A year has gone by in what seems almost as a blink of an eye.

As per usual (I love saying that – this is only my 2nd goals-post ever), it’s thus time to look ahead into the coming year(s), and see what might be in store for the Total Balance household.

Last year I set myself a goal to reach a certain target Total Balance at the end of the year. I did this to adhere to my 13-year (lean)FIRE plan, to reach my Total Balance goal within those 13 years (preferably sooner). As I revealed in my latest Monthly update I managed to reach my yearly target – just barely 😉

As I crunched the numbers after my first year of blogging in September, it quickly became apparent that the current plan relies heavily on the income from Property #1, which is not due to start arriving until year 2023 (October 2023). As this is more than 3 years away, it’s clear that if I want to reach my goal sooner than currently projected (which I do), I’m gonna have to up my game! (Like get Property #2 on the roster – quickly)…

Please note: Since this post was written I’ve revised the plan due to various reasons.

My 3 pillars of wealth

In order to clearly understand the context that my Total Balance is a part of, I’ve constructed the concept of “The 3 Pillars of Wealth”. These are 3 different “buckets” that I sink my hard earned money into (your job is really not that hard, Nick? Scchhh!), every month.

- My Total Balance (which currently constitutes Property #1, my crowdlending portfolio, a Brickshare property and some Gold)

- My home equity (in danish: Friværdi)

- My Pension

What’s with the traffic light colors, Nick?

I’m glad you ask! 😉 – The colors represent the liquid nature of the pillar. My Total Balance consist of (fairly) liquid assets, which can be liquidated, should I choose to do so (granted, it can’t be done in days, like with stocks – but you get the idea!).

Liquidating my Home equity will obviously require us to sell our home. And we would then need to find another place to live (rent a place?). Our house is located in a small village, surrounded by old style farm houses, and a few of them is currently on the market. They’re not moving fast, I’ll tell you that. The value of a house is of course a mix of location, price and what kind of condition the house is in. I sense that people have become a bit greedy, so the current prices do not match the value in our area, in my opinion. I believe our house would sell within 6-12 months, given that the price was just right. But setting the right price is a challenge. There is not a huge market for selling these particular old style farm houses. But the area is nice, so we’ve got that going for us! 😛 However, liquidating our home equity would not be challenge free, for sure.

My Pension is a part of my salary from my day job. It consists of an employer (11%) contribution and an employee contribution (5%), which are both mandatory. Even if I wanted to pay less money towards my pension, I couldn’t (at least not in my current job). These funds are currently “locked” til I turn 60. It is in certain situations possible to liquidate your pension, but you are slapped with a 60%(!) tax if you withdraw them prior to your pension age (which for this particular scheme is when I turn 60. This has been changed since, so new pension schemes introduces a sliding pension age that follows the public pension age -3 years, which is total bullshit. Anyway, I’m just happy that my pension scheme was created before these new mad rules came about).

You’re rambling a bit here, Nick. What does this have to do with your goals for 2020?!

Patience, my dear reader! I’m getting to it!

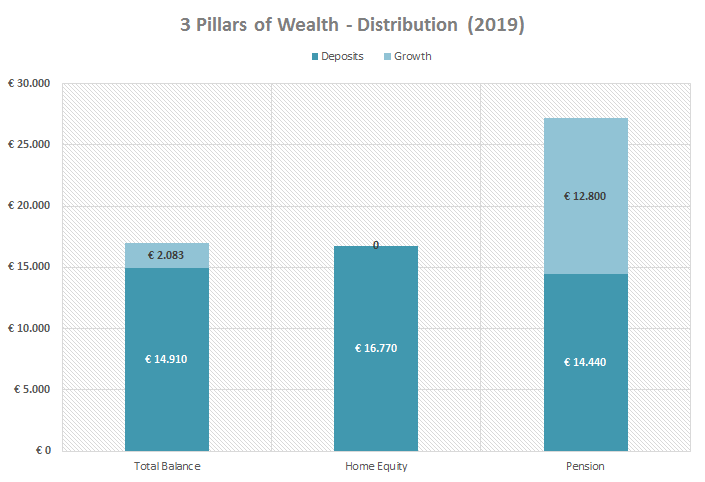

Now, this is a depiction of how My 3 Pillars of Wealth has developed in 2019:

Notice the lovely (almost) symmetrical contributions to each pillar (I’m a sucker for symmetry!). This is actually purely coincidental, but I can’t help but point it out anyway! 😛

Clearly, my Pension did pretty well in 2019, albeit it could have done even better, had I not instated the Mr. Conservative allocation upon it back in April. Anyway, I managed to squeeze out a decent growth anyway – but perhaps it would be prudent to re-visit my Pension strategy again soon 😉 (more on that in a later post!).

So, why is this at all interesting, you ask?!

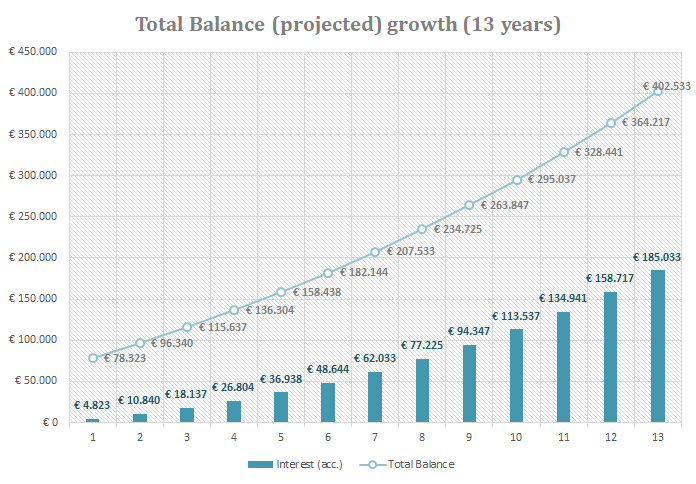

Well, let’s have a quick look at the 13-year plan from last year:

Year-1 has now been completed, and we remain on target (yay!). However, the projection for year-2 (2020), states that in order to remain on target, I will need to find more than €6.000 in interests/passive income somewhere (and add €12.000 in savings). Since I don’t plan to invest a lot more in crowdlending than I did in 2019, I can already predict that I will be falling short of this target. Not only do I want to STAY on target – I want to beat the target.

I want my Total Balance to be (more than) €100.000 by the end of 2020!

Why? – It just seems like a nice round number, that’s why! 😛

HOW do I intend to achieve that, then?!

Well, I have two options:

- Up my savings rate (significantly)

- Change the symmetry of the 3 Pillar allocation

I suspect you might have already guessed this, but obviously it’s pretty clear that I can’t fiddle with my Pension allocation – it’s fixed, unless I find a new job that will allow me to control this more freely (which can never really be ruled out, if we consider my job-changing history – but I don’t plan to switch jobs in 2020…Unless of course I somehow get an offer I just can’t resist…).

Upping my savings rate might be possible in 2020 (I aim to add €1.000/month), but judging by the history of 2019, I don’t think I can budget with a much higher savings rate. I might be able to push it to €1.200-€1.500, which I am gonna try, but I doubt I will be able to maintain that level through the entire year. So for now, I will aim at the regular €1.000 contribution, and then hope that some months will see higher savings 😉

That leaves me with my home equity! We’ve established earlier that liquidating my home equity is a challenge. Instead of selling the house, we could opt to borrow against our equity, but that would mean a higher LTV, which I’m not really keen on.

How about I stop paying down my principal in 2020, and instead allocate those funds towards my Total Balance? Would that work?!

Yes, Nick I suppose it would – but you would be changing your fundamental risk balance, by effectively leveraging a higher LTV in your home.

YES! – BUT NO GUTS, NO GLORY, GUYS!

We currently owe €507.333 on our house, which puts our LTV at about 70% (depending on an upcoming evaluation of the house). Ideally, I would have liked our LTV to be below 60%, before we started leveraging our equity, but I simple can’t be bothered to wait, honestly. I know it’s an added risk, but we currently pay 0.51% on our loan, and we can fix the rate for the next 3-5 years around 0.70% (it’s a flex-mortgage).

Re-arranging the 3 Pillar allotment would make it possible for me to add Property #2 to the roster in less than 2 years. Then adding Property #3 in 4 years. By then we will have entered “cash flow heaven” from Property #1, and then Property #4 and Property #5 will be added all within 5-6 years from now. THEN we can start paying down the mortgage again, and within 10 years or so, I reckon we will be pretty FIRE-ready 😉

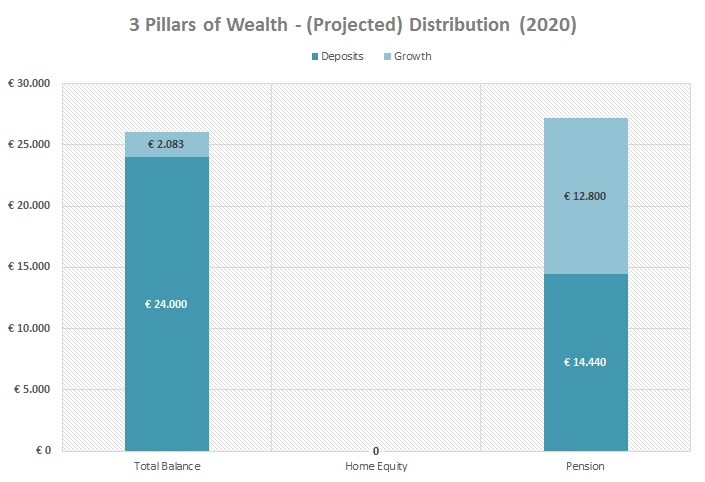

And thus, the 3 Pillar distribution for 2020 will look something like this:

This should put my Total Balance well in the €100.000’s by the time 2020 draws to a close…

Yes, lets do that! Exciting times ahead!…

I realize that this will be considered as “reckless” by some people, but I actually got the idea from my surroundings. A handful of family/friends who are either on the verge of retirement – or already retired have actually dipped into their house equity even before they retired.

The idea is that “borrowing” from your own “brick stash” is effectively free, because of the low interest rate and the inflation (which I also wrote a bit about back in 2018). Inflation in Denmark has been fairly low in the last decade, albeit higher than the interest rate. So for people who owe less than 50% on their mortgage, there is really no need to pay it all the way down to 0. – Unless of course you LIKE not owing any money.

(Actually, only around 50% of the danish retirees are debt free in retirement, according to this – sorry, it’s in danish)

That was always my original intent; to be debt free. I was brought up with that “goal” that this was the only sensible thing to do. But the interest rate has just been in a steady decline since I was born. Now when I look at my older family members, and friends who are in that stage of their life, very few of them are debt free – or aim to be. I’m sure it’s a wonderful feeling, to be debt free (I was, once!), but from an economical standpoint, it’s just not really that sensible…

But Nick, your LTV is 70% – not 50%?

Correct – but I have 25 years til my “actual retirement”, so I have plenty of time to lower my LTV, once I reach FI.

Comments are welcome!

How does your 2020-> strategy look like?

Hi Nick. Nice set of goals. 1000€/mo saving and goal for 100k€ NetWorth looks nice. Good luck with that. If your mortgege rate is 0,something% definatly stop amortisation and gather some capital for investments.

What relates to pension fund we just had a even dumber pension reform. Now im alocated to a chosen pension fund setup according to my age and cannot change it (state decided what is the best investment strategy for me, yey) and after my pension age hit the accumulated pension fund money will go to… (drums) … the state.. (what the…) yes the state will take the pension fund money and will allocate me a monthly payments until my death. Well lucky for me im 30y or so from pension age so hopefuly this nonesence scheme will be changed. Well it was even worse for the Poles as their state nationalised their pension funds or how they called returned people to state pension fund system. For now I have only 11kEUR in the pension fund so its not a life saving bag of money as my investment portfolio (which state cannot regulate or take over unless we will turn communist again) is x2 that and im into investment only for 5y while pesion fund was established 15y or so ago 🙂

Hey Nick, I certanily love the three pillars of wealth. Can I copy it? I promise to wait a few months before posting anything related so no one notices? 😛 – Now seriously, I honestly like it!

You started 2020 with the right positive energy showing eagerness to improve one’s plan, great!

Does it seems like you had this trick up your sleeve though? hehe (I also have one that no one knows, just in case I don’t meet targets!).

You told me a while ago that you were considering selling one of your cars? Did you do it? That would seriously help that SR.

I am not a mortatge expert myself, but if you can guarrante a only interest payment mortage for a 0.7% it is nuts! As a simple fact it’s a no brainer. Also, from my personal point of view, rates won’t increase any time soon as we are nearing towards a bull market end, where rates tend to decrease further as market stimulus (you know that! 😉

Great strategy! I’m just kicking myself right now for still renting. Aargg!

Good luck , will see how it plays.

Thanks, Tony! I knew I could count on you for encouragement! 😛

The 3 Pillars of Wealth is now a TotalBalance trademark, and so will expect to receive royalties, if you copy it! Just kidding 😉 I think we all “borrow” ideas from one another all the time, so feel free to borrow that one!

The interest rate on my mortgage is currently -0.33%, but because the mortgage company also wants to make money out of us, they add something that they call “contribution”, which is just a stupid name for “fee” 😉 that brings my current total interest rate to about 0,5%. The flex mortgage interests fluctuate a bit though, and when you convert it to an interest-only loan, that contribution fee goes up a bit, so I figure 0,7% for the next 3-5 years is doable. My concern is obviously what happens after that period. If the interests are significantly higher than now, I’ve added an extra burden on my shoulder, by not paying down on the principal. But such is the risk of a flex-mortgage!

About the car situation, we own one car and lease mine. My lease is up in June, and I’ve been telling everybody that I don’t plan to lease another one…but I’m not completely convinced that it is going to turn out that way in the end 😛

There’s also a little wildcard here, because our daughter starts school this year, and we don’t know exactly which one yet 🙁 So until our future transportation patterns are completely locked down, I don’t think I can be without a car. It’s simply too impractical and time consuming to get around without one (remember we don’t live in the city). – But I am looking at cheaper leases though! 😛 not by a lot, but maybe I can save like €50/month or something…

I feel you, what happens after de 3-5 years is a feared mystery. Your property 1 will be producing you passive income, so perhaps you could use it to repay the mortatge faster if rates seems to rise? Or would that impact your retirement date too much? Only you know it best 🙂

Another thing I would consider is downgrading If rates get insane, but that would also mean a price reduction on the property to make it attractitive to buyers in such conditions.

It’s always a dilemma! But I would have also taken the risk if I were in your shoes 🙂

Do you accept revolut payments for royalties? 😛

Hey T, I noticed I forgot to reply to your last comment, and since last month we’ve actually reached a major milestone; We now know for sure which school our daughter will be attending for the (hopefully) next 10 years. This then locks down our transportation patterns so it’s now very likely that we can make due with only 1 car in the family…However, I am a car guy and I’m currently struggling a lot with the decision. Do I make such a decision with my brain (logik: Easy, save the money and retire ealier!) or do I make the decision with my heart? (I need a NICE car to get around 😛 ). Right now I’m 50/50 but I have until June to decide, so nothing is finale yet. I will probably spend the next months going back and forth between one or the other. To lease a new car or not?! Tough life decision. Meanwhile China is on a lockdown from a killer virus threatening to kill thousands of people…This kinda makes my car-decision-troubles seem like a SERIOUS first world problem 😉

The income from Property #1 could be used to pay down our loan in case of a serious interest spike, yeah – but I don’t think it will be relevant. I’d much rather use that income to re-invest in Property #X 😛

Oh, on a little sidenote; I might have a lead on a potential Property #2. It doesn’t have a cashflow anywhere near Property #2, but it’s cheaper and a totally different kind of property 😛 But more on that later! 🙂

Oh yeah, and then there’s this: My plan to go interest-only for the next 3-5 years was thwarted by our bank…So the 2020 plan now needs a complete revamp 🙁

I’ll be sure to keep you posted 😛