my affiliate link and have both started investing. One of them I know (he’s a close friend, who wanted to try out this whole crowdlending mumbo-jumbo) but the other one I have no idea who is! And he invested quite a decent amount of money, so thank you very much for that! 🙂 I hope you enjoy it! (Do hit me up in the comments if it’s you 😉 ).

Because of the generous bonus scheme at Envestio I made €27 from the bonus program in January! That is pretty awesome. Thanks a lot for the support, it’s much appreciated 😉

Also, because of the man-flu situation, I didn’t have a whole lot of time to spend any money in the 2nd half of January, so I’ve added a nice little chunk of cash to my savings this month. More than €1300 actually, which is just shy of 1/3 of my net income. I’m quite pleased with that. So without further ado, here are the numbers from the man-flu month of January 2019:

| Platform | Value last month | Current value | Change (+/-) | Change (%) | Expected yearly return |

| Bulkestate | € 3.525 | € 3.525 | € 0 | 0,00% | 14% |

| Crowdestate * | € 201 | € 301 | € 0 | 0,00% | 11% |

| Crowdestor * | € 201 | € 405 | € 4 | 1,99% | 15% |

| Envestio * | € 3.144 | € 3.124 | € 80 | 2,54% | 16% |

| Estateguru | € 201 | € 202 | € 1 | 0,50% | 11% |

| FastInvest | € 200 | € 202 | € 2 | 1,00% | 14% |

| Grupeer * | € 1.020 | € 1.072 | € 12 | 1,18% | 13% |

| Mintos | € 926 | € 936 | € 10 | 1,08% | 10% |

| € 9.418 | € 9.767 | € 109 | 1,16% | 13% | |

| Bank #1 cash (main savings) | € 38.666 | € 40.000 | € 1.333 | 0,70% | |

| Bank #2 cash (emergency fund) | € 13.333 | € 13.333 | 5% | ||

| € 53.333 | |||||

| Total balance | € 63.100 |

Operation diversify has commenced, as I managed to move some funds around to pad my investments further at Crowdestate, Crowdestor and Grupeer. I will continue to favor the platforms with high yield and buyback guarantee (which Crowdestor currently does not have, but the rumors say they are working on it) . This however does not really include Estateguru, so I’ve decided to hold off on investing further on this platform. Something odd happened in the beginning of January, and since the average yield is closing in on 10%, I think there are better alternatives out there. I had invested in a loan and then I suddenly got this message:

The #4093 bridge loan will be closed due to reasons beyond EstateGuru’s or the borrower’s control. Despite this, the borrower will pay 12.5% p.a interest to all investors for the period between the end of the syndication period and today, 3rd of January 2019.

That was it. OK? I decided I would write them to get some more info, but I never got around to it, and now I feel I can’t really be bothered. I had been looking at their loan-list (which is quite extensive) and noticed quite a few that had defaulted. They are not making it easy to export the loan list, and have now changed the layout, making it even harder to “discover” the defaulted loans. Seems a bit fishy to me 😉 I calculate their total default rate to just above 2%, which I guess is not bad. I’d prefer to avoid defaults altogether of course, but this proves that this type of crowdlending is not without risk. Hopefully most of these defaulted loans will be recovered, but they’re not making it very transparent, so it’s hard to tell. This stuff should be on the front page, if you ask me 😉

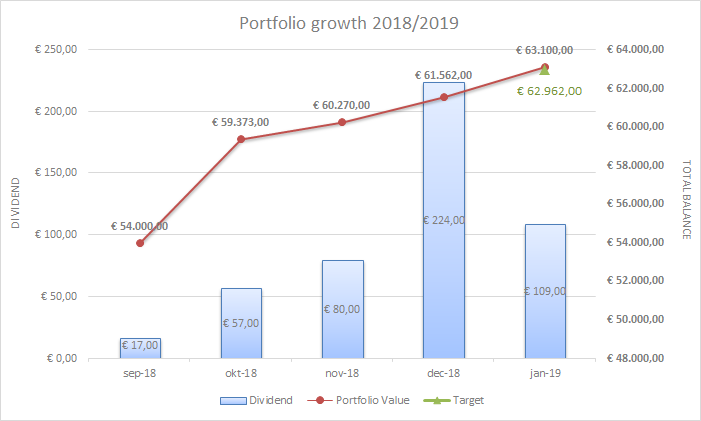

Anyway, I managed to net a total profit of €109 on my crowdlending investments in January (this is including the bonus payments). I’m quite happy with that!

The diversification of my crowdlending portfolio now looks like this:

Still a little lopsided, but by the end of February I’ll get my first principal repayment at Envestio (€500) so I will be able to diversify more in March. Perhaps even, add a new platform to the roster!?

I’m still holding on to a huge pile of cash, so it would be nice if brickshare.dk or imbro.dk could come up with something interesting for me to invest in. The future will tell – I’ve kind of gotten a hold of that whole impatience thing I was battling a while back. I’m Mr. Patience now! (That’s a lie…).

So, how does this all put me in terms of the big picture?

I’m currently €138 above my target for the year! (year end goal is €78.323 to stay on track to reach my Total Balance goal within the next 13 years). Despite of the man-flu incident, this was a good month after all!

See you next month! – Remember to stay safe, and eat your vitamins!

January and February are my least favourite months as well. It’s just so cold and dark, and the fun time of Christmas is over and spring is still 2-3 months away. I feel your pain!

Maybe you’ve covered this before, but is there a reason why you have invested so heavily into peer-to-peer lending, rather than the usual advice of index funds? I have only recently dipped my toe into trying out P2P, investing £1000 with Ratesetter, but don’t want to invest too much too soon as they seem even riskier than the stock market to me. The UK already has a lot of uncertainty at the moment thanks to Brexit, so I don’t want to compound that risk even further!

Hi Dr FIRE, thanks for stopping by! 😉

About 15% of my Total Balance is currently allocated towards crowdlending. The rest is currenly awaiting a local REIT-like opportunity.

I’m in DK, so Brexit doesn’t scare me that much 😉 In fact I’m fairly sure the £ is going to come out stronger (long term). Perhaps now is the time to gamble with some £ investments?

Ideally I would want 10-15% of my portfolio to be in indexes, but for now I have yet to bet on that branch. I like the transparency of my current crowdlending portfolio – it’s poviding a steady stream of passive income, unlike the stock market, which is extremely volatile (just look at what happened in november/december).

Slow and steady wins the race is not my mantra… 😉 I’m more of a “fast and loud” kind of guy 😛

Hey Nick, congrats on your bonus payments from Envestio! That’s a good motivator and must have eased the momentary state of self-pity due to the man-flu crisis 😉

I have yet to make new friends 😉 …but I guess I have to begin putting my money where my mouth is.. and actually invest real money in the various platforms… not only talk about it 😉

Remember to pay off any debts in the wife-credit bank in February! 😉

Yes, the interests in the wife-credit bank is insane 😉 You don’t want that debt to linger around for too long! 😛

Envestio has become insanely popular – I think primarily because of that huge bonus fest. Just look at how much Jørgen is bringing in on that account alone. It’s crazy, but obviousy it’s short lived. I don’t imagine they will keep up that bonus program, once they have a steady amount of investors.

I’m now hoping for crowdestor to come up with something similar though. I think they could be the next big ting. Their projects resemble the first projects at Envestio a lot…

Haha, I like the way you turn the man-flu into an humorous text. You got me laughing for a while!

January didn’t treat you that bad at the end, congrats on your bonus, you well deserve it.

I will make sure I take my daily vitamins from now on 😉

Enjoy your short February vacation, I am also taking a short brake soon.

Congrats on a great month, Nick! I also hate January. It’s like that month of the year moves slowest. I’m glad to see you are still blogging frequently. Most bloggers quit within the first year, so now you are almost half-way! 😉

Thanks, Carl! I have been feeling a bit of the dreaded “bloggers fatique” lately, I must admit 😉 However, if all else fails I will just continue to do the monthly updates at least. It really was a bit of a crazy month. The best thing about January, is that it preceeds February! 😛 The shortest month of the year, and this year we’re going on vacation in the middle of February, so something tells me that March is going to come soon this year!

Given my recent “brush with death” I am however worried that I won’t recover fully, before my body has to endure another middle-eastern trip. Fingers crossed that it all goes well.

How is your mini-retirement treading you? 😉

Don’t worry. I’m also fatiqued once in a while 🙂 then I use my good periods to write lots of content and schedule it ahead. This way I’m not feeling guilty in the periods I’m not writing.

Mini-retirement is a dream! 10/10 recommend it 😉