Much like your clothes, your friends, your pet(s) and your means of transportation says something about who you are, so does your budget…

When I talk to people about my FIRE project (it happens a lot, according to my wife), they often react as though I’ve just told them that they can’t have coffee again. Ever. Are you crazy?! Why, Nick?! WHY?!

Then I try to explain that I’m not trying to deprive myself of life’s luxuries. I’m merely trying to optimize my life and my time. Whenever I choose to buy something, I’m essentially paying for that item with my time (time that I’ve spent at work, earning that money).

Then they argue that it can’t possibly be worth it, living “on a rock” (I never really understood that expression – we all live on a giant rock, remember? 😛 ) just so I can quit my job and continue to live my miserable existence without coffee, ice cream and holidays to foreign countries…

When we (humans) deny ourselves something, our brains instantly implants an image of that “thing” in the back of our mind with a huge red cross over it (as in: DON’T!). We’ve all been there. Eventually that DON’T becomes DO! – DO IT! NOW!

I’m not a neurologist, so I can’t explain why that’s the way it works – I just know that’s how it works (also from experience!). So this is why people get defensive when you present them with an idea that to them translates into something like: DON’T SPEND YOUR MONEY NOW! – SAVE IT, SO YOU CAN SPEND IT LATER…

– Which is actually not what I’m saying. Not at all. I’m merely advocating that we begin to employ a little more conscious spending. Not just for the sake of our finances, our time and our future well-being, but also for the sake of our planet. I really do feel that unconscious spending is what got us here in the first place; The oceans overflowing with plastic waste, air pollution from burning fossil fuels (to produce more consumer goods that nobody really needs), the deforestation (to produce palm oil etc. – hello, Nutella), rivers being polluted by chemical waste from the clothing industry (more clothes! That’ll fix our self-confidence issues – new clothes, because clothes makes the man, right?).

So naturally, by the logic of our society; More of the same will eventually fix our problems.

Stop. Just. Stop. Stop doing what you are doing! Try something different for a change. It doesn’t take a whole lot of “sacrifice” (in the lack of a better word) to become a little more conscious about what you spend your money on – and what you actually support, when you choose to spend it. You don’t have to “live on a rock” (albeit you already do!) to become a more conscious spender.

The circular economy is booming in Denmark. I’m sure this is also the case in a lot of other countries. We (as in our household) has decided to save money where we can, both for the sake of the environment, but also for the sake of our wallets. Conscious spending! That’s the new thing. Think before you buy!

You don’t have to save 50%+ of your net income to become FI. Naturally, the more you save (and invest!), the quicker you’re going to get there. – But as so often seen before, when you put things into a different perspective, magic can start to happen! So if you, like me, live a somewhat inflated “luxurious” lifestyle, and claim it would be impossible for you to save 50% of your net income, without having to live on the before-mentioned rock, you should start by putting your budget into perspective. There’s nothing like PIE that can change your perspective!

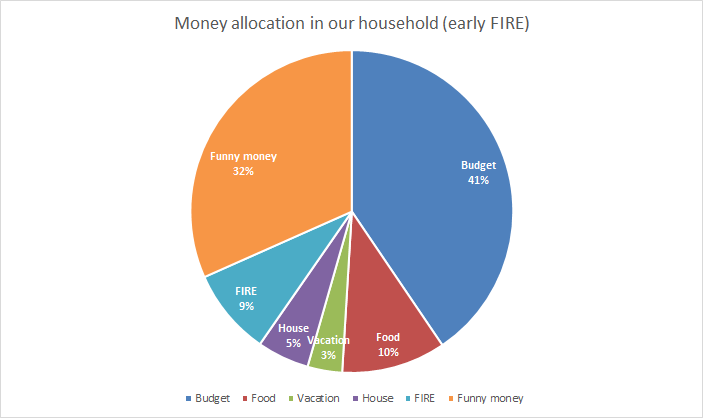

This was our budget when I first began my FIRE journey:

The biggest piece of the pie: our fixed expenditures. This is our mortgage, property taxes, insurance, cars, gas utility bills etc. 41% of our monthly net income goes towards these expenses. That seems a little excessive to be honest, but hey, we live in an expensive area in an expensive house, so I guess that explains it…

I didn’t think much of it at the time (back in September 2018) – what I did however think about, was the 2nd largest piece of the pie: The funny money. This was basically our “allowance” that we could spend on everyday luxury; clothes, gadgets, fancy dinners etc. It also includes gifts and personal hygiene stuff though, the latter being an expensive item in my OH’s (the wife) budget 😉

The next piece is Food (this also includes the occasional take-away meals). We’ve tried playing around with this several times, but since we primarily eat organic foods and like to snack a lot (fruits, nuts, crackers, chocolate etc.) 10% is an acceptable level, I think. A big part of my/our life is food.

Nothing beats food in my world (except maybe the occasional wild monkey dance – you know what I mean 😛 ). I live to eat, I don’t eat to live! We have eaten at a few Michelin restaurants, but honestly this is a bit too much for my taste. That’s just really excessively decadent in my opinion. I enjoy all kinds of foods – it doesn’t have to be expensive. If it’s made of some good decent ingredients, and prepared with love – then I’ll gladly eat it!

Anyway, besides the Food budget, we also have a savings account for vacations and for our house stuff. This is for maintenance, and whenever we buy some furniture, a plant or a piece of gardening equipment (these are just examples!). To be fair, some of the funny money also goes towards vacations, but the vacations saving account is primarily used to pay for our vacations (like flights and hotels etc.) – then we use some of the funny money as our “pocket money” when we’re on vacation (sometimes to buy food or excursions etc.).

The last one (the FIRE) is pretty self explanatory. I started out with a 9% allotment for my FIRE project. I was quite content with that at the time. At least it was a start!

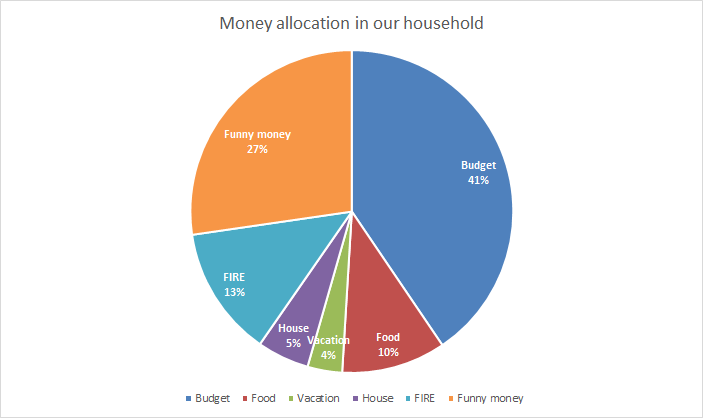

Then came the new year, and I quickly decided that I needed to up my game a little bit, so I decided to allocate some (more) of my funny money towards my FIRE project:

I was reading about people that had a savings rate upwards of 50-60%. It seemed my measly 13% wasn’t really going to get me anywhere near my goal of becoming FI within the next 13-15 years…

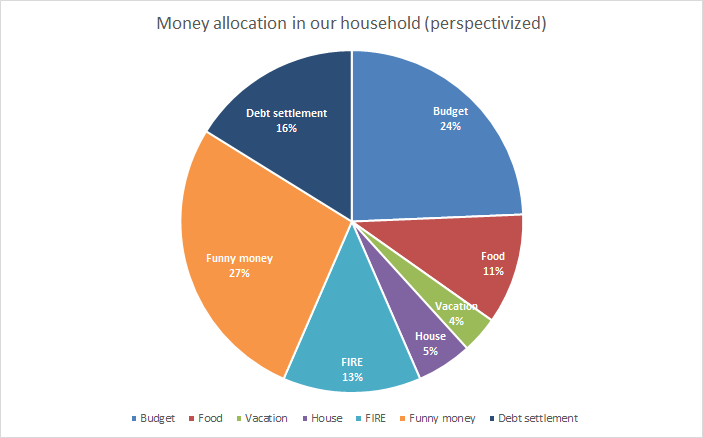

But then it dawned on me that a huge part of our budget, was actually used to pay down our mortgage…

So, if you take out our mortgage payments from the budget piece, then it looks like this:

Hmm. So with a little bit of perspectivization (that’s not a word, I know…), I’ve now upped my/our savings rate from 13% to 29% (paying down our loan is effectively a “hidden” savings account, in that I increase my equity by doing so). That’s pretty good, I think!

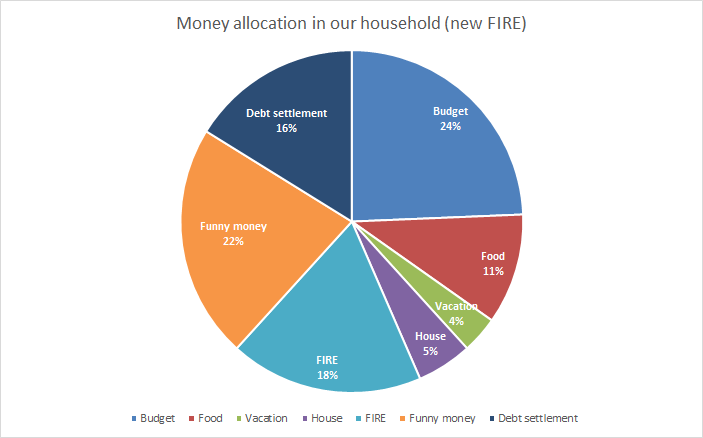

But wait, I’m not done yet! I decided recently that it was time to up the ante. I’ve been playing with the idea, of upping my contributions to my FIRE pot from €1000 to €1400 (effectively lowering the amount of funny money once again). Lets see how that would look like then:

Boom! FIRE allotment hereby increased to 18%, bringing my savings rate to 34%, lowering the funny money allotment to 22%. Am I going to have less fun now?! I doubt it 😉

Granted, it’s not quite 50% yet, but I’m getting closer!

How does your budget look? – Are you also struggling to up your savings rate? Perhaps a new perspective might help you increase your savings rate!

Nice budgeting 🙂 looked at our y2018 budget and we spend way more on food 23% of our income, but that includes everythingwe buy at the grosory store like dipers ect. Then we spend 28% on home, which is mortgege, utilities and home repair cost. 7% goes on transport. Combines it makes 35%. Compared to you (41+5) we spend somewhat less. Then the other cost 25%, also bit better. But that is 2018. Lets see how it will go this year as we have a new car, will have more costly hollidays ect.

Thanks!

Why are you going to have more costly holidays, because of your new car?…

My 41% also includes transport costs (including a leased car). Perhaps I should make a more granular one, to make that a little more clear 🙂

Very cool, here is ours (2 adults, 1 child, Copenhagen). I tried to use your labels for the categories. Btw. how are you only paying 800ish for daycare? We are paying 3.800 for one child in cph. https://imgur.com/a/sQjiA7p

Nice, Johan! Looks like you’ve got a good saving rate there! About the daycare (That’s another vigilant finding from you 😉 ) We’re actually paying 1725kr in total – but we use 1000kr/month of the child support money. I should’ve technically added the child support money to our income – but I’ve somehow managed to rule them out. Anyway, it would yield the same end result if I factured them in. But yes, you most likely live in the most expensive kommune in the country in terms of daycare pricing 😉 I apparently then live in a cheap one! We also used to pay around 3600kr/month before we moved further away from the City..

Thanks, yes it won’t last forever as we will have to move eventually and get a car etc. but for now I’m pretty happy with it. Thanks for clarifying, was hoping you knew someone in the kommune or something 🙂

Very interesting, Nick! There’s a lot of debate about whether to include real estate “savings” in your net worth. I include it mostly as illiquid savings and make it part of my net worth (which technically it is), but I don’t use the majority of it towards calculating my progress towards FI because I expect to be a home owner in the future too and thus cannot access the money 🙂

However, you could argue that if you end up depleting your liquid assets in FI, you could just sell your house and start renting a house instead, thus making it liquid assets, but that is too many ifs and buts for me, and I like it more simple.

… and I agree you funny money account seemed quite high, but cool you reduced it with 10%-points! I saw you also mentioned “cars” in plural? 😉

Hi Carl,

You know I agree 😉 I’m not going to use my equity in my FI calculations either – I do however believe it’s fair to include it, to calculate your savings rate. There are mortgages now that will allow you to leverage your equity on a quarterly basis, provided that you have an LTV less than 60%. I’m considering re-mortgaging to such a loan, because it would give me the option to turn on/off leverage of my equity if I suddenly found myself in front of a good investment opportunity. Ideally I would like to pay down my loan to about 40% (to get into the lowest “contribution”/fee rate), and then stop there. I see no reason to become debt free, as long as the interest rate remain < 5%.

Yes, CarS! We have two. We kind of have to, when we live where we live 😛 I am however planning to convert to a pedal-powered car, once this hits the streets: mypodride.com

I was an early backer of their indiegogo compaign, so I will get a 10% discount 😛 Still gonna run me an expected $5-6000, but that money will be recovered within a year, provided that I return my leased car instead (we own my wifes Skoda Rapid! *wroom wroom*) 😉

Ha, excellent! Really looking forward to seeing you on the streets in the PodRide 😉

You and me both, brother! 😛

Awesome Nick! I love that your savings rate is going up, is it the influence if your fellow bloggers? 😀

I’ll probably never leave my hovel due to not wanting to decrease my savings rate (sad really), I think the only thing I can actually do now is earn more. I’m hoping to start contracting at the end of the year which should boost my earnings massively!

I’ve had one too many of the conversations you described, I’m reluctant to bring it up now. I do pass out handy saving tips often though, I’m regularly known as the “Work Martin Lewis”… (if only they knew the half of it!)

It’s difficult to tell, I know – but I am in fact a very insecure guy (not really), so I’m highly influenced by my fellow bloggers! 😛

HAHA! Anyway, I haven’t been too upset with my savings rate to be honest. I can’t really compare myself to people like yourself, who’s still young and living a very un-inflated lifestyle. I’m quite happy with a 20-25% savings rate. Obviously this just means that I will have to get a much higher yield on my investments than you guys at 50%+ 😉 So that’s the plan for now! haha!

There’s a popular recurring discussion in the danish FIRE community, whether your goal should be to become debt free. I used to believe that that was what I should strive for. Now I realize that debt is an important tool (if used correctly) to accelerate my way to FI! 😛

I’m interested about the circular economy in your country…would you write an article with examples?

I’m usually reading US blogs and am curious of other European countries, what are the trends in other countries.

Hi Dori, Thanks for reading (and commenting!). I dont Think I will be able to write an entire post about it, and I only have first hand experience from the Nordic countries (and Belgium and the Netherlands), where I think the circular economy has always been popular (even before it got that fancy name).

I attribute it to a culture thing. Flee markets have always been very popular in Europe, and the 2nd hand market is big business in some areas (we have an infinite amount of 2nd hand lifestyle shops in the most fashionable adresses in the larger cities). We love a great bargain, and antiques have kind of become a mainstream thing. In Denmark the 2nd hand market is booming in these recent years, also because we’ve managed to digitize our money transfers to an extremely high degree. More than half of the adult population use the most popular mobile payment service in Denmark (mobilepay). This (in my opinion) also plays a vital role. I havent had cash on me for years (only when I go to the US!) 😛

In general the Nordic countries have a very High degree of trust in our authorities, which is why there are now talks to completely ban cash in most stores (It’s costly and inefficient to handle cash).

Because of the High degree of trust in each other, sharing of everything from cars to apartments have also become popular in recent years 😉

I hope that helped a little!

Can you recommend any good US blogs that I should add to my reading list?

The usual…financial samurai, mrtakoescapes, afford anything, mmm.

I like to buy used toys for my son and will give them to other kids when he gets tired of them. Also,try to give back the presents he gets…if he got a toy from X, and X had a child in the meantime….the toys goes back.

You can pay with your card at the flee market?I must have cash with me…small bills,because I buy cheap stuff… usually.

Do you pay for kindergarten?For us, it’s around 8-9%.

We dont pay for kindergarten, No – but we do pay for daycare. It’s subsidized though, so the government pays the majority of it. Education is also free, but It’s of course funded by one of the worlds highest tax rates 😉 People complain about taxes regardless of how high (or low) they are – but in general, we’re happy paying a little extra for the amount of “free stuff” that then comes with it. Free healthcare and free education.

When we go to flee markets we pay with our phones 😉 (mobile payments). A little like PayPal and ApplePay.

Good work here Nick, I’m impressed with your tracking and accounting precision. You are giving a great example of how working hard on your numbers brings rewards sooner or later, which in your case is showing as an improvement in your savings rate, congrats.

I’m also targeting for a 50% savings rate while not following a radical frugal living, as some eventual treats and gifts keep me mentally healthier. After all I don’t want to be mentally trapped to become financially free, or mentally sick by the time I get there.

This post has encouraged me to get my net worth ready. By the way, what plugin do you use for your first chart on The Portfolio tab?

Thanks, Tony! Actually I’m not nearly as precise in my accounting, as I could be. When you constantly have to convert your holdings from DKK to EUR, you loose a few coins here and there 😛 – But overall, I’m happy with my progress! Thanks for noticing!

I use a plugin called Easy Charts for the bar-chart on The Portfolio page, but I’m actually planning to move to a new format in my next update 😉 (little teaser). The name “Easy charts” is a bit misleading, as it does take a little fiddling to get it perfect.

I’m not sure which approach is the best to present your charts, really. I’m leaning towards direct excel chart exports (images) is probably the best/safest way going forward. These plugins might not work across all browsers (they dont) and new version of WP could potentially break the old graphs. Years down the line you thus might find yourself having to traverse old pages and replace “live graphs” with images from excel or similar…

I think your approach is probably the best/safest way to present your progress 😉

Hmmm… I wasn’t aware of this but it makes perfect sense. Thanks for the advice, I’ll stick to excel charts then 😉