It’s been a while since I’ve written about my investment strategy, so I thought it was time for a little update on that front, seeing that this is supposed to be a personal finance blog. – I realize that it has taken a bit of a slant towards the personal part, rather than the finance part lately 😉

I’m all about the balance (pun intended), so it’s time for some lofty thoughts, numbers, pie charts and maybe a(nother) pun or two (we’ll see about that!).

Being an IT guy, I have decided to adopt a well-known term from the tech-industry, and adapt it to my investment strategy: KISS! (Keep It Simple, Stupid!)

That sounds simple enough, right?…

Basically the idea is that by keeping it simple, you minimize the risk of errors – this approach can obviously be applied in many aspects of life! – Try it out for yourself; Whenever you’re faced with a difficult decision or a tough choice – KISS! 😛

I used to be a very confident person, but with age I’ve grown more and more anxious and uncertain (thank you, life!). In the attempt to regain some of that past confidence, I’ve decided to once again listen to my gut, and stick to my first impulse (because that’s usually the right one!). Being a bit anxious and uncertain, I decided a long time ago that the stock market wasn’t for me. This whole rollercoaster ordeal simply affects my mood too much (I’m not the only one, just look at Marc over here, who had a rough December – like a lot of the other stock-holding FIRE guys).

You just have to NOT look at your portfolio every day!

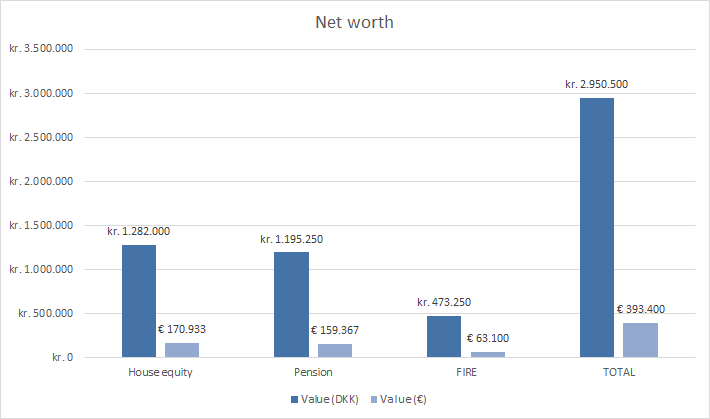

Yeah, like that would ever happen…I’d look at that shit 4 times per day! (I know, because I do this sometimes with my pension – which is currently invested in stocks, via a handful of indexes). So, to really understand my disdain towards the stock market, we have to take a look at my Net Worth.

I basically have 3 pots: My house (equity), my pension (60+ retirement money) and my FIRE pot.

Let’s see some charts, man!

I did not realize until just now that my Net worth is getting very close to my Total Balance goal. Funny! Remember though that my Total Balance goal is for the FIRE pot alone, as I intend to use the FIRE pot to eventually bridge my way between early retirement and my actual retirement (I can start withdrawing my pension when I’m 60).

As promised, a pie chart (uuuhmmmm, piiie):

(Notice the symmetry! I did not plan for this – it’s just the magic of coincidence 😉 )

So it turns out, I currently have 40.5% of my Net worth tied up in the stock market. Given my disliking of the stock market, this is a bit surprising! Unfortunately, my current pension provider does not really allow me to de-allocate my funds from the stock market.

BIG NEWS: My company has chosen to switch pension provider as of March 1st 2019! YAY! They have even chosen one of my preferred providers! YAY! So soon (April-Mayish), I will be able to allocate a vast majority of my pension funds to REITs (Real Estate Investment Trust) instead of stocks. This is indeed good news! I will write a post about that at a later date, once the move has been executed. (EDIT: I moved 75% of my Pension portfolio out of the stock market in April 2019) (EDIT: I moved a portion back into the stock market in April 2020).

I currently add roughly DKK 118.000 (€15.733) to my pension pot every year (this is mandatory – even if I wanted to change it, I couldn’t). Interestingly enough, I add just about the same amount in equity (mortgage payments) as we pay down our loan with DKK 112.000 each year (this does not include interest payments). It shall be interesting to see, if our equity can keep up with my pension (it shouldn’t, as I expect at least 5%+ interest on my pension yearly on average). Anyway, as I outlined in a previous post we are planning to reduce our loan repayments, in order to leverage our equity – but our loan isn’t up for refinancing until April 2020, so I won’t be able to launch that plan for another year. (EDIT: Yeah, so that plan didn’t quite pan out either!).

Nick, you’re starting to ramble – back to your investment strategy?

Yes, sorry! Now that we’ve established my current exposure towards the stock market, my FIRE-KISS plan can now easily be explained:

My investment strategy:

- Accumulate a shit ton of money (“a shit ton” is relative of course – I think I’m getting there!)

- Allocate 10-15% of that money towards a high yield, high risk asset class (hello,

crowdlending) (EDIT: Erhm, I mean: Hello CRYPTO!) - Allocate another 10-15% towards the stock market, via a few select indexes/ETFs (hello, aktiesparekonto)

- Use the rest to buy real estate! (show me something good soon, imbro!) (EDIT: Hello, Property #1)

I was kind of hoping for brickshare.dk to launch something interesting in Q1, but it appear that they’ve lost their mojo and gotten themselves into some sort of trouble with the authorities (that’s the word on the street – but since they’ve failed to inform the public about what’s actually going on, we don’t really know what’s happening – but they are not accepting new signups at the moment, and previously promised projects are yet to be seen). I expect them to resolve the issues in Q2 though, so hopefully we’ll see some good news from them shortly (we’re giving them the benefit of the doubt 😉 ). (EDIT: We now know that they were working on attaining a so-called FAIF-license with the danish FSA, which they have received and have now released several new projects)

Anyway, why am I planning to invest 70-80% of my FIRE pot in passive real estate investments? – KISS!

Real estate is in generally considered a fairly low risk asset class – but also a very illiquid asset class, which fits me perfectly! I have a 10 year+ investment strategy, and I really don’t need the distraction of having the possibility to keep second-guessing my investments (the other day I seriously considered going long on the Cannabis market).

Slow and steady wins the race.

There’s not a lot of assets out there, which are as slow and steady as real estate 😉

How does your strategy look? Enjoying the rollercoaster rides?!

Let’s get this plan and work it. I like your approach to the KISS. That’s something I live by these days. I’m ready to see what’s next for you brotha.

Hi TB. Love the kiss as well 😉 dont fall in love with re and p2p lending platforms. They are not risk free. Sure 10% return is not possible these cheap money days without a risk but these platforms sell themselves as nearly risk free. In a recesion this will be the one that will take most of the shit when it will hit the fane 😉

Hi P2035,

I know how you feel about crowdlending but rememeber I only allocate about 15% of my portfolio towards that “risky business”. My planned Real estate investment is the Classic kind – not via crowdlending 😉

Good. Then your following the rich guys rule. Never invest +20% of you money in exotics. Bitcoints, crowdlending ect. Collectables ect.

Hi P2035, I am interested in discussing a bit more your thoughts on p2p investing. What makes you think that stocks prices and returns will do better in the bear market than p2p platforms? I will post some of the discussion that went on Jorgens blog in this and the following replies if TB doesn’t mind.

Hey Jørgen!

Great results, especially the affiliate income. That is insane.

Anyways, I have followed your blog for a short time, and maybe you have already addressed this previously, but I’m interested in knowing how you feel about having the majority of your assets tied to P2P platforms?

Because as I see it P2P platforms and companies have not really experienced a recession, and they have not truly been tested when the global market goes sour. Furthermore, the majority of P2P companies do not operate with a profit, and therefore does not really have a company buffer against a serious market downturn. If Estonian P2P platforms go bankrupt, your loans will most likely be given to associated lawfirms so they can hunt all the defaults that are gonna come, and they will take a large share of whatever money they manage to salvage. In the end a really harsh market downturn might spell disaster for P2P platforms and saving, including the majority of your assets.

What is your thoughts on that?

Kind Regards

JT

Hi JT.

Sorry for the late reply. We discuss most of your questions in the podcast episode 030, which you can find on the About page.

I can add a little bit to it here:

I feel awesome having most of my assets in P2P platforms. I’ve tried many other investment vehicles and most of them I don’t understand. I don’t know what moves the stock markets or how to tell if a stock is a good buy. I’ve also tried different kinds of trading and it’s not for me.

I don’t worry about recessions or things I cannot control in general. I act with the best available information I have right now and don’t look back. The past cannot be changed and the future cannot be foreseen, so why bother? In many cases, if a certain scenario happens, eg. a recession, the outcome is often different than imagined. Take Trump as president for example. Most experts predicted a stock market crash if Trump would win. There was a 30 minute shock and then the bull market continued, even stronger than before.

People’s ability to pay back loans have been tested in every recession the world has experienced. If the borrower looses his job, he will have a hard time to keep up with the schedule. In most cases he will be able to pay eventually. In many cases, the lowest paid worker (who needs this kind of loan?) will keep his job and the managers gets fired. In my opinion, the fact that it’s online now doesn’t change much.

Hi JT.

Sorry for the late reply. We discuss most of your questions in the podcast episode 030, which you can find on the About page.

I can add a little bit to it here:

I feel awesome having most of my assets in P2P platforms. I’ve tried many other investment vehicles and most of them I don’t understand. I don’t know what moves the stock markets or how to tell if a stock is a good buy. I’ve also tried different kinds of trading and it’s not for me.

I don’t worry about recessions or things I cannot control in general. I act with the best available information I have right now and don’t look back. The past cannot be changed and the future cannot be foreseen, so why bother? In many cases, if a certain scenario happens, eg. a recession, the outcome is often different than imagined. Take Trump as president for example. Most experts predicted a stock market crash if Trump would win. There was a 30 minute shock and then the bull market continued, even stronger than before.

People’s ability to pay back loans have been tested in every recession the world has experienced. If the borrower looses his job, he will have a hard time to keep up with the schedule. In most cases he will be able to pay eventually. In many cases, the lowest paid worker (who needs this kind of loan?) will keep his job and the managers gets fired. In my opinion, the fact that it’s online now doesn’t change much.

I think your strategy is very sensitive to a rise in the interest, if/when it rises after you place your money your could be looking at very modest gains from your real estate investment and at the same time face rising costs on your mortgage. I think I would at least switch to a fixed interest rate mortgage before investing more in real estate. Depending of course on how long you will be staying in your current residence.

Hi Johan,

Thanks for your comment! It’s much appreciated.

The funny thing is, I’ve actually just written a post today (which I will publish soon) about my own concerns in regards to my exposure towards the interest rate. The Real estate investments I’ve been looking at is however typically funded with 75% fixed and 25% flex. And in the budgets are plenty of room to allow for the interest rate to rise significantly, and still leave room for a profit.

Stay tuned 😉

Hey Nick, thanks for the mention and using me as an example for how nerve-wrecking last year’s stock market roller coaster rides were…for some 😉

These events are long gone, it stopped raining and the sun is shining again (but I did run out of whiskey…so I am not totally prepared yet for the next roller coaster ride…which will come sooner or later).

I like it you keep things simple. Crowd lending as the high yield, higher risk corner and more conservative/safer investments in ETF’s and real estate. I will keep things simple as well, but not tie much more money in real estate (in addition to the current equity in my home), as I want to keep things pretty liquid… I have started to countdown already and I can see the FIRE finish line at the horizon…..

8 years to go, eh?! 😛

It’s striking how many different ways you can reach FIRE.

Everyone I know in the community seem to have their own personal way of investing/saving/moneying. Not one way is the correct way. I think the important thing is that you stay true to yourself, and follow your gut. If something is making you uncomfortable, then you should stay away from it 😉 My reason for preferring illiquid assets, is simply my way to try to “lock down” my path to FIRE. I’m constantly tempted to try something different, and it’s making me anxious 😛 If I were to follow every little impulse I got, I would go insane! This week alone I had 3 new ideas pop into my head, how I could invest my current nest egg. Today I suddenly got the impulse to just fuck it, and throw my nest egg at my mortgage instead (this would bring me just below the 60% mortgage threshold), and then convert my loan to an interest-only loan. This would be a way to increase my cashflow – but then, what would I do with the cashflow!?! I don’t know! AAAAAAAARGH!

Stick to the plan, Nick! 😛

See that’s what I’m talking about . I’m thinking of doing the same thing with my nest egg. Throw that MF at the mortgage and get out of from under this debt. Great strategy at work. I’m looking to put 70% of my income into real estate and start making money besides my regular income . Awesome post!!

Hi Brandon,

I’m glad you enjoyed it! Before you do that, you might want to read my latest post about Opportunity cost! It contains some great wisdom (if I have to say so myself 😛 )