I wrote my first post on the 25th of September 2018, which makes today my blogs first birthday (I also started to get those domain renewal reminders a few weeks ago).

Much like real babies, it takes some work before they actually come out – so obviously the blog started way before that – but I figure it’s fair to consider the day of the first post, as the “official birthday” 😛

Since that first post 1 year ago, I have published more than 50 articles and received more than 300 comments (thanks for the support guys, I really appreciate it!) from over 4000 visitors. I know these stats might not be very impressive in the professional blog-o-sphere, but to me they are pretty awesome. I really didn’t have any expectations, going into this whole blogging universe, so seeing that people actually read my ramblings (on a regular basis!) has been one of the best parts of this journey so far. I love all my readers, so thank you all for reading 🙂

Lets look back at what happened in my first year on FIRE…

The beginning

As you all know, the name “Total Balance” is not a randomly picked name, and its ambiguity is one of the reasons why I picked it. It works on multiple levels, and looking back on those now more than 50 posts, there seems to be a good mix between the numerical related content, and the more philosophical/spiritual content on the blog. From my stats however, it quickly became apparent that you guys clearly prefer the posts with a lot of numbers in them (the ones with a financial topic, which I guess is very fair, given that this is a personal finance blog 😛 ).

I started writing because I felt like I had something to give (share) with the world, and at the same time, I believed it could be a great motivator for me to keep tracking my progress on my way to FI. I’m happy to report that it appear to have been the right decision. I don’t think I would have had quite the same amount of determination, had I not been sharing my plans and my progress with you guys. I remember a few times, where I’ve made an extra savings effort, because I knew I had to present the results at the end of the month 😛

In the first few months of the blogs existence, I spent A LOT of time working on content, and being active in the community. I ended up getting told off by the wife (I was simply spending too much time on the computer), so I had to turn down the activity a little bit, and I feel I’ve found a good balance (there you go), now that I no longer aim to post each week. Also I have to admit, making those monthly updates has become a little less exciting after 1 year, than they were the first 6 months. Not a whole lot happens in 1 month to be honest (don’t worry, they will keep coming, and I promise there will be some excitement the next couple of months…), but I continue to make them, as they are a great way to keep track of my progress, and to keep myself in check (do not stray from the path!).

So, what have I learned so far?

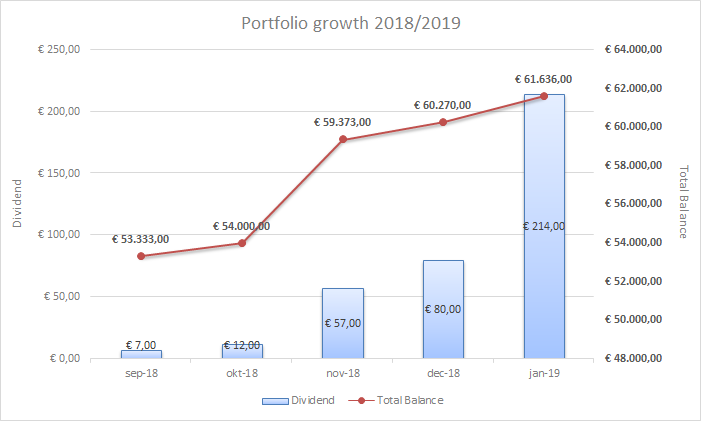

The other day, I read through some of my old posts and couldn’t help but laugh a little, when I came across my first Portfolio growth chart, which has now been dubbed “The classic growth chart” (It’s in every one of my monthly updates). Here it is:

So cute. It’s like a small child who just learned to bike without training wheels 😀 It shows great progress in only 5 months, though!

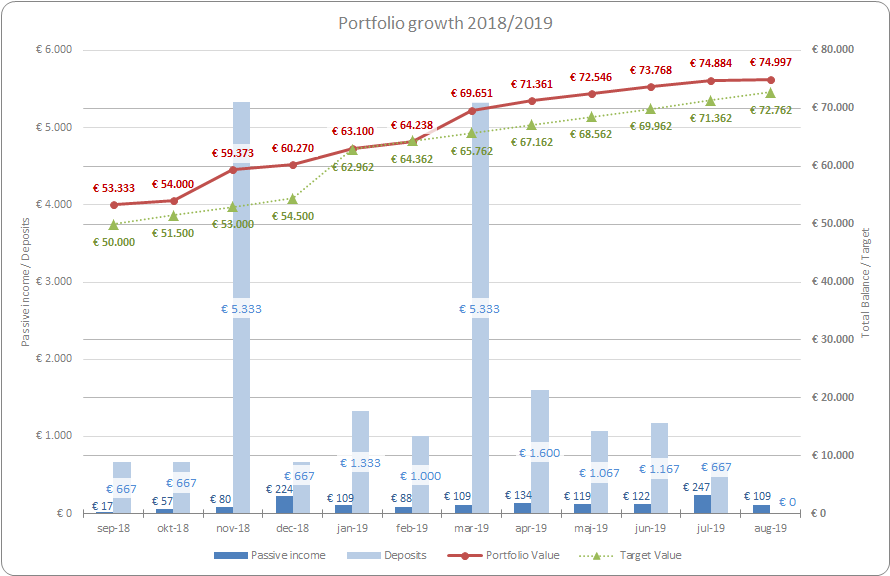

Here is the latest one for comparison:

Comparing those two charts really says a whole lot about this whole FIRE project. The bigger your perspective, the clearer the picture…

You have to be willing to put in the work every day, every month, every year. – But it’s only when you zoom out from your daily/monthly grind that you really get to see your progress 🙂

When I look at those two graphs, I’m primarily filled with one emotion: I’m damn proud!

I cannot wait to add that next month – and the next – and the next one after that…

Having said that, one of the greatest paradoxes of being on this journey, is mastering the art of living in the present, while (agressively) waiting to add that next column to the chart. It’s not easy, and I don’t think I will ever actually master it. But like any other thing worth doing in this life, it’s going to take a lot of practice – so I will continue to practice, and hopefully one day, I can claim that I’ve actually become good at it 🙂

In the immortal words of Master Uguay (Kung Fu Panda…):

Yesterday is history, tomorrow is a mystery, but today is a gift. That is why it is called the “present.”

(I couldn’t believe I hadn’t used that quote before! That is one wise turtle!). Remember to enjoy the journey, Nick.

The Total Balance progress

So the question remain, after 1 year; How is your Total Balance, Nick?

I managed to grow my Total Balance by almost 30%! I will be extremely surprised, if I can manage to do the same in the coming year – but I damn sure am gonna try 😉

The majority of the growth is from my savings though. Hopefully my investments are also going to pick up a bit (of the slack) in the coming year(s) 😉

On a more personal level though, my own internal total balance has actually also improved quite a bit. (WARNING: This is when it’s going to get a little funky, so you hardcore numbers-fans might want to tune out here…)

When I started this blog, I was kinda depressed. My state of mind had been going downhill for a while, and I was not very happy. The blog and my newfound FIRE goal gave me a little boost, but it was short-lived. I switched jobs (again) in November 2018 after having been in my (then) current job for less than 1 year. In January 2019 I came down with a serious case of the man-flu (I was certain I was gonna die! Again! True story!…).

After miraculously recovering, but still feeling depressed as fuck (the new job didn’t help in that area either), I decided to call a so-called “stress and well-being”-hotline, which is provided as part of my private health insurance (offered via my pension). I figured it couldn’t hurt to talk to somebody. I talked for about 1 hour with a nice lady, whom I’ve spoken to a couple of times since (we could call her Shelley). I now call her my “spiritual guidance counselor”, although she is not really spiritual at all – she is just a professional who’s trained in talking to people who are stressed or depressed/feeling bad. The best part about it is: it’s free! (Well, technically I pay for the insurance – but using it is free! 😛 )

Shelley gave me 3 concrete advice that first time I spoke with her:

- Start meditating regularly (daily, if possible)

- Start doing something that YOU love doing – just for you

- Go to the doctor

So, I started meditating.

I was kind of already doing something that I loved doing (writing/blogging), and I didn’t go to the doctor! (It’s not like I was dying or thinking about killing myself or anything – I was just feeling down).

Then summer came, and we went on a pre-summer holiday with my parents. It was nice (sun and blue skies always lightens the mood), but I still felt off and unable to truly enjoy myself…

When we got back from the holiday, I called Shelley again. She gave me the same 3 advice, but this time she was more specific in #3. She said: Go to the doctor and get your fatty acid balance tested…

WHAT?! She did not specify what that had to do with my problem, but naturally I got a little intrigued. So I did what any sensible man would do (No, I still didn’t go to the doctor – what am I, a girl?!); I Googled!

After researching a lot on fatty acids and the optimal balance (omega-3, omega-6, omega-9), I kind of concluded that I was most likely getting too much Omega-6 (meat) and not enough Omega-3 (fish), which is very common for most carnivores in our part of the world today (apparently). I’ve always known that I wasn’t eating enough fish (for a country surrounded by water, fish is not that common in our daily diet). I like fish, but I typically don’t eat it more than once per week.

This was when my wife stepped in, and declared that I should start taking Omega-3 capsules, also known as fish oil (she had been taking them for years). HAVE YOU SEEN THOSE THINGS?! They are huge! No way!

For some reason, I decided to try them anyway. A mouthful of water, and down it goes (it wasn’t that bad).

1 week later (after having swallowed 2 capsules each day) I start to feel a difference. But it’s summer, and the weather is nice, and the summer holiday is approaching, so naturally I’m a bit more cheerful than usual…

3 months later I’m now absolutely certain that I’ve found my Omega balance (2 capsules per day). I no longer feel depressed, and my mood is a lot more stable than before. In addition to my mood, I also feel less annoyance in my joints (I have suffered from carpal tunnel syndrome and aching joints for years). I kid you not, guys! This shit is real magic!

Don’t take my word for it though, there are several studies out there, which point to two facts about Omega-3:

- Omega-3 is believed to be beneficial against mood disorders (health.harvard.edu)

- Omega-3 has an anti-inflammatory effect (healthline.com) – Omega-6 actually has the opposite effect…

Suddenly those vegetarians who claim to feel much better, after they stop eating meat makes a lot more sense to me; They alter their Omega-balance.

According to the studies that I could find, one should strive to keep their Omega-6 to Omega-3 balance no higher than 4:1 (ideally 1:1). Perhaps it would now be beneficial to actually visit that doctor, and have mine tested – just to know what my current balance is…(nah!).

Omega-3, guys! (and meditation). It did the trick for me! 🙂

(Unfortunately, while the clue to look in the direction of fatty acids was free, the capsules aren’t! They are quite expensive, so perhaps the better solution here would be to start eating more fatty fish, eh?…)

Anyway, the lesson here is pretty obvious:

If you’re feeling down, talk to somebody (preferably a professional). It helped me, and I’m grateful that I live in a country, where we have (easy) access to first class healthcare.

Anyway, enough about fatty acids (and depression)! – Lets get to the good stuff!

The (most) popular posts

My #1 read page is The portfolio, followed by my The guy (about me) page.

Those two pages are covering the basics I guess, so I’m not surprised that those are the most clicked. I update my portfolio every month, so I expect that page to remain in the #1 spot for years to come 😉

My 3 most popular posts are:

- My 3 biggest crowdlending mistakes

- Why I invest (heavily) in properties

- Say hello to my little friend (Property #1)

Obviously, I’m very proud of all those 3, and I’m glad that people are reading them. It’s clear that the two most popular topics on the blog are “crowdlending” and “Property investing” 🙂

“My 3 biggest crowdlending mistakes” was also featured on firehub.eu (yay!), where I also just happen to currently be featured as this weeks “blogger on fire“! (Yay! Go check it out!)

Another post that I’m also kinda proud of, which I think might deserve a little more love, is my post about IKIGAI (Finding your purpose/reason for being). This post says a lot about my (then) current state of mind, and I believe it’s the key to unlock that all important answer, of what I intend to do once I reach FI (10+ years from now, unfortunately!).

It’s one of the first questions that people ask me, when I tell them about my FI plans (I’m very open and honest with everyone I meet – including my boss, which was a little awkward at first, but I think he kind of gets it – he doesn’t know about my blog though). I still don’t know exactly how I want to spend my FI-days, but I’m sure I will figure it out, once I get there 😉

Meanwhile, I will continue to write about crowdlending (and Property investing, of course – since it’s kind of the cornerstone of my investment strategy).

The goals for year two

Looking ahead I’m going to continue my 2019 goals, which is continue to save €1000+/month and invest 15-20% in crowdlending to eventually average about €400/month in passive income. This milestone probably wont happen in year two, but I’ve come to learn that tough goals are highly motivating for me, so setting myself a goal of €200/month seems a bit too low.

Our mortgage is up for refinancing in the spring of 2020 (it’s a 3-year flex-rate mortgage), and luckily as it stands at the moment (thanks to Mr. President & Co), we’re going to get another 3 years of record-breaking low interest rates. We have a special loan type, which allow us to underpay the mortgage. I know the trend is to overpay, but at the current interest rate levels, I see no reason to do so. We currently only pay 3/4 (of what we’re supposed to) each year, and we’re planning to actually lower it to 2/4. This means that at some point in time, we’re going to have to start overpaying on the loan – but that won’t be until 20 years from now, and by then I will be rolling in cash, so who cares, right? 😛

(EDIT: Yeah so the under-paying our mortgage plan didn’t quite pan out).

The money that we save on the mortgage payments is going to go directly into my Total Balance, so I’m going to go out on a limb here and predict that those first €100,000 should be in the bank, by the end of 2020…

On another note, the lease on my car is up in June 2020 – so one of two things is going to happen:

- I’m going to get myself a Podride instead or (EDIT: Still an option – but final production date for the Podride remains unknown)

- I’m going to get myself a new (cheaper) car… (EDIT: Spoiler alert – new car)

Either way, it will have an impact on my savings capacity. The Podride is estimated to cost around $6,000, which incidentally is about the same that I pay for my car (per year). Either way, the summer of 2020 is going to bring some exciting new gear to the Total Balance household! 😛

See you in another years time! (Or next month, maybe?…)

Congrats my man! Most people quit before this point I’ve heard 🙂

Keep up the good work! I love your posts.

Also, join in with the TE’s 😉

Congratulations on the one year bloggiversary, Nick! I always enjoy reading your posts, and I’m looking forward to many more to come!

Interesting to read about your state of mind one year ago. I can relate, and your openness with the topic is helpful in making me realise that I should do something about my own state of mind! I don’t know if I’d say I’m depressed as such, but I can identify with sometimes feeling down, for no good reason that I can think of. I’m not aware of a similar hotline that I can phone, but a visit to the GP is completely free over here, so there’s nothing to be lost by simply visiting and seeing what they have to say. Thank you for your candidness!

Love that Kung Fu Panda quote. Classic film!

Thanks, Doc!

I’m happy to share my experiences – both money- and mood-related 😛

It’s interesting though that you are now the 2nd one who mention making that call yourself. I’ve often wondered if the FIRE lifestyle comes at a price, in terms of (short term) happiness issues. But after now having kind of “crossed over to the other side”, I’m happier than ever, and more determined with my FIRE goal. I’ve even come to semi-like my job now (don’t know how that happened!). When I was down, I felt my self-confidence was low too (and I’ve always been a very confident guy), and I also suffered a great deal from imposter syndrome. After having regained my mojo, I’m back to my good old (overly) confident self. Sure there are bad days, but they never last more than a day.

I thought you were are doctor? Don’t you have coworkers/peers who can help you out? 😛

Anything Dreamworks/Pixar is worth a quote or two, if you ask me 😛

I am obliged to point out that I have a PhD, and am not a medical doctor

There’s supposed to be a ‘ :p ‘ face at the end of that last comment! Now it just reads as way too serious, haha

Nick I’m so happy for you.

First of all, congrats on your one year blog anniversary 🙂 I always enjoy reading your posts, especially those that include Olaf’s and Catzilla’s stories! hehe, so it’s great to see you’ll keep us entertained for the long haul 🙂

Secondly, congrats on your 30% increase. How did you do that without algos? ;p

Third, you needed total balance and it seems that you’ve just found where the correct standing point is. This is the greatest and more challenging achievement of all, from my view.

I didn’t know about your initial depression. I can relate to the feeling of writing on a blog to heal yourself (Algotechs) and I also have it for a similar reason. I may follow your timing and explain that reason in my first blog anniversary.

I still remember those days when I read your blog as a non blogger and how you told us about your new job. I also remember thinking that you were such an intelligent person (no worries my opinion hasn’t changed! Yet? ;))

Haha! Thanks Tony, that means a lot! I’m looking forward to your first blogaversary post 😉 I will try to include some more Catzilla stories 😛

I’m glad I was among the inspiration sources for you to start your own blog – and yes, I do enjoy the therapeutic nature of blogging too 🙂

Congrats on the blogoversary 😉 I can understand why you are damn proud. Great job!

Thanks, Carl! How many years have you been going at it now? 🙂

Hey Nick,

Congratulations on your one year blogoversary!

Great to see the development in the charts, both the figures and style-wise.

All the best,

ScottyFi

Thanks, Scotty! And what a wonderful timing for you to debut your first comment! 😛 Have you got another night out with Rich Dad in the pipeline for us? 😉

Congrats, Nick! I love your blog and your personal story – I’m actually in a position with the same soort of health insurance and you inspired me to maybe make a similar call. I get the feeling of depression and struggle to find joy in the present. Instead I contantly try to work out how I can optimize my life and what changes that needs to happen accordingly. Daydreaming is good, but it is unfortunately getting out of hand and starting to really effect my well-being as a human. I absolutely back up you’re quote about the hardest part of FIRE is to enjoy the moment.

I know exactly how you feel. I think I took far too long to make that call, so if you have the option available, I would definitely make the call 😉 (can’t hurt, right?)