Hello dear readers and followers!

Guess what?! – You guessed it 😉 Another month has gone by, and it’s thus time for the obligatory monthly update that we all love so much (I personally love both writing them and reading them).

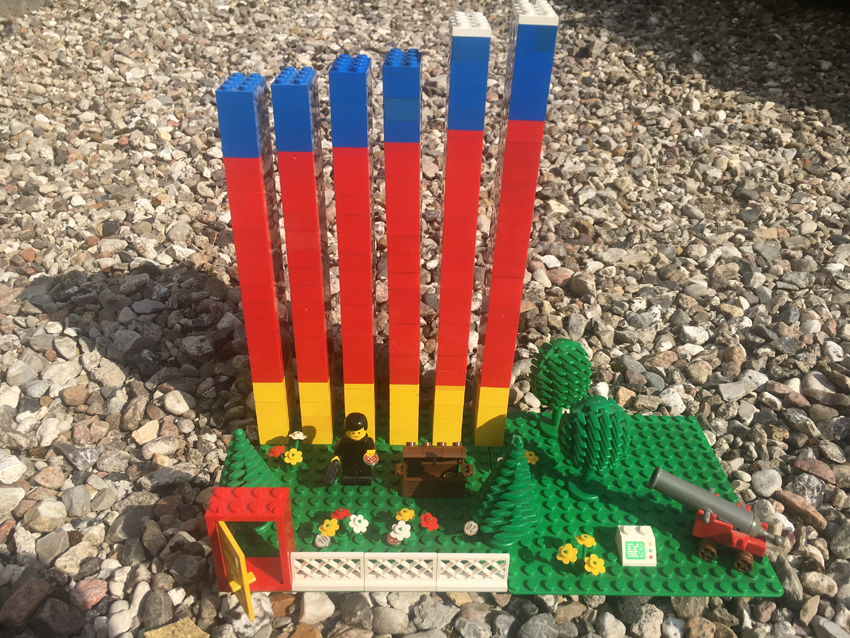

As you might have already noticed, this month debuts a whole new character to the Total Balance universe! Inspired by Marc from financeyourfire.com (thanks, Marc!), I decided to build a physical representation of my Total Balance progress (together with my 4 year old of course). Being Danish, I could not think of anything more befitting, than to build it out of: LEGO!

Give a warm welcome to Russel – the new mascot of the Total Balance blog! I’m sure we will do great things together! Be sure to follow his shenanigans every month going forward 😉

Anyway, enough mumbo-jumbo – let’s look at the numbers for April 2019!

(EDIT: Infogram removed due to license restrictions on the free version of Infogram. Only the latest 10 months will be live Inforgrams.)

I just noticed that I had forgot to add the two new platforms in the Infogram in the March update, so they have been added now in the April update (even though they technically arrived in March). I know I said future updates wouldn’t contain Live infograms, but I changed my mind (for now). Since I use the free version there’s a limit to how many “projects” I can have, so eventually I will transform the live Infograms to static images (will probably keep 3-6 months live, and anything older will become static images).

Total Portfolio – Table overview

| Platform | Invested | Deposits / Withdrawals | Value last month | Current value | Cashback & Bonus / Fees & Commissions | Return | Change (%) | Expected yearly return |

| Bulkestate | € 3.525 | € 0 | € 3.525 | € 3.525 | € 0 | € 0 | 0,00% | 14% |

| Crowdestate | € 700 | € 0 | € 701 | € 703 | € 0 | € 2 | 0,28% | 13% |

| Crowdestor | € 900 | € 0 | € 915 | € 927 | € 0 | € 12 | 1,29% | 16% |

| Envestio | € 2.450 | € 0 | € 2.784 | € 2.867 | € 35 | € 48 | 1,67% | 16% |

| Estateguru | € 100 | € 0 | € 104 | € 105 | € 0 | € 1 | 0,95% | 11% |

| FastInvest | € 400 | € 0 | € 407 | € 411 | € 0 | € 4 | 0,97% | 14% |

| Grupeer | € 1.140 | € 0 | € 1.205 | € 1.218 | € 0 | € 13 | 1,07% | 14% |

| Mintos | € 900 | € 0 | € 957 | € 967 | € 2 | € 8 | 0,83% | 11% |

| ReInvest24 | € 1.000 | € 0 | € 990 | € 990 | € 0 | € 0 | 0,00% | 13% |

| Viventor | € 400 | € 0 | € 401 | € 405 | € 0 | € 4 | 0,99% | 13% |

| € 11.515 | € 0 | € 11.989 | € 12.118 | € 37 | € 92 | 0,77% | 14% | |

| Stocks | ||||||||

| Pro Real Estate Trust (REIT #1) | € 910 | € 0 | € 996 | € 915 | € 5 | 9% | ||

| Realty Income Corp (REIT #2) | € 60 | € 60 | € 0 | € 62 | € 0 | 4% | ||

| € 977 | € 5 | |||||||

| Cash | ||||||||

| Bank #1 cash (opportunity fund) | € 1.600 | € 43.333 | € 44.933 | 0,70% | ||||

| Bank #2 cash (emergency fund) | € 13.333 | € 13.333 | 5% | |||||

| € 56.666 | € 58.266 | |||||||

| Total balance | € 69.651 | € 71.361 |

I didn’t make any deposits or withdrawals from my crowdlending platforms this month, so nothing major happened here. The returns were thus pretty average (which is a good thing!), and together with a few bonuses I managed to squeeze out a new record return on my crowdlending investments of € 129. I have a few loans maturing at Envestio in May and June, so I’m going to continue “operation diversify” in the coming months. I’d like to see a fairly even spread of around € 1.000 on each platform (maybe I will even add a few new platforms to the roster, who knows?! 😛 ).

I’ve been teasing about Property #1 for a few weeks now, and unfortunately it didn’t make it into the books in April. I’m expecting the deal to close by the end of this week, so I will keep you posted on the progress 😉 I can already reveal that it’s going to make a serious dent in my cash reserves; as in I will have to pretty much empty the bank (and then some), to get Property #1 on the roster. More info coming, as soon as the deal is finalized 😉

Before Property #1 appeared on the horizon, I had pretty much decided to invest a little cash in another REIT, but since I’m gonna have to break the bank to secure Property #1, I decided to hold off on that investment. I did have a little cash on my SaxoInvestor account, so I decided to purchase a single share of Realty Income Corp. Yes, I’m weird, I know. This will allow me to track it closely, and I do plan to buy a few more shares of that particular REIT in the future (I’ll wait for another drop in the price though, which seems to happen occasionally) 😉 It doesn’t pay anywhere near as good as REIT #1, but it’s considered a fairly safe long term investment.

Then there was also the little matter of Brickshare, which I was also planning to invest in. This plan has also fallen victim of the before mentioned Property #1 deal 😉 – So, I didn’t invest with Brickshare this month, but I am still planning to at one point. For now though, I feel that residential real estate (especially in Copenhagen) is very overpriced, so I’m not in a rush to invest in Copenhagen at this point in time. I prefer the “smaller” growth cities, which Brickshare unfortunately doesn’t have any plans to go into (I asked them).

My contribution to my savings this month was a bit above average, which keeps me way above my target for the year. I have planned vacation in June and July, so those months will be expensive (on many levels), so I doubt I will be able to contribute anything significant to my savings in those summer months – so it’s good that I’m 3 months ahead of my target right now! 😛

I’ve been blogging for more than 8 months now, and I have to say it’s quite satisfying to look at the progress that I’ve made so far. My Total Balance has grown more than €18.000 in 8 months, and I’m now almost 18% of the way, towards my level 1 FIRE goal (lean FIRE).

Since I started tracking my Total Net worth that has also grown significantly, this month seeing a growth of more than €7.000. The big leap is mainly due to my Pension having a good month in the stock market. I’ve now changed my Pension portfolio to a more defensive strategy, so I do not expect the same kind of growth going forward. I do however expect a slow but steady growth during the next couple of years. We shall see what happens there, whether I made the right choice or not. I’m currently feeling pretty good about it, but I’ll admit: I will be the first person to whine, if the stock market continues to grow at the same pace, which it’s been going since the beginning of 2019 😉

That’s it for this months update, folks! Hope to see you again next month!

Whoa, whoa, whoa!? No blog stats or shoutouts this month, Nick?

Erhm…No 😛 I’ve been busy, so I haven’t really had the time to read a whole lot of posts this month.

OK OK, maybe just one then!

This post from M @ Radical Fire really made me think about “making good decisions”.

I’m awful at spending a lot of my precious “compute power” (brain power), worrying about stuff that I really have no influence over, so I often cite this mantra to myself: Don’t worry about stuff that doesn’t worry about you. The post also kind of inspired me to write about my relationship with a scale. This is really why we all do this, isn’t it? – To inspire others.

So thank you for that, Radical Fire 😀

Well, now you’ve got me started!

I did read a couple of other posts that really had my wheels spinning. There’s this one from Cheesy Finance, about enjoying your journey, and not regretting the time you’ve spent (wasted) not knowing about the FIRE. If FIRE is your destiny, you will discover it in due time (these are my words, not theirs). I sometimes regret that I didn’t discover the FIRE movement 10 years ago, but then again; I’ve enjoyed my life for those 10 years, so there’s really nothing to regret! 😉 This post also introduced me to a new acronym that I hadn’t seen before: H.O.T (Happy – Opportunity rich – Time rich). I like it! So now we can strive to be HOT and on FIRE! 😛

That then leads me to this post from Miss FF (Fretful Finance) AKA The Sanguine Saver 😛 About being jealous of others (primarily their financials), which I can definitely relate to.

Congrats on finally making that flat purchase, Miss FF! I hope you enjoy it 😉

About the blog statistics: Aprils traffic was very similar to March, so unless something major changes (for better or worse) I’m not going to report about it on a monthly basis 😉

So, that was my monthly update! How did you do this past month?

Hello Nick,

have to agree with the comments above, your presentation is awesome again.

Looking forward to your next big move, you have lots of cash aside.

Good luck.

I like the distinction between opportunity and emergency fund. 🙂 Where does the 5% of the emergency fund come from?

By the way, what do you use for the charts? I’m keen on replacing my Excel screenshots for asset allocation.

My emergency fund is placed in a local bank, which offer 5% interest on the first €6.666 that you place on your regular salary account (this means your paycheck has to land on the account). My wife and I each have one of these accounts. Unfortunately, They’ve just announced that the interest will be lowered to 3%. That’s really annoying, since we recently switched to this bank to gain this small advantage. Anyway, the Property #1 deal is going to clean out my bank accounts anyway, so It’s going to be a little while before my emergency fund is replenished again (it was an absolute emergency to get Property #1 into the portfolio! 😛 ).

The graphs are made with infogram.

I’ve just realised that your numbers and mine are very similar now, including our investment portfolio and network.

I’m also in a defensive approach in regards to the stock market. This game is always full of surprises, but time will tell whether we took the right decision or not.

Looking forward to seeing how your property number 1 deal develops and how much we (readers) can learn from it. Also glad you are on target for this year, well-done Nick!

I can Imagine that you’d lean towards a defensive approach after having to write off those algotechs money 🙁 glad you put that behind you! It will be interesting to see how we fare going forward 😉

The Property #1 deal was closed today! Will post about it soon 😉

I have to say Nick these graphs are amazing! I’m a lazy person – who loves excels and graphs but doesn’t take the time to set them up properly. Your graphs are a true inspiration.

I’m happy to hear that my article got you thinking. “Don’t worry about stuff that doesn’t worry about you” is a great mantra to have!

Also, you’re doing a great job with your diversification strategy in crowdlending. I’ll check those platforms out, do you have any review posts or affiliate links I can use when I decide to go for it?

Hi M!

Thanks for your kind words – I’m glad you enjoy the art work 😛 I can’t take full credit though – I was inspired by the P2P-millionaire.com, who first introduced the infograms. I just copied the idea from them, and extended it a bit 😉

I was a graphic designer in my early days, so I really enjoy playing with this kind of stuff. Once It’s set up, adding the new monthly figures is really simple, and takes about 5 minutes to do.

I can send you a few links (I dont do review posts, as it seems there are already plenty of those out there), but I’m really awful at selling myself via affil links, so I try not to push it on people 😉 the p2p millionaire is a great source of knowledge for crowdlending, and I also follow financiallyfree.eu, who’s also got some really good posts on the individuel platforms.

If you’re contemplating adding it to your portfolio I would advise you to stick to the platforms that offer (a form of) buyback guarantee and also has a secondary market (so you can sell your investments if you want to get out). Few of the ones I use have these two traits 😉 – but you live and you learn!

Nice Lego project you have there Nick! And welcome Russel to the FIRE community! 😉

You seem to do great with the crowdlending diversification/expansion. And you make great progress with accumulating wealth. Quite impressive what you are achieving 🙂

Oh yes..and I love the live infographics!

Thank you! I’m curious myself to learn what Russel will do with his new found 15-minutes of fame 😛

So far, I’m happy with the crowdlending, and I plan to keep doing it, to fill that time between my big property investments. When Property #1 land on the books, it will be quite some time before I’m able to add Property #2 🙁

So I need something to keep me busy in the meantime 😛

Are you not considering cashing out on some of those gains in your Company Stock? 😉

“Are you not considering cashing out on some of those gains in your Company Stock?”

I consider it all the time! And each time I do the stock reaches new record highs. It is like being in a casino and not knowing when to stop 😉 But there is no doubt I will begin to ‘skumme fløden’ pretty soon. I have some things to get straightened out (tax-wise) before I will make that move however.